Low Cost Business Insurance

In the dynamic world of entrepreneurship, protecting your business with adequate insurance is essential, but finding affordable coverage can be a challenging endeavor. Understanding the intricacies of business insurance and how to navigate the market to secure the best value is crucial for any business owner. This article aims to demystify the process, providing a comprehensive guide to obtaining low-cost business insurance without compromising on the protection your enterprise deserves.

Understanding the Fundamentals of Business Insurance

Business insurance, often referred to as commercial insurance, is a vital tool for mitigating risks and safeguarding your business against a multitude of potential perils. These risks can range from property damage and liability claims to disruptions in your supply chain or the unexpected loss of key personnel. By purchasing the right insurance policies, you not only protect your business assets but also ensure the financial stability and longevity of your enterprise.

The world of business insurance is vast and complex, with a myriad of policies tailored to different industries and business structures. Some common types of business insurance include general liability insurance, which covers bodily injury and property damage claims; professional liability insurance (or errors and omissions insurance), which protects against negligence claims; and property insurance, which safeguards your business premises and its contents. Other crucial policies might include business interruption insurance, which provides a safety net during periods when your business is unable to operate, and workers' compensation insurance, which is mandatory in many regions and covers medical expenses and lost wages for employees injured on the job.

The Importance of Tailored Insurance Solutions

Every business is unique, with its own set of risks and vulnerabilities. That’s why a one-size-fits-all approach to business insurance often falls short. A tailored insurance solution takes into account the specific needs and circumstances of your business, providing coverage that is both comprehensive and cost-effective. For instance, a small e-commerce startup may primarily require general liability and product liability insurance, while a construction firm would benefit more from a robust contractor’s insurance package that includes coverage for tools and equipment.

Customized insurance plans can be particularly beneficial for businesses operating in niche industries or those with unique operational models. Take, for example, a software development firm that provides cloud-based services. In addition to general liability and professional indemnity insurance, they might also need to consider cyber liability insurance to protect against potential data breaches or system failures. Similarly, a restaurant might require specialized insurance coverage for food safety and liquor liability, aspects that are less critical for a digital marketing agency.

Strategies for Securing Low-Cost Business Insurance

While the primary goal of business insurance is to provide adequate protection, cost is invariably a significant consideration for small and medium-sized businesses. Here are some effective strategies to help you secure low-cost business insurance without compromising on the coverage you need.

Shop Around and Compare Quotes

One of the simplest yet most effective ways to find low-cost business insurance is to shop around and compare quotes from multiple providers. Insurance rates can vary significantly between companies, and you might be surprised at the differences in premiums for similar coverage. Utilize online comparison tools, reach out to local insurance brokers, and engage directly with insurance carriers to gather a range of quotes. Make sure to compare apples with apples; evaluate policies based on their coverage limits, deductibles, and any additional benefits or exclusions.

Bundle Your Insurance Policies

Bundling your insurance policies, also known as a business owner’s policy (BOP), is an excellent way to save money on your premiums. A BOP typically combines general liability insurance with property insurance, and often includes business interruption insurance as well. By purchasing these policies together, you can often secure a substantial discount. Additionally, BOPs are tailored to your specific business needs, ensuring you have the right coverage without paying for unnecessary add-ons.

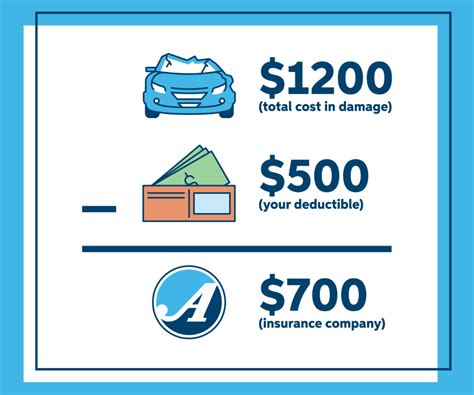

Increase Your Deductibles

Opting for higher deductibles can lead to significant savings on your insurance premiums. A deductible is the amount you agree to pay out of pocket before your insurance coverage kicks in. By increasing this amount, you take on more financial responsibility in the event of a claim, which can result in lower premiums. However, it’s essential to strike a balance; you don’t want to choose a deductible that’s so high it becomes unaffordable if you need to make a claim.

Improve Your Business’s Risk Profile

Insurance companies often offer discounts or more favorable rates to businesses that take steps to mitigate their risks. By demonstrating that you’re proactive in managing your business’s risks, you can enhance your appeal to insurers and potentially secure lower premiums. This might involve implementing safety measures, such as installing fire suppression systems or security cameras, or adopting best practices in your industry that reduce the likelihood of accidents or claims.

Explore Discounts and Credits

Many insurance companies offer discounts and credits for a variety of reasons. You might qualify for a discount if you’ve been in business for a certain number of years without any significant claims, or if you have multiple policies with the same insurer. Some insurers also offer credits for businesses that implement specific safety measures or participate in certain industry associations. It’s worth asking your insurance broker or carrier about any potential discounts or credits you might be eligible for.

Leverage Technology for Risk Management

In today’s digital age, technology can be a powerful tool for managing risks and improving your business’s insurance profile. For instance, using telematics devices in your fleet vehicles can provide real-time data on driving behavior, which can lead to safer driving habits and potentially lower premiums. Similarly, implementing robust cybersecurity measures can reduce the risk of data breaches, making your business a less risky prospect for insurers and potentially leading to lower cyber liability insurance premiums.

