Insurance Policy Meaning

In the complex world of financial protection, insurance policies emerge as vital instruments designed to shield individuals and entities from the financial impact of unforeseen events. These events could range from natural disasters to health crises or legal liabilities, and the scope of insurance coverage is as varied as the risks it aims to mitigate.

The core purpose of an insurance policy is to provide a financial safety net, ensuring that policyholders can recover from losses or damages without enduring catastrophic financial consequences. This protection is especially crucial in an uncertain world where the cost of healthcare, property repair, or legal defense can be prohibitively expensive.

Understanding the Fundamentals of Insurance Policies

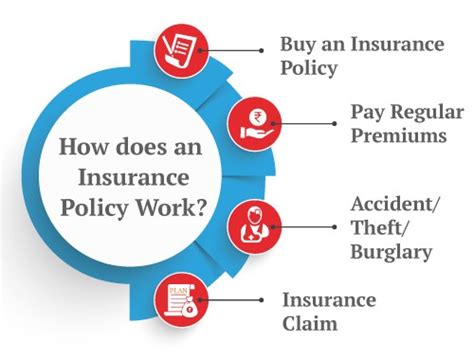

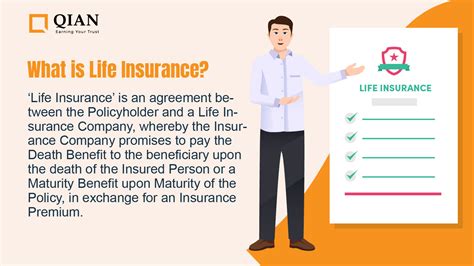

At its essence, an insurance policy is a contract between an individual or entity (the insured) and an insurance company (the insurer). This contract details the terms and conditions under which the insurer agrees to compensate the insured for specific types of losses, damages, or liabilities.

The insured pays a premium, typically at regular intervals, to the insurer. In return, the insurer promises to provide financial protection up to the policy's coverage limits if the insured experiences a covered loss or damage.

The scope of this protection is defined by the policy's coverage terms, which specify the types of events or circumstances for which the insured will be compensated. These terms are critical as they determine the situations where the insurer will provide financial support and the extent of that support.

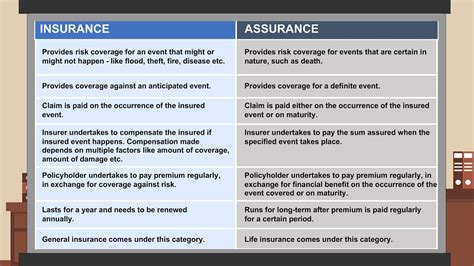

Insurance policies are incredibly versatile, catering to a wide range of risks. From the healthcare costs covered by health insurance to the property damages reimbursed by homeowners' or renters' insurance, and even the legal expenses covered by liability insurance, the spectrum of protection is vast.

The Intricacies of Insurance Coverage

While the basic premise of insurance is straightforward, the intricacies of insurance coverage are complex. Each policy is unique, tailored to the specific needs and risks of the insured. This customization means that no two policies are exactly alike, and the level of protection can vary significantly.

The level of coverage provided by an insurance policy is influenced by several factors. These include the type of insurance (e.g., health, life, property, liability), the amount of coverage chosen by the insured, and the policy's deductibles and limits. Deductibles are the amount the insured must pay out of pocket before the insurer covers the rest, while limits define the maximum amount the insurer will pay for a covered loss.

For instance, a health insurance policy might cover a broad range of medical services, including doctor visits, hospital stays, and prescription medications. However, the coverage may have specific limits on certain services, such as a maximum annual benefit for prescription drugs or a limit on the number of physical therapy sessions covered.

The Role of Premiums and Deductibles

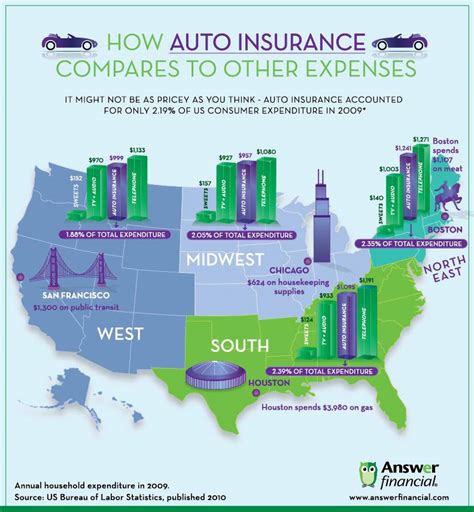

Premiums and deductibles are key components of insurance policies. Premiums are the regular payments made by the insured to the insurer to maintain coverage. The amount of the premium is influenced by several factors, including the type of insurance, the level of coverage, the insured's age and health status (for health and life insurance), and the insured's location and claims history (for property and auto insurance).

Deductibles, on the other hand, are the amount the insured must pay out of pocket before the insurer begins to cover the costs. For example, in a health insurance policy with a $500 deductible, the insured would need to pay the first $500 of covered medical expenses each year before the insurer starts to contribute.

Exclusions and Limitations

Insurance policies also contain exclusions and limitations. Exclusions are specific events or circumstances that are not covered by the policy. For instance, many health insurance policies exclude coverage for pre-existing conditions or cosmetic procedures. Limitations, on the other hand, are restrictions on the amount or type of coverage provided. For example, a policy might limit the number of physical therapy sessions covered or impose a maximum dollar amount for certain procedures.

