Business Insurance Claim

When it comes to running a business, one of the most crucial aspects to consider is protection against potential risks and unforeseen events. This is where business insurance plays a vital role. While obtaining insurance coverage is a standard practice for many businesses, the process of making an insurance claim can be complex and daunting, especially for those who are unfamiliar with the intricacies involved.

In this comprehensive guide, we will delve into the world of business insurance claims, providing you with an expert analysis and practical insights to navigate this critical aspect of risk management. Whether you are a seasoned business owner or just starting out, understanding the claims process is essential to ensuring your business's financial security and continuity.

Understanding Business Insurance Claims

Business insurance claims refer to the process of seeking compensation or coverage for losses, damages, or liabilities incurred by a business. These claims are typically made to the insurance provider who issued the business insurance policy. The purpose of these claims is to mitigate financial losses and help businesses recover from unforeseen circumstances.

Business insurance policies can cover a wide range of potential risks, including property damage, liability claims, business interruption, theft, and even employee-related issues. The specific coverage and terms of a policy depend on the industry, size of the business, and the risks it faces. Therefore, it is crucial for business owners to carefully assess their unique needs and tailor their insurance policies accordingly.

The Claims Process: A Step-by-Step Guide

Making a business insurance claim can be a lengthy and detailed process, but by breaking it down into steps, you can ensure a smoother and more efficient journey. Here’s a comprehensive guide to navigating the claims process:

Step 1: Assess the Damage or Loss

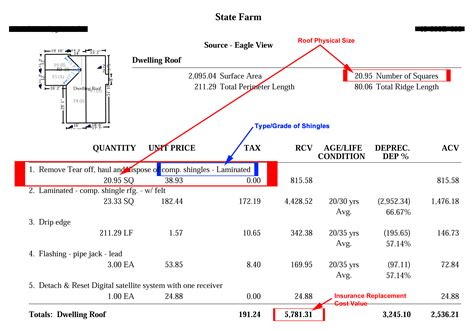

The first step in making a business insurance claim is to thoroughly assess the extent of the damage or loss. This involves conducting a detailed inspection of the affected area, documenting the damage, and collecting any relevant evidence. It is crucial to act promptly, as some insurance policies have time limits for reporting claims.

During this step, it is beneficial to create a comprehensive report, including photographs, videos, and written descriptions of the damage. This documentation will serve as vital evidence when submitting your claim. Additionally, be sure to secure any vulnerable areas to prevent further damage or loss.

Step 2: Review Your Insurance Policy

Before proceeding with the claim, it is essential to review your business insurance policy thoroughly. Understand the coverage limits, deductibles, and any specific exclusions or limitations outlined in the policy. This step ensures that you are aware of what is covered and what steps you need to take to make a valid claim.

Pay close attention to the policy's wording and any conditions that may apply to your situation. For instance, some policies may require you to take certain actions, such as implementing loss prevention measures or providing specific documentation, to be eligible for coverage.

Step 3: Notify Your Insurance Provider

Once you have assessed the damage and reviewed your policy, it’s time to notify your insurance provider about the incident. Most insurance companies have dedicated claims departments, and they will guide you through the process. Provide them with all the relevant details, including the date, time, and circumstances of the incident.

During this step, it is crucial to be honest and transparent about the event. Withholding information or providing false details can lead to claim denial or even legal consequences. Be prepared to answer any questions your insurance provider may have and provide additional documentation if requested.

Step 4: Gather Supporting Documentation

To strengthen your business insurance claim, gather all the necessary supporting documentation. This may include invoices, receipts, contracts, and any other relevant records that demonstrate the financial impact of the loss or damage. If applicable, obtain statements or reports from witnesses or experts who can provide additional evidence.

It is beneficial to organize your documentation systematically, creating a clear and concise file for your insurance provider. This will make it easier for them to review your claim and expedite the process.

