Insure A Life

Life insurance is a vital financial tool that provides security and peace of mind for individuals and their loved ones. In an uncertain world, having adequate life insurance coverage is essential to protect your family's future and ensure their financial stability in the event of an untimely demise. This comprehensive guide aims to explore the intricacies of life insurance, helping you make informed decisions to maximize your coverage and safeguard your family's financial well-being.

Understanding Life Insurance

Life insurance is a contract between an individual (the policyholder) and an insurance company. The policyholder pays regular premiums, and in return, the insurance provider agrees to pay a specified amount (known as the death benefit) to the beneficiaries upon the policyholder's death. This financial protection can help cover various expenses, including funeral costs, outstanding debts, and provide ongoing support for daily living expenses, education, and more.

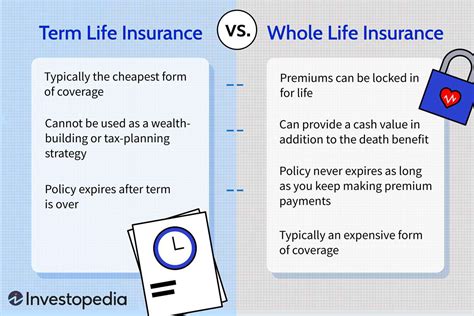

Life insurance policies come in various forms, each with unique features and benefits. The two primary types are term life insurance and permanent life insurance. Term life insurance offers coverage for a specified period, typically ranging from 10 to 30 years, and is generally more affordable. Permanent life insurance, on the other hand, provides lifelong coverage and often includes a cash value component that can be accessed during the policyholder's lifetime.

Maximizing Coverage: A Step-by-Step Guide

Maximizing your life insurance coverage is crucial to ensure your family's financial security. Here's a detailed guide to help you navigate the process effectively:

1. Assess Your Needs

Begin by evaluating your current financial situation and future goals. Consider factors such as your income, outstanding debts, mortgage, and your family's financial dependencies. Calculate the amount of coverage needed to replace your income and cover these expenses. It's recommended to aim for a coverage amount that is 10-15 times your annual income to provide sufficient financial support for your loved ones.

2. Choose the Right Type of Policy

Decide between term life insurance and permanent life insurance based on your needs and financial circumstances. Term life insurance is ideal for those seeking coverage for a specific period, such as until their children become independent or their mortgage is paid off. Permanent life insurance, with its lifelong coverage and cash value benefits, is suitable for individuals looking for long-term financial protection and potential tax advantages.

3. Compare Providers and Policies

Research and compare different life insurance providers and their policies. Consider factors such as financial stability, customer service reputation, policy features, and premiums. Online tools and comparison websites can simplify this process by providing quotes and detailed policy information. Additionally, seek recommendations from trusted sources, such as financial advisors or friends who have had positive experiences with specific providers.

| Provider | Policy Type | Premiums | Features |

|---|---|---|---|

| Company A | Term Life (20-year term) | $50/month | Affordable, renewable option |

| Company B | Permanent Life | $120/month | Cash value growth, tax benefits |

| Company C | Term Life (30-year term) | $65/month | Longer coverage period |

4. Review Your Policy Regularly

Life insurance needs can change over time due to various factors, such as marriage, the birth of children, career changes, or significant financial milestones. Regularly review your policy to ensure it aligns with your current needs. Consider increasing your coverage amount or adjusting your policy type if your circumstances change significantly. Most insurance providers offer flexible options to accommodate life's changes.

5. Consider Additional Coverage Options

Explore additional coverage options to enhance your life insurance protection. Some providers offer riders or endorsements that can be added to your policy, providing extra benefits such as accelerated death benefits for terminal illnesses, waiver of premium in case of disability, or child riders that provide coverage for your children.

