Best Insurances

In today's fast-paced world, having the right insurance coverage is more crucial than ever. From unexpected medical emergencies to unforeseen property damage, insurance provides a safety net, offering financial protection and peace of mind. However, with countless insurance providers and policies available, finding the best coverage tailored to your unique needs can be a daunting task. This comprehensive guide aims to simplify the process, offering expert insights and recommendations to help you navigate the complex world of insurance and make informed decisions.

Understanding Your Insurance Needs

The first step in securing the best insurance is to clearly understand your specific needs. Different life stages, lifestyles, and circumstances require varying levels and types of coverage. For instance, a young professional just starting their career may prioritize health and auto insurance, while a homeowner with a family might focus on comprehensive home insurance and life insurance.

Assessing Your Risk Profile

Each individual has a unique risk profile. Factors such as age, health status, occupation, location, and personal lifestyle can significantly impact the types of insurance you need and the level of coverage required. For example, a person living in a high-crime area may need more robust home security features and higher liability coverage compared to someone in a safer neighborhood.

| Risk Factor | Considerations |

|---|---|

| Age | Younger individuals often require more health and disability coverage, while older adults may need long-term care and life insurance. |

| Health Status | Pre-existing conditions can impact the cost and availability of health insurance. Consider critical illness coverage for serious health issues. |

| Occupation | High-risk occupations may require specialized insurance coverage. For instance, construction workers might need additional accident or disability coverage. |

| Location | Natural disasters, crime rates, and property values in your area can influence the type and amount of insurance you need. |

| Lifestyle | Hobbies and activities like extreme sports or travel can increase the need for specialized insurance. |

By thoroughly evaluating your risk profile, you can make more informed decisions about the insurance policies that best suit your needs.

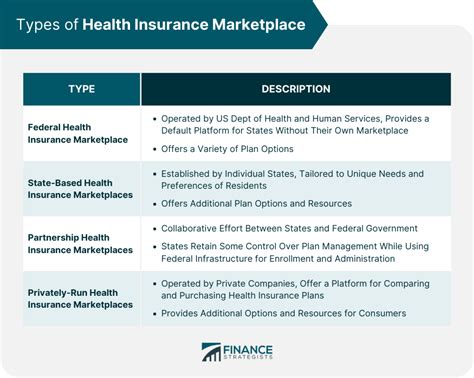

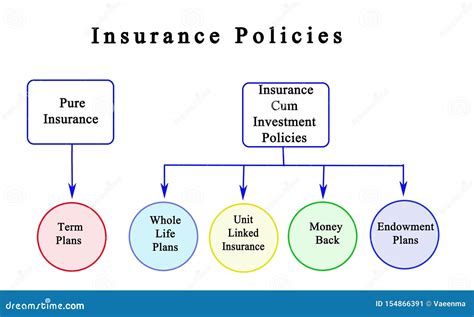

Key Types of Insurance

There are several primary types of insurance that most individuals and families should consider. While the specific coverage needed will vary based on personal circumstances, these are some of the most common and essential types of insurance:

- Health Insurance: Covers medical expenses, including doctor visits, hospital stays, prescription drugs, and sometimes dental and vision care. Health insurance is a critical component of financial protection, ensuring access to necessary healthcare services without the burden of full costs.

- Auto Insurance: Provides financial protection against physical damage and/or bodily injury resulting from traffic accidents, as well as coverage for theft and other damages to your vehicle. In most places, auto insurance is mandatory for vehicle owners.

- Home Insurance: Protects homeowners against damages to their property and belongings due to events like fires, storms, theft, and vandalism. It also typically includes liability coverage for accidents or injuries that occur on the insured property.

- Life Insurance: Offers financial protection to beneficiaries in the event of the policyholder's death. It can provide a safety net for loved ones, covering expenses like funeral costs, outstanding debts, and ongoing living expenses.

- Disability Insurance: Replaces a portion of income if you become unable to work due to an injury or illness. It ensures financial stability during a period of disability, covering expenses like mortgage payments, utilities, and other necessities.

