Renters Insurance Cheap

Renters insurance is a crucial aspect of financial planning for anyone living in a rented space. It provides protection against unforeseen events and can save renters from significant financial burdens. While the cost of insurance is often a concern, it is possible to find affordable options that offer comprehensive coverage. In this article, we will explore the world of renters insurance, delve into the factors that influence its cost, and provide expert insights on how to secure cheap renters insurance without compromising on quality.

Understanding Renters Insurance and Its Benefits

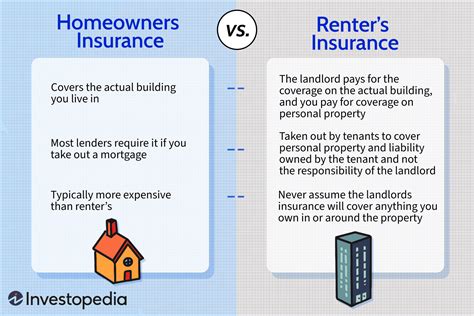

Renters insurance is a type of policy designed specifically for individuals who rent their living spaces, be it an apartment, condo, or house. Unlike homeowners insurance, which covers the structure and its contents, renters insurance primarily focuses on the personal belongings and liabilities of the policyholder. It offers financial protection in the event of theft, vandalism, natural disasters, and even accidents that result in property damage or personal injury.

One of the primary benefits of renters insurance is the peace of mind it provides. In the event of a covered loss, renters insurance can help cover the cost of replacing damaged or stolen belongings, paying for temporary housing if your residence becomes uninhabitable, and providing liability coverage if someone is injured on your property.

Furthermore, renters insurance can be customized to meet individual needs. Policyholders can choose the level of coverage they require, select specific add-ons or endorsements for valuable items like jewelry or electronics, and even opt for additional liability coverage if needed.

Factors Affecting Renters Insurance Cost

The cost of renters insurance can vary significantly depending on several factors. Understanding these factors can help renters make informed decisions when choosing a policy and potentially find cheaper options.

Location

The geographical location of the rental property plays a significant role in determining insurance rates. Areas with higher crime rates, frequent natural disasters, or a higher cost of living tend to have higher insurance premiums. For instance, a rental in a metropolitan area with a high risk of theft may incur higher insurance costs compared to a rural area.

Value of Belongings

The value of the policyholder’s personal belongings is another crucial factor. Insurance companies assess the replacement cost of items like furniture, electronics, clothing, and appliances. Higher-value items or a larger number of possessions can increase the cost of insurance.

Coverage Limits and Deductibles

The level of coverage chosen by the policyholder also affects the cost. Higher coverage limits typically result in higher premiums. Additionally, the deductible, which is the amount the policyholder pays out of pocket before the insurance coverage kicks in, can impact the overall cost. Opting for a higher deductible may reduce monthly premiums but could mean a larger upfront cost in the event of a claim.

Discounts and Bundling

Insurance companies often offer discounts to policyholders who meet certain criteria. For instance, bundling renters insurance with other policies like auto insurance can lead to significant savings. Additionally, some providers offer discounts for policyholders who maintain a good credit score, have smoke detectors installed, or take other safety precautions.

Strategies for Securing Cheap Renters Insurance

Now that we understand the factors influencing the cost of renters insurance, let’s explore some strategies to find affordable coverage.

Shop Around and Compare Quotes

One of the most effective ways to find cheap renters insurance is to compare quotes from multiple providers. Insurance rates can vary significantly between companies, so it’s essential to shop around. Online comparison tools can be particularly useful for this purpose, as they allow you to quickly and easily compare rates and coverage options from various insurers.

When comparing quotes, pay attention to the coverage limits, deductibles, and any additional perks or discounts offered. Ensure that you're comparing policies with similar coverage to make an accurate assessment of the best value.

Bundle Policies for Savings

As mentioned earlier, bundling your insurance policies can lead to substantial savings. Many insurance companies offer discounts when you purchase multiple policies from them. For example, if you already have auto insurance with a particular provider, inquire about a potential discount if you add renters insurance to your policy.

Consider Higher Deductibles

Opting for a higher deductible can reduce your monthly premiums. However, it’s important to choose a deductible amount that you can comfortably afford to pay out of pocket in the event of a claim. While a higher deductible may save you money in the short term, it could mean a larger financial burden if you need to make a claim.

Explore Discounts and Promotions

Insurance companies often provide discounts and promotions to attract new customers. These can include discounts for policyholders who pay their premiums annually rather than monthly, loyalty discounts for long-term customers, or promotional offers for new policyholders.

Keep an eye out for such opportunities, as they can significantly reduce your insurance costs. However, it's essential to read the fine print and understand any conditions or limitations associated with these discounts.

Maintain a Good Credit Score

Your credit score can impact your insurance rates. Many insurance companies use credit-based insurance scores to assess the risk associated with insuring a policyholder. A higher credit score may result in lower insurance premiums, as it indicates a lower risk of financial loss for the insurer.

Take Advantage of Safety Features

Installing safety features like smoke detectors, fire sprinklers, or security systems can reduce the risk of accidents and theft. Many insurance companies offer discounts to policyholders who have these safety measures in place. Additionally, maintaining a clean and well-maintained rental property can also contribute to lower insurance costs.

Choose the Right Coverage Limits

While it’s tempting to opt for the lowest coverage limits to save money, it’s essential to choose limits that adequately protect your belongings. Assess the value of your possessions and choose coverage limits that align with your needs. Insuring your belongings for their actual replacement cost can help ensure you’re not underinsured.

