Top Dental Insurance Plans

Dental insurance is an essential aspect of maintaining good oral health and can provide significant financial benefits for individuals and families. With a wide range of dental plans available, choosing the right one can be a daunting task. This comprehensive guide aims to explore the top dental insurance plans, offering insights into their features, coverage, and potential advantages for different consumer needs.

Understanding the Landscape of Dental Insurance

The dental insurance market offers a variety of plans, each with its own unique set of benefits and restrictions. Understanding the key differences between these plans is crucial for making an informed decision. Here’s an overview of the main types of dental insurance plans available in the market today.

1. Indemnity Plans

Indemnity, or fee-for-service, plans are among the most flexible options in the dental insurance landscape. With this type of plan, policyholders can choose any dentist they wish, whether in-network or out-of-network. While these plans offer maximum flexibility, they may come with higher premiums and out-of-pocket costs.

Indemnity plans typically cover a certain percentage of the cost of dental procedures, with the policyholder responsible for the remaining amount. The exact coverage and out-of-pocket expenses can vary depending on the specific plan and the type of dental treatment required.

2. Preferred Provider Organization (PPO) Plans

PPO plans provide a balance between flexibility and cost-effectiveness. With a PPO plan, policyholders have the freedom to choose any dentist, but they will save the most on their dental care if they visit an in-network dentist. In-network dentists have agreed to provide services at discounted rates, which can result in significant savings for policyholders.

PPO plans often have a higher premium than indemnity plans, but they may offer more comprehensive coverage for certain procedures. Additionally, PPO plans typically have lower out-of-pocket costs compared to indemnity plans, making them a popular choice for many individuals and families.

3. Health Maintenance Organization (HMO) Plans

HMO plans are generally the most cost-effective option for dental insurance. With an HMO plan, policyholders must choose a primary dentist from within the plan’s network. This primary dentist acts as a gatekeeper, referring the patient to other in-network specialists if necessary. HMO plans often have the lowest premiums and out-of-pocket costs but may offer more limited flexibility compared to PPO and indemnity plans.

4. Discount Dental Plans

Discount dental plans are an alternative to traditional dental insurance. Instead of providing coverage for dental procedures, these plans offer discounted rates on dental services. Members pay an annual fee and receive access to a network of participating dentists who offer reduced rates on various dental treatments.

While discount dental plans may not provide the same level of financial protection as traditional insurance, they can be a cost-effective option for individuals and families who require occasional dental care and are looking for ways to save on their dental expenses.

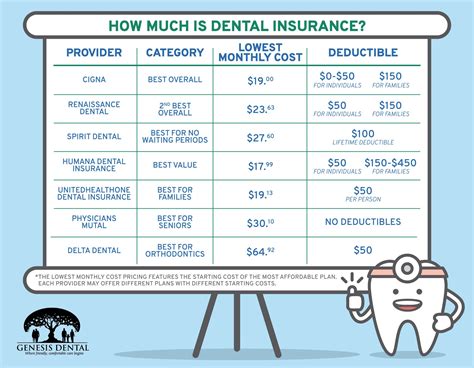

Analyzing Top Dental Insurance Providers

When it comes to choosing a dental insurance plan, it’s important to consider the reputation and reliability of the insurance provider. Here’s a closer look at some of the top dental insurance companies and their standout features.

1. Delta Dental

Delta Dental is one of the most well-known and trusted names in the dental insurance industry. With a vast network of over 150,000 dentists across the United States, Delta Dental offers a wide range of plan options to suit different needs. Their plans often include comprehensive coverage for preventive care, such as dental cleanings and exams, as well as substantial benefits for more complex procedures like root canals and crowns.

One of the standout features of Delta Dental is their focus on educational resources. They provide extensive information on oral health, helping policyholders make informed decisions about their dental care. Additionally, Delta Dental offers various programs and incentives to encourage good oral hygiene practices, making them a top choice for those seeking comprehensive dental coverage.