- Long-Term Care Insurance: Provides coverage for the cost of long-term care, which can include assistance with daily activities like bathing, dressing, and eating. This type of insurance is particularly important for those who anticipate needing extended care in their golden years.

Comparing Insurance Providers and Policies

Once you’ve identified your insurance needs, the next step is to research and compare different insurance providers and their policies. This process can be time-consuming, but it’s essential to ensure you get the best coverage at the most competitive price.

Researching Insurance Companies

Start by researching reputable insurance companies that offer the types of coverage you require. Consider factors such as financial stability, customer service ratings, claim satisfaction, and the breadth of their product offerings. Online reviews and industry ratings can provide valuable insights into the company’s reputation and customer experience.

Some well-known insurance companies include State Farm, Allstate, Progressive, Geico, and USAA, among others. However, it's important to note that the best insurance company for you will depend on your specific needs and circumstances.

Analyzing Policy Details

When comparing policies, pay close attention to the coverage details, exclusions, and limitations. Ensure that the policy covers all the risks you want to protect against. For instance, when reviewing a health insurance policy, consider the network of providers, prescription drug coverage, and any out-of-pocket expenses like deductibles, copays, and coinsurance.

Similarly, when evaluating auto insurance, look at the liability limits, comprehensive and collision coverage, and any additional features like rental car coverage or roadside assistance. For home insurance, assess the dwelling coverage, personal property limits, liability protection, and any specific endorsements or riders you might need for valuable possessions.

Understanding Cost Factors

Insurance premiums can vary significantly based on several factors, including the type of coverage, the amount of coverage, and individual risk factors. For instance, younger drivers tend to pay higher auto insurance premiums due to their higher risk of accidents, while homeowners in areas prone to natural disasters may face higher home insurance costs.

It's important to strike a balance between the cost of insurance and the level of coverage you need. While it might be tempting to opt for the lowest-cost policy, it's crucial to ensure that the coverage meets your needs and provides adequate protection.

| Cost Factor | Description |

|---|---|

| Type of Coverage | Different types of insurance (e.g., health, auto, home) have varying average costs based on the risks involved and the frequency of claims. |

| Amount of Coverage | Higher coverage limits typically result in higher premiums. For instance, a health insurance policy with a higher maximum benefit will generally cost more. |

| Risk Factors | Individual characteristics and circumstances can impact insurance costs. For example, a person with a history of health issues may pay more for health insurance, while a homeowner in an area prone to floods may face higher home insurance premiums. |

Utilizing Insurance Comparison Tools

To streamline the comparison process, consider using online insurance comparison tools. These tools allow you to input your specific needs and preferences, and they’ll provide a list of insurance policies that match your criteria, along with estimated costs. This can save you time and effort, especially when researching multiple types of insurance.

Some popular insurance comparison websites include Insurance.com, Compare.com, and TheZebra.com. These platforms offer a user-friendly interface, allowing you to quickly compare policies side-by-side and get quotes from multiple providers.

Tips for Negotiating Better Insurance Rates

While insurance premiums are primarily based on risk assessment, there are strategies you can employ to potentially negotiate better rates or discounts. Here are some tips to consider:

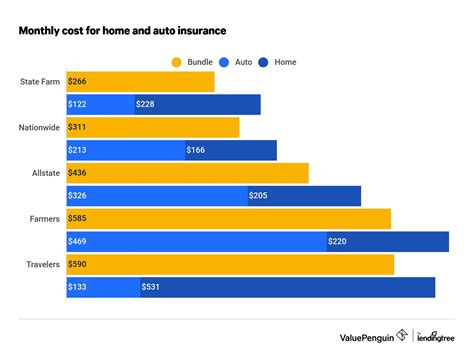

Bundling Policies

Many insurance companies offer discounts when you bundle multiple policies with them. For instance, you might be able to save on your auto and home insurance by purchasing both policies from the same provider. This strategy can be particularly beneficial for homeowners, as it often results in significant cost savings.

Increasing Deductibles

Increasing your deductible (the amount you pay out of pocket before your insurance coverage kicks in) can lower your insurance premiums. However, this strategy requires careful consideration, as it means you’ll have to pay more out of pocket in the event of a claim. Ensure that the increased deductible amount is affordable and aligns with your financial plan.

