Insurance Auto Car

In the ever-evolving landscape of the automotive industry, one crucial aspect that often remains overlooked is the significance of Insurance Auto Car policies. These policies, while seemingly straightforward, play a pivotal role in safeguarding vehicle owners and drivers from unforeseen circumstances. As we delve into the intricacies of Insurance Auto Car, we uncover a complex yet indispensable system that provides financial protection and peace of mind to millions of individuals worldwide. This comprehensive guide aims to demystify the world of automotive insurance, shedding light on its importance, coverage options, and the impact it has on both personal and commercial vehicles.

Understanding the Essentials of Insurance Auto Car

At its core, Insurance Auto Car is a contractual agreement between an insurance provider and a vehicle owner or driver. This agreement, often referred to as a policy, outlines the terms and conditions under which the insurance company agrees to provide financial coverage for specific risks associated with vehicle ownership and operation. These risks can range from accidents and theft to natural disasters and vandalism.

The primary objective of Insurance Auto Car is to mitigate the financial burden that arises from unexpected events. Whether it’s a fender bender on a busy highway or a total loss due to a natural calamity, having adequate insurance coverage ensures that vehicle owners can recover and resume their normal lives without incurring substantial financial setbacks.

Moreover, Insurance Auto Car is not merely a financial safeguard; it also serves as a legal requirement in many jurisdictions. Most countries mandate that vehicle owners carry a minimum level of insurance coverage to ensure accountability and provide a safety net for other road users. This mandatory aspect of automotive insurance underscores its importance in maintaining a safe and responsible driving environment.

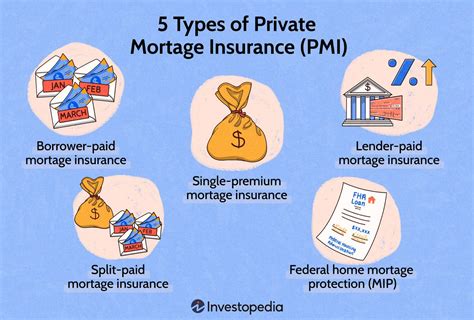

The Spectrum of Coverage Options

Insurance Auto Car offers a wide array of coverage options, each tailored to meet the diverse needs of vehicle owners. Understanding these options is crucial for making informed decisions and ensuring comprehensive protection.

- Liability Coverage: This is the most basic form of insurance, covering damages and injuries caused to others in an accident for which the policyholder is at fault. It provides financial protection against lawsuits and medical expenses incurred by third parties.

- Collision Coverage: This type of insurance covers the cost of repairing or replacing the policyholder’s vehicle after an accident, regardless of fault. It provides peace of mind by ensuring that the vehicle can be restored to its pre-accident condition.

- Comprehensive Coverage: As the name suggests, comprehensive coverage offers a broad range of protections. It includes damages caused by events other than collisions, such as theft, vandalism, natural disasters, and even damage caused by animals. This type of coverage is essential for protecting against unforeseen events that are beyond the control of the vehicle owner.

- Uninsured/Underinsured Motorist Coverage: This coverage comes into play when the at-fault driver in an accident either lacks insurance or has insufficient coverage to compensate for the damages caused. It provides a safety net for policyholders, ensuring they are not left bearing the financial burden of another driver’s negligence.

- Personal Injury Protection (PIP): PIP coverage focuses on the medical and rehabilitation expenses of the policyholder and their passengers, regardless of fault. It provides a quick and efficient way to cover medical bills, lost wages, and other related costs, ensuring prompt access to necessary care.

Each of these coverage options can be customized to suit individual needs, and policyholders can often choose deductibles and coverage limits that align with their budget and risk tolerance.

The Impact on Personal and Commercial Vehicles

Insurance Auto Car is not a one-size-fits-all solution; its impact varies significantly depending on whether it’s applied to personal or commercial vehicles.

For personal vehicles, insurance coverage is often a matter of personal preference and financial planning. Policyholders can choose the level of coverage that suits their needs and budget, ensuring they have the necessary protection without overspending. Additionally, personal insurance policies can be customized to include specific endorsements or riders that cater to unique circumstances, such as classic car ownership or teen drivers.

On the other hand, commercial vehicles present a different set of challenges and requirements. Businesses that rely on vehicles for their operations often face higher risks and more complex insurance needs. Commercial auto insurance policies are designed to provide broader coverage, often including liability protection for employees and protection against property damage. These policies may also include additional features like coverage for cargo, rental car reimbursement, and business interruption insurance.

Navigating the Complexities: Real-World Scenarios

To truly grasp the importance of Insurance Auto Car, it’s essential to explore real-world scenarios where these policies have made a significant difference.