Real-World Examples and Case Studies

To further illustrate the strategies for securing cheap renters insurance, let’s examine some real-world examples and case studies.

John’s Experience: Bundling for Savings

John, a recent college graduate, was looking for affordable renters insurance for his new apartment. He discovered that by bundling his renters insurance with his auto insurance policy, he could save over 20% on his total insurance premiums. By taking advantage of the bundling discount, John was able to secure comprehensive coverage without breaking the bank.

Sarah’s Story: Adjusting Deductibles

Sarah, a young professional, wanted to reduce her monthly insurance costs. After consulting with her insurance agent, she decided to increase her renters insurance deductible from 250 to 1,000. This change resulted in a 15% reduction in her monthly premiums, saving her a significant amount over the course of a year. However, Sarah ensured that she could afford the higher deductible in the event of a claim.

Michael’s Journey: Shopping Around for the Best Deal

Michael, a cautious renter, was determined to find the best renters insurance policy for his budget. He spent time researching and comparing quotes from various providers. He discovered that insurance rates varied widely, with some companies offering significantly lower premiums for similar coverage. By carefully evaluating the options and negotiating with insurance agents, Michael was able to secure a policy that provided adequate coverage at a very competitive price.

Expert Tips and Recommendations

Here are some additional tips and recommendations from industry experts to help you find cheap renters insurance:

- Consider raising your liability coverage limits if you have significant assets or a high income. This can provide added protection in the event of a liability claim.

- Review your policy annually to ensure it aligns with your current needs and circumstances. Life changes, such as acquiring new possessions or moving to a different rental, may impact your insurance requirements.

- If you're a student, inquire about student discounts. Many insurance companies offer reduced rates for students, particularly if they maintain a good academic record.

- Explore the option of paying your premiums annually rather than monthly. Some insurance companies provide a discount for annual payments, which can result in significant savings over time.

- Don't be afraid to negotiate with insurance agents. Many providers are willing to offer discounts or customize policies to meet your specific needs.

Future Implications and Trends

The world of renters insurance is constantly evolving, and several trends and developments are shaping the industry’s future.

Digital Transformation

The insurance industry is undergoing a digital transformation, with many providers embracing online platforms and mobile apps. This shift towards digital insurance has made it easier for renters to compare policies, obtain quotes, and manage their insurance needs. Additionally, digital insurance often comes with added benefits, such as paperless documentation and faster claim processing.

Personalized Coverage

Insurance companies are increasingly adopting personalized coverage approaches. This means tailoring insurance policies to individual renters based on their specific needs and circumstances. By leveraging data analytics and customer insights, insurers can offer customized coverage options that provide better value and protection.

Incorporating Smart Home Technology

The rise of smart home technology is influencing the renters insurance market. Insurance companies are recognizing the benefits of smart home devices, such as smart locks, security cameras, and water leak detectors, in reducing the risk of theft and water damage. As a result, some providers are offering discounts or incentives to policyholders who install these devices in their rental properties.

Focus on Customer Experience

Insurance companies are placing a greater emphasis on delivering a superior customer experience. This includes providing efficient claim processing, offering 24⁄7 customer support, and utilizing technology to streamline policy management. By prioritizing customer satisfaction, insurers aim to build long-term relationships with their policyholders.

Environmental Considerations

With growing concerns about climate change and environmental sustainability, some insurance companies are exploring ways to incorporate eco-friendly practices into their policies. This may involve offering discounts to policyholders who adopt sustainable practices in their rental properties or supporting initiatives that promote environmental conservation.

Conclusion

Renters insurance is an essential investment for anyone living in a rented space. By understanding the factors that influence insurance costs and implementing the strategies outlined in this article, you can secure cheap renters insurance without sacrificing quality coverage. Remember to shop around, compare quotes, take advantage of discounts and promotions, and customize your policy to your specific needs.

As the insurance industry continues to evolve, stay informed about the latest trends and developments. Embrace digital insurance platforms, explore personalized coverage options, and consider the potential benefits of smart home technology. By staying proactive and informed, you can make the most of your renters insurance policy and protect your financial well-being.

What is the average cost of renters insurance?

+The average cost of renters insurance can vary widely depending on factors such as location, coverage limits, and deductibles. On average, renters insurance policies can range from 15 to 30 per month, although rates can be higher or lower based on individual circumstances.

Are there any additional fees associated with renters insurance?

+In addition to the monthly premium, some insurance companies may charge administrative fees or apply surcharges for certain add-ons or endorsements. It’s important to carefully review the policy terms and conditions to understand any potential additional fees.

How often should I review my renters insurance policy?

+It is recommended to review your renters insurance policy annually or whenever your circumstances change significantly. Life events such as marriage, the acquisition of valuable possessions, or a change in rental location may impact your insurance needs and require adjustments to your policy.

Can I cancel my renters insurance policy at any time?

+Most renters insurance policies allow policyholders to cancel at any time. However, it’s important to note that canceling your policy may result in a penalty or a fee, especially if you cancel mid-term. Review the terms of your policy to understand the cancellation process and any potential consequences.

What should I do if I need to make a claim on my renters insurance policy?

+If you need to make a claim on your renters insurance policy, it’s important to contact your insurance provider promptly. Provide them with all the necessary details and documentation related to the incident. Follow their instructions and work closely with their claims department to ensure a smooth and efficient claims process.