Cheaper Car Insurance Quotes

Finding affordable car insurance quotes is a top priority for many vehicle owners. The cost of insurance can vary significantly, and understanding the factors that influence these quotes is essential to securing the best deal. In this comprehensive guide, we delve into the world of car insurance, exploring the key elements that affect your premium and providing expert insights on how to obtain cheaper quotes.

Understanding the Basics of Car Insurance Quotes

Car insurance is a financial safeguard designed to protect you and your vehicle in the event of an accident, theft, or other types of damage. It’s a mandatory requirement in most countries, and the quotes you receive reflect the level of coverage you need and the perceived risk associated with your driving profile.

Insurance companies use a complex system to calculate premiums, taking into account a multitude of factors. These include your age, gender, driving history, the make and model of your car, and even your geographic location. Understanding how these factors influence your quote is the first step towards securing a better deal.

The Impact of Personal Factors

Your age and gender are fundamental determinants of your insurance quote. Statistically, younger drivers, particularly males, are considered higher-risk due to their propensity for more aggressive driving and higher accident rates. As a result, insurance premiums for this demographic tend to be higher.

Your driving history is another critical factor. Insurance companies scrutinize your record for accidents, traffic violations, and claims. A clean driving record is a significant advantage when seeking cheaper quotes. Conversely, a history of accidents or violations can lead to higher premiums or even difficulty in securing coverage.

| Personal Factor | Impact on Quote |

|---|---|

| Age | Younger drivers often face higher premiums. |

| Gender | Males may pay more due to higher accident risks. |

| Driving History | Clean records lead to better rates; violations increase costs. |

Vehicle-Related Factors

The type of car you drive plays a pivotal role in determining your insurance quote. Certain makes and models are more expensive to insure due to their higher repair costs, frequency of theft, or involvement in accidents. Sports cars and luxury vehicles, for instance, often command higher premiums.

The age and condition of your vehicle are also considered. Older cars may have lower premiums, but they might not offer the same level of coverage as newer models with advanced safety features. The value of your car and its potential for future repairs influence the cost of insurance.

Geographic and Lifestyle Factors

Where you live and your daily commute can affect your insurance quote. Urban areas often have higher premiums due to increased traffic and a higher risk of accidents and theft. Similarly, if you use your car for business purposes or commute long distances, your insurance costs may be higher.

Your lifestyle choices also matter. For instance, if you have a home-based business that requires frequent deliveries, your insurance needs and costs may be different from those of a typical homeowner.

Strategies for Securing Cheaper Car Insurance Quotes

Now that we’ve explored the key factors influencing car insurance quotes, let’s delve into practical strategies to obtain more affordable coverage.

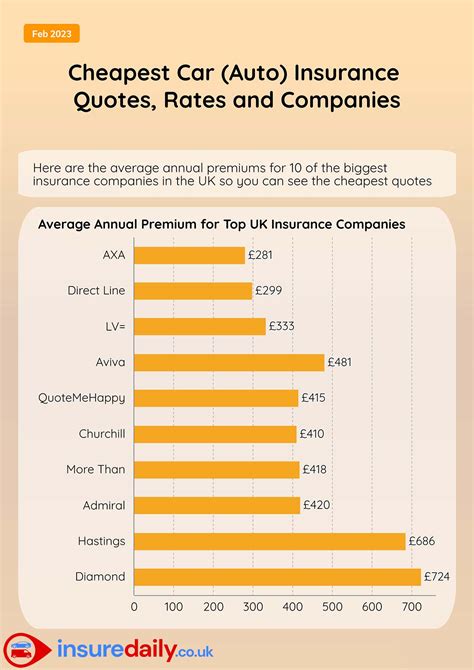

Comparing Quotes from Multiple Insurers

The insurance market is competitive, and quotes can vary significantly between providers. By comparing quotes from multiple insurers, you can identify the most competitive rates for your specific needs. Online comparison tools and broker services can streamline this process, allowing you to quickly assess a range of options.

When comparing quotes, pay attention to the level of coverage offered. Some insurers may provide lower premiums but with reduced coverage, so it's crucial to balance cost with the level of protection you require.

Understanding Your Coverage Needs

Car insurance is not a one-size-fits-all product. Your specific needs will dictate the type and extent of coverage you require. Understanding your coverage needs is essential to ensuring you’re not overpaying for unnecessary features.

For instance, if you own an older vehicle that's paid off, you may not need comprehensive or collision coverage, as these are primarily designed to protect the value of the car. Instead, you might opt for liability coverage, which protects you against claims made by others in the event of an accident you cause.

Utilizing Discounts and Bundling Options

Insurance companies offer various discounts to attract and retain customers. These discounts can significantly reduce your insurance costs. Some common discounts include:

- Safe Driver Discount: Rewards drivers with clean records.

- Multi-Policy Discount: Bundling your car insurance with other policies, such as home or life insurance, often results in savings.

- Loyalty Discount: Staying with the same insurer for an extended period may lead to reduced premiums.

- Good Student Discount: Many insurers offer discounts to students with good grades.

