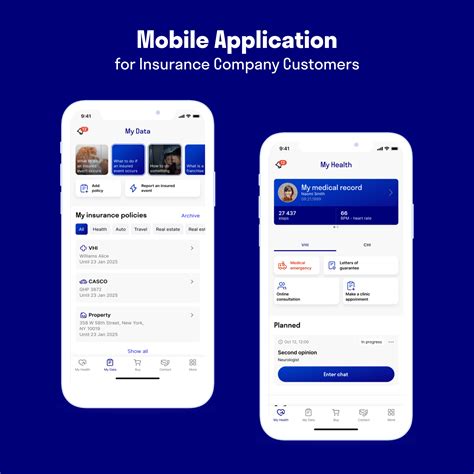

Insurance Mobile App

In today's fast-paced digital world, convenience and accessibility are paramount. The insurance industry, known for its complex processes and paperwork, has undergone a remarkable transformation with the advent of mobile applications. Insurance mobile apps have revolutionized the way customers interact with their insurance providers, offering a seamless and efficient experience. In this comprehensive article, we will delve into the world of insurance mobile apps, exploring their features, benefits, and the significant impact they have had on the industry.

The Rise of Insurance Mobile Apps: A Game-Changer for Customers and Insurers

Insurance mobile apps have emerged as a game-changer, reshaping the traditional insurance landscape. With the tap of a finger, customers can now access a wide range of services and information, making insurance management more convenient than ever before. These apps have not only simplified the lives of policyholders but have also opened up new avenues for insurers to engage with their customers and provide enhanced services.

One of the key advantages of insurance mobile apps is the real-time accessibility they offer. Policyholders can easily view their policy details, make payments, and file claims directly from their smartphones. This instant access to information empowers customers to take control of their insurance journey, reducing the need for time-consuming calls or visits to insurance offices.

Key Features and Benefits of Insurance Mobile Apps

Insurance mobile apps are packed with a plethora of features designed to enhance the customer experience and streamline insurance processes. Here are some of the standout features and their benefits:

- Policy Management: Customers can access their entire insurance portfolio, including health, life, auto, and home policies, in one place. This centralized view allows for easy policy tracking and management, ensuring that policyholders stay up-to-date with their coverage.

- Claim Filing and Tracking: Filing a claim has never been easier. Insurance apps enable customers to initiate claims directly from their devices, providing a step-by-step guide and often integrating with relevant services like emergency roadside assistance. The tracking feature keeps policyholders informed about the claim's progress, providing transparency and peace of mind.

- Payment Options: Insurance apps offer a range of payment methods, including credit/debit card payments, e-wallets, and even digital currencies. This flexibility ensures that customers can choose their preferred payment option, making the process more convenient and secure.

- Personalized Recommendations: Advanced analytics and machine learning algorithms power insurance apps to provide personalized recommendations. Based on a customer's profile and preferences, the app can suggest suitable insurance products, offering a tailored experience that meets individual needs.

- Document Storage and Retrieval: Say goodbye to cluttered file cabinets! Insurance apps provide a digital repository for important documents, such as policy certificates, claim forms, and ID cards. This feature ensures that vital information is always accessible, even when on the go.

| Feature | Description |

|---|---|

| Location-Based Services | Apps utilize GPS to provide location-specific services, such as nearby repair shops or medical facilities, enhancing customer convenience. |

| Chatbots and AI Assistance | Insurance apps integrate AI-powered chatbots to provide instant support and answers to common queries, improving customer service. |

| Digital Signature | Policyholders can digitally sign documents, simplifying the approval process and reducing paperwork. |

Performance Analysis and User Experience

The success of insurance mobile apps is not just about the features they offer but also about the user experience they deliver. Let’s take a closer look at the performance and user feedback:

Usability and Navigation

Insurance apps prioritize user-friendly interfaces and intuitive navigation. A well-designed app ensures that customers can easily find the information or services they need without getting lost in a maze of menus. Clear labels, logical organization, and visual cues enhance the overall usability, making the app accessible to a wide range of users.

