How Much Is A Renter Insurance

Renter's insurance, also known as tenant insurance or renters coverage, is a type of property insurance designed to protect individuals who rent their living spaces. It provides financial coverage for personal belongings, liability protection, and additional living expenses in the event of unforeseen circumstances. The cost of renter's insurance can vary depending on several factors, including the location, coverage limits, and the policyholder's personal circumstances. In this comprehensive article, we will delve into the world of renter's insurance, exploring its importance, coverage options, and factors that influence its cost.

Understanding Renter's Insurance

Renter's insurance is a vital aspect of financial protection for individuals living in rental properties, such as apartments, condominiums, or even houses. Unlike homeowners insurance, which is typically required for those who own property, renter's insurance is often optional but highly recommended. It serves as a safety net, ensuring that tenants can recover from losses and unexpected events without incurring significant financial burdens.

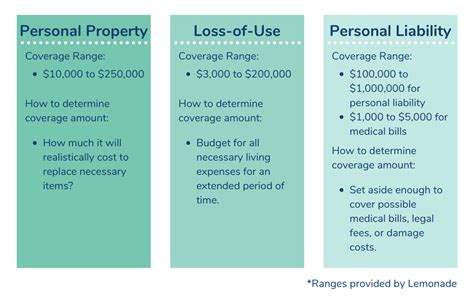

One of the primary benefits of renter's insurance is the protection it offers for personal belongings. This coverage, known as personal property coverage, reimburses policyholders for losses or damages to their possessions due to covered perils. These perils can include fire, theft, vandalism, and natural disasters, depending on the specific policy and its exclusions.

Additionally, renter's insurance provides liability coverage, which is essential for protecting against legal claims and lawsuits. If a guest is injured in the rental unit or if the tenant's actions result in property damage to others, liability coverage can provide financial assistance to cover medical expenses, legal fees, and potential settlements.

Another crucial aspect of renter's insurance is the coverage for additional living expenses. In the event that the rental unit becomes uninhabitable due to a covered loss, such as a fire or severe weather damage, this coverage helps tenants cover the cost of temporary housing and other necessary expenses until they can return to their residence.

Factors Influencing Renter's Insurance Cost

The cost of renter's insurance can vary significantly based on several key factors. Understanding these factors can help individuals make informed decisions when choosing a policy and potentially save money on their insurance premiums.

Location and Coverage Limits

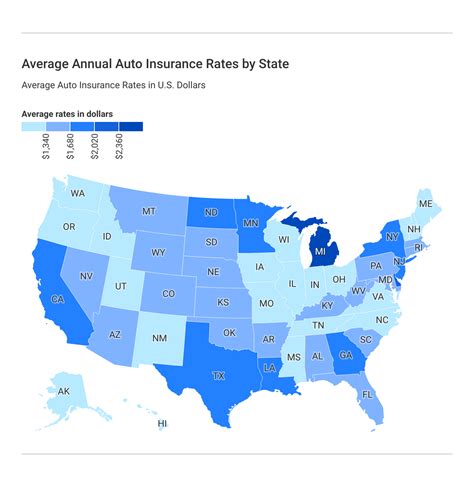

The geographical location of the rental property plays a significant role in determining the cost of renter's insurance. Areas with higher crime rates, frequent natural disasters, or a history of severe weather events may experience higher insurance premiums. Additionally, the coverage limits chosen by the policyholder directly impact the cost. Higher coverage limits for personal property and liability provide more extensive protection but come at a higher price.

| Coverage Type | Average Cost per Month |

|---|---|

| Basic Coverage (Low Limits) | $10–$20 |

| Standard Coverage (Moderate Limits) | $20–$35 |

| Enhanced Coverage (High Limits) | $35+ |

It's important to note that while higher coverage limits offer more protection, policyholders should carefully assess their needs and choose limits that align with the value of their belongings and potential liability risks.

Policy Deductibles

Deductibles are the amount policyholders must pay out of pocket before their insurance coverage kicks in. Opting for a higher deductible can lead to lower insurance premiums, as it reduces the insurer's financial risk. However, it's essential to consider one's financial capabilities and choose a deductible that is manageable in the event of a claim.

