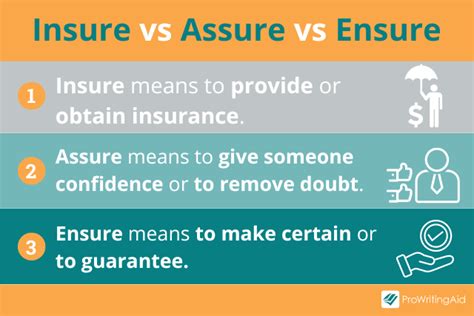

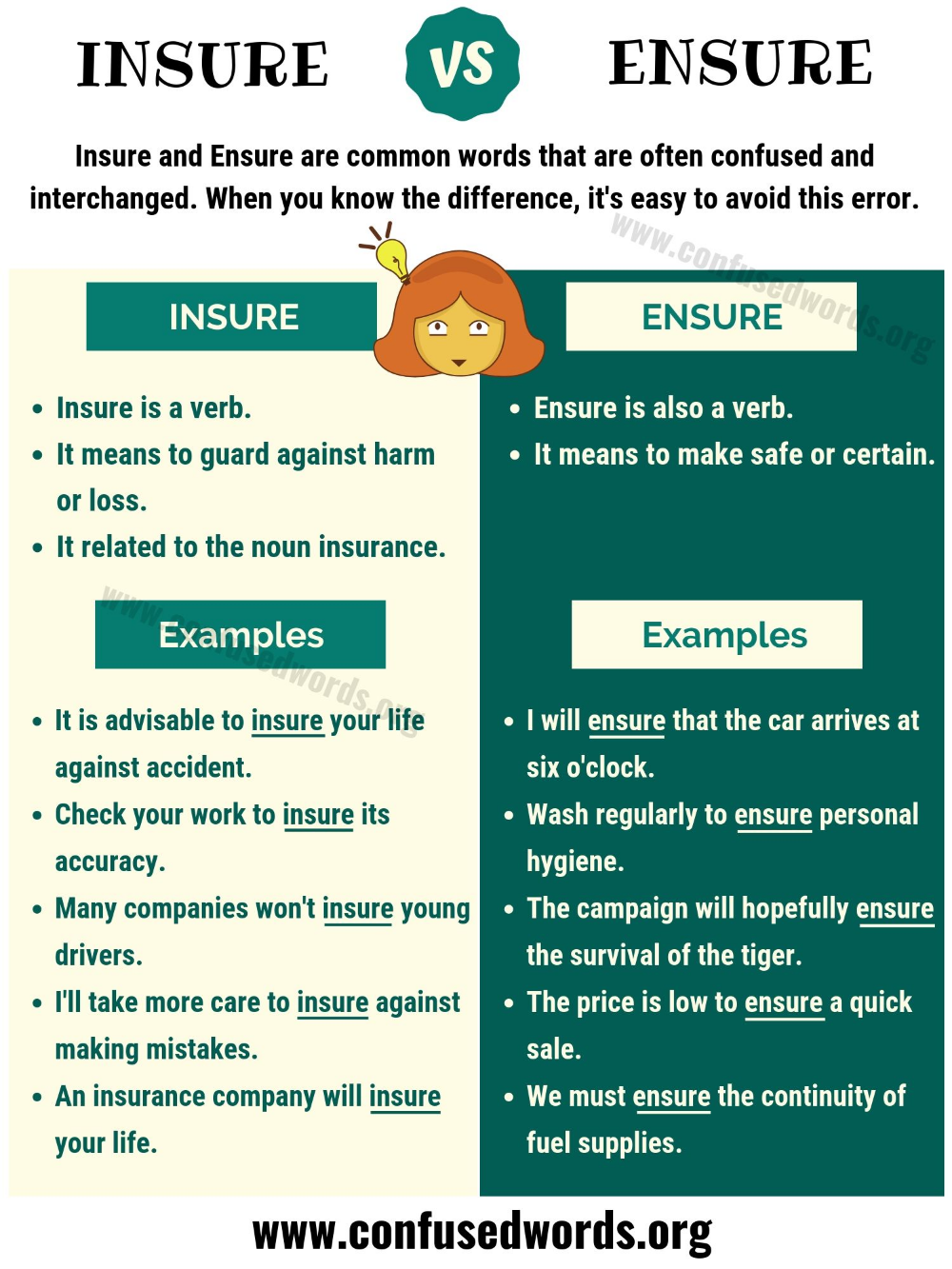

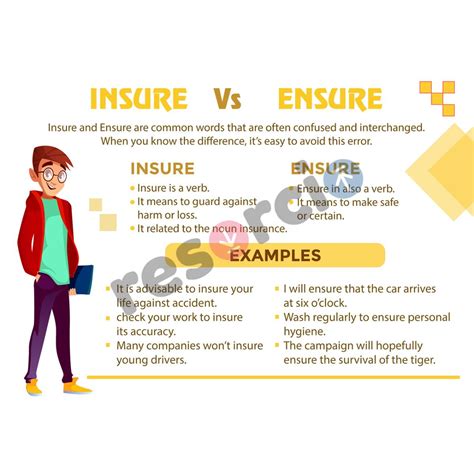

Ensure V Insure

Welcome to the world of Ensure V Insure, where we revolutionize the insurance industry with cutting-edge technology and a customer-centric approach. In today's rapidly evolving digital landscape, it's crucial for businesses to adapt and innovate to stay ahead of the curve. That's exactly what we've done at Ensure V Insure, and we're proud to share our story and expertise with you.

