Automobile Insurance Coverage Types

Welcome to a comprehensive guide exploring the diverse landscape of automobile insurance coverage types, a vital aspect of responsible vehicle ownership. In this expert-crafted journal article, we delve into the intricacies of automotive insurance, providing you with a nuanced understanding of the different policies and their implications. From the essential liability coverage to the comprehensive protection offered by collision and comprehensive policies, we'll navigate through the complex world of automotive insurance, shedding light on the critical factors that influence your choice of coverage.

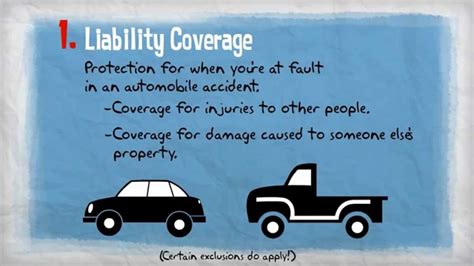

Understanding the Fundamentals: Liability Insurance

At the core of automotive insurance lies liability coverage, a fundamental component that safeguards policyholders against financial losses arising from legal liabilities. This coverage is divided into two key areas: bodily injury liability and property damage liability.

Bodily Injury Liability

Bodily injury liability coverage is designed to cover medical expenses, pain and suffering, and lost wages resulting from injuries sustained by others in an accident for which you are deemed responsible. This coverage extends to the legal fees and settlements associated with such incidents, offering a crucial financial safety net in the event of a lawsuit.

| Coverage Type | Description |

|---|---|

| Bodily Injury Liability | Protects against medical costs, pain and suffering, and lost wages for injured parties. |

| Property Damage Liability | Covers repairs or replacements for damaged property in an accident caused by the policyholder. |

Property Damage Liability

Property damage liability, on the other hand, covers the costs associated with repairing or replacing property damaged in an accident caused by the policyholder. This could include damage to other vehicles, structures, or even personal belongings inside a vehicle.

Expanding Protection: Collision and Comprehensive Insurance

While liability coverage is essential, it only addresses the financial liabilities arising from accidents. To ensure comprehensive protection, policyholders often opt for collision and comprehensive insurance, which cover a broader range of potential risks.

Collision Insurance

Collision insurance provides coverage for damages to your vehicle resulting from an accident, regardless of who is at fault. This coverage is particularly valuable when you are involved in a collision with an uninsured or underinsured driver, as it ensures you’re not left footing the bill for repairs.

| Coverage Type | Description |

|---|---|

| Collision Insurance | Covers repairs or replacements for your vehicle after an accident, regardless of fault. |

| Comprehensive Insurance | Protects against damages caused by non-collision incidents like theft, vandalism, or natural disasters. |

Comprehensive Insurance

Comprehensive insurance, often paired with collision coverage, offers protection against damages caused by non-collision incidents. This includes events such as theft, vandalism, natural disasters like hail or floods, or even damage caused by animals.

Specialized Coverages: Uninsured/Underinsured Motorist and Medical Payments

Beyond the fundamental liability, collision, and comprehensive coverages, there are specialized options designed to address specific scenarios.

Uninsured/Underinsured Motorist Coverage

Uninsured/Underinsured Motorist (UM/UIM) coverage is a critical addition to your policy, especially in states with high uninsured driver rates. This coverage steps in when an at-fault driver lacks sufficient insurance to cover the costs of the accident, ensuring you’re not left paying out of pocket for damages and injuries.

Medical Payments Coverage

Medical payments coverage, often referred to as MedPay, provides a quick and easy way to cover medical expenses for you and your passengers after an accident, regardless of who is at fault. This coverage is particularly beneficial as it offers prompt assistance for medical bills, allowing you to focus on recovery without the immediate financial burden.

| Coverage Type | Description |

|---|---|

| Uninsured/Underinsured Motorist Coverage | Protects you when an at-fault driver lacks sufficient insurance, covering medical bills, property damage, and lost wages. |

| Medical Payments Coverage | Provides quick assistance for medical expenses for you and your passengers after an accident, regardless of fault. |

Additional Considerations: Personal Injury Protection and Gap Insurance

As you navigate the world of automotive insurance, it’s essential to explore the full range of available coverages to ensure you’re adequately protected.

Personal Injury Protection (PIP)

Personal Injury Protection, or PIP, is a no-fault insurance coverage that provides benefits to policyholders and their passengers after an accident, regardless of who is at fault. PIP covers a wide range of expenses, including medical bills, lost wages, and even funeral costs, ensuring a comprehensive approach to post-accident financial support.

Gap Insurance

Gap insurance, or Guaranteed Auto Protection, is designed to cover the difference between the actual cash value of your vehicle and the amount you still owe on your auto loan or lease. This coverage is particularly valuable if you’ve financed or leased your vehicle, as it ensures you’re not left with a large, unexpected bill in the event of a total loss.

| Coverage Type | Description |

|---|---|

| Personal Injury Protection (PIP) | No-fault coverage that provides benefits for medical expenses, lost wages, and other costs after an accident. |

| Gap Insurance | Covers the difference between a vehicle's actual cash value and the amount owed on a loan or lease in case of total loss. |

Tailoring Your Coverage: Customizing Your Automotive Insurance Policy

The beauty of automotive insurance lies in its adaptability, allowing policyholders to customize their coverage to align with their unique needs and circumstances. Factors such as the age and health of drivers, the make and model of vehicles, and the geographic location all influence the type and level of coverage required.

Assessing Your Needs

When evaluating your insurance needs, it’s crucial to consider not only the legal minimums but also your personal financial situation and the potential risks you face. For instance, if you live in an area prone to natural disasters or high crime rates, comprehensive coverage becomes even more critical. Similarly, if you have a history of accidents or live with teenage drivers, you might benefit from higher liability limits and additional coverage options.

Working with Your Insurance Provider

Your insurance provider plays a pivotal role in helping you navigate the complex world of automotive insurance. They can offer guidance on the most suitable coverage options, provide insights into potential discounts, and ensure you’re aware of any state-specific requirements or recommendations. Additionally, they can assist in understanding the fine print of your policy, ensuring you’re fully aware of what’s covered and what’s not.

Conclusion: Navigating the Complexities of Automotive Insurance

The world of automotive insurance is intricate, offering a myriad of coverage types to safeguard policyholders against a wide range of potential risks. From the fundamental liability coverage to the comprehensive protection of collision and comprehensive policies, each type of coverage serves a unique purpose, ensuring peace of mind and financial security for vehicle owners.

As you navigate the complexities of automotive insurance, remember that the right coverage is not a one-size-fits-all proposition. It's a tailored solution, crafted to address your specific needs and circumstances. By understanding the various coverage types and working closely with your insurance provider, you can ensure you're adequately protected, whether on the open road or navigating life's unexpected twists and turns.

What is the main difference between liability and collision insurance?

+Liability insurance covers damages you cause to others, while collision insurance covers damages to your own vehicle, regardless of fault.

Is comprehensive insurance necessary for all vehicle owners?

+While not mandatory, comprehensive insurance is highly recommended, especially if your vehicle is leased or financed, as it covers a wide range of non-collision incidents.

What is the role of uninsured/underinsured motorist coverage?

+This coverage protects you financially if you’re involved in an accident with a driver who has insufficient insurance to cover the costs.

How does medical payments coverage differ from personal injury protection (PIP)?

+Medical payments coverage is a more limited form of coverage, focusing solely on medical expenses, while PIP provides a broader range of benefits, including medical expenses, lost wages, and funeral costs.