Texas Auto Insurance Quote

When it comes to auto insurance, Texas drivers have unique needs and considerations. The Lone Star State has its own set of regulations and requirements, which can impact the cost and coverage of your insurance policy. Understanding the specific factors that influence Texas auto insurance quotes is crucial for finding the best coverage at the most affordable price.

Understanding Texas Auto Insurance Regulations

Texas is known for its unique insurance laws, which can differ significantly from other states. One key regulation is the financial responsibility law, which mandates that all drivers must either carry valid insurance or provide proof of financial responsibility in case of an accident. This law aims to ensure that drivers can cover potential damages and liabilities.

Additionally, Texas has a no-fault insurance system, which means that in the event of an accident, your insurance provider will cover your medical expenses and damages, regardless of who caused the accident. This system simplifies the claims process and provides quick access to medical care. However, it also means that your insurance premiums may be higher to cover these potential expenses.

Another important regulation is the Personal Injury Protection (PIP) requirement. Texas law mandates that all auto insurance policies must include PIP coverage, which covers medical expenses, loss of income, and other related costs. This coverage is designed to protect you and your passengers in the event of an accident, ensuring you have the necessary financial support for recovery.

Minimum Coverage Requirements in Texas

Understanding the minimum coverage requirements set by the state is essential when seeking an auto insurance quote. Texas requires drivers to carry liability insurance, which includes:

- Bodily Injury Liability: Coverage for injuries or death caused to others in an accident. The minimum requirement is 30,000 per person and 60,000 per accident.

- Property Damage Liability: Coverage for damage to others’ property, with a minimum requirement of 25,000.</li> <li><strong>Personal Injury Protection (PIP)</strong>: As mentioned earlier, this coverage is mandatory in Texas and provides a minimum of 2,500 in medical benefits per person.

While these are the minimum requirements, it's important to note that they may not provide sufficient coverage for all situations. It's always advisable to assess your individual needs and consider purchasing additional coverage options to ensure you're adequately protected.

Factors Influencing Texas Auto Insurance Quotes

Several factors play a significant role in determining your auto insurance quote in Texas. Insurance providers use a combination of these factors to assess the risk associated with insuring a particular driver. Understanding these factors can help you make informed decisions about your coverage and potentially negotiate better rates.

Driver’s Profile and History

Your personal driving history and profile are key considerations for insurance providers. Factors such as your age, gender, marital status, and driving record can impact your quote. For instance, younger drivers and those with a history of accidents or traffic violations may be considered higher-risk and face higher premiums.

Additionally, the number of years you've been licensed and the type of vehicle you drive can also influence your quote. Insurers often offer discounts for experienced drivers and those who own safer, more fuel-efficient vehicles.

Location and Usage

Where you live and how you use your vehicle can significantly impact your insurance quote. Texas is a vast state with varying traffic conditions and crime rates across different regions. Insurance providers take into account factors such as the crime rate, accident frequency, and weather conditions in your area when calculating your quote.

Furthermore, the purpose for which you use your vehicle can also be a consideration. If you primarily use your car for commuting to work or running errands, your quote may be different from someone who uses their vehicle for business purposes or long-distance travel.

Vehicle Information

The make, model, and year of your vehicle are crucial factors in determining your insurance quote. Newer and more expensive vehicles often come with higher premiums due to the cost of repairs and replacement parts. Additionally, vehicles with advanced safety features may qualify for discounts, as they reduce the risk of accidents and injuries.

The type of vehicle you drive, such as a sedan, SUV, or sports car, can also impact your quote. Sports cars and high-performance vehicles are often associated with higher risks and may attract higher premiums.

| Vehicle Category | Average Premium Increase |

|---|---|

| Sports Cars | 10-20% |

| SUVs | 5-10% |

| Luxury Vehicles | 15-25% |

Coverage Options and Deductibles

The coverage options you choose and the deductibles you select can significantly impact your insurance quote. Opting for higher coverage limits and additional coverage options, such as comprehensive and collision coverage, will generally increase your premium. However, these choices provide more comprehensive protection in case of accidents or other incidents.

Additionally, the deductible you choose plays a crucial role. A higher deductible means you'll pay more out of pocket before your insurance coverage kicks in, but it can lead to lower premiums. It's essential to find a balance that aligns with your financial situation and risk tolerance.

