Insurance Plans For Family

In today's world, ensuring the financial well-being and protection of your loved ones is of utmost importance. Family insurance plans have become an essential tool to secure the future and mitigate the risks associated with unexpected events. These plans offer a comprehensive approach to safeguarding your family's health, wealth, and overall security. In this article, we will delve into the intricacies of family insurance plans, exploring their benefits, coverage options, and the impact they can have on your family's life.

The Importance of Family Insurance Plans

Family insurance plans serve as a safety net, providing peace of mind and financial stability during challenging times. Whether it’s protecting your family from the financial burden of medical emergencies, ensuring a secure future for your children’s education, or safeguarding your loved ones in the event of an unforeseen tragedy, these plans offer a holistic approach to risk management.

In a world filled with uncertainties, having a robust insurance plan tailored to your family's needs can make a significant difference. It allows you to focus on what truly matters - the health, happiness, and growth of your loved ones - without the constant worry of financial setbacks.

Key Components of Family Insurance Plans

Family insurance plans typically encompass a range of coverage options, each designed to address specific aspects of your family’s well-being. Let’s explore some of the key components that make up these comprehensive plans:

Health Insurance

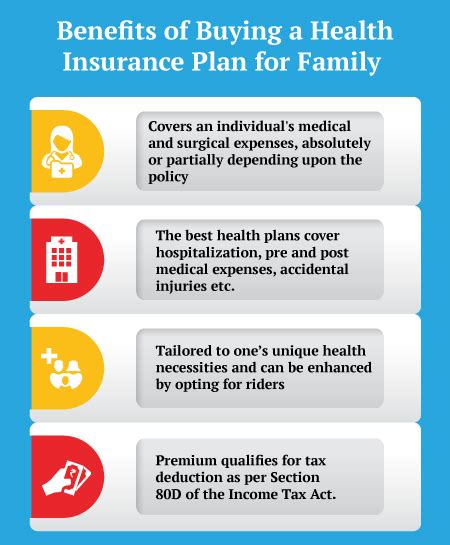

Health insurance is often considered the cornerstone of family insurance plans. It provides coverage for medical expenses, including hospitalization, doctor visits, prescription medications, and preventive care. With rising healthcare costs, having a robust health insurance policy ensures that your family receives the necessary medical attention without incurring substantial financial burdens.

Some health insurance plans offer additional benefits such as maternity coverage, critical illness protection, and even dental and vision care. These comprehensive policies aim to cover a wide range of healthcare needs, providing your family with the reassurance of accessible and affordable medical services.

| Health Insurance Benefits | Description |

|---|---|

| Hospitalization Coverage | Covers expenses for inpatient treatment, surgery, and room charges. |

| Outpatient Benefits | Provides coverage for doctor consultations, diagnostic tests, and outpatient procedures. |

| Maternity Coverage | Offers financial support for pregnancy-related expenses, including delivery and newborn care. |

| Critical Illness Protection | Provides a lump-sum payment upon diagnosis of specified critical illnesses, aiding in treatment costs. |

Life Insurance

Life insurance is an integral part of family insurance plans, ensuring financial security for your loved ones in the event of your untimely demise. It provides a death benefit, which can be used to cover funeral expenses, pay off debts, and maintain the family’s standard of living.

Life insurance policies come in various forms, including term life insurance, whole life insurance, and universal life insurance. Each type offers unique features and benefits, allowing you to customize the coverage based on your family's needs and financial goals.

| Life Insurance Types | Description |

|---|---|

| Term Life Insurance | Offers coverage for a specified term, providing a death benefit during that period. It is often more affordable than other types. |

| Whole Life Insurance | Provides lifelong coverage with a fixed premium and offers cash value accumulation over time. |

| Universal Life Insurance | Provides flexibility in premium payments and coverage amounts, allowing for adjustments as your needs change. |

Education Planning

Education planning is a critical aspect of family insurance, especially when considering the rising costs of higher education. Many insurance providers offer specialized plans that help you save and invest for your children’s future education expenses.

These plans often provide tax benefits and ensure a dedicated fund for educational purposes. Whether it's for undergraduate studies, postgraduate programs, or specialized training, education planning insurance helps alleviate the financial strain associated with pursuing quality education.

Income Protection

Income protection insurance, also known as disability insurance, safeguards your family’s financial stability in the event of a disability or prolonged illness that prevents you from working. It provides a regular income stream to cover living expenses and maintain your family’s standard of living.