The Role of Insurance Brokers in Securing Low-Cost Coverage

Insurance brokers can be invaluable allies in your quest for low-cost business insurance. These professionals have extensive knowledge of the insurance market and can help you navigate the complexities of business insurance, providing expert advice and guidance tailored to your specific needs. They can assess your business’s unique risks and recommend the most suitable policies and carriers, often securing better rates and terms than you might be able to negotiate on your own.

Brokers typically work with multiple insurance carriers, giving them access to a wide range of policies and rates. They can compare quotes from different providers, negotiate on your behalf, and help you understand the fine print of each policy, ensuring you're getting the best value for your money. Additionally, brokers can often secure exclusive rates or packages not available to the general public, further enhancing your ability to find low-cost insurance.

Furthermore, insurance brokers can provide ongoing support and guidance, helping you manage your insurance portfolio over time. They can advise on policy renewals, recommend adjustments to your coverage as your business evolves, and assist with the claims process should the need arise. This level of service and expertise can be particularly beneficial for small business owners who may not have the time or resources to dedicate to insurance management.

The Impact of Industry and Business Size on Insurance Costs

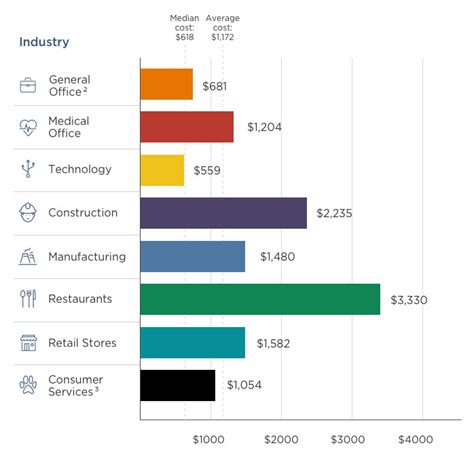

The cost of business insurance can vary significantly depending on the industry you operate in and the size of your business. Certain industries, such as construction or manufacturing, are inherently riskier and therefore attract higher insurance premiums. On the other hand, industries like professional services or retail may have lower insurance costs due to the lower risk profile associated with these sectors.

Business size also plays a crucial role in determining insurance costs. Larger businesses often enjoy economies of scale, which can lead to lower insurance premiums per employee or per unit of production. Conversely, small businesses may face higher insurance costs relative to their size due to the perceived higher risk of smaller operations. However, small businesses can often mitigate these costs by bundling their insurance policies or by implementing effective risk management strategies.

Additionally, the location of your business can impact insurance costs. Some regions may have higher insurance rates due to factors such as increased risk of natural disasters, higher crime rates, or a lack of competitive insurance markets. It's therefore essential to consider these factors when assessing the cost of business insurance and to work with an insurance broker who understands the nuances of your industry and region to secure the most competitive rates.

The Future of Low-Cost Business Insurance

The landscape of business insurance is evolving rapidly, driven by technological advancements and changing consumer expectations. Insurtech, the intersection of insurance and technology, is transforming the way insurance is delivered and consumed, with a focus on efficiency, customization, and affordability. This includes the development of innovative insurance products, such as on-demand or parametric insurance, which can provide more flexible and cost-effective coverage for businesses.

Furthermore, the increasing adoption of artificial intelligence and data analytics is enabling insurers to more accurately assess and manage risk, leading to more tailored and affordable insurance solutions. By leveraging vast amounts of data, insurers can offer personalized insurance policies that better reflect the unique risks and needs of individual businesses. This shift towards data-driven underwriting is expected to continue, making insurance more accessible and affordable for businesses of all sizes.

In conclusion, securing low-cost business insurance is a complex but achievable task. By understanding your business's unique risks, shopping around for the best rates, and leveraging the expertise of insurance brokers, you can find insurance coverage that provides the protection you need without breaking the bank. As the business insurance market continues to evolve, staying informed and adaptable will be key to ensuring your business remains adequately protected at a price you can afford.

What is the average cost of business insurance?

+The average cost of business insurance can vary widely depending on factors such as industry, business size, location, and coverage needs. On average, small businesses pay around 500 to 1,000 per year for general liability insurance, but this can increase significantly for more complex or high-risk businesses. It’s important to get tailored quotes to understand the specific cost for your business.

How often should I review my business insurance policies?

+It’s recommended to review your business insurance policies annually, or whenever there are significant changes to your business operations, structure, or assets. Regular reviews ensure your coverage remains up-to-date and appropriate for your evolving needs.

Can I get business insurance if I have a home-based business?

+Yes, you can get business insurance for a home-based business. However, your standard homeowners insurance may not provide sufficient coverage for business-related risks. It’s essential to have a separate business insurance policy to protect your business assets and operations.

What happens if I don’t have enough business insurance coverage?

+If you don’t have sufficient business insurance coverage and a covered loss occurs, you may be left with significant out-of-pocket expenses. It’s crucial to assess your business’s risks and potential liabilities to ensure you have adequate coverage to protect your business and personal assets.

How can I further reduce my business insurance costs?

+In addition to the strategies mentioned earlier, you can also explore options like increasing your policy deductibles, maintaining a clean claims history, and implementing effective risk management practices. Additionally, consider negotiating with your insurer for loyalty discounts or discounts for bundling multiple policies.