Insurance Info

In today's world, insurance is an indispensable part of financial planning, offering individuals and businesses protection against unforeseen events and financial risks. With a vast array of insurance products available, from health and life insurance to property and liability coverage, navigating the insurance landscape can be daunting. This article aims to provide a comprehensive guide to understanding insurance, its importance, and the various types available, helping you make informed decisions to secure your future.

Understanding the Fundamentals of Insurance

At its core, insurance is a form of risk management primarily designed to protect individuals and entities from financial loss. It operates on the principle of sharing risks among a large group of people, known as the insurance pool. Each member of this pool contributes a small, regular payment known as a premium. In return, the insurance company promises to compensate the insured for specific losses as defined in the insurance policy.

The concept of insurance is deeply rooted in the idea of indemnity, which refers to the promise to make the insured whole again after a loss. This means that the insurance company will provide financial compensation to cover the cost of the insured's loss up to the limits outlined in the policy.

The process of insurance involves several key players. The insured is the individual or entity who purchases the insurance policy and is protected by it. The insurer, also known as the insurance company, is the entity that assumes the risk and provides the insurance coverage. The policy is the legal contract between the insured and the insurer, outlining the terms and conditions of the insurance coverage, including the rights and obligations of both parties.

Key Components of an Insurance Policy

An insurance policy typically consists of several key components. These include the premium, which is the amount the insured pays for the coverage, usually on a monthly or annual basis. The deductible is the amount the insured must pay out of pocket before the insurance coverage kicks in. The coverage limits specify the maximum amount the insurer will pay for a covered loss. Exclusions are specific events or circumstances that are not covered by the policy.

Furthermore, an insurance policy often includes endorsements or riders, which are amendments to the policy that either add or exclude specific coverage. These can be added at the time of policy purchase or later on, depending on the insured's changing needs.

Understanding these components is crucial when evaluating an insurance policy to ensure it meets your specific needs and expectations.

Types of Insurance: Navigating the Insurance Landscape

The insurance industry offers a wide range of products to cater to various needs and risks. Here’s an overview of some of the most common types of insurance:

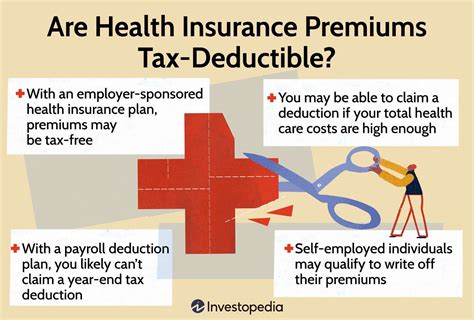

Health Insurance

Health insurance is designed to cover the cost of medical care, including hospital stays, doctor visits, prescription drugs, and often preventive care. It is a crucial form of insurance, especially in countries where healthcare costs can be prohibitively expensive. Health insurance can be provided through employers, purchased individually, or offered through government programs.

| Key Health Insurance Types | Description |

|---|---|

| Managed Care Plans | Includes Health Maintenance Organizations (HMOs) and Preferred Provider Organizations (PPOs). These plans typically offer comprehensive coverage but may require you to choose from a network of providers. |

| Fee-for-Service Plans | Allow you to choose any doctor or hospital. You typically pay a portion of the cost up front, and the insurance company reimburses you for the rest. |

| High-Deductible Health Plans (HDHPs) | Offer lower premiums but require you to pay a higher deductible before the insurance coverage kicks in. |

Life Insurance

Life insurance provides financial protection to the insured’s family or beneficiaries in the event of their death. It serves as a safety net, ensuring that loved ones are taken care of financially even in the absence of the insured. Life insurance policies come in two main types: term life insurance, which provides coverage for a specified period of time, and permanent life insurance, which offers coverage for the insured’s entire life and also includes a cash value component.

Property Insurance

Property insurance protects an individual’s personal property, such as homes, vehicles, and personal belongings, against damage or loss due to various events like fire, theft, or natural disasters. It provides financial security, ensuring that individuals can replace or repair their possessions after a covered loss.

| Property Insurance Types | Coverage |

|---|---|

| Homeowner's Insurance | Covers damage to the home and its contents, as well as liability for accidents that occur on the property. |

| Renter's Insurance | Protects tenants against damage or loss of personal property, as well as liability for accidents that occur within the rented space. |

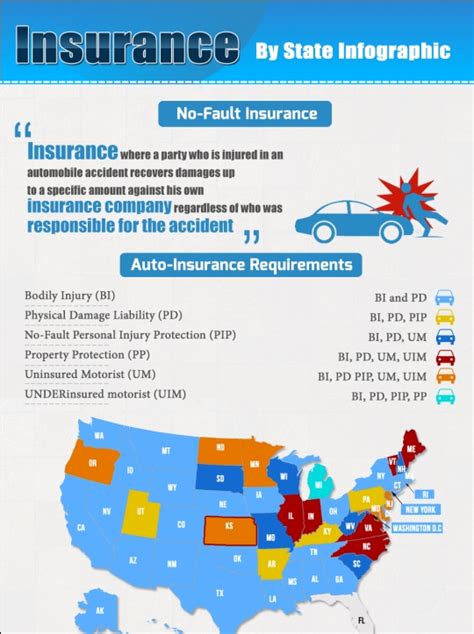

| Auto Insurance | Covers damage or loss to vehicles, as well as liability for accidents involving the insured vehicle. |

