Wegovy Cost With Insurance

For individuals seeking to manage their weight and improve their overall health, Wegovy has emerged as a popular prescription medication. While the potential benefits are well-documented, one of the primary concerns for many prospective users is the cost. In this comprehensive guide, we will delve into the details of the cost of Wegovy when covered by insurance, shedding light on the financial aspects of this treatment option.

Understanding Wegovy and Its Potential Benefits

Wegovy, also known by its generic name, semaglutide, is a prescription medication approved for chronic weight management in adults with a body mass index (BMI) of 30 or higher, or in adults with a BMI of 27 or higher who have at least one weight-related condition such as type 2 diabetes or high blood pressure. It belongs to a class of drugs called glucagon-like peptide-1 (GLP-1) receptor agonists, which work by regulating appetite and promoting a sense of fullness.

When used as directed, Wegovy has been shown to lead to significant weight loss, often resulting in improved health outcomes. The medication is administered once weekly via subcutaneous injection, making it a convenient option for those managing their weight.

The Impact of Insurance Coverage on Wegovy Cost

The cost of Wegovy can vary significantly depending on whether it is covered by insurance and the specific details of the insurance plan. In the United States, the list price for a monthly supply of Wegovy is approximately $1,300, making it an expensive treatment option without insurance coverage.

However, for those with insurance, the out-of-pocket cost can be significantly reduced. Many insurance plans, including Medicare and Medicaid, cover a portion or the full cost of Wegovy, making it more accessible and affordable for those who qualify.

Insurance Coverage Options

Insurance coverage for Wegovy typically falls into one of the following categories:

- Commercial Insurance: Many private insurance plans cover Wegovy as a prescription medication. The extent of coverage can vary, with some plans covering a larger portion of the cost while others may have higher copays or deductibles.

- Medicare: Medicare Part D plans often cover Wegovy, but the specifics can vary depending on the chosen plan. Some plans may have a coverage gap or require prior authorization, so it's essential to check the details of your specific plan.

- Medicaid: Medicaid programs in various states cover Wegovy, but the criteria for coverage can differ. Some states may require additional documentation or proof of medical necessity.

- Veterans Affairs (VA): The VA healthcare system provides coverage for Wegovy, making it a viable option for veterans seeking weight management assistance.

Out-of-Pocket Costs with Insurance

The out-of-pocket cost for Wegovy with insurance can vary widely based on the insurance plan and the patient’s specific circumstances. Here are some general guidelines:

| Insurance Type | Estimated Out-of-Pocket Cost |

|---|---|

| Commercial Insurance | $50 - $250 per month |

| Medicare | $0 - $150 per month |

| Medicaid | Varies by state, often fully covered |

| Veterans Affairs (VA) | Varies, often fully covered or with a small copay |

It's important to note that these estimates are rough guidelines and the actual out-of-pocket cost can differ based on individual plan details and the patient's prescription coverage.

Assistance Programs for Uninsured Patients

For those without insurance coverage, Wegovy can still be accessible through various assistance programs. These programs often provide significant discounts or even free medication to eligible patients.

Patient Assistance Programs (PAPs)

Several pharmaceutical companies offer PAPs for Wegovy, providing the medication at little to no cost for those who meet certain income and eligibility criteria. These programs typically require documentation of financial need and may have specific application processes.

Co-Pay Assistance

Some organizations and foundations provide co-pay assistance for Wegovy, helping to reduce the out-of-pocket cost for those with high copays or deductibles. These programs can be a valuable resource for patients who are struggling to afford their medication.

Discount Cards and Coupons

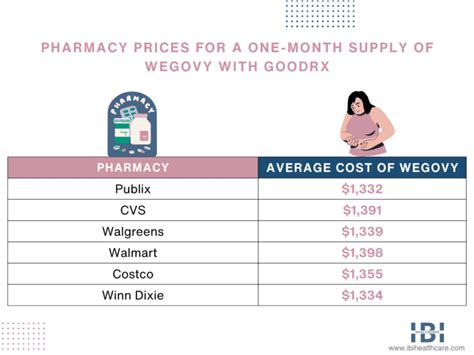

Discount cards and coupons can also be a great way to save on Wegovy. These cards and coupons are often offered by pharmaceutical companies or third-party organizations and can provide significant discounts on the medication. It’s worth exploring these options to find the best deal.

