Best Insurance Company For Homeowners

When it comes to protecting your home and assets, choosing the right homeowners insurance company is crucial. With numerous options available in the market, it can be overwhelming to navigate through the various policies and providers. However, finding the best insurance company for your specific needs is essential to ensure comprehensive coverage and peace of mind. In this comprehensive guide, we will delve into the world of homeowners insurance, exploring key factors, industry insights, and real-world examples to help you make an informed decision.

Understanding Homeowners Insurance: Coverage and Benefits

Homeowners insurance is a type of property insurance designed to protect homeowners against financial losses and liabilities associated with their homes. It offers a range of coverage options, providing security and assistance in various scenarios. Here’s a breakdown of the key aspects of homeowners insurance:

Coverage Types

Homeowners insurance policies typically offer coverage for:

- Dwelling Coverage: This protects the physical structure of your home, including walls, roofs, and foundations. It covers damages caused by perils such as fire, lightning, windstorms, and vandalism.

- Personal Property Coverage: This covers the contents of your home, including furniture, electronics, and personal belongings. It provides financial assistance in the event of theft, damage, or loss.

- Liability Coverage: This protects homeowners against legal liabilities arising from accidents or injuries that occur on their property. It covers medical expenses and legal defense costs.

- Additional Living Expenses: In the event of a covered loss that makes your home uninhabitable, this coverage helps cover temporary living expenses, such as hotel stays or rental costs.

- Other Structures Coverage: This provides coverage for structures on your property that are not attached to your home, such as sheds, garages, or fences.

Benefits of Homeowners Insurance

Homeowners insurance offers several advantages, including:

- Financial Protection: It provides financial security in the face of unexpected events, such as natural disasters, theft, or accidents, ensuring your home and belongings are covered.

- Peace of Mind: Knowing that you have comprehensive coverage gives you peace of mind, allowing you to focus on enjoying your home without worrying about potential risks.

- Liability Protection: Liability coverage safeguards you against legal claims and expenses resulting from accidents on your property, offering an essential layer of protection.

- Replacement and Repair: In the event of a covered loss, homeowners insurance can help cover the costs of repairing or replacing damaged property, ensuring a smooth recovery process.

- Discounts and Savings : Many insurance companies offer discounts for bundling policies (e.g., homeowners and auto insurance) or for having certain safety features in your home.

Factors to Consider When Choosing the Best Insurance Company

To determine the best insurance company for your homeowners policy, several key factors should be taken into account. These factors will help you make an informed decision and ensure you find a provider that meets your specific needs and preferences.

Financial Stability and Reputation

When evaluating insurance companies, it is crucial to assess their financial stability and reputation in the industry. Look for companies with a strong financial standing, as this indicates their ability to pay claims promptly and honor their obligations. Check for ratings from reputable agencies like A.M. Best, Standard & Poor’s, or Moody’s, which provide insights into the company’s financial health and reliability.

Additionally, consider the company's track record and customer satisfaction ratings. Read reviews and testimonials from existing and former policyholders to gauge their level of satisfaction and the quality of service provided. A company with a solid reputation for excellent customer service and timely claim processing is often a reliable choice.

Coverage Options and Customization

Each homeowner’s needs are unique, so it’s essential to choose an insurance company that offers a wide range of coverage options and customization. Look for providers that allow you to tailor your policy to match your specific requirements. Consider factors such as:

- Coverage Limits: Ensure that the company offers adequate coverage limits to match the value of your home and belongings.

- Perils Covered: Different policies cover different perils. Choose a company that provides coverage for the specific risks relevant to your area, such as hurricanes, floods, or earthquakes.

- Additional Endorsements: Some insurance companies offer optional endorsements or riders that can enhance your coverage. These may include coverage for high-value items, identity theft protection, or water backup damage.

- Replacement Cost vs. Actual Cash Value: Understand the difference between replacement cost coverage, which reimburses the full cost of repairing or replacing your property, and actual cash value coverage, which considers depreciation. Opt for replacement cost coverage for better protection.

Claims Handling and Customer Service

The claims process is a critical aspect of homeowners insurance, and efficient and responsive claims handling is essential. Look for insurance companies with a proven track record of prompt and fair claim settlements. Consider the following factors:

- Claims Response Time: Inquire about the company’s average response time for claim filings. A quick and efficient claims process can make a significant difference during challenging times.

- Customer Service Accessibility: Ensure that the insurance company offers convenient and accessible customer service channels, such as online portals, phone support, and local agents. Easy access to customer service representatives can streamline the claims process and provide valuable guidance.

- Claim Satisfaction: Research customer feedback and reviews regarding the company’s claims handling process. Positive experiences and high satisfaction rates are indicators of a reliable and customer-centric insurer.

