Wellness Insurance For Dogs

As the trend of treating pets as family members continues to rise, pet owners are becoming increasingly concerned about the well-being and healthcare of their furry companions. This has led to a growing demand for comprehensive insurance coverage for dogs, offering a safety net for unexpected veterinary expenses. In this comprehensive article, we delve into the world of wellness insurance for dogs, exploring its benefits, coverage options, and how it can provide peace of mind for dog owners.

Understanding Dog Wellness Insurance

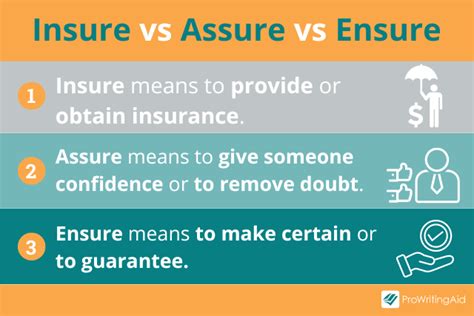

Dog wellness insurance is a specialized type of pet insurance that goes beyond traditional accident and illness coverage. While standard pet insurance plans typically reimburse owners for unexpected illnesses or injuries, wellness insurance takes a proactive approach by covering routine care and preventive measures to maintain a dog’s overall health and well-being.

By investing in wellness insurance, dog owners can access a range of benefits that promote a dog's long-term health and happiness. These benefits often include annual check-ups, vaccinations, parasite prevention, dental care, spaying or neutering, and even alternative therapies like acupuncture or chiropractic care. The goal is to catch potential health issues early on and provide regular care to prevent them from becoming more serious and costly problems down the line.

One of the key advantages of wellness insurance is its ability to help pet owners stay on top of their dog's healthcare needs without breaking the bank. Routine veterinary care can quickly add up, especially for breeds prone to certain health conditions. With wellness insurance, owners can budget for these expenses more effectively and ensure their dog receives the best possible care throughout its life.

Coverage Options and Customization

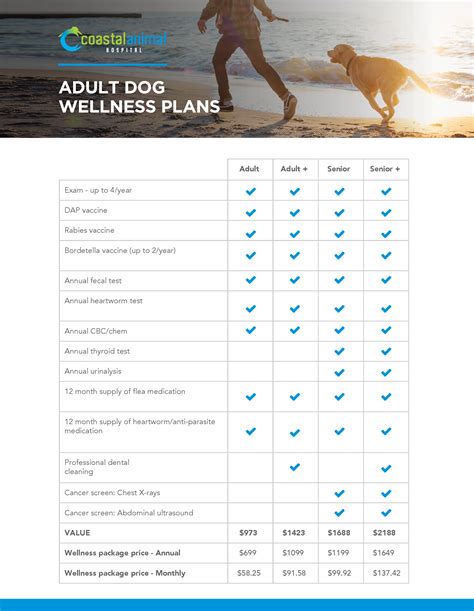

Wellness insurance plans offer a variety of coverage options to suit different dog breeds, ages, and lifestyles. Some plans provide comprehensive coverage for all aspects of routine care, while others allow owners to choose specific add-ons based on their dog’s unique needs.

For example, a plan might offer separate coverage for annual exams, vaccinations, and parasite prevention, with the option to add on dental care or alternative therapies. This level of customization ensures that pet owners can tailor their insurance to their budget and their dog's specific health requirements.

Additionally, many wellness insurance providers offer flexible reimbursement options. Some plans reimburse owners for a certain percentage of eligible expenses, while others provide direct payment to the veterinary clinic. This flexibility allows owners to choose the option that best fits their financial situation and preferences.

| Coverage Category | Description |

|---|---|

| Annual Check-ups | Routine examinations to assess overall health and detect any potential issues. |

| Vaccinations | Protection against common diseases like rabies, distemper, and parvovirus. |

| Parasite Prevention | Coverage for flea, tick, and heartworm prevention medications. |

| Dental Care | Treatment for dental issues, including cleanings, extractions, and dental disease management. |

| Spaying/Neutering | Coverage for the surgical procedure to prevent unwanted pregnancies and certain health risks. |

| Alternative Therapies | Reimbursement for treatments like acupuncture, chiropractic care, or hydrotherapy. |

The Benefits of Wellness Insurance for Dogs

Wellness insurance for dogs offers a multitude of benefits that extend beyond financial protection. Here are some key advantages:

Proactive Health Management

With wellness insurance, dog owners can take a proactive approach to their pet’s health. Regular check-ups and preventive measures help catch potential health issues early on, allowing for prompt treatment and potentially preventing more serious illnesses.