Additional Coverage Options

Renter's insurance policies often come with the option to add additional coverage endorsements or riders. These add-ons can provide specialized protection for valuable items, such as jewelry, artwork, or electronics, which may have higher replacement costs. While these additional coverages increase the policy's overall cost, they offer peace of mind for individuals with valuable possessions.

Bundling with Other Insurance Policies

Bundling renter's insurance with other insurance policies, such as auto insurance or homeowners insurance, can result in significant cost savings. Many insurance providers offer multi-policy discounts, making it more affordable to protect multiple aspects of one's life under a single insurer.

Discounts and Special Offers

Insurance companies frequently offer discounts to attract new customers and retain existing ones. These discounts can include loyalty discounts, early bird discounts for purchasing insurance before moving into a rental, or even discounts for being a non-smoker or having a security system installed in the rental property.

Coverage Options and Considerations

When selecting a renter's insurance policy, it's crucial to carefully consider the coverage options and tailor them to one's specific needs. Here are some key coverage considerations:

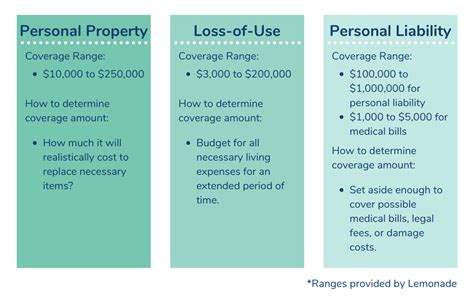

Personal Property Coverage

Personal property coverage is a fundamental aspect of renter's insurance. Policyholders should assess the value of their belongings and choose coverage limits that adequately protect their possessions. It's essential to review the policy's exclusions and limitations to understand what perils are covered and what additional endorsements may be necessary.

Liability Coverage

Liability coverage is another critical component of renter's insurance. Policyholders should consider their potential liability risks, especially if they frequently host guests or have children or pets. Higher liability limits provide greater protection against lawsuits and legal expenses.

Additional Living Expenses Coverage

Additional living expenses coverage is particularly important for individuals who may face financial challenges if their rental unit becomes uninhabitable. This coverage ensures that policyholders can maintain their standard of living during temporary displacement.

Loss of Use Coverage

Loss of use coverage is an extension of additional living expenses coverage. It provides reimbursement for necessary expenses incurred due to a covered loss, such as temporary housing, meals, and transportation costs. This coverage ensures that policyholders can maintain their routine without excessive financial strain.

Personal Injury Coverage

Personal injury coverage protects policyholders against claims of defamation, libel, or slander. While this coverage is not as common as other types of coverage, it can provide an extra layer of protection for individuals who may be at risk of such claims.

The Benefits of Renter's Insurance

Renter's insurance offers a multitude of benefits that extend beyond the financial protection it provides. Here are some key advantages of having renter's insurance:

Peace of Mind

One of the most significant benefits of renter's insurance is the peace of mind it brings. Knowing that one's personal belongings and liability are protected against unforeseen events can alleviate stress and provide a sense of security. Renter's insurance acts as a safety net, ensuring that individuals can recover from losses without devastating financial consequences.

Affordable Protection

Renter's insurance is often more affordable than many individuals realize. Basic coverage options can be obtained for as little as $10–$20 per month, making it an accessible form of insurance for tenants on various budgets. By carefully assessing coverage needs and utilizing available discounts, policyholders can secure adequate protection without breaking the bank.

Financial Recovery

In the event of a covered loss, renter's insurance provides financial assistance to help policyholders recover and rebuild. Whether it's replacing stolen belongings, covering medical expenses for injured guests, or paying for temporary housing, renter's insurance ensures that individuals can get back on their feet without incurring substantial debts.

Legal Defense

Liability coverage within renter's insurance policies can provide legal defense in the event of a lawsuit. This protection is invaluable, as legal fees and settlements can be costly and financially devastating. With renter's insurance, policyholders can rely on their insurer to handle the legal aspects, allowing them to focus on their well-being and recovery.