Tips for Finding the Best Texas Auto Insurance Quote

Now that we’ve explored the factors influencing Texas auto insurance quotes, here are some practical tips to help you find the best coverage at the most competitive rates:

Shop Around and Compare

Don’t settle for the first quote you receive. Take the time to shop around and compare quotes from multiple insurance providers. Each insurer has its own rating system and may offer different rates for similar coverage. By comparing quotes, you can identify the best value and potentially negotiate better terms.

Utilize Online Quote Tools

Many insurance providers offer online quote tools that allow you to input your information and receive personalized quotes instantly. These tools can be a convenient way to quickly compare rates and coverage options from the comfort of your home.

Bundle Your Policies

If you have multiple insurance needs, such as auto, home, or renters’ insurance, consider bundling your policies with the same provider. Many insurers offer discounts for customers who bundle their policies, as it simplifies administration and reduces overhead costs for the insurer.

Explore Discounts

Insurance providers offer a variety of discounts to attract and retain customers. Common discounts include safe driver discounts, good student discounts, loyalty discounts, and discounts for certain professions or affiliations. Ask your insurer about the discounts they offer and ensure you’re taking advantage of all applicable ones.

Maintain a Clean Driving Record

Your driving record is a significant factor in determining your insurance quote. By maintaining a clean driving record, you can qualify for lower premiums. Avoid accidents and traffic violations, and if you have a minor infraction, work on improving your driving habits to keep your record clean.

Consider Usage-Based Insurance

Usage-based insurance, also known as telematics insurance, uses technology to monitor your driving habits and adjust your premium accordingly. If you’re a safe and cautious driver, you may qualify for lower rates with this type of insurance. However, it’s essential to understand the privacy implications and the potential for increased surveillance.

Future of Auto Insurance in Texas

The auto insurance landscape in Texas is constantly evolving, and several trends and developments are shaping the future of coverage in the state. Here’s a glimpse into what we can expect:

Advancements in Telematics and Data Analytics

Telematics and data analytics are transforming the insurance industry. With the increasing adoption of connected car technologies, insurers can gather more precise data on driving behavior, vehicle performance, and potential risks. This data-driven approach allows for more accurate risk assessment and personalized insurance offerings.

Growth of Insurtech Companies

Insurtech companies are disrupting the traditional insurance industry with innovative technologies and business models. These companies leverage digital platforms, artificial intelligence, and machine learning to streamline processes, enhance customer experiences, and offer more competitive rates. As these companies continue to grow, they may present new options for Texas drivers seeking affordable auto insurance.

Focus on Risk Prevention and Safety

Insurance providers are increasingly investing in risk prevention and safety initiatives. This includes offering discounts for drivers who participate in defensive driving courses, install advanced safety features in their vehicles, or use safe driving apps. By incentivizing safer driving behaviors, insurers can reduce the frequency and severity of accidents, leading to lower premiums for all policyholders.

Expansion of Autonomous Vehicle Coverage

As autonomous vehicles become more prevalent, insurance providers are exploring coverage options for this emerging technology. Texas, being a leader in technological innovation, is likely to see the development of specialized insurance policies for autonomous vehicles. These policies will need to address unique risks and liabilities associated with self-driving cars.

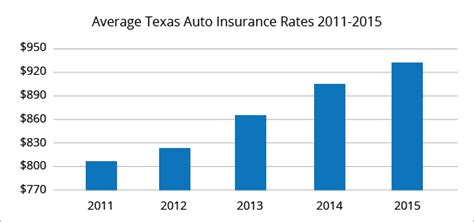

What is the average cost of auto insurance in Texas?

+The average cost of auto insurance in Texas varies depending on several factors, including the driver’s profile, location, and coverage options. As of [most recent data], the average annual premium for minimum liability coverage in Texas is around 700, while a more comprehensive policy with higher limits can cost upwards of 1,500 or more.

Are there any ways to reduce my auto insurance premium in Texas?

+Yes, there are several strategies to reduce your auto insurance premium in Texas. These include shopping around for quotes from different insurers, bundling your policies, maintaining a clean driving record, exploring usage-based insurance options, and taking advantage of discounts offered by your insurer.

What happens if I don’t have auto insurance in Texas?

+Driving without valid auto insurance in Texas is illegal and can result in severe penalties. If caught, you may face fines, license suspension, and even criminal charges. It’s essential to maintain valid insurance coverage to comply with state laws and protect yourself financially in case of accidents.