For instance, annual exams can reveal early signs of joint issues, dental problems, or weight management concerns. By addressing these issues promptly, owners can ensure their dog maintains a high quality of life and avoid more costly and invasive treatments down the line.

Peace of Mind and Financial Stability

Unforeseen veterinary expenses can be a significant financial burden for pet owners. Wellness insurance provides a safety net, ensuring that routine care and preventive measures are covered, reducing the risk of unexpected costs. This peace of mind allows owners to focus on their dog’s well-being without worrying about the financial implications.

Additionally, wellness insurance often includes coverage for emergency situations, providing owners with the necessary funds to seek immediate veterinary care without delay. This can be especially crucial for dog owners with limited financial means or those who may need to make quick decisions in a medical emergency.

Enhanced Access to Veterinary Care

Wellness insurance can make high-quality veterinary care more accessible to a wider range of dog owners. By covering routine expenses, owners may feel more comfortable seeking regular check-ups and preventive treatments, ensuring their dog receives the care it needs to stay healthy.

This is particularly beneficial for dog owners who may have previously struggled to afford regular veterinary visits or those who have multiple pets and need to budget carefully. With wellness insurance, owners can prioritize their dog's health and well-being without financial constraints.

Real-Life Impact: Success Stories

To illustrate the impact of wellness insurance, let’s explore a few real-life success stories:

Story 1: Preventing Dental Issues

Meet Lucy, a 7-year-old Labrador Retriever with a history of dental problems. Her owner, Sarah, invested in wellness insurance when Lucy was a puppy, knowing that dental care would be an important aspect of her long-term health. Thanks to the insurance coverage, Sarah was able to bring Lucy in for regular dental check-ups and cleanings, preventing the need for more extensive and costly dental procedures in the future.

By staying on top of Lucy's dental health, Sarah not only saved money but also ensured her beloved pet remained pain-free and enjoyed a better quality of life. Wellness insurance allowed Sarah to make informed decisions about Lucy's care and provided the financial support to do so.

Story 2: Managing Chronic Conditions

Max, a 10-year-old Golden Retriever, was diagnosed with arthritis at a relatively young age. His owner, John, had the foresight to purchase wellness insurance, which covered Max’s annual check-ups and diagnostic tests. As a result, John was able to detect the early signs of arthritis and work with his veterinarian to develop a comprehensive management plan.

With the financial support from wellness insurance, John could afford the necessary medications, supplements, and physical therapy to help Max manage his condition. Max's quality of life improved significantly, and he remained active and happy despite his arthritis. Wellness insurance played a crucial role in providing the necessary funds for his ongoing care.

Choosing the Right Wellness Insurance Plan

When selecting a wellness insurance plan for your dog, it’s important to consider several factors to ensure you find the best fit:

Breed and Age Considerations

Different dog breeds have unique health needs and predispositions to certain conditions. Research common health issues associated with your dog’s breed and choose a plan that offers coverage for those specific concerns. Additionally, older dogs may require more comprehensive coverage to address age-related health issues.

Coverage Levels and Customization

Assess your dog’s current and future healthcare needs to determine the appropriate coverage level. Some plans offer basic coverage for routine care, while others provide more extensive coverage for specialized treatments. Evaluate the add-on options and customize the plan to match your dog’s unique requirements.

Reputation and Reliability

Research the reputation of the insurance provider. Look for companies with a strong track record of paying claims promptly and offering excellent customer service. Read reviews from other pet owners to get an idea of the provider’s reliability and responsiveness.

Policy Terms and Conditions

Carefully review the policy terms and conditions, including any exclusions, waiting periods, or limitations. Understand the coverage limits and reimbursement processes to ensure the plan aligns with your expectations and budget.

