Auto Insurance Quotes Ny

Welcome to our comprehensive guide on auto insurance quotes in the state of New York. Navigating the world of car insurance can be a complex task, especially when it comes to understanding the unique factors that influence rates in different regions. In this article, we delve into the specifics of auto insurance quotes in NY, offering valuable insights and practical tips to help you make informed decisions.

Understanding Auto Insurance in New York

Auto insurance is a legal requirement for all vehicle owners in New York State. It provides financial protection in the event of accidents, covering potential liabilities, damages, and injuries. The state’s insurance regulations ensure a standard level of coverage, but the actual quotes can vary significantly depending on numerous factors.

New York is known for its highly competitive insurance market, with numerous providers offering a wide range of policies. This competition often results in diverse pricing structures and coverage options, making it crucial for consumers to compare quotes and understand the nuances of their policies.

Factors Influencing Auto Insurance Quotes in NY

The cost of auto insurance in New York is influenced by a multitude of factors, each playing a unique role in determining your individual quote. These factors include, but are not limited to:

- Vehicle Type and Usage: The make, model, and year of your vehicle, as well as how you use it (commuting, leisure, business), can impact your insurance rates. Sports cars and luxury vehicles, for instance, often carry higher premiums due to their performance capabilities and higher repair costs.

- Driver Profile: Your age, gender, driving history, and even marital status can affect your insurance rates. Young drivers, especially males under 25, are typically considered high-risk due to their propensity for accidents. Conversely, experienced drivers with clean records often enjoy more competitive rates.

- Location: Where you live and park your vehicle can significantly impact your insurance costs. Urban areas like New York City often have higher premiums due to increased accident risks and higher rates of theft and vandalism. Rural areas, on the other hand, may offer more affordable rates.

- Coverage Level: The level of coverage you choose directly affects your premium. Comprehensive coverage, which includes collision, liability, and additional protections, will generally be more expensive than basic liability-only insurance.

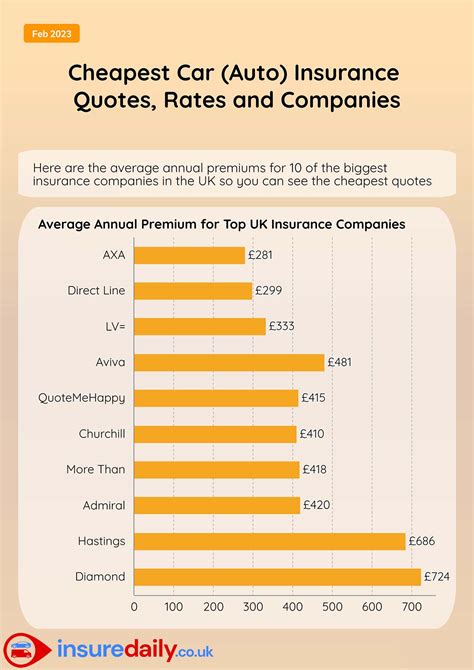

- Insurance Provider: Different insurance companies in New York offer varying rates and coverage options. It's essential to shop around and compare quotes from multiple providers to find the best deal that suits your needs.

Tips for Getting the Best Auto Insurance Quotes in NY

Securing the most competitive auto insurance quote in New York requires a strategic approach. Here are some expert tips to guide you:

Compare Multiple Quotes

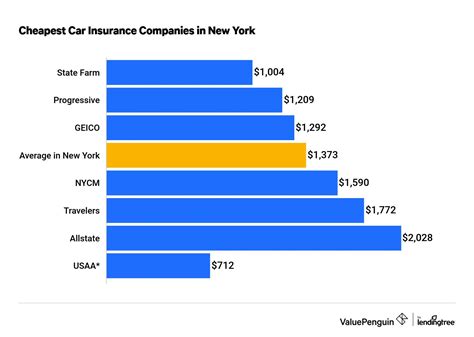

The insurance market in New York is diverse, so it’s crucial to obtain quotes from various providers. Online comparison tools can be a convenient way to quickly gather multiple quotes, but be sure to also reach out to individual companies for personalized quotes.

Understand Your Coverage Needs

Assess your specific insurance needs based on your vehicle, driving habits, and personal circumstances. Consider factors like the value of your car, your financial liability, and any additional coverage you may require (e.g., personal injury protection or uninsured/underinsured motorist coverage).

Utilize Discounts

Insurance companies often offer a range of discounts to attract and retain customers. These can include discounts for safe driving records, multi-policy bundles (e.g., bundling auto and home insurance), and even educational discounts for completing defensive driving courses. Be sure to inquire about available discounts when obtaining quotes.

Maintain a Clean Driving Record

Your driving history is a significant factor in determining your insurance rates. Maintaining a clean record, free of accidents and violations, can lead to substantial savings on your premium. Additionally, many insurance companies offer safe driver discounts, further incentivizing responsible driving behavior.

Consider Bundling Policies

If you own multiple vehicles or have other insurance needs (e.g., home or renters insurance), consider bundling your policies with a single provider. Bundling often results in significant savings and simplifies the management of your insurance needs.

Review and Update Your Policy Regularly

Insurance needs can change over time. Regularly review your policy to ensure it still aligns with your current circumstances and coverage requirements. Update your policy as needed to reflect changes in your life, such as a new vehicle, a move to a different location, or significant life events.

