Medical Insurance Nj

Understanding medical insurance is crucial, especially when considering your healthcare needs and financial stability. In the state of New Jersey, medical insurance options are diverse, catering to various demographics and requirements. This comprehensive guide aims to demystify the world of medical insurance in NJ, offering insights into different plans, coverage, and how to navigate the healthcare system effectively.

The Landscape of Medical Insurance in New Jersey

The healthcare market in New Jersey is robust, with a wide array of insurance providers offering comprehensive plans. These plans are designed to meet the unique healthcare needs of individuals, families, and businesses across the state. From major medical plans to more specialized coverage, New Jersey residents have a range of options to choose from.

Major Medical Plans

Major medical plans are the cornerstone of healthcare coverage in New Jersey. These plans typically cover a broad range of medical services, including hospitalizations, surgeries, outpatient care, and prescription medications. They are designed to provide financial protection against the high costs of medical care, ensuring that policyholders can access the healthcare they need without facing crippling financial burdens.

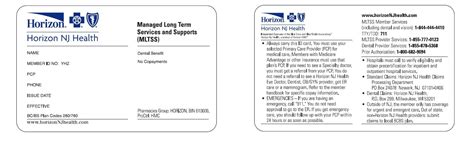

Some of the leading insurance providers in New Jersey offering major medical plans include Horizon Blue Cross Blue Shield of New Jersey, AmeriHealth New Jersey, and UnitedHealthcare of New Jersey. These providers offer a variety of plan options, each with its own set of benefits, deductibles, and coverage limits. For instance, Horizon BCBSNJ provides Horizon HMO and Horizon OMNIA plans, known for their comprehensive coverage and extensive network of healthcare providers.

Specialized Coverage

In addition to major medical plans, New Jersey residents have access to specialized coverage options tailored to specific needs. These include:

- Dental Insurance: Dental plans in New Jersey can be purchased separately or as part of a comprehensive medical plan. They cover a range of services, from routine check-ups and cleanings to more complex procedures like root canals and implants.

- Vision Insurance: Vision plans typically cover eye exams, corrective lenses, and in some cases, even LASIK surgery. These plans are essential for maintaining good eye health and can be purchased as stand-alone policies or as part of a larger healthcare package.

- Short-Term Health Insurance: For those in between jobs or facing a gap in coverage, short-term health insurance plans offer temporary protection. These plans are typically more affordable than major medical plans but may have limitations on pre-existing conditions and coverage duration.

- Medicare Supplement Plans: For seniors aged 65 and over, Medicare supplement plans, also known as Medigap plans, fill in the gaps left by original Medicare coverage. They can cover costs like copayments, coinsurance, and deductibles, making healthcare more affordable for seniors.

| Insurance Type | Provider | Key Features |

|---|---|---|

| Major Medical | Horizon BCBSNJ | Comprehensive coverage, extensive provider network |

| Dental | Delta Dental of New Jersey | Customizable plans, nationwide coverage |

| Vision | VSP Vision Care | Coverage for exams, lenses, and surgery |

| Short-Term | UnitedHealthcare | Affordable temporary coverage, customizable terms |

| Medicare Supplement | Aetna | Gap coverage for original Medicare, multiple plan options |

Navigating the Enrollment Process

Enrolling in a medical insurance plan in New Jersey involves a few key steps. Understanding these steps can streamline the process and ensure a seamless transition into your new coverage.

Open Enrollment Periods

In New Jersey, as with most states, there are designated open enrollment periods when individuals can sign up for new health insurance plans or make changes to their existing coverage. These periods typically occur annually, and it's important to be aware of the dates to ensure you don't miss out on coverage opportunities.

For instance, the Affordable Care Act (ACA) open enrollment period usually runs from November 1st to December 15th each year. During this time, New Jersey residents can enroll in or switch to a new ACA-compliant health plan. Outside of this period, you generally need to qualify for a Special Enrollment Period due to certain life events, such as getting married, having a baby, or losing other health coverage.

Choosing the Right Plan

Selecting the right medical insurance plan involves careful consideration of your healthcare needs and budget. Here are some key factors to keep in mind:

- Premium Costs: The amount you pay monthly for your insurance plan is known as the premium. While it's tempting to choose the lowest-cost plan, consider your healthcare needs and potential out-of-pocket expenses.

- Deductibles and Copays: Deductibles are the amount you pay out of pocket before your insurance coverage kicks in. Copays, on the other hand, are fixed amounts you pay for specific services, like a doctor's visit or prescription medication. Plans with lower premiums often have higher deductibles and copays, so weigh these factors carefully.

- Network of Providers: Check if your preferred healthcare providers are in-network with the plan you're considering. In-network providers offer services at a discounted rate, which can significantly impact your out-of-pocket costs.

- Coverage Limits and Exclusions: Review the plan's benefits summary to understand what is and isn't covered. Some plans may have limits on certain services or exclude coverage for pre-existing conditions.

Utilizing Your Insurance Coverage

Once you've enrolled in a medical insurance plan, it's important to understand how to maximize your coverage and navigate the healthcare system effectively.

Understanding Your Benefits

Each medical insurance plan comes with a unique set of benefits. These benefits dictate what services are covered, how much you'll pay out of pocket, and which providers you can see. Familiarize yourself with your plan's benefits summary, which outlines these details. For instance, some plans may cover preventive care services like annual check-ups and screenings at 100%, while others may require a copay or deductible.

Choosing In-Network Providers

When possible, choose healthcare providers that are in your insurance plan's network. In-network providers have negotiated rates with your insurance company, so you'll pay less out of pocket for their services. You can typically find a list of in-network providers on your insurance company's website or by calling their customer service line.

Submitting Claims

When you receive medical services, your healthcare provider will typically file a claim with your insurance company on your behalf. However, there may be times when you need to file a claim yourself, such as for out-of-network services or if your provider doesn't accept assignment (meaning they don't bill insurance companies directly). In these cases, you'll need to complete and submit a claim form, along with any required documentation, to your insurance company for reimbursement.

FAQs about Medical Insurance in New Jersey

Can I enroll in a medical insurance plan outside of the open enrollment period?

+Yes, you can enroll outside of the open enrollment period if you qualify for a Special Enrollment Period (SEP). SEPs are triggered by certain life events, such as getting married, having a baby, losing other health coverage, or moving to a new area. You typically have 60 days from the date of the qualifying event to enroll in a new plan.

What happens if I can't afford the premium for my chosen plan?

+If you can't afford the premium for your chosen plan, you may be eligible for financial assistance through the Affordable Care Act (ACA). The ACA provides subsidies to help lower- and middle-income individuals and families afford healthcare coverage. You can check your eligibility and apply for subsidies during the open enrollment period.

Are pre-existing conditions covered under New Jersey's medical insurance plans?

+Yes, under the ACA, insurance companies cannot deny coverage or charge more for individuals with pre-existing conditions. This includes conditions like diabetes, heart disease, and even pregnancy. However, there may be waiting periods or limitations on certain services related to your pre-existing condition, so it's important to review your plan's benefits summary carefully.

Navigating the world of medical insurance can be complex, but with the right information and resources, you can make informed decisions about your healthcare coverage. Remember to compare plans, understand your benefits, and choose providers wisely to maximize your coverage and minimize out-of-pocket expenses.