Income protection plans can be tailored to your specific needs, offering benefits such as partial or full income replacement, and the coverage period can be customized to align with your family's financial goals and dependencies.

Home and Property Insurance

Family insurance plans often extend beyond personal health and life coverage to include protection for your home and valuable assets. Home insurance provides coverage for damages to your property, whether caused by natural disasters, accidents, or theft.

Additionally, valuable asset insurance can protect your family's possessions, such as jewelry, electronics, and collectibles, ensuring that your hard-earned belongings are secure and covered in the event of loss or damage.

Customizing Your Family Insurance Plan

One of the significant advantages of family insurance plans is the ability to customize them to fit your unique circumstances and financial goals. Insurance providers offer a wide range of options and add-ons that allow you to create a plan that addresses your specific needs.

When customizing your family insurance plan, consider factors such as your family's current and future financial obligations, the age and health of each family member, and any specific concerns or goals you have. Working with an insurance advisor can help you navigate these choices and ensure you select the right coverage.

Key Considerations for Customization

- Health History: Evaluate the health conditions and medical needs of each family member to determine the appropriate level of health insurance coverage.

- Financial Goals: Assess your family’s short-term and long-term financial goals, such as saving for education, retirement, or major purchases, and choose insurance options that align with these goals.

- Risk Assessment: Identify potential risks specific to your family, such as living in an area prone to natural disasters or having a family history of certain illnesses. Tailor your insurance plan to address these risks.

- Lifestyle Changes: Consider any upcoming lifestyle changes, such as having a new baby, buying a new home, or starting a business, and choose insurance options that provide coverage during these transitions.

The Impact of Family Insurance Plans

Family insurance plans have a profound impact on the overall well-being and financial security of your loved ones. By providing a safety net against unforeseen events, these plans empower you to focus on what truly matters - the health, happiness, and future of your family.

With comprehensive health insurance, you can rest assured that your family will receive the necessary medical care without financial strain. Life insurance ensures that your loved ones are financially protected in the event of an untimely demise, allowing them to maintain their lifestyle and pursue their dreams.

Education planning insurance helps alleviate the burden of rising education costs, making quality education accessible to your children. Income protection insurance provides a stable income stream during times of disability or illness, ensuring your family's financial stability and peace of mind.

Real-Life Testimonial

“When my husband and I started our family, we knew the importance of having a solid insurance plan. We wanted to ensure that our children’s future was secure, regardless of any unexpected circumstances. So, we worked with an insurance advisor to create a comprehensive family insurance plan.

The plan included health insurance with maternity coverage, life insurance with a substantial death benefit, and education planning insurance to cover our children's college expenses. We also added income protection insurance to provide a safety net in case either of us faced a disability or long-term illness.

Having this plan in place gave us immense peace of mind. We knew that no matter what life threw our way, our family would be taken care of. It allowed us to focus on our careers, spend quality time with our children, and pursue our passions without the constant worry of financial instability."

Frequently Asked Questions (FAQ)

What is the difference between term life insurance and whole life insurance?

+

Term life insurance offers coverage for a specified term, typically 10 to 30 years, and provides a death benefit during that period. It is often more affordable than whole life insurance. Whole life insurance, on the other hand, provides lifelong coverage with a fixed premium and accumulates cash value over time. It offers more stability and can be used as an investment vehicle.

How much health insurance coverage do I need for my family?

+

The amount of health insurance coverage you need depends on various factors, including your family’s health history, the age of family members, and your budget. It’s recommended to assess your family’s healthcare needs and choose a plan that provides adequate coverage for common medical expenses. Consider factors like deductibles, copayments, and out-of-pocket maximums when selecting a health insurance plan.

Can I include my extended family members in my family insurance plan?

+

In some cases, extended family members can be included in a family insurance plan. However, the eligibility and coverage options may vary depending on the insurance provider and the specific plan. It’s best to consult with your insurance advisor to understand the options available for including extended family members in your plan.

What is the process for claiming insurance benefits under a family insurance plan?

+

The process for claiming insurance benefits can vary depending on the type of insurance and the specific provider. Generally, you will need to submit a claim form along with supporting documentation, such as medical bills or proof of loss. It’s important to familiarize yourself with the claim process and any required steps to ensure a smooth and timely reimbursement.

In conclusion, family insurance plans are a vital tool for safeguarding your loved ones’ future. By understanding the key components, customization options, and the impact these plans can have, you can make informed decisions to create a comprehensive insurance strategy. Remember, the peace of mind that comes with knowing your family is protected is invaluable.