Performance Analysis: Real-World Auto Insurance Quotes in NY

To provide a more tangible understanding of auto insurance quotes in New York, let’s examine some real-world examples. These scenarios illustrate how different factors can influence insurance rates:

| Scenario | Quote (Annual) | Factors Influencing Rate |

|---|---|---|

| John, 28, owns a 2018 Toyota Camry. He has a clean driving record and lives in a suburban area. He seeks basic liability-only coverage. | $750 | Safe driving record, suburban location, basic coverage level. |

| Sarah, 35, drives a 2020 Tesla Model 3. She has a few minor violations on her record and lives in an urban area. She opts for comprehensive coverage. | $2,100 | Urban location, luxury vehicle, comprehensive coverage, minor violations. |

| Mike, 55, drives a 2015 Ford F-150. He has a long history of safe driving and owns a home in a rural area. He bundles his auto and home insurance policies. | $1,200 | Safe driving history, rural location, bundled policies, standard coverage. |

These examples demonstrate the wide range of auto insurance quotes in New York and the significant impact of various factors. By understanding these influences and implementing the tips outlined above, you can navigate the insurance landscape more effectively and secure the best coverage at the most competitive rates.

Future Implications and Industry Insights

The auto insurance landscape in New York is continually evolving, driven by technological advancements, regulatory changes, and shifting consumer behaviors. Here are some key trends and insights to consider for the future:

Telematics and Usage-Based Insurance

Telematics technology, which tracks driving behavior and habits, is gaining traction in the insurance industry. Usage-based insurance policies, often referred to as “pay-as-you-drive” or “pay-how-you-drive,” offer premiums based on real-time data. This technology rewards safe driving behaviors and provides more personalized insurance rates. In the future, we can expect to see an increase in the adoption of telematics-based insurance policies, offering more tailored coverage options and potentially reducing costs for safe drivers.

Regulatory Changes and Market Dynamics

The insurance industry in New York is subject to regulatory oversight and market forces that can influence rates and coverage options. Stay informed about any changes in state regulations, such as adjustments to mandatory minimum coverage levels or the introduction of new consumer protections. Additionally, monitor market dynamics, including mergers and acquisitions among insurance providers, which can impact the competitive landscape and potentially affect your insurance options.

Digital Transformation and Online Quoting

The digital transformation of the insurance industry has been accelerated by the COVID-19 pandemic. Online quoting platforms and digital insurance management tools have become increasingly popular, offering convenience and efficiency to consumers. Expect continued innovation in this space, with more advanced algorithms and data analytics driving more accurate and personalized quotes. Additionally, the rise of InsurTech startups is bringing new competition and disruptive technologies to the market, potentially driving down insurance costs and improving consumer experiences.

Sustainable and Electric Vehicle Insurance

The growing adoption of electric vehicles (EVs) and sustainable transportation options is likely to impact auto insurance in the coming years. Insurance providers are already developing specialized policies and coverage options tailored to the unique needs of EV owners, including extended warranties and roadside assistance for battery-related issues. As the EV market matures, we can expect to see more comprehensive insurance solutions for sustainable transportation, potentially offering cost savings and incentives for environmentally conscious consumers.

Conclusion: Navigating Auto Insurance in NY

Obtaining auto insurance quotes in New York involves understanding the unique factors that influence rates in the state, comparing quotes from multiple providers, and tailoring your coverage to your specific needs. By staying informed about industry trends and regulatory changes, you can make more strategic decisions about your insurance coverage. As the market continues to evolve, embracing digital tools and innovative insurance solutions can help you secure the best value and coverage for your unique circumstances.

What is the average cost of auto insurance in New York State?

+The average cost of auto insurance in New York can vary significantly based on numerous factors. As of our latest data, the average annual premium for a standard policy in NY is approximately 1,500. However, this can range widely depending on your individual circumstances and the level of coverage you choose.</p> </div> </div> <div class="faq-item"> <div class="faq-question"> <h3>Are there any state-specific insurance requirements in New York?</h3> <span class="faq-toggle">+</span> </div> <div class="faq-answer"> <p>Yes, New York State has specific insurance requirements for vehicle owners. The minimum liability coverage required is 25,000 for bodily injury per person, 50,000 for bodily injury per accident, and 10,000 for property damage per accident. However, many drivers opt for coverage that exceeds these minimums to ensure adequate protection.

How can I reduce my auto insurance costs in New York?

+There are several strategies to reduce your auto insurance costs in New York. These include maintaining a clean driving record, comparing quotes from multiple providers, utilizing available discounts, choosing a higher deductible, and considering bundling your auto insurance with other policies (e.g., home or renters insurance). It’s also important to regularly review and update your policy to ensure it aligns with your current needs and circumstances.

What factors can lead to higher auto insurance rates in New York?

+Several factors can lead to higher auto insurance rates in New York. These include living in an urban area with higher accident risks, owning a high-performance or luxury vehicle, having a poor driving record with accidents or violations, and choosing a comprehensive coverage level. It’s important to carefully consider these factors when obtaining quotes and tailoring your insurance policy to your specific needs.

How often should I review and update my auto insurance policy in New York?

+It’s recommended to review and update your auto insurance policy annually or whenever there are significant changes in your life or circumstances. This could include buying a new vehicle, moving to a different location, getting married or divorced, or experiencing a change in your driving habits or needs. Regularly reviewing your policy ensures that your coverage remains adequate and that you’re not overpaying for unnecessary coverage.