2. MetLife

MetLife is a leading provider of dental insurance, offering a comprehensive suite of plans to individuals and families. Their plans are known for their flexibility, allowing policyholders to choose from a wide range of dental providers, both in-network and out-of-network. MetLife’s plans often cover a high percentage of the cost of dental procedures, making them a cost-effective option for those seeking extensive dental care.

One unique aspect of MetLife’s dental insurance is their focus on preventative care. Their plans typically include generous coverage for preventive services, such as dental cleanings, fluoride treatments, and oral cancer screenings. By emphasizing preventative care, MetLife aims to help policyholders maintain optimal oral health and avoid more costly procedures down the line.

3. Cigna

Cigna is another prominent player in the dental insurance market, offering a diverse range of plan options. Their plans are designed to cater to different consumer needs, whether it’s a focus on flexibility, cost-effectiveness, or comprehensive coverage. Cigna’s network of dental providers is extensive, ensuring policyholders have access to quality dental care regardless of their location.

One notable feature of Cigna’s dental insurance is their commitment to digital innovation. They offer a user-friendly online platform that allows policyholders to easily manage their dental benefits, view their coverage details, and locate in-network dentists. Additionally, Cigna provides convenient tools for estimating out-of-pocket costs and understanding the financial aspects of their dental care, making the process more transparent and accessible.

4. United Concordia

United Concordia is a highly regarded dental insurance provider, known for its extensive network of dental professionals and its commitment to customer satisfaction. Their plans often include generous coverage for preventive care, helping policyholders maintain good oral health and avoid more costly procedures in the future.

One of the standout features of United Concordia’s dental insurance is their focus on specialized care. Their plans typically offer coverage for a wide range of dental specialties, including orthodontics, periodontics, and endodontics. This comprehensive approach ensures that policyholders have access to the full spectrum of dental care, from routine check-ups to more complex procedures.

Comparative Analysis: Key Considerations

When comparing dental insurance plans, there are several key factors to consider. These factors can help individuals and families make an informed decision based on their unique needs and preferences.

1. Coverage and Benefits

One of the most crucial aspects of dental insurance is the coverage and benefits it provides. Different plans offer varying levels of coverage for preventive care, basic procedures, and major treatments. It’s essential to evaluate the scope of coverage, including the percentage of costs covered and any potential limitations or exclusions.

Additionally, it’s beneficial to consider the plan’s coverage for specific procedures that may be of interest. For example, if orthodontic treatment is a priority, choosing a plan with comprehensive orthodontic coverage could be a wise decision. Understanding the coverage details and comparing them across different plans can help individuals find the best fit for their dental needs.

2. Cost and Affordability

The cost of dental insurance is a significant consideration for many individuals and families. Plans can vary widely in terms of premiums, deductibles, and out-of-pocket expenses. It’s important to assess the overall affordability of a plan, taking into account not only the monthly premium but also any potential copayments or coinsurance fees.

Additionally, individuals should consider their anticipated dental needs and the potential costs associated with those needs. For instance, if there is a history of complex dental issues, a plan with higher premiums but more comprehensive coverage might be a more cost-effective option in the long run. Understanding the financial aspects of different plans can help individuals make a decision that aligns with their budget and dental care requirements.

3. Network of Dentists

The network of dentists available under a dental insurance plan is another critical consideration. Some plans have a more extensive network, offering policyholders a wider range of choices when selecting a dentist. Others may have a more limited network, which can restrict options but may result in lower costs.

It’s beneficial to assess the network of dentists in the plan’s area, considering factors such as proximity, convenience, and the specific dental specialties offered. Additionally, individuals should evaluate whether they prefer the flexibility of choosing any dentist, even if it means paying more, or if they prioritize cost savings by staying within the plan’s network.

4. Customer Service and Claims Process

The quality of customer service and the ease of the claims process are often overlooked but crucial aspects of dental insurance. A plan with responsive and helpful customer service can make a significant difference in the overall experience. Additionally, a straightforward and efficient claims process can streamline the reimbursement process, making it less burdensome for policyholders.

