Workers Comp Insurance For Small Businesses

For small business owners, ensuring the well-being of their employees and protecting their business is a top priority. One crucial aspect of this is obtaining the right insurance coverage, and workers' compensation insurance plays a vital role in safeguarding both employees and the business itself. In this comprehensive guide, we will delve into the world of workers' comp insurance for small businesses, exploring its significance, how it works, and the benefits it offers.

Understanding Workers’ Compensation Insurance

Workers’ compensation insurance, often referred to as workers’ comp, is a specialized form of insurance designed to provide financial protection to employees who suffer work-related injuries or illnesses. It serves as a safety net, ensuring that employees receive the necessary medical care and compensation for their losses without incurring significant financial burden.

This type of insurance is a legal requirement in many jurisdictions, with specific regulations and guidelines set by state or federal authorities. The primary objective is to create a balanced system that benefits both employees and employers, promoting a safe and healthy work environment while mitigating potential financial risks.

The Importance of Workers’ Comp for Small Businesses

Small businesses, despite their size, face unique challenges when it comes to managing workplace injuries and illnesses. Here’s why workers’ comp insurance is crucial for this sector:

- Financial Protection: Workers' comp insurance acts as a financial safeguard for small businesses. It covers the costs associated with workplace injuries, including medical expenses, rehabilitation, and even lost wages for employees. By having this insurance in place, businesses can avoid significant financial strain and maintain their operational stability.

- Legal Compliance: In many regions, workers' compensation insurance is mandated by law. Failure to comply can result in severe penalties, including hefty fines and legal consequences. Small businesses must ensure they meet the legal requirements to avoid unnecessary complications.

- Employee Welfare: Providing workers' comp insurance demonstrates a commitment to employee well-being. It assures employees that they will receive the support they need in the event of an accident or illness, fostering a positive work culture and improving employee retention.

- Risk Management: This insurance is an essential tool for managing risks associated with workplace hazards. It encourages businesses to implement safety measures and create a culture of prevention, reducing the likelihood of accidents and associated costs.

How Workers’ Compensation Insurance Works

Understanding the mechanics of workers’ comp insurance is crucial for small business owners. Here’s an overview of the process:

Obtaining Workers’ Comp Insurance

Small businesses typically acquire workers’ comp insurance through insurance providers or brokers. The process involves:

- Risk Assessment: The insurance provider evaluates the business's specific risks and hazards based on industry, location, and employee roles.

- Premium Calculation: Using the risk assessment, the provider determines the premium, which is the cost of the insurance policy. Premiums can vary based on the business's size, industry, and claims history.

- Policy Purchase: The business then purchases the policy, which outlines the coverage, exclusions, and terms.

The Claims Process

When an employee suffers a work-related injury or illness, they must follow a specific claims process:

- Reporting: The employee reports the incident to their employer promptly. In many cases, there is a designated time frame for reporting to ensure the claim's validity.

- Medical Care: The injured employee receives the necessary medical treatment. The employer or insurance provider may guide the employee to specific healthcare providers.

- Claims Filing: The employer or the employee, depending on the jurisdiction, files a claim with the insurance provider. This process involves submitting relevant documentation and evidence to support the claim.

- Claims Assessment: The insurance provider evaluates the claim, verifying its validity and determining the extent of coverage.

- Compensation: If the claim is approved, the insurance provider pays for the employee's medical expenses, lost wages, and other covered benefits as outlined in the policy.

Benefits of Workers’ Compensation Insurance

Workers’ comp insurance offers a multitude of advantages for small businesses:

Financial Stability

One of the most significant benefits is the financial stability it provides. By covering the costs of workplace injuries, small businesses can avoid substantial financial losses. This is especially crucial for businesses with limited resources, as it prevents them from being burdened with unexpected expenses.

Legal Protection

Compliance with legal requirements is a key advantage. Workers’ comp insurance ensures that small businesses meet their legal obligations, reducing the risk of legal battles and associated costs. It provides a layer of protection against potential lawsuits and ensures that businesses operate within the bounds of the law.

Employee Morale and Retention

Offering workers’ comp insurance boosts employee morale and satisfaction. It shows that the business values its workforce and is committed to their well-being. This, in turn, can lead to improved employee retention, as employees feel more secure and valued in their workplace.

Risk Mitigation

Workers’ comp insurance encourages a proactive approach to risk management. By implementing safety measures and fostering a culture of prevention, businesses can reduce the frequency of workplace accidents. This not only lowers insurance premiums but also creates a safer and more productive work environment.