Comparing Wegovy to Other Weight Loss Treatments

When considering the cost of Wegovy, it’s essential to compare it to other weight loss treatments to understand its value and affordability.

Surgical Options

Weight loss surgeries, such as gastric bypass or sleeve gastrectomy, are often considered more costly upfront compared to Wegovy. However, the long-term benefits and weight loss potential of these surgeries can make them a more cost-effective option for some individuals.

Other Prescription Medications

There are several other prescription weight loss medications available, each with its own cost structure. Some medications may be covered by insurance at a lower cost than Wegovy, while others may be more expensive. It’s important to explore all options and consider the potential benefits and costs.

Lifestyle Interventions

Non-pharmacological weight loss interventions, such as diet and exercise programs, can be more affordable than prescription medications. However, the effectiveness and sustainability of these interventions can vary, and some individuals may require additional support from medications like Wegovy.

Maximizing Insurance Benefits for Wegovy

To ensure you get the most out of your insurance coverage for Wegovy, it’s essential to understand your plan’s specifics and take advantage of all available benefits.

Review Your Insurance Plan

Familiarize yourself with your insurance plan’s prescription coverage, including any copays, deductibles, and prior authorization requirements. Understanding these details can help you plan and budget for your Wegovy treatment.

Explore Prior Authorization

If your insurance plan requires prior authorization for Wegovy, work with your healthcare provider to ensure the necessary documentation is provided. This step is crucial to getting your medication covered.

Consider Mail-Order Pharmacies

Many insurance plans offer lower costs or additional savings when medications are ordered through mail-order pharmacies. These pharmacies often provide discounts and can deliver your medication directly to your home, saving you time and effort.

Potential Side Effects and Considerations

While Wegovy is generally well-tolerated, it’s essential to be aware of potential side effects and considerations when using this medication.

Common Side Effects

Common side effects of Wegovy include nausea, vomiting, diarrhea, constipation, and abdominal pain. These side effects are typically mild and resolve over time as the body adjusts to the medication.

Serious Side Effects

In rare cases, Wegovy may cause more serious side effects, such as allergic reactions, pancreatitis, or kidney problems. It’s crucial to seek immediate medical attention if you experience any severe or persistent side effects.

Contraindications and Precautions

Wegovy may not be suitable for everyone. It is contraindicated in individuals with a personal or family history of medullary thyroid cancer or multiple endocrine neoplasia syndrome type 2. Additionally, it should be used with caution in those with a history of kidney or liver problems.

Conclusion: Navigating the Cost of Wegovy

The cost of Wegovy can be a significant concern for individuals seeking weight management assistance. However, with proper insurance coverage, assistance programs, and a thorough understanding of the medication’s benefits and potential side effects, Wegovy can be a viable and affordable option for many. By exploring all available resources and working closely with healthcare providers, patients can make informed decisions about their weight loss journey.

How do I know if Wegovy is covered by my insurance plan?

+To determine if Wegovy is covered by your insurance plan, contact your insurance provider directly. They can provide specific details about your prescription coverage, including any copays, deductibles, or prior authorization requirements.

What if my insurance plan doesn’t cover Wegovy?

+If your insurance plan doesn’t cover Wegovy, consider exploring assistance programs, co-pay assistance, or discount cards. These options can help reduce the out-of-pocket cost of the medication. Additionally, you can discuss alternative weight loss treatments with your healthcare provider.

Can I use Wegovy long-term, or is it only for short-term weight loss?

+Wegovy is approved for long-term use in chronic weight management. It is intended to be used continuously as part of a comprehensive weight loss plan, which may include lifestyle modifications and ongoing medical supervision.