Understanding these exclusions and limitations is crucial for policyholders. It ensures they are aware of what is and isn't covered, allowing them to make informed decisions about their insurance coverage and any additional protections they might need.

The Process of Claims and Compensation

When a policyholder experiences a covered loss or damage, they file a claim with their insurer. This process involves providing documentation and details of the loss or damage, which the insurer then evaluates to determine if it is covered under the policy.

If the claim is approved, the insurer provides compensation up to the policy's coverage limits. This compensation can take various forms, depending on the type of insurance and the nature of the claim. It could involve direct payment to the policyholder, payment to a third party (e.g., a hospital or mechanic), or reimbursement for expenses already incurred by the policyholder.

The claims process can be complex and time-consuming, often requiring detailed documentation and adherence to specific procedures. Policyholders are therefore advised to thoroughly understand their policy's claims process and their rights and responsibilities under the policy.

The Importance of Regular Policy Review

Insurance policies are not static; they should be reviewed and updated regularly to ensure they continue to meet the policyholder's needs. Life events such as marriage, the birth of a child, purchasing a new home, or starting a business can significantly impact insurance needs.

Regular policy review allows policyholders to ensure their coverage remains adequate and appropriate. It also provides an opportunity to identify any gaps in coverage and make necessary adjustments to the policy. For instance, a homeowner might increase their policy limits after making significant home improvements or add additional coverage for valuables like jewelry or art.

The Future of Insurance: Technological Innovations and Industry Trends

The insurance industry is evolving rapidly, driven by technological advancements and changing consumer expectations. The rise of digital platforms and data analytics is transforming the way insurance policies are designed, marketed, and administered.

One notable trend is the increasing use of telematics in auto insurance. Telematics devices installed in vehicles collect data on driving behavior, such as speed, acceleration, and braking. This data is then used to assess risk and set insurance premiums. This pay-as-you-drive model is gaining popularity, offering policyholders the opportunity to reduce their premiums by demonstrating safe driving habits.

Another emerging trend is the use of parametric insurance, which provides coverage based on the occurrence of a specific event or the crossing of a predetermined threshold. This type of insurance is particularly useful for covering unpredictable events, such as natural disasters or cyber attacks. By paying out based on the occurrence of the event rather than the actual loss, parametric insurance can provide faster, more certain compensation.

Additionally, the use of artificial intelligence (AI) and machine learning is revolutionizing the insurance industry. AI is being used to automate tasks such as policy underwriting, claims processing, and fraud detection. It is also enhancing customer service through chatbots and personalized recommendation engines.

The Impact of Regulatory Changes

Regulatory changes also play a significant role in shaping the insurance landscape. New regulations can impact the types of coverage offered, the way premiums are calculated, and the claims process. For example, the Affordable Care Act in the United States brought about significant changes to the health insurance market, mandating essential health benefits and prohibiting insurers from denying coverage based on pre-existing conditions.

Similarly, the General Data Protection Regulation (GDPR) in the European Union has had a profound impact on the way insurance companies handle personal data. It has led to enhanced data protection measures and a greater focus on transparency and consent in data handling practices.

Conclusion: Navigating the Complex World of Insurance

Insurance policies are a critical component of financial planning, offering protection against a wide range of risks. From health and life insurance to property and liability coverage, these policies provide a vital safety net in an uncertain world.

Understanding the intricacies of insurance coverage is essential for making informed decisions about insurance. Policyholders need to be aware of their coverage limits, deductibles, exclusions, and claims processes to ensure they are adequately protected and can navigate the claims process effectively.

As the insurance industry continues to evolve, driven by technological advancements and changing regulations, staying informed about the latest trends and innovations is crucial. By keeping abreast of these changes, policyholders can ensure they have the most relevant and up-to-date coverage to protect themselves and their assets.

What is the purpose of an insurance policy?

+An insurance policy is a contract that provides financial protection to policyholders, helping them recover from losses or damages without facing catastrophic financial consequences. It offers coverage for a wide range of risks, including healthcare costs, property damages, and legal liabilities.

How does an insurance policy work?

+An insurance policy works by having the insured pay regular premiums to the insurer. In return, the insurer promises to provide financial compensation if the insured experiences a covered loss or damage. The policy’s coverage terms define the types of events or circumstances for which the insured will be compensated.

What are the key components of an insurance policy?

+The key components of an insurance policy include the policy’s coverage terms, which define the types of events or circumstances covered; premiums, which are the regular payments made by the insured to the insurer; deductibles, which are the amount the insured must pay out of pocket before the insurer starts to cover costs; and limits, which define the maximum amount the insurer will pay for a covered loss.

How do I choose the right insurance policy for my needs?

+Choosing the right insurance policy involves assessing your specific needs and risks. Consider the type of insurance you require (e.g., health, life, property, liability), the level of coverage you need, and your budget for premiums. It’s also important to understand the policy’s deductibles and limits, and to be aware of any exclusions or limitations.

What should I do if I need to file an insurance claim?

+If you need to file an insurance claim, start by reviewing your policy to understand the claims process and your rights and responsibilities. Gather all relevant documentation and details of the loss or damage, and contact your insurer to initiate the claim. Be prepared to provide the necessary information and cooperate with the insurer’s investigation.