Step 5: Collaborate with Adjusters

Insurance companies often assign adjusters to handle and evaluate claims. These professionals will work with you to assess the extent of the damage, determine the value of the loss, and negotiate a settlement. It is crucial to maintain open communication with the adjuster and provide any additional information they may require.

During this step, it is essential to understand that adjusters work on behalf of the insurance company, so their primary goal is to protect the company's interests. However, by providing accurate and comprehensive information, you can help them make a fair assessment and reach a satisfactory resolution.

Step 6: Negotiate and Settle the Claim

Once the adjuster has evaluated your claim, they will present you with a settlement offer. It is important to carefully review this offer and consider whether it adequately covers the losses you have incurred. If you feel the offer is insufficient, you have the right to negotiate and provide additional evidence to support your case.

During the negotiation process, it is beneficial to remain calm and professional. Present your arguments logically and provide any supporting documentation to strengthen your position. Remember, the goal is to reach a mutually agreeable settlement that ensures your business's financial recovery.

Common Challenges and Tips for Success

While the business insurance claims process can be complex, there are strategies you can employ to increase your chances of a successful outcome:

1. Maintain Comprehensive Records

Keep detailed and organized records of your business’s assets, including invoices, purchase orders, and financial statements. These records will serve as crucial evidence when making a claim. Regularly update and backup your records to ensure their availability when needed.

2. Understand Your Policy

Take the time to thoroughly understand your business insurance policy. Familiarize yourself with the coverage limits, exclusions, and any specific conditions that may apply. This knowledge will empower you to make informed decisions during the claims process.

3. Act Promptly

Time is of the essence when it comes to business insurance claims. Act promptly after an incident occurs and report the claim within the required time frame outlined in your policy. Delayed reporting can lead to claim denials or reduced coverage.

4. Seek Professional Advice

If you are unsure about any aspect of the claims process or have a complex claim, consider seeking advice from an insurance professional or legal expert. They can provide valuable guidance and ensure that your rights are protected throughout the process.

5. Be Persistent

The claims process can sometimes be lengthy and require patience. If you encounter delays or face challenges, remain persistent and follow up with your insurance provider regularly. Stay organized and keep track of all communications to ensure a smooth and timely resolution.

Future Implications and Risk Management

The process of making a business insurance claim provides valuable insights into your business’s risk management strategies. By analyzing the causes and consequences of the incident, you can identify areas for improvement and implement preventive measures to minimize future risks.

Consider conducting a thorough risk assessment to identify potential vulnerabilities and develop a comprehensive risk management plan. This plan should include strategies to mitigate risks, such as implementing safety protocols, improving security measures, and regularly reviewing and updating your insurance coverage.

Furthermore, staying informed about industry trends and best practices can help you anticipate and prepare for potential risks. By staying proactive, you can protect your business's financial health and ensure its long-term success.

Conclusion

Navigating the business insurance claims process requires a combination of knowledge, organization, and persistence. By understanding the steps involved, maintaining comprehensive records, and seeking professional guidance when needed, you can effectively manage claims and protect your business’s financial well-being.

Remember, business insurance is a critical component of risk management, and by treating it as such, you can ensure the continuity and prosperity of your enterprise. Stay vigilant, stay informed, and always prioritize the protection of your business.

What should I do if my business insurance claim is denied?

+If your business insurance claim is denied, it is important to understand the reasons behind the denial. Review the denial letter carefully and consider seeking legal advice or contacting an insurance professional to evaluate your options. You may need to provide additional evidence or appeal the decision.

How long does the business insurance claims process typically take?

+The duration of the business insurance claims process can vary depending on the complexity of the claim and the responsiveness of all parties involved. While some claims may be resolved within a few weeks, others may take several months. It is important to stay in regular contact with your insurance provider to monitor the progress of your claim.

Can I make multiple business insurance claims simultaneously?

+In general, it is possible to make multiple business insurance claims simultaneously if your policy allows for it and the claims are unrelated. However, it is essential to review your policy terms and conditions to understand any limitations or restrictions. Some policies may have specific rules regarding multiple claims, so it is best to consult with your insurance provider.