Obtaining Renter's Insurance

When it comes to obtaining renter's insurance, individuals have several options to choose from. Here's a breakdown of the steps involved in securing the right policy:

Assess Your Needs

Before purchasing renter's insurance, it's crucial to assess your specific needs. Consider the value of your personal belongings, your liability risks, and the potential for additional living expenses. By understanding your unique circumstances, you can choose a policy that provides adequate coverage without unnecessary expenses.

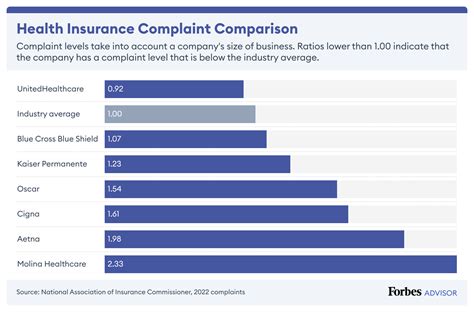

Research Insurance Providers

Take the time to research reputable insurance providers in your area. Look for companies with a strong track record of customer satisfaction and financial stability. Online reviews and ratings can provide valuable insights into the quality of service and claim handling processes.

Compare Policies and Prices

Obtain quotes from multiple insurance providers to compare policies and prices. Consider not only the cost but also the coverage limits, deductibles, and additional endorsements offered. Ensure that you understand the differences between policies to make an informed decision.

Evaluate Coverage Options

Carefully review the coverage options provided by each insurance policy. Pay attention to the exclusions and limitations, as well as any add-ons or endorsements that may be necessary to meet your specific needs. It's essential to choose a policy that provides comprehensive protection without unnecessary overlap.

Consider Bundling Options

If you have other insurance policies, such as auto insurance or homeowners insurance, explore the possibility of bundling your renter's insurance with these existing policies. Bundling can result in significant cost savings and simplify your insurance management.

Review Policy Terms and Conditions

Before finalizing your renter's insurance policy, thoroughly review the terms and conditions. Understand the coverage limits, deductibles, and any exclusions that may apply. Ensure that you are comfortable with the policy's provisions and that it aligns with your expectations.

Purchase the Policy

Once you have found a policy that meets your needs and budget, proceed with the purchase. Many insurance providers offer online purchasing options, making it convenient to secure your renter's insurance coverage.

Frequently Asked Questions

Does renter's insurance cover my pet's injuries or damages caused by my pet?

+Renter's insurance typically provides liability coverage for injuries or damages caused by pets, but the extent of coverage may vary. Some policies may exclude certain breeds or have specific restrictions. It's important to review the policy's terms and conditions or consult with your insurance provider to understand the coverage related to your pet.

What if I have valuable items, such as jewelry or artwork? Do I need additional coverage for them?

+If you possess valuable items, it's recommended to consider additional coverage options. Renter's insurance policies often have limits on coverage for specific items, and valuable possessions may exceed these limits. Adding endorsements or riders to your policy can provide specialized protection for these items, ensuring they are adequately covered.

Can I customize my renter's insurance policy to fit my specific needs?

+Yes, renter's insurance policies can be customized to fit your unique circumstances. You can choose coverage limits, deductibles, and add-ons that align with your personal belongings' value and liability risks. By tailoring the policy, you can ensure that you have the right level of protection without paying for unnecessary coverage.

Is renter's insurance mandatory, or is it an optional coverage?

+Renter's insurance is generally optional, but it is highly recommended. While it is not legally required like homeowners insurance, having renter's insurance provides essential protection for your personal belongings and liability. It is a wise investment to safeguard yourself and your possessions in the event of unforeseen circumstances.

In conclusion, renter’s insurance is an invaluable tool for protecting individuals who rent their living spaces. By understanding the factors that influence its cost and carefully selecting coverage options, policyholders can secure affordable and comprehensive protection. With renter’s insurance, tenants can enjoy peace of mind, knowing that their personal belongings, liability, and additional living expenses are covered in the face of unexpected events. Whether it’s recovering from theft, covering medical expenses for injured guests, