Insurance Price Comparison

Insurance is an essential aspect of modern life, providing financial protection and peace of mind to individuals and businesses alike. With numerous insurance providers offering a vast array of policies, it can be a daunting task to navigate the market and find the best coverage at the most competitive price. This comprehensive guide aims to demystify the insurance price comparison process, offering valuable insights and strategies to help you make informed decisions.

Understanding Insurance: The Basics

Insurance is a contract, known as a policy, between an individual or entity (the policyholder) and an insurance company. The policyholder pays a premium to the insurer, who, in return, agrees to provide financial protection in the event of a covered loss or incident. This protection can cover a wide range of risks, from property damage and liability to health-related expenses and even income loss.

The insurance industry is vast and diverse, offering various types of coverage tailored to specific needs. Some common insurance types include:

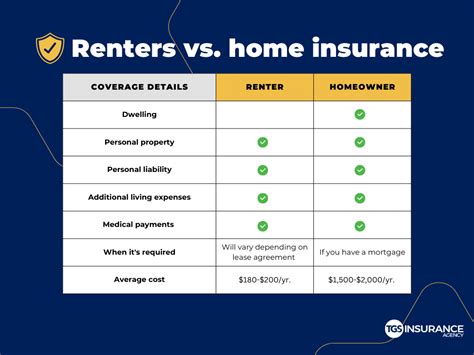

- Property Insurance: Protects against damage or loss of physical assets like homes, vehicles, and businesses.

- Health Insurance: Covers medical expenses, providing financial support for healthcare needs.

- Life Insurance: Provides a financial payout to beneficiaries upon the policyholder's death.

- Liability Insurance: Shields policyholders from legal claims and lawsuits.

- Business Insurance: Offers coverage for various risks associated with running a business.

Each type of insurance policy can further be customized with various endorsements or riders to meet specific needs. The complexity of the insurance landscape makes comparing policies and prices a challenging but crucial task.

The Importance of Price Comparison

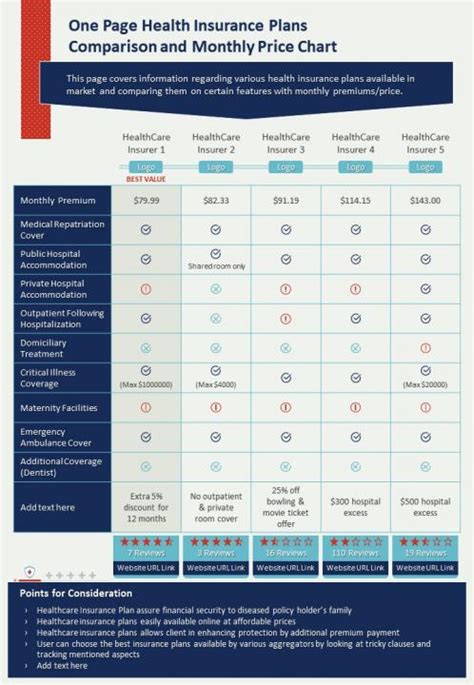

Price comparison in the insurance industry is a vital step to ensure you receive the best value for your money. With numerous providers competing for your business, the range of prices and coverage options can vary significantly. By comparing prices, you can identify the most affordable policies without compromising on the quality of coverage.

Moreover, price comparison allows you to assess the market and negotiate better terms with your insurer. It empowers you to make informed decisions, ensuring you're not overpaying for coverage you may not need. Additionally, it can help you identify additional benefits or discounts that could further reduce your premium.

Factors Influencing Insurance Prices

Insurance prices are not set arbitrarily. Insurers use a variety of factors to calculate premiums, ensuring they can adequately cover the risks associated with each policy. Understanding these factors can help you make more informed choices during the price comparison process.

Risk Assessment

Insurance companies assess the risk associated with each policy. Higher-risk policies, such as insuring a sports car or a business in a high-crime area, typically attract higher premiums. Insurers use statistical data and actuarial science to predict the likelihood of a claim and set prices accordingly.

| Risk Factor | Description |

|---|---|

| Type of Coverage | Different types of insurance (e.g., health, auto, life) have varying risk profiles. |

| Location | The area where the insured asset is located can affect the risk (e.g., flood zones, crime rates) |

| Claim History | A history of frequent claims can increase the perceived risk and thus the premium. |

Personal and Business Factors

Individual and business-specific factors can also influence insurance prices. These factors help insurers assess the likelihood of a claim and set premiums accordingly.

- Age: In certain types of insurance, age can be a significant factor. For instance, younger drivers often pay higher car insurance premiums due to their higher risk profile.