Maintaining a Good Credit Score

In many cases, insurance companies use your credit score as a factor in determining your insurance premiums. Generally, a higher credit score can lead to lower insurance costs. Therefore, it’s essential to maintain a good credit score to potentially negotiate better insurance rates.

Taking Advantage of Discounts

Insurance companies often offer various discounts to policyholders. These can include safe driver discounts for auto insurance, good student discounts for young drivers, or loyalty discounts for long-term customers. Be sure to ask your insurance provider about any discounts you might be eligible for.

Reviewing Your Policies Regularly

Insurance needs can change over time as your life circumstances evolve. It’s important to review your insurance policies annually to ensure they still meet your needs and to look for potential cost savings. This review process can help you stay up-to-date with any changes in your coverage requirements and ensure you’re not overpaying for unnecessary features.

The Future of Insurance: Emerging Trends

The insurance industry is continuously evolving, and several emerging trends are shaping the future of insurance. These trends are driven by technological advancements, changing consumer preferences, and shifting regulatory landscapes.

Digital Transformation

The insurance industry is undergoing a digital transformation, with an increasing number of insurance companies adopting digital technologies to enhance their operations and customer experience. This includes the use of artificial intelligence (AI) and machine learning for risk assessment and claims processing, as well as the development of digital platforms and mobile apps for policy management and claims reporting.

Personalized Insurance

Insurance companies are moving towards more personalized insurance products that cater to individual needs. This trend is driven by the increasing availability of data and the ability to analyze it using advanced analytics tools. By leveraging data, insurance companies can offer more tailored coverage options, providing customers with the exact protection they need without unnecessary costs.

Usage-Based Insurance

Usage-based insurance (UBI) is gaining traction, particularly in the auto insurance sector. UBI policies use telematics devices or smartphone apps to track driving behavior and offer insurance premiums based on actual usage. This model rewards safe drivers with lower premiums, providing a more fair and personalized pricing structure.

InsureTech Innovations

The rise of InsureTech, or insurance technology startups, is disrupting the traditional insurance landscape. These startups are leveraging technology to offer innovative insurance products and services, such as on-demand insurance, parametric insurance, and microinsurance. InsureTech companies are also developing new distribution channels, such as social media and peer-to-peer platforms, to reach a wider audience and provide more accessible insurance solutions.

Sustainable and Socially Responsible Insurance

There is a growing trend towards sustainable and socially responsible insurance products. This includes insurance offerings that promote environmental sustainability, such as green home insurance or eco-friendly auto insurance. Additionally, insurance companies are increasingly focusing on social responsibility, offering products that support community development and social causes.

Conclusion: Making Informed Insurance Decisions

Securing the best insurance coverage is a critical step towards financial security and peace of mind. By thoroughly understanding your insurance needs, researching and comparing different providers and policies, and staying informed about emerging trends in the insurance industry, you can make informed decisions that align with your unique circumstances and goals.

Remember, insurance is a long-term investment, and it's essential to regularly review and update your coverage to ensure it continues to meet your evolving needs. By staying proactive and educated about your insurance options, you can protect yourself, your loved ones, and your assets effectively.

What is the best type of insurance for me?

+

The best type of insurance for you will depend on your specific needs and circumstances. Some common types of insurance include health insurance, auto insurance, home insurance, life insurance, and disability insurance. It’s important to assess your risks and priorities to determine which types of insurance are most crucial for your situation.

How can I save money on insurance premiums?

+

There are several strategies you can employ to potentially save money on insurance premiums. These include bundling multiple policies with the same insurer, increasing your deductibles, maintaining a good credit score, taking advantage of available discounts, and regularly reviewing your policies to ensure you’re not overpaying for unnecessary coverage.

What are some emerging trends in the insurance industry?

+

The insurance industry is undergoing significant transformation, with several emerging trends shaping its future. These include digital transformation, personalized insurance, usage-based insurance, InsureTech innovations, and a focus on sustainable and socially responsible insurance products. These trends are driven by technological advancements, changing consumer preferences, and shifting regulatory landscapes.