Scenario 1: Collision and Repair

Imagine a scenario where a driver, let’s call them Jane, gets into a minor collision while commuting to work. The accident results in damage to the front bumper and a cracked headlight. Without insurance, Jane would be responsible for paying for these repairs out of pocket, which could amount to several hundred dollars. However, with comprehensive collision coverage, Jane’s insurance provider covers the cost of repairs, ensuring her vehicle is restored to its pre-accident condition without incurring a substantial financial burden.

Scenario 2: Natural Disaster

In another instance, a severe storm hits a region, causing widespread damage to vehicles. Many car owners are left with extensive repairs or even total losses. For those with comprehensive insurance, the situation is significantly less dire. Their policies cover the cost of repairs or provide a payout to replace the vehicle, ensuring they can get back on the road without financial hardship.

Scenario 3: Commercial Vehicle Loss

Consider a small business owner, John, who relies on a fleet of trucks for deliveries. One of his trucks is involved in an accident, resulting in significant damage and rendering it inoperable. Without commercial auto insurance, John would face a challenging situation, as he would need to cover the cost of repairs or replacement out of his own pocket. However, with the right insurance coverage, John’s policy provides the necessary funds to get his business back on track, ensuring minimal disruption to his operations.

Industry Insights and Future Trends

The automotive insurance industry is continually evolving, driven by technological advancements and changing consumer preferences. As we look ahead, several key trends are shaping the future of Insurance Auto Car.

Telematics and Usage-Based Insurance

Telematics technology, which utilizes data from on-board sensors and GPS systems, is revolutionizing the way insurance policies are priced and tailored. Usage-based insurance, also known as pay-as-you-drive or pay-how-you-drive, allows insurance providers to offer policies based on an individual’s actual driving behavior. This technology rewards safe drivers with lower premiums, creating a more personalized and fair insurance landscape.

Connected Car Technologies

The integration of connected car technologies, such as advanced driver-assistance systems (ADAS) and vehicle-to-everything (V2X) communication, is expected to have a significant impact on automotive insurance. These technologies enhance safety and reduce the likelihood of accidents, potentially leading to lower insurance premiums for policyholders. Additionally, connected car data can provide valuable insights for insurance providers, enabling them to offer more accurate and tailored coverage.

Digital Transformation and Insurtech

The digital transformation of the insurance industry, driven by insurtech innovations, is streamlining the entire insurance process. From online policy management and claims submission to real-time risk assessment, technology is making insurance more accessible, efficient, and customer-centric. Insurtech startups are also bringing new products and services to the market, challenging traditional insurance models and offering innovative solutions to meet the evolving needs of consumers.

Collaborative Insurance Models

The rise of shared mobility and the gig economy is leading to a shift towards collaborative insurance models. These models involve multiple stakeholders, including vehicle owners, ride-sharing platforms, and insurance providers, working together to provide comprehensive coverage for a diverse range of vehicles and usage scenarios. Collaborative insurance models aim to address the unique challenges posed by the sharing economy, ensuring that all participants are adequately protected.

Conclusion: A Vital Component of Automotive Ownership

Insurance Auto Car is more than just a legal requirement; it is a fundamental component of responsible automotive ownership. By providing financial protection and peace of mind, these policies empower vehicle owners to navigate the complexities of the road with confidence. As the automotive industry continues to evolve, so too will the world of insurance, adapting to meet the changing needs and expectations of drivers and businesses alike.

What are the key factors that influence the cost of Insurance Auto Car policies?

+

The cost of Insurance Auto Car policies is influenced by a multitude of factors, including the make and model of the vehicle, the driver’s age and driving record, the level of coverage chosen, and the location where the vehicle is registered and primarily driven. Additionally, insurance providers may consider factors such as credit score and the number of miles driven annually.

How can policyholders reduce their Insurance Auto Car premiums?

+

There are several strategies that policyholders can employ to reduce their insurance premiums. These include maintaining a clean driving record, taking advantage of discounts offered by insurance providers (such as safe driver or multi-policy discounts), increasing deductibles, and exploring usage-based insurance options. Additionally, comparing quotes from multiple providers can help identify the most cost-effective coverage options.

What should I do if I’m involved in an accident while driving an insured vehicle?

+

In the event of an accident, it’s crucial to remain calm and follow a few key steps. First, ensure the safety of all involved parties and call emergency services if necessary. Collect information from the other driver(s) involved, including their contact details, insurance information, and vehicle details. Take photographs of the accident scene and any damage to vehicles. Finally, notify your insurance provider as soon as possible to initiate the claims process.

How does Insurance Auto Car coverage differ for personal and commercial vehicles?

+

Insurance Auto Car coverage for personal and commercial vehicles differs significantly. Personal auto insurance policies are designed to meet the needs of individual drivers and typically offer coverage for liability, collision, comprehensive, and personal injury protection (PIP). On the other hand, commercial auto insurance policies cater to businesses, providing broader coverage for liability, property damage, and potential losses due to business interruption. Additionally, commercial policies often include coverage for cargo and rental car reimbursement.