Future Trends in Dog Wellness Insurance

As the pet insurance industry continues to evolve, we can expect to see several emerging trends in dog wellness insurance:

Digital Health Records and Telemedicine

The integration of digital health records and telemedicine services is likely to become more prevalent in the future. This will allow pet owners to access their dog’s medical information easily and consult with veterinarians remotely, enhancing the convenience and efficiency of healthcare.

Personalized Care Plans

Insurance providers may start offering more personalized care plans based on a dog’s breed, age, and individual health needs. These plans could provide tailored recommendations for preventive care and offer customized coverage options to address specific health concerns.

Wellness Incentives and Rewards

Some insurance companies may introduce incentives and rewards programs to encourage pet owners to prioritize their dog’s wellness. This could include discounts for regular check-ups, loyalty rewards for maintaining a healthy lifestyle, or even partnerships with pet-focused businesses to offer additional benefits.

Advanced Preventive Measures

As veterinary medicine advances, we can expect to see more innovative preventive measures being covered by wellness insurance plans. This may include advanced diagnostics, genetic testing, and innovative therapies to detect and prevent potential health issues before they become severe.

Frequently Asked Questions

How much does wellness insurance for dogs typically cost?

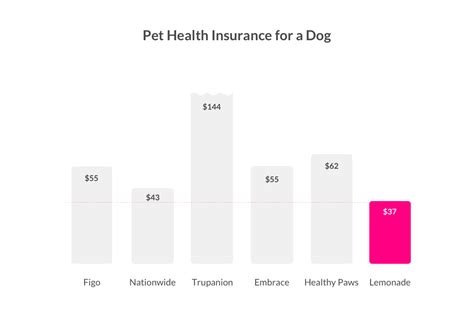

+The cost of wellness insurance can vary depending on several factors, including the age and breed of your dog, the level of coverage you choose, and the insurance provider. On average, wellness insurance plans can range from 20 to 60 per month, but this can increase for more comprehensive coverage or for older dogs with pre-existing conditions. It’s important to shop around and compare different plans to find the best fit for your budget and your dog’s needs.

Does wellness insurance cover pre-existing conditions?

+Most wellness insurance plans have specific guidelines regarding pre-existing conditions. In general, pre-existing conditions are not covered by wellness insurance, as these plans focus on preventive care and routine expenses. However, some plans may offer coverage for certain pre-existing conditions after a waiting period or if the condition has been successfully managed for a specific duration. It’s crucial to carefully review the policy terms and conditions to understand the coverage for pre-existing conditions.

Can I combine wellness insurance with traditional accident and illness coverage?

+Absolutely! Many pet owners opt for a combination of wellness insurance and traditional accident and illness coverage to provide comprehensive protection for their dogs. Wellness insurance focuses on preventive care and routine expenses, while accident and illness coverage steps in for unexpected veterinary emergencies. By combining these plans, you can ensure your dog receives the best possible care for all aspects of their health.

Are there any limitations or exclusions in wellness insurance plans?

+Yes, wellness insurance plans typically have certain limitations and exclusions. These may include specific treatments, procedures, or conditions that are not covered by the plan. It’s essential to review the policy documents thoroughly to understand the scope of coverage and any potential limitations. Some common exclusions may include cosmetic procedures, pre-existing conditions, and behavioral issues.

How can I choose the best wellness insurance plan for my dog?

+Choosing the best wellness insurance plan involves considering several factors. Start by assessing your dog’s current and future healthcare needs, including any breed-specific concerns or age-related issues. Compare different plans, considering the coverage levels, customization options, and reputation of the insurance provider. Read reviews and seek recommendations from other pet owners to help guide your decision. Finally, carefully review the policy terms and conditions to ensure the plan aligns with your expectations and budget.

Wellness insurance for dogs offers a valuable solution for pet owners looking to prioritize their furry companions’ health and well-being. By investing in this specialized insurance, owners can access a range of benefits, from proactive health management to financial stability and enhanced access to veterinary care. With the right plan, dog owners can ensure their beloved pets receive the care they need to lead happy, healthy lives.