Cheapest Car Insurance Full Coverage

When it comes to car insurance, finding the cheapest full coverage option is a priority for many drivers. Full coverage insurance provides a comprehensive protection plan, offering financial security in the event of accidents, natural disasters, or other unexpected incidents. However, the cost of this coverage can vary significantly between insurance providers and regions, making it essential to explore options thoroughly.

This article aims to guide you through the process of securing the most affordable full coverage car insurance, taking into account various factors that influence premiums. We will delve into the specific components of full coverage insurance, compare prices across different providers, and highlight the key strategies to obtain the best deal. By understanding the nuances of this insurance type and leveraging effective negotiation techniques, you can strike a balance between cost and comprehensive protection.

Understanding Full Coverage Car Insurance

Full coverage car insurance is a term used to describe a policy that combines collision coverage and comprehensive coverage with liability insurance. It is often recommended for newer vehicles or those with high resale value, as it provides a more extensive level of protection.

Collision coverage pays for damages to your vehicle after an accident, regardless of who is at fault. On the other hand, comprehensive coverage protects against damages caused by events other than collisions, such as theft, vandalism, natural disasters, or collisions with animals. Liability insurance, which is a legal requirement in most states, covers the cost of injuries or property damage you cause to others.

By opting for full coverage, drivers can have peace of mind knowing that their vehicle is protected from a wide range of potential incidents. However, the trade-off is often a higher premium compared to basic liability-only insurance.

Key Components of Full Coverage

- Collision Coverage: Covers damages to your vehicle from accidents, regardless of fault.

- Comprehensive Coverage: Protects against non-collision events like theft, vandalism, or natural disasters.

- Liability Insurance: Mandatory coverage that pays for injuries or property damage caused to others.

Benefits of Full Coverage

- Financial protection for your vehicle in a wide range of situations.

- Peace of mind knowing you’re covered for unexpected incidents.

- Potential to save money in the long run, especially for newer or high-value vehicles.

Factors Influencing Full Coverage Premiums

The cost of full coverage car insurance can vary significantly depending on various factors. Understanding these influences can help you negotiate better rates and find the cheapest option available.

Vehicle Make and Model

The make and model of your vehicle play a crucial role in determining insurance premiums. Insurers consider factors such as the vehicle’s safety features, repair costs, and its likelihood of being stolen or involved in accidents. For instance, sports cars and luxury vehicles often come with higher insurance premiums due to their performance and expensive parts.

Driver’s Age and Experience

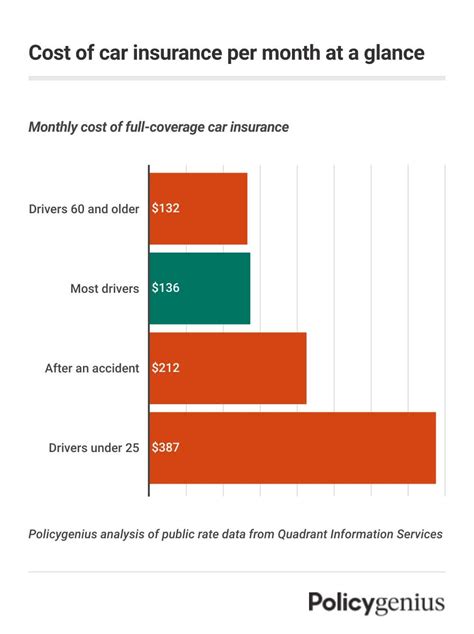

Your age and driving experience are significant factors in calculating insurance premiums. Generally, younger drivers, especially those under 25, are considered high-risk and face higher insurance rates. Conversely, more experienced drivers with a clean driving record can enjoy lower premiums.

Location and Usage

The region where you live and the purpose of your vehicle usage also impact insurance costs. Urban areas often have higher premiums due to increased traffic congestion and the higher likelihood of accidents. Similarly, using your vehicle for business or commercial purposes may result in higher rates.

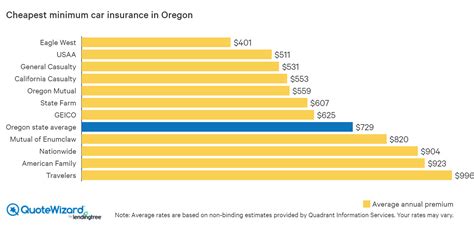

Insurance Company and Coverage Options

Different insurance companies offer varying coverage options and pricing structures. It’s crucial to compare quotes from multiple providers to find the best deal. Additionally, the specific coverage options you choose, such as deductible amounts and additional endorsements, can significantly affect your premium.