- Occupation: Some occupations may be considered riskier than others. For example, a construction worker may pay higher premiums for workers' compensation insurance.

- Credit Score: Surprisingly, credit score can impact insurance prices. Insurers may view a lower credit score as an indicator of higher risk, leading to increased premiums.

Policy Coverage and Deductibles

The level of coverage you choose and the associated deductibles can significantly impact your premium. Higher coverage limits and lower deductibles generally result in higher premiums, as the insurer assumes more financial risk.

Strategies for Effective Price Comparison

Now that we understand the factors influencing insurance prices, let’s explore some strategies to effectively compare insurance prices and find the best deals.

Online Comparison Tools

The internet has revolutionized the insurance price comparison process. Numerous online platforms and tools allow you to compare prices from multiple insurers in one place. These tools can provide a quick and convenient way to get an overview of the market.

- Insurance Aggregators: Websites like Compare.com and InsuranceQuotes.com allow you to enter your details once and receive multiple quotes from different insurers. These sites often have partnerships with various providers, ensuring a wide range of options.

- Insurers' Websites: Many insurance companies now offer online quote tools on their websites. While you may not get as many options as with aggregators, it can be a good way to get a quote from a specific insurer you're interested in.

Broker or Agent Assistance

Insurance brokers and agents can be invaluable resources when comparing insurance prices. They have extensive knowledge of the market and can provide personalized advice based on your specific needs.

- Independent Brokers: These professionals are not tied to any particular insurer, allowing them to shop around for the best policy and price on your behalf. They can negotiate with multiple insurers, ensuring you get the most competitive deal.

- Captive Agents: Captive agents work exclusively for one insurance company. While they may not offer as wide a range of options, they can provide in-depth knowledge of their company's policies and can help you understand the nuances of coverage.

Bundle and Save

Many insurers offer discounts when you bundle multiple policies together. For instance, you might get a discounted rate on your home and auto insurance if you purchase them from the same insurer. This strategy can be particularly beneficial for individuals with multiple insurance needs.

Review and Renegotiate

Insurance prices can change over time due to various factors, such as changes in risk assessment or market competition. Regularly reviewing your insurance policies and comparing prices can help you identify opportunities to save money. If you find a better deal elsewhere, you can use it as leverage to renegotiate your current policy with your insurer.

The Future of Insurance Price Comparison

The insurance industry is evolving rapidly, driven by technological advancements and changing consumer preferences. This evolution is set to revolutionize the way we compare insurance prices, making the process even more efficient and consumer-friendly.

Emerging Technologies

Technologies like artificial intelligence (AI) and machine learning are transforming the insurance landscape. These technologies can analyze vast amounts of data to provide more accurate risk assessments and personalized pricing. Insurers are also leveraging technology to offer more interactive and engaging quote processes, making it easier for consumers to understand their options.

Digital Transformation

The digital transformation of the insurance industry is set to continue, with more insurers moving their operations online. This shift will likely lead to more efficient and streamlined quote processes, allowing consumers to compare prices and purchase policies entirely digitally.

Consumer Empowerment

With the rise of online resources and tools, consumers are becoming increasingly empowered in the insurance market. They have access to more information and can make more informed decisions about their coverage needs and preferences. This shift is expected to drive insurers to be more competitive and transparent in their pricing strategies.

Conclusion: Navigating the Insurance Market

Comparing insurance prices is a critical step in ensuring you get the best value for your money. By understanding the factors that influence prices and employing effective comparison strategies, you can make informed decisions about your insurance coverage. As the insurance industry continues to evolve, staying informed and utilizing the latest tools and technologies will be key to navigating the market successfully.

How often should I compare insurance prices?

+It’s recommended to review and compare insurance prices annually or whenever your circumstances change significantly (e.g., buying a new car, moving to a new location, getting married). Regular reviews can help you stay on top of market changes and ensure you’re not overpaying.

What are some common discounts I should look for when comparing insurance prices?

+Common discounts include safe driver discounts, multi-policy discounts (bundling multiple policies with the same insurer), loyalty discounts, and discounts for certain professions or memberships. It’s worth asking your insurer about available discounts to see if you qualify.

How can I improve my chances of getting lower insurance premiums?

+To reduce your insurance premiums, consider increasing your deductibles (the amount you pay out-of-pocket before your insurance kicks in), maintaining a clean driving or claims history, improving your credit score, and shopping around for the best deals. Additionally, some insurers offer discounts for taking defensive driving courses or installing safety features in your home or vehicle.