Progressive Insurance Ratings

The Comprehensive Guide to Progressive Insurance Ratings

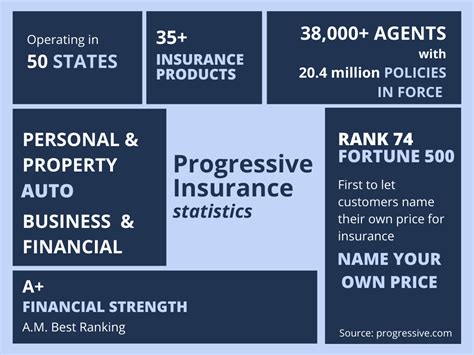

In the ever-evolving landscape of the insurance industry, Progressive Insurance has established itself as a leader, offering innovative solutions and a wide range of coverage options. One of its key strengths lies in its unique rating system, which sets it apart from traditional insurers. This guide aims to delve into the intricacies of Progressive Insurance's ratings, providing a detailed understanding of how it operates and the benefits it brings to policyholders.

At its core, Progressive's rating system is designed to be fair, transparent, and highly personalized. Unlike many insurance providers that rely on broad, often outdated, risk assessment models, Progressive employs a dynamic approach that takes into account an extensive array of factors to determine premiums. This ensures that policyholders are not penalized for circumstances beyond their control and that their rates reflect their actual risk profile.

Understanding the Progressive Rating Process

Progressive's rating process is a meticulous journey, tailored to each individual or business seeking coverage. It involves a comprehensive analysis of various aspects of the policyholder's lifestyle, habits, and circumstances. Here's a closer look at the key factors that influence Progressive's ratings:

1. Driving Behavior and History

One of the most significant factors in Progressive’s rating system is the policyholder’s driving behavior and history. Progressive utilizes advanced technologies, including telematics and data analytics, to gain insights into driving patterns. This allows the company to offer personalized rates based on factors like miles driven, time of day, and even driving style. Policyholders who demonstrate safe driving habits and a low risk profile often benefit from reduced premiums.

| Driving Factor | Impact on Rating |

|---|---|

| Safe Driving Habits | Lower Premiums |

| Accident-Free History | Discounts and Rewards |

| High Mileage Driving | Potentially Higher Rates |

2. Vehicle and Usage

The type of vehicle being insured and its intended usage are also critical components of Progressive’s rating process. Factors such as the make, model, year, and even the safety features of the vehicle can influence premiums. Additionally, the purpose for which the vehicle is used - whether it’s for personal, commercial, or leisure activities - can also impact the rating.

3. Location and Geographical Factors

Progressive considers the policyholder’s location and geographical factors when determining rates. This includes evaluating the risk associated with the area, such as the frequency of accidents, crime rates, and natural disasters. Regions with higher risk profiles may result in slightly elevated premiums to account for potential claims.

4. Personal and Financial Information

Progressive also takes into account personal and financial information when rating policies. This includes the policyholder’s age, gender, marital status, and credit score. While age and gender are standard considerations in the insurance industry, Progressive uses this information to offer more tailored coverage options. For instance, younger drivers may benefit from specialized programs designed to encourage safe driving and reduce premiums over time.

5. Policy Customization and Add-Ons

Progressive’s rating system allows for a high degree of policy customization. Policyholders can choose from a wide range of coverage options and add-ons to suit their specific needs. Whether it’s comprehensive coverage, liability protection, or specialized endorsements, Progressive’s ratings reflect the level of coverage chosen, ensuring policyholders only pay for the protection they require.

The Benefits of Progressive's Rating System

Progressive's innovative rating approach offers several advantages to policyholders, setting it apart from traditional insurance providers. Here are some key benefits:

1. Fair and Transparent Pricing

Progressive’s rating system ensures that premiums are based on an individual’s unique risk profile, rather than broad generalizations. This means that policyholders are not penalized for factors beyond their control, such as their age or gender. Instead, rates are determined by their driving behavior, vehicle usage, and other personalized factors, resulting in fair and transparent pricing.

2. Incentives for Safe Driving

By monitoring driving behavior through programs like Snapshot, Progressive encourages safe driving habits. Policyholders who demonstrate responsible driving can receive discounts and rewards, further reducing their premiums. This not only benefits the individual but also contributes to safer roads overall.

3. Customizable Coverage

Progressive’s rating system allows policyholders to tailor their coverage to their specific needs. Whether it’s adding comprehensive coverage for a new vehicle or opting for liability-only protection on an older model, Progressive’s ratings ensure that policyholders receive the right coverage at a fair price. This level of customization ensures that policyholders are not overpaying for coverage they don’t need.

4. Advanced Risk Assessment

Progressive’s use of advanced technologies and data analytics enables a more accurate assessment of risk. By continuously monitoring driving behavior and analyzing vast amounts of data, Progressive can identify trends and adjust premiums accordingly. This ensures that policyholders are not overcharged for their coverage and that the company can maintain a sustainable business model.

The Future of Progressive Insurance Ratings

As technology continues to advance and data analytics become increasingly sophisticated, Progressive's rating system is poised to evolve further. The company is already at the forefront of utilizing artificial intelligence and machine learning to enhance its risk assessment capabilities. By leveraging these technologies, Progressive can continue to offer fair and personalized premiums while adapting to changing market conditions.

In the future, we can expect Progressive's rating system to become even more refined, taking into account an even wider range of factors. This could include the integration of advanced vehicle technologies, such as autonomous driving features, which could further reduce risk and influence premiums. Additionally, Progressive may explore the use of biometric data to assess health-related risks, offering specialized coverage for policyholders with unique health considerations.

Progressive Insurance's rating system exemplifies the company's commitment to innovation and fairness. By offering personalized premiums based on an individual's unique risk profile, Progressive ensures that policyholders receive the coverage they need at a fair price. As the insurance industry continues to evolve, Progressive's dynamic and data-driven approach positions it as a leader, providing a model for other insurers to follow.

How often does Progressive review and adjust ratings?

+

Progressive continuously monitors policyholder data and adjusts ratings as needed. This ensures that premiums remain fair and accurate over time, reflecting changes in risk profiles.

Can policyholders negotiate their Progressive insurance ratings?

+

While Progressive’s ratings are based on a comprehensive analysis of various factors, policyholders can discuss their specific circumstances with an agent to ensure all relevant information is considered. However, the final rating is determined by Progressive’s proprietary rating system.

What steps can policyholders take to improve their Progressive insurance ratings and potentially lower their premiums?

+

Policyholders can focus on maintaining a safe driving record, opting into programs like Snapshot to demonstrate responsible driving, and reviewing their coverage options to ensure they’re only paying for what they need. Additionally, maintaining a good credit score and exploring multi-policy discounts can further reduce premiums.