Insurance Deductable

Insurance deductibles are an essential component of any insurance policy, impacting the overall cost and coverage. Understanding how deductibles work and their implications is crucial for policyholders to make informed decisions about their insurance plans. In this comprehensive guide, we delve into the world of insurance deductibles, exploring their definition, types, factors affecting them, and their impact on insurance claims. By the end of this article, you'll have a deeper understanding of insurance deductibles and their role in the insurance landscape.

Understanding Insurance Deductibles

An insurance deductible is a specified amount that a policyholder must pay out of pocket before their insurance coverage kicks in to cover the remaining costs of a claim. In simpler terms, it's the initial portion of a claim that you, as the insured, are responsible for paying. Deductibles are a common feature in various insurance policies, including health, auto, homeowners, and renters insurance.

The purpose of deductibles is twofold: first, they help insurance companies manage their risk by sharing a portion of the financial burden with policyholders. Second, deductibles encourage policyholders to be more cautious and responsible, as they have a financial stake in preventing and mitigating losses. By implementing deductibles, insurance companies aim to reduce the frequency and severity of claims, leading to more efficient and sustainable insurance practices.

Types of Insurance Deductibles

Insurance deductibles come in various forms, and the type of deductible can significantly impact the overall cost and coverage of your insurance policy. Here are the most common types of insurance deductibles:

Fixed Deductibles

A fixed deductible, as the name suggests, is a predetermined amount that remains constant for each claim during the policy period. For instance, if your health insurance policy has a $500 fixed deductible, you'll need to pay the first $500 of any covered medical expenses out of pocket before your insurance coverage takes effect. Fixed deductibles provide clarity and predictability, as you know exactly how much you'll be responsible for paying before insurance coverage begins.

Percentage Deductibles

Percentage deductibles, also known as variable or flexible deductibles, are calculated as a percentage of the total claim amount. These deductibles can vary based on the severity of the loss or the specific policy provisions. For example, if your homeowners insurance policy has a 2% deductible and you file a claim for $10,000 in damages, your deductible would be $200. Percentage deductibles are often used in property insurance policies, as they can adapt to the value of the insured property and the extent of the damage.

Composite Deductibles

Composite deductibles combine elements of both fixed and percentage deductibles. In this type of deductible, the policyholder pays a fixed amount up to a certain threshold, after which a percentage deductible comes into play. Composite deductibles are designed to provide a balance between the predictability of fixed deductibles and the flexibility of percentage deductibles. They are commonly used in health insurance policies, where the fixed amount covers initial expenses, and the percentage covers larger claims.

Per-Occurrence Deductibles

Per-occurrence deductibles apply to each individual claim or incident, regardless of the total number of claims during the policy period. This means that every time you file a claim, you'll need to pay the specified deductible amount. Per-occurrence deductibles are often found in auto insurance policies, where each accident or incident has its own deductible.

Annual Deductibles

Annual deductibles, also known as aggregate deductibles, are calculated based on the total claims made within a specific policy period, typically a year. In this case, the policyholder pays the deductible once for all claims made during that period. Annual deductibles are commonly used in health insurance plans, where the policyholder pays the deductible at the beginning of the year, and any claims made thereafter are covered by the insurance provider.

Factors Affecting Insurance Deductibles

The amount of your insurance deductible can vary depending on several factors. Understanding these factors can help you make more informed decisions when choosing an insurance policy or adjusting your existing coverage.

Policy Type and Coverage

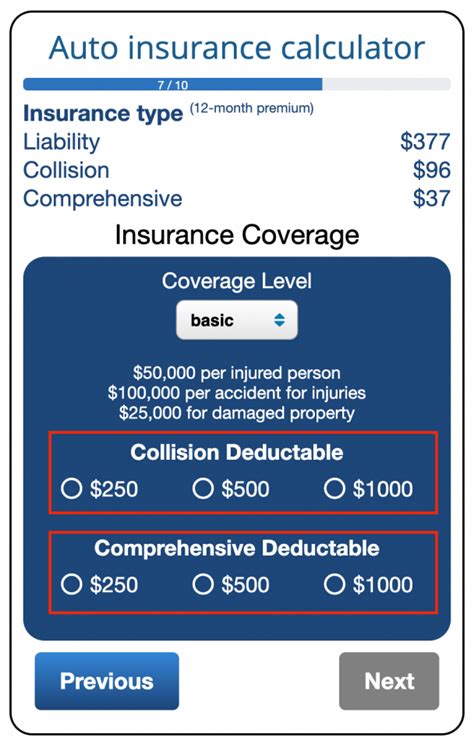

Different types of insurance policies have varying deductible structures. For instance, health insurance policies often have separate deductibles for medical expenses, prescription drugs, and specialized treatments. Auto insurance policies may have different deductibles for collision and comprehensive coverage. Understanding the specific deductibles associated with your policy type and coverage is crucial for accurate cost estimation.

Policy Limits and Deductible Relationship

Insurance policies typically have maximum coverage limits, and deductibles play a role in defining these limits. Higher deductibles can lead to lower premiums, as policyholders bear more financial responsibility. Conversely, lower deductibles result in higher premiums, as the insurance company assumes more financial risk. It's essential to strike a balance between deductibles and policy limits to ensure adequate coverage without incurring excessive out-of-pocket expenses.

Risk Factors and Insurance Provider

Insurance providers assess various risk factors when determining deductibles. These factors can include your location, age, driving record (for auto insurance), the value of your property (for homeowners or renters insurance), and your health history (for health insurance). Higher-risk individuals or properties may be subject to higher deductibles to mitigate the insurance company's exposure to potential losses.