6. Seek Professional Advice

Consulting a qualified financial advisor or insurance broker can be invaluable when maximizing your life insurance coverage. They can provide personalized advice based on your financial situation and goals, helping you navigate the complex world of life insurance policies. Additionally, they can assist in identifying potential tax benefits and strategies to optimize your coverage.

Life Insurance and Financial Planning

Life insurance is an integral part of comprehensive financial planning. It provides a safety net for your loved ones, ensuring they can maintain their standard of living and achieve their financial goals even in the event of your passing. By integrating life insurance into your overall financial strategy, you can create a robust plan that addresses various aspects of financial security, including retirement planning, estate planning, and risk management.

Key Considerations for Financial Planning:

- Retirement Planning: Life insurance can be a valuable tool to supplement retirement savings, especially if you have significant debt or financial obligations. It can provide a lump sum to pay off debts, allowing your retirement funds to grow unhindered.

- Estate Planning: Life insurance can play a crucial role in estate planning by providing liquidity to pay for estate taxes and settlement costs. It can also help ensure the smooth transfer of assets to your beneficiaries, avoiding potential legal hurdles.

- Risk Management: Life insurance is an effective risk management strategy, protecting your family from the financial impact of your untimely death. It provides a financial cushion that can help your loved ones maintain their lifestyle and achieve their financial goals.

The Future of Life Insurance

The life insurance industry is evolving, driven by technological advancements and changing consumer needs. Insurers are embracing digital technologies to streamline the application process, offering more efficient and convenient ways to purchase and manage policies. Additionally, the rise of parametric life insurance, which uses data-driven models to assess risk and set premiums, is transforming the industry, offering more personalized and affordable coverage options.

Looking ahead, the future of life insurance promises increased customization and accessibility. Insurers are likely to continue leveraging technology to enhance the customer experience, providing more tailored policies and seamless digital interactions. Moreover, the integration of health and lifestyle data into insurance underwriting is expected to play a significant role, allowing for more accurate risk assessment and potentially lowering premiums for healthy individuals.

As the life insurance landscape evolves, staying informed about the latest trends and advancements is essential. Keeping up with industry developments can help you make informed decisions when reviewing and maximizing your coverage. Regularly engaging with reputable insurance providers and financial advisors can ensure you remain up-to-date with the latest innovations and opportunities in the life insurance market.

Conclusion

Maximizing your life insurance coverage is a critical step towards securing your family's financial future. By understanding your needs, choosing the right policy type, and regularly reviewing your coverage, you can ensure that your loved ones are protected and supported. Life insurance is a powerful tool in your financial arsenal, providing peace of mind and a solid foundation for your family's long-term financial well-being.

Remember, life insurance is not a one-size-fits-all solution. Tailor your coverage to your unique circumstances and goals, and don't hesitate to seek professional advice to make the most informed decisions. With the right life insurance coverage, you can face the future with confidence, knowing that your family's financial future is protected.

How much life insurance coverage do I need?

+

The amount of life insurance coverage you need depends on your financial situation and goals. A general rule of thumb is to aim for 10-15 times your annual income. However, it’s essential to consider factors such as outstanding debts, mortgage, and your family’s financial dependencies. Consult a financial advisor to determine the appropriate coverage amount for your specific circumstances.

What is the difference between term life and permanent life insurance?

+

Term life insurance provides coverage for a specified period, typically 10-30 years, and is often more affordable. It is suitable for individuals seeking coverage for a specific timeframe, such as until their children become independent or their mortgage is paid off. Permanent life insurance, on the other hand, offers lifelong coverage and includes a cash value component that can be accessed during the policyholder’s lifetime. It is ideal for those seeking long-term financial protection and potential tax advantages.

How can I compare different life insurance policies and providers?

+

You can compare life insurance policies and providers by researching their financial stability, customer service reputation, policy features, and premiums. Online tools and comparison websites can provide valuable insights and quotes. Additionally, seeking recommendations from trusted sources, such as financial advisors or friends, can help you make an informed decision.