- Safety Features Discount: Vehicles equipped with advanced safety features may qualify for reduced rates.

Additionally, bundling your car insurance with other policies, such as home or renters insurance, can result in significant savings. Many insurers offer bundled packages that provide additional convenience and cost-effectiveness.

Improving Your Driving Profile

Your driving record is a critical factor in determining your insurance quote. Taking steps to improve your driving profile can lead to substantial savings over time. This includes maintaining a clean driving record, avoiding traffic violations, and completing defensive driving courses.

Some insurers offer programs that monitor your driving behavior, such as telematics or usage-based insurance. These programs can reward safe driving habits with lower premiums. However, it's essential to understand the implications of these programs, as they may also penalize risky driving behaviors.

Choosing the Right Deductible

Your deductible is the amount you pay out of pocket before your insurance coverage kicks in. Opting for a higher deductible can lead to lower premiums, as you’re assuming more financial responsibility in the event of a claim. However, it’s crucial to choose a deductible that aligns with your financial capabilities.

If you're confident in your driving skills and have a solid financial plan, a higher deductible can be a strategic choice. Conversely, if you're risk-averse or have limited financial flexibility, a lower deductible may be more suitable, even if it results in slightly higher premiums.

Maintaining a Good Credit Score

Your credit score is another factor that insurance companies consider when calculating your premium. A good credit score can lead to lower insurance rates, as it’s seen as an indicator of financial responsibility. Conversely, a poor credit score may result in higher premiums.

Improving your credit score can take time, but it's a worthwhile investment. Regularly review your credit report, ensure timely bill payments, and consider strategies to improve your credit utilization ratio. These steps can enhance your overall financial health and lead to savings on your car insurance.

The Future of Car Insurance Quotes

The car insurance landscape is evolving rapidly, driven by advancements in technology and changing consumer behaviors. Here’s a glimpse into the future of car insurance quotes and how they may impact your wallet.

Telematics and Usage-Based Insurance

Telematics and usage-based insurance are becoming increasingly popular, offering a more personalized and dynamic approach to car insurance. These programs use telematics devices or smartphone apps to monitor your driving behavior, including speed, braking habits, and mileage. Insurers then use this data to tailor your insurance premium to your actual driving risk.

While these programs can lead to significant savings for safe drivers, they also come with potential privacy concerns. It's essential to understand the data collection practices of your insurer and ensure your privacy is protected.

Connected Cars and Data Analytics

The rise of connected cars and the Internet of Things (IoT) is transforming the insurance industry. Connected cars generate vast amounts of data, which insurers can analyze to gain insights into driving behaviors and risk factors. This data-driven approach allows insurers to offer more accurate and personalized quotes.

As connected car technology becomes more prevalent, insurers will have access to even more detailed driving data. This could lead to more precise risk assessments and potentially lower premiums for drivers who embrace this technology.

AI and Machine Learning in Insurance

Artificial Intelligence (AI) and machine learning are revolutionizing the insurance industry. These technologies enable insurers to process vast amounts of data quickly and accurately, leading to more efficient underwriting and claim processing. AI can also identify patterns and trends in data, allowing insurers to make more informed decisions about risk assessment and pricing.

The use of AI and machine learning has the potential to make car insurance quotes more affordable and accessible. These technologies can streamline the quote process, reduce administrative costs, and improve the overall customer experience.

The Rise of Insurtech Startups

Insurtech startups are disrupting the traditional insurance industry with innovative technologies and business models. These startups often leverage digital platforms and AI to offer more transparent and efficient insurance services, including car insurance.

Insurtech startups are known for their agility and customer-centric approach. They often provide more flexible and personalized insurance options, catering to the specific needs of individual drivers. This competitive landscape can drive down insurance costs and offer more choice to consumers.

Conclusion

Securing cheaper car insurance quotes is a complex process that involves understanding the various factors that influence your premium and strategically leveraging your unique circumstances. By comparing quotes, understanding your coverage needs, and utilizing discounts and bundling options, you can significantly reduce your insurance costs.

The future of car insurance quotes looks promising, with advancements in technology and data analytics set to revolutionize the industry. As a consumer, staying informed and proactive about your insurance needs can lead to substantial savings and a more tailored insurance experience.

How often should I review my car insurance policy and quotes?

+It’s a good practice to review your car insurance policy and quotes annually, or whenever your circumstances change significantly. This could include moving to a new location, purchasing a new vehicle, or getting married, as these life events can impact your insurance needs and potential savings.

Can I negotiate my car insurance quote with the insurer?

+While car insurance quotes are largely based on algorithms and data analysis, you can still negotiate with your insurer. Discuss your coverage needs, any discounts you may be eligible for, and your loyalty to the company. Insurers often value long-term customers and may be open to providing a better deal to retain your business.

What are some common misconceptions about car insurance quotes?

+One common misconception is that car insurance is a fixed cost that cannot be influenced. In reality, there are numerous factors that can impact your insurance premium, and by understanding these factors and taking proactive steps, you can significantly reduce your costs. Another misconception is that all insurance providers offer the same coverage for the same price, when in fact, quotes can vary greatly between insurers.