For instance, let's consider the navigation of a leading insurance app. The home screen provides a dashboard-like overview, displaying key policy details and recent activities. With just a few swipes, users can access their profile, manage payments, and view claim history. The simplicity of the navigation design ensures that even first-time users can quickly familiarize themselves with the app.

Performance Metrics

To gauge the effectiveness of insurance apps, it is essential to analyze key performance indicators (KPIs). Here are some metrics that provide insights into the success of these apps:

- App Downloads and User Base: Tracking the number of downloads and active users provides a snapshot of the app's popularity and reach. A growing user base indicates that the app is meeting customer needs and gaining traction in the market.

- User Engagement: Measuring user engagement, such as the average time spent on the app, the number of sessions, and the frequency of app usage, reveals how actively customers are utilizing the app's features. High engagement rates suggest that the app is delivering value and keeping users engaged.

- Claim Processing Efficiency: Analyzing the time taken to process claims through the app can highlight the app's impact on streamlining processes. Faster claim processing not only improves customer satisfaction but also reduces administrative overhead for insurers.

- Customer Satisfaction and Feedback: Collecting and analyzing customer feedback is crucial for continuous improvement. Positive reviews and high ratings indicate that the app is well-received and aligns with customer expectations. Feedback also provides valuable insights for future enhancements.

Future Implications and Innovations

The future of insurance mobile apps looks promising, with ongoing advancements and innovations shaping the industry. Here are some trends and developments to watch out for:

Integration with Wearable Devices

As wearable technology gains popularity, insurance apps are exploring ways to integrate with these devices. For example, fitness trackers and smartwatches can provide valuable health data, allowing insurance apps to offer personalized health insurance plans based on an individual’s activity levels and health metrics. This integration opens up new possibilities for incentivizing healthy lifestyles and creating more dynamic insurance products.

Blockchain and Smart Contracts

Blockchain technology has the potential to revolutionize insurance processes. By leveraging smart contracts, insurance apps can automate certain processes, such as claim verification and policy issuance. This not only reduces administrative burdens but also enhances security and transparency. Blockchain-based insurance platforms can provide a decentralized and tamper-proof system, building trust between insurers and policyholders.

AI and Machine Learning Enhancements

Artificial Intelligence (AI) and Machine Learning (ML) are set to play a pivotal role in the evolution of insurance apps. Advanced analytics and predictive modeling can further personalize insurance offerings, providing tailored recommendations and improving risk assessment. Additionally, AI-powered chatbots can enhance customer support, offering 24⁄7 assistance and reducing response times.

Voice-Enabled Services

Voice-enabled technologies, such as virtual assistants, are becoming increasingly popular. Insurance apps can integrate voice commands, allowing customers to interact with their policies and services using voice prompts. This hands-free interaction enhances convenience and accessibility, particularly for users with visual impairments or those who prefer voice-based interactions.

Conclusion

Insurance mobile apps have transformed the way customers interact with their insurance providers, offering a seamless and efficient experience. With a range of features, from policy management to personalized recommendations, these apps have become an indispensable tool for modern policyholders. As the industry continues to innovate, insurance apps will play a pivotal role in shaping the future of insurance, providing enhanced services, improved user experiences, and new avenues for engagement.

What are the key benefits of using an insurance mobile app?

+Insurance mobile apps offer a range of benefits, including real-time policy management, convenient claim filing, and personalized recommendations. They provide instant access to information, streamline processes, and enhance customer engagement.

How do insurance apps improve the customer experience?

+Insurance apps improve the customer experience by offering a user-friendly interface, intuitive navigation, and a centralized hub for all insurance-related services. They provide quick access to policy details, payments, and claim tracking, making insurance management more efficient and convenient.

What future innovations can we expect in insurance mobile apps?

+The future of insurance apps looks promising with innovations such as integration with wearable devices, blockchain technology, advanced AI and ML capabilities, and voice-enabled services. These advancements will further enhance user experiences, streamline processes, and open up new possibilities for personalized insurance offerings.