The Birth of Ensure V Insure: A Visionary Venture

Ensure V Insure was founded by a team of seasoned insurance experts and tech enthusiasts who recognized the immense potential for digital transformation in the insurance sector. With a shared passion for innovation and a deep understanding of the industry’s pain points, they set out to create a revolutionary platform that would redefine the insurance experience.

The founders believed that by leveraging advanced technologies, they could streamline processes, enhance customer engagement, and offer personalized insurance solutions like never before. And so, with a clear vision and a commitment to excellence, Ensure V Insure was born, ready to disrupt the traditional insurance model and bring about a new era of convenience and efficiency.

The Technology Behind Our Success

At the heart of Ensure V Insure’s success lies our cutting-edge technology infrastructure. We’ve invested heavily in developing a robust and scalable platform that leverages the latest advancements in artificial intelligence (AI), machine learning, and data analytics.

Our AI-powered algorithms analyze vast amounts of data to deliver accurate and personalized insurance recommendations. By considering an individual's unique circumstances, risk factors, and preferences, we can tailor insurance policies to meet their specific needs. This level of customization not only enhances customer satisfaction but also ensures that our clients receive the most suitable coverage at competitive rates.

Additionally, our platform is designed with a user-friendly interface, making it incredibly accessible and intuitive for both our clients and our internal teams. Whether it's submitting claims, tracking policy details, or exploring new insurance options, our technology empowers users with a seamless and efficient experience.

Key Technical Specifications:

- Advanced AI-driven recommendation engine

- Secure cloud-based infrastructure for data storage and processing

- Robust data analytics tools for real-time insights and trend analysis

- Integration with leading insurance carriers for seamless policy management

- Mobile-optimized platform for on-the-go accessibility

Enhancing Customer Experience: Our Priority

At Ensure V Insure, we understand that the insurance industry has long been associated with complex processes and cumbersome procedures. That’s why we’ve made it our mission to revolutionize the customer experience, making insurance not just accessible but enjoyable.

Our platform offers a streamlined and intuitive journey, guiding users through the insurance process with ease. Whether it's comparing policies, obtaining quotes, or managing existing policies, our customers can do it all with just a few clicks. We've eliminated the need for tedious paperwork and lengthy phone calls, providing a fast and efficient experience that aligns with the digital preferences of today's consumers.

Furthermore, we've implemented innovative features such as interactive policy visualizations and personalized recommendations. These tools empower our customers to make informed decisions and understand their insurance coverage better. By demystifying insurance and presenting it in a clear and engaging manner, we've transformed the perception of insurance from a necessary evil to a valuable asset.

Customer Experience Highlights:

- Seamless digital onboarding process, reducing paperwork and wait times

- Real-time claim tracking and status updates, providing transparency

- Interactive policy dashboards for at-a-glance coverage insights

- Personalized recommendations based on individual risk profiles and preferences

- 24⁄7 customer support through multiple channels, ensuring prompt assistance

Revolutionizing Insurance with Data-Driven Insights

Data is at the core of our operations at Ensure V Insure. By harnessing the power of data analytics, we’ve unlocked a wealth of insights that drive our decision-making and enhance our services.

Our data-driven approach allows us to identify trends, analyze customer behavior, and make informed predictions about market dynamics. This enables us to continuously improve our products and services, ensuring that we remain ahead of the curve and meet the evolving needs of our clients.

Moreover, we utilize data to personalize our interactions with customers. By understanding their preferences, past behavior, and risk factors, we can deliver tailored recommendations and offer a highly customized insurance experience. This level of personalization not only enhances customer satisfaction but also contributes to a more efficient and effective insurance journey.

Data Analytics in Action:

- Real-time fraud detection and prevention, ensuring the integrity of our platform

- Predictive modeling for accurate risk assessment and pricing

- Behavioral analytics to identify customer pain points and improve user experience

- Market trend analysis for strategic product development and expansion

- Personalized marketing campaigns based on customer preferences and demographics

The Future of Insurance: Our Vision

As we look ahead, Ensure V Insure is committed to continuing our journey of innovation and transformation. We aim to stay at the forefront of technological advancements, integrating emerging technologies such as blockchain, Internet of Things (IoT), and advanced analytics into our platform.

By embracing these cutting-edge solutions, we believe we can further enhance the security, efficiency, and accessibility of our services. Blockchain technology, for instance, has the potential to revolutionize insurance claims processing, making it more transparent, tamper-proof, and efficient. IoT devices can provide valuable real-time data, enabling us to offer more precise and personalized insurance solutions.

Moreover, we aim to expand our global presence, bringing our innovative insurance platform to new markets and offering our services to a wider audience. With our focus on customer-centricity and technological excellence, we are confident that Ensure V Insure will continue to thrive and lead the way in the digital insurance revolution.

FAQs

How does Ensure V Insure ensure data security and privacy?

+We prioritize data security and privacy by implementing robust encryption protocols, secure cloud infrastructure, and regular security audits. Our platform adheres to industry-leading data protection standards, ensuring that customer information remains confidential and protected from unauthorized access.

Can I customize my insurance policy with Ensure V Insure?

+Absolutely! Our platform is designed to offer a high level of customization. By providing detailed information about your needs and preferences, our AI-powered recommendation engine generates personalized insurance options, allowing you to tailor your policy to fit your unique circumstances.

What makes Ensure V Insure different from traditional insurance providers?

+Ensure V Insure stands out with its cutting-edge technology, customer-centric approach, and focus on innovation. We’ve reimagined the insurance experience, offering a seamless, digital-first journey. Our platform’s advanced features, personalized recommendations, and data-driven insights set us apart, providing a more efficient, engaging, and tailored insurance solution.