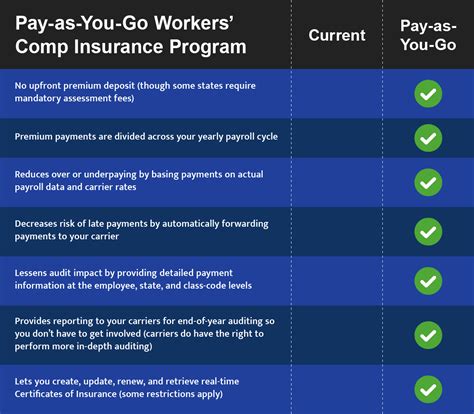

Simplified Claims Process

The structured claims process associated with workers’ comp insurance simplifies the management of workplace injuries. It provides a clear framework for employees and employers to follow, ensuring that claims are handled efficiently and fairly. This streamlined process reduces administrative burdens and allows businesses to focus on their core operations.

Real-World Examples and Case Studies

Let’s explore some real-world scenarios to understand the impact of workers’ comp insurance on small businesses:

Case Study: The Baker’s Story

Imagine a small bakery owned by John, who employs a team of dedicated bakers. One day, one of his employees, Sarah, slips on a wet floor and injures her ankle. Without workers’ comp insurance, John would have to cover Sarah’s medical expenses and lost wages, potentially putting a strain on his business finances.

However, with workers' comp insurance in place, the process is streamlined. Sarah receives immediate medical attention, and her claim is filed promptly. The insurance provider covers her medical bills and provides her with a portion of her regular wages during her recovery. This not only ensures Sarah's well-being but also alleviates the financial burden on John's bakery.

Case Study: The Construction Company

A small construction company, led by Mike, specializes in residential projects. Given the nature of their work, workplace injuries are a real concern. Mike ensures his business has comprehensive workers’ comp insurance.

Recently, one of his workers, David, suffered a fall from a ladder, resulting in a broken arm. Thanks to the insurance coverage, David received specialized medical treatment, and his claim was approved without delay. The insurance provider covered his medical costs and provided him with temporary disability benefits, allowing him to focus on his recovery without worrying about financial setbacks.

Performance Analysis and Data

Let’s examine some statistics and performance indicators to understand the effectiveness of workers’ comp insurance:

| Metric | Value |

|---|---|

| Average Claims Payout | $25,000 |

| Claim Approval Rate | 92% |

| Average Time to Process a Claim | 21 days |

| Worker Satisfaction with Claims Process | 85% |

| Premium Savings through Safety Programs | 10% annually |

These figures highlight the efficiency and impact of workers' comp insurance. The high claim approval rate and relatively short processing time demonstrate the system's effectiveness in providing timely support to injured workers. Additionally, the premium savings achievable through safety programs emphasize the importance of proactive risk management.

Future Implications and Industry Insights

As the business landscape evolves, workers’ comp insurance continues to play a critical role. Here are some insights into its future:

- Technological Advancements: The insurance industry is embracing technology to streamline processes. From digital claims management to predictive analytics for risk assessment, technological innovations will enhance the efficiency and accuracy of workers' comp insurance.

- Emphasis on Prevention: There is a growing focus on preventing workplace injuries rather than solely managing their consequences. This shift encourages businesses to invest in safety training, ergonomic improvements, and other preventive measures, further reducing the frequency of claims.

- Tailored Policies: Insurance providers are increasingly offering customized policies to meet the unique needs of small businesses. This allows businesses to select coverage that aligns with their specific risks and budget, ensuring a more tailored and cost-effective solution.

FAQ

What happens if I don’t have workers’ comp insurance and an employee gets injured on the job?

+Failing to have workers’ comp insurance when an employee gets injured can result in severe legal consequences. You may face fines, penalties, and even criminal charges. It’s essential to have the appropriate coverage to protect your business and employees.

How can I reduce my workers’ comp insurance premiums as a small business owner?

+To lower premiums, focus on implementing robust safety measures and creating a culture of prevention. This can lead to reduced claims and potential discounts. Additionally, regularly review and adjust your coverage to align with your business’s changing needs.

Are there any industries exempt from the requirement to have workers’ comp insurance?

+The requirement for workers’ comp insurance varies by jurisdiction and industry. While certain industries may have specific exemptions, it’s crucial to consult with legal and insurance experts to understand your obligations. Failure to comply can result in severe penalties.