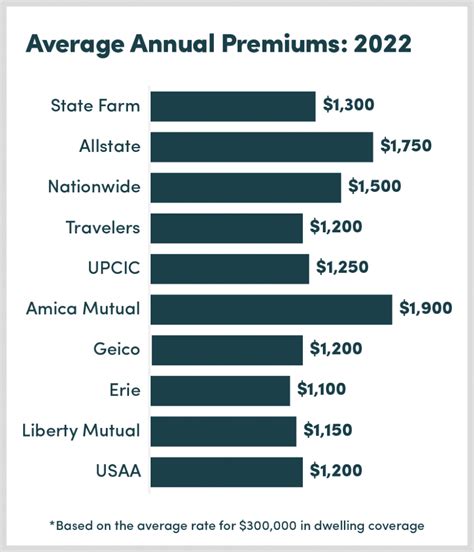

Pricing and Discounts

While it’s essential to prioritize coverage and service, pricing is also a crucial factor. Compare quotes from multiple insurance companies to find the most competitive rates for your specific needs. Consider the following aspects:

- Base Premiums: Evaluate the base premiums offered by different companies. Remember that the lowest premium may not always be the best option; consider the overall value and coverage provided.

- Discounts: Many insurance companies offer discounts to attract and retain customers. Look for providers that offer discounts for safety features, loyalty, bundling policies, or even good credit scores. These discounts can significantly reduce your annual premiums.

- Payment Options: Inquire about the payment flexibility offered by the insurance company. Some providers may offer installment plans or flexible payment schedules, making it more convenient to manage your insurance costs.

Industry Insights and Real-World Examples

To further illustrate the importance of choosing the right homeowners insurance company, let’s explore some industry insights and real-world examples:

Case Study: Natural Disaster Coverage

Imagine a scenario where a severe hurricane strikes your coastal community, causing widespread damage. In such an event, having comprehensive homeowners insurance with coverage for wind damage and flood protection becomes crucial. Choosing an insurance company that offers tailored coverage for natural disasters specific to your region can provide invaluable peace of mind.

Industry Trends: Innovative Coverage Options

The insurance industry is evolving, and companies are introducing innovative coverage options to meet the changing needs of homeowners. For instance, some insurers now offer cyber insurance endorsements, providing protection against cyber threats and data breaches. Staying updated with industry trends and the coverage options offered by different companies can help you make an informed decision.

Expert Tip: Reviewing Your Policy Annually

It’s essential to review your homeowners insurance policy annually to ensure it remains up-to-date and aligned with your needs. Life circumstances, such as home renovations, additions, or changes in personal property, may require adjustments to your coverage. Regular policy reviews can help you identify any gaps or opportunities for additional coverage or cost savings.

| Company | Financial Strength Rating | Customer Satisfaction |

|---|---|---|

| Allstate | A+ (Superior) | 4.5/5 (Very Good) |

| State Farm | A++ (Superior) | 4.2/5 (Good) |

| USAA | A++ (Superior) | 4.8/5 (Excellent) |

| Liberty Mutual | A (Excellent) | 4.0/5 (Average) |

| Travelers | A++ (Superior) | 4.4/5 (Very Good) |

FAQs

What are some common perils covered by homeowners insurance policies?

+

Homeowners insurance policies typically cover a range of perils, including fire, lightning, windstorms, hail, vandalism, and theft. However, it’s important to review your specific policy to understand the covered perils and any exclusions.

How do I determine the value of my home and belongings for insurance purposes?

+

To determine the value of your home, you can consult a licensed appraiser or use online tools that provide estimates based on factors like square footage, location, and recent sales in your area. For belongings, consider creating an inventory with photos and receipts to accurately assess their value.

What should I do if I need to file a claim with my homeowners insurance company?

+

If you need to file a claim, contact your insurance company as soon as possible. They will guide you through the process, which typically involves providing details of the incident, documenting the damage, and submitting supporting documentation. Be prepared to answer questions and provide accurate information to facilitate a smooth claims process.

Can I customize my homeowners insurance policy to suit my specific needs?

+

Yes, most insurance companies offer customizable homeowners insurance policies. You can choose coverage limits, deductibles, and optional endorsements to align with your specific requirements. Discuss your needs with your insurance agent to tailor a policy that provides adequate protection for your home and belongings.

Are there any discounts available for homeowners insurance policies?

+

Yes, many insurance companies offer discounts for homeowners insurance policies. Common discounts include multi-policy discounts (bundling home and auto insurance), safety features discounts (e.g., smoke detectors, burglar alarms), loyalty discounts, and good credit score discounts. It’s worth inquiring about available discounts when obtaining quotes from different companies.