Discounts and Promotions

Insurance companies often offer discounts and promotions to attract new customers or reward loyal policyholders. These incentives can include lower deductibles or waived deductibles for specific types of claims. Keep an eye out for such promotions, as they can significantly impact your out-of-pocket expenses and overall insurance costs.

Impact of Insurance Deductibles on Claims

Insurance deductibles have a direct impact on how insurance claims are processed and paid out. Understanding this impact can help you navigate the claims process more effectively.

Claim Reimbursement Process

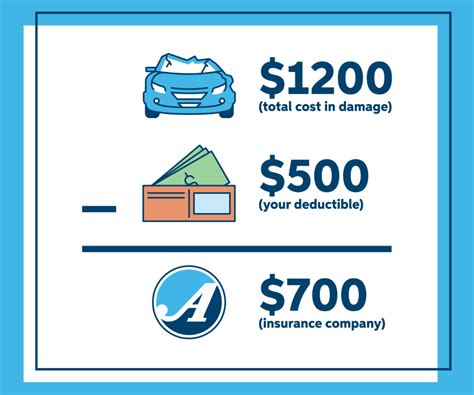

When you file an insurance claim, the reimbursement process typically involves several steps. First, the insurance company assesses the validity and extent of the claim. Once the claim is approved, the deductible amount is subtracted from the total claim amount. The insurance provider then covers the remaining expenses, up to the policy's coverage limits.

For example, if you have a $1,000 claim and a $200 deductible, you'll pay the $200 deductible out of pocket, and the insurance company will reimburse you for the remaining $800. It's important to note that deductibles are paid by the policyholder, not the insurance company.

Frequency and Severity of Claims

Insurance deductibles can influence the frequency and severity of claims. Higher deductibles may discourage policyholders from filing smaller, less significant claims, as the cost of the deductible may outweigh the benefits. This can lead to fewer claims being filed, reducing administrative costs for insurance companies and potentially lowering premiums for all policyholders.

On the other hand, lower deductibles may encourage policyholders to file claims more frequently, as the out-of-pocket expense is minimal. However, this can result in higher administrative costs for insurance companies and potentially increase premiums over time.

Potential for Fraud Reduction

Insurance deductibles can act as a deterrent to fraudulent claims. Policyholders who have to pay a portion of the claim out of pocket are less likely to engage in fraudulent activities, as they have a financial stake in the outcome. Higher deductibles can reduce the incentive for fraudulent claims, as the potential gain from the fraud may not outweigh the cost of the deductible.

Choosing the Right Insurance Deductible

Selecting the appropriate insurance deductible for your needs involves careful consideration of several factors. Here are some tips to help you make an informed decision:

Assess Your Financial Situation

Evaluate your financial capabilities and determine how much you can comfortably afford to pay out of pocket in the event of a claim. Higher deductibles may result in lower premiums, but you must ensure you have the financial resources to cover the deductible amount if needed.

Review Your Risk Profile

Consider your personal or business risk profile. If you're in a high-risk category, such as living in an area prone to natural disasters or having a history of frequent accidents, opting for a higher deductible can help mitigate your insurance costs. However, if you have a low-risk profile, a lower deductible may be more suitable.

Analyze Your Insurance Needs

Examine your specific insurance needs and the coverage you require. If you anticipate making frequent claims, a lower deductible may be more advantageous. Conversely, if you rarely file claims and prioritize lower premiums, a higher deductible could be a suitable choice.

Compare Different Policies

Research and compare insurance policies from multiple providers to find the best combination of deductibles and premiums that align with your needs and budget. Don't hesitate to seek advice from insurance professionals or brokers who can guide you through the process and help you make an informed decision.

FAQ

Can I negotiate my insurance deductible?

+In most cases, insurance deductibles are set by the insurance company based on various factors, including risk assessment and market trends. While it's uncommon to negotiate deductibles directly, you can explore options with your insurance provider to customize your policy. Discuss your specific needs and preferences with your insurer to find a suitable deductible that aligns with your budget and coverage requirements.

Do insurance deductibles apply to all types of claims?

+Insurance deductibles typically apply to covered losses or claims as specified in your policy. The applicability of deductibles can vary depending on the type of insurance and the specific provisions of your policy. Some policies may have separate deductibles for different types of claims, while others may have a single deductible that applies across all covered losses. Review your policy documents carefully to understand the deductibles associated with your insurance coverage.

Are there any tax implications associated with insurance deductibles?

+The tax implications of insurance deductibles can vary depending on your jurisdiction and the type of insurance. In some cases, the amount you pay for insurance deductibles may be tax-deductible, especially if the insurance policy is for business purposes or is part of a qualified health plan. However, it's essential to consult with a tax professional or refer to your country's tax regulations to understand the specific tax implications related to insurance deductibles.

Can insurance deductibles be waived under certain circumstances?

+In certain situations, insurance companies may waive deductibles as a goodwill gesture or to retain customer loyalty. For example, if you have been a long-term policyholder with a good claims history, the insurance provider might waive the deductible for a specific claim. Additionally, some policies offer deductible waivers for specific events or circumstances, such as natural disasters or accidents involving uninsured drivers. Check your policy documents or consult with your insurer to understand the conditions under which deductibles may be waived.

Insurance deductibles are a vital aspect of insurance policies, impacting both policyholders and insurance companies. By understanding the types of deductibles, the factors that influence them, and their impact on claims, you can make more informed decisions when choosing or adjusting your insurance coverage. Remember to assess your financial situation, risk profile, and insurance needs to select the right deductible that provides the balance of coverage and cost that suits your circumstances.