When evaluating dental insurance plans, individuals should consider the reputation of the provider’s customer service and claims handling. Reviews and feedback from current and former policyholders can provide valuable insights into the quality of service and the overall satisfaction levels. A plan with a proven track record of excellent customer service and a smooth claims process can be a significant advantage for policyholders.

The Impact of Dental Insurance on Oral Health

Dental insurance plays a pivotal role in promoting and maintaining good oral health. By providing access to affordable dental care, insurance plans encourage individuals to prioritize their oral hygiene and seek regular dental check-ups. This proactive approach to oral health can lead to early detection and treatment of dental issues, preventing more severe problems and potentially costly procedures down the line.

Additionally, dental insurance plans often include coverage for preventive care, such as dental cleanings, fluoride treatments, and oral cancer screenings. These preventive measures are essential for maintaining optimal oral health and can help individuals avoid the development of more serious dental conditions. By investing in preventive care, dental insurance plans contribute to long-term oral health and overall well-being.

Future Trends and Innovations in Dental Insurance

The dental insurance industry is continually evolving, with new trends and innovations shaping the landscape. Here’s a glimpse into some of the future developments that are likely to impact the industry.

1. Telehealth and Virtual Dental Care

The rise of telehealth services has already made its way into the dental industry. With virtual dental care, individuals can consult with dentists remotely, seeking advice and guidance on various dental concerns. This trend is expected to continue, offering greater accessibility and convenience for policyholders, especially in rural or underserved areas.

Virtual dental care can also enhance the efficiency of the dental insurance process. Policyholders can receive preliminary assessments and recommendations from dentists online, streamlining the decision-making process for both patients and insurance providers. This integration of technology into dental care is likely to improve overall patient experiences and outcomes.

2. Data-Driven Personalized Care

The increasing availability of health data and advancements in analytics are poised to revolutionize dental insurance. By leveraging data-driven insights, insurance providers can offer more personalized care plans tailored to the unique needs of policyholders. This approach can lead to more efficient and effective treatment strategies, optimizing the overall dental care experience.

Additionally, data-driven personalized care can help identify high-risk individuals and implement targeted interventions to prevent the onset of dental issues. By analyzing individual health data, insurance providers can develop tailored prevention programs, ensuring that policyholders receive the necessary support to maintain optimal oral health.

3. Integration of AI and Machine Learning

Artificial intelligence (AI) and machine learning technologies are already making their mark on various industries, and the dental insurance sector is no exception. These technologies have the potential to revolutionize the way dental insurance claims are processed and assessed. By automating certain tasks and leveraging advanced analytics, insurance providers can streamline the claims process, reducing administrative burdens and enhancing efficiency.

Furthermore, AI and machine learning can be utilized to enhance fraud detection capabilities. By analyzing patterns and identifying anomalies, these technologies can help identify potential fraudulent activities, ensuring the integrity of the dental insurance system. The integration of AI and machine learning is expected to bring about significant improvements in claim processing accuracy and overall system efficiency.

What are the key factors to consider when choosing a dental insurance plan?

+When selecting a dental insurance plan, it’s crucial to consider factors such as coverage and benefits, cost and affordability, network of dentists, and the quality of customer service and claims handling. Assessing these aspects will help you find a plan that aligns with your specific needs and preferences.

How can I save money on dental insurance?

+To save money on dental insurance, consider choosing a plan with a larger network of dentists, as this can lead to lower out-of-pocket costs. Additionally, evaluate your anticipated dental needs and select a plan with coverage that matches those needs, ensuring you’re not overpaying for unnecessary benefits.

What is the difference between a PPO and an HMO dental plan?

+PPO plans offer flexibility, allowing you to choose any dentist, but you’ll save more by visiting in-network providers. HMO plans are more cost-effective but require you to choose a primary dentist from within the network. HMO plans often have lower premiums and out-of-pocket costs.

Can I switch my dental insurance provider if I’m unhappy with my current plan?

+Yes, you can switch dental insurance providers if you’re dissatisfied with your current plan. It’s important to carefully evaluate the features and benefits of different plans before making a decision to ensure you find a provider that better meets your needs.