Liability Insurance

Liability insurance protects individuals and businesses from financial losses arising from claims of negligence or other wrongdoing. It provides coverage for legal defense costs and damages awarded against the insured in a lawsuit. Liability insurance is especially crucial for businesses, as it can protect them against a wide range of potential liabilities.

| Liability Insurance Types | Description |

|---|---|

| General Liability Insurance | Covers a broad range of liabilities, including bodily injury, property damage, and advertising injuries. |

| Professional Liability Insurance (E&O Insurance) | Protects professionals, such as doctors, lawyers, and consultants, against claims of negligence, errors, or omissions in their work. |

| Product Liability Insurance | Covers businesses against claims arising from defects in their products. |

Other Types of Insurance

The insurance landscape is vast and offers coverage for numerous other risks. These include disability insurance, which provides income protection in the event of a disabling injury or illness; long-term care insurance, which covers the cost of long-term care services; and travel insurance, which offers protection against trip cancellations, medical emergencies, and lost luggage.

The Importance of Insurance: Securing Your Financial Future

Insurance plays a critical role in securing your financial future and protecting you from unforeseen events that could otherwise lead to significant financial hardship. By spreading the risk across a large group of individuals, insurance provides a safety net that ensures you won’t be left financially devastated by an unexpected loss.

For individuals, insurance is a vital tool for managing financial risk. Health insurance ensures you have access to necessary medical care without the worry of incurring massive medical bills. Life insurance provides a financial safety net for your loved ones, ensuring they are taken care of in the event of your untimely demise. Property insurance protects your assets, allowing you to rebuild or replace what you've lost.

For businesses, insurance is equally crucial. It protects against a wide range of risks, from property damage and liability claims to business interruption due to unforeseen events. Insurance allows businesses to operate with confidence, knowing that they have the financial resources to withstand unexpected losses and continue their operations.

Furthermore, insurance plays a significant role in promoting economic growth and stability. By spreading risk and providing a safety net for individuals and businesses, insurance encourages investment, entrepreneurship, and economic activity. It fosters a sense of financial security, enabling individuals and businesses to focus on their goals and aspirations without the constant worry of financial ruin.

The Future of Insurance: Trends and Innovations

The insurance industry is evolving rapidly, driven by technological advancements and changing consumer needs. Here are some key trends and innovations shaping the future of insurance:

Digital Transformation

The insurance industry is undergoing a digital transformation, leveraging technology to streamline processes, enhance customer experience, and improve operational efficiency. Digital platforms and mobile apps are becoming increasingly popular, allowing customers to manage their policies, file claims, and access insurance information anytime, anywhere.

Telematics and Usage-Based Insurance

In the auto insurance sector, telematics and usage-based insurance are gaining traction. These technologies use sensors and GPS data to track driving behavior and provide real-time feedback. Insurers can then offer discounts or incentives based on safe driving practices, creating a more personalized and fair insurance experience.

Artificial Intelligence and Machine Learning

AI and machine learning are transforming the way insurance companies operate. These technologies are used for everything from fraud detection and risk assessment to personalized pricing and product recommendations. By analyzing vast amounts of data, insurers can make more informed decisions and offer more tailored coverage options.

Blockchain Technology

Blockchain, the technology behind cryptocurrencies like Bitcoin, is finding new applications in the insurance industry. It can enhance data security, streamline processes, and improve transparency in insurance transactions. Blockchain can also facilitate the development of smart contracts, which automatically trigger insurance payouts when certain conditions are met.

Insurtech Startups

The rise of Insurtech startups is disrupting the traditional insurance landscape. These innovative companies are leveraging technology to offer new insurance products and services, often at a lower cost and with a more customer-centric approach. Insurtech startups are particularly active in areas like peer-to-peer insurance, parametric insurance, and micro-insurance.

Conclusion: Navigating the Insurance Landscape with Confidence

Insurance is a complex but indispensable part of modern life. Understanding the various types of insurance and how they work is crucial for making informed decisions about your financial protection. Whether you’re an individual looking to safeguard your health, life, and property, or a business owner seeking to protect your operations and assets, insurance provides the peace of mind that comes with being prepared for the unexpected.

As the insurance industry continues to evolve, staying informed about the latest trends and innovations will be key to making the most of your insurance coverage. By leveraging technology and embracing new insurance models, you can access more personalized, efficient, and cost-effective insurance solutions. Remember, insurance is not just about financial protection—it's about empowering you to live your life and run your business with confidence and security.

What is the primary purpose of insurance?

+

The primary purpose of insurance is to protect individuals and entities from financial loss by sharing risks among a large group of people. It provides a safety net to ensure that in the event of an unforeseen loss, the insured can be compensated for their financial damages.

How does an insurance policy work?

+

An insurance policy is a legal contract between the insured and the insurer. The insured pays a regular premium to the insurer, and in return, the insurer promises to compensate the insured for specific losses as defined in the policy. The policy outlines the coverage limits, deductibles, and exclusions, ensuring both parties understand the terms and conditions.

What are some common types of insurance?

+

Common types of insurance include health insurance, life insurance, property insurance, liability insurance, disability insurance, long-term care insurance, and travel insurance. Each type serves a specific purpose, whether it’s covering medical expenses, protecting loved ones, safeguarding assets, or managing business risks.