Strategies to Find the Cheapest Full Coverage

To secure the cheapest full coverage car insurance, consider the following strategies:

Compare Quotes from Multiple Insurers

The insurance market is highly competitive, and quotes can vary significantly between providers. By obtaining quotes from several insurers, you can identify the most affordable option for your specific needs. Online comparison tools can simplify this process, allowing you to quickly gather and compare quotes.

Adjust Your Coverage Options

Review your coverage options and consider adjusting them to reduce costs. For example, increasing your deductible (the amount you pay out-of-pocket before insurance coverage kicks in) can lower your premium. However, ensure that you choose a deductible amount that you can comfortably afford in the event of a claim.

Bundle Policies

If you have multiple insurance needs, such as home and auto insurance, consider bundling them with the same provider. Many insurers offer discounts for customers who bundle their policies, resulting in significant savings.

Maintain a Good Driving Record

A clean driving record is essential for obtaining lower insurance rates. Avoid accidents and traffic violations, as they can significantly increase your premiums. Additionally, consider taking defensive driving courses, which can sometimes lead to insurance discounts.

Shop Around Regularly

Insurance rates can change over time, and new providers may offer better deals. It’s advisable to shop around for insurance quotes regularly, especially during significant life events like purchasing a new vehicle or moving to a new location.

Real-World Examples of Full Coverage Premiums

To provide a clearer picture of full coverage car insurance costs, let’s examine some real-world examples. These examples are based on average rates and should be used as a general guide rather than precise quotes.

| Provider | Average Annual Premium |

|---|---|

| State Farm | $1,500 |

| GEICO | $1,200 |

| Progressive | $1,350 |

| Allstate | $1,600 |

| Liberty Mutual | $1,450 |

These averages illustrate the range of prices for full coverage insurance. However, it's important to note that premiums can vary widely based on individual circumstances and the specific coverage options chosen.

Future Implications and Trends

The car insurance market is constantly evolving, and several trends are shaping the future of full coverage insurance.

Technological Advancements

The integration of advanced technologies, such as telematics and usage-based insurance, is gaining traction. These technologies allow insurers to gather more precise data on driving behavior, which can lead to more accurate risk assessments and potentially lower premiums for safe drivers.

Increased Focus on Personalization

Insurance providers are shifting towards more personalized coverage options. This means that drivers can tailor their insurance policies to their specific needs, potentially reducing costs while maintaining adequate coverage.

The Rise of Online Insurance Platforms

Online insurance platforms are becoming increasingly popular, offering convenient and efficient ways to compare quotes and purchase insurance. These platforms often provide competitive rates and additional discounts, making it easier for consumers to find the cheapest full coverage options.

Conclusion

Finding the cheapest full coverage car insurance requires a combination of thorough research, effective negotiation, and an understanding of the factors influencing premiums. By comparing quotes, adjusting coverage options, and staying informed about industry trends, you can secure a comprehensive insurance plan at an affordable price.

Remember, car insurance is an essential aspect of responsible driving, and choosing the right coverage is crucial for your financial well-being. With the right approach and a bit of effort, you can navigate the insurance market successfully and protect your vehicle without breaking the bank.

How much does full coverage car insurance typically cost?

+The cost of full coverage car insurance varies widely depending on factors like the driver’s age, driving record, location, and the make and model of the vehicle. On average, full coverage insurance can range from 1,000 to 2,500 per year, but it’s important to get quotes from multiple insurers to find the best rate for your specific circumstances.

What are some ways to reduce the cost of full coverage insurance?

+There are several strategies to lower your full coverage insurance premiums. These include shopping around for quotes from different insurers, adjusting your coverage options (e.g., increasing deductibles), taking advantage of discounts (such as safe driver discounts), and maintaining a clean driving record. Additionally, consider bundling your auto insurance with other policies like home or renters insurance for potential savings.

Are there any alternatives to full coverage insurance?

+Yes, if you’re looking to reduce costs, you may consider liability-only insurance, which provides coverage for injuries and property damage you cause to others but does not cover damage to your own vehicle. However, it’s important to carefully assess your needs and financial situation before opting for this alternative, as it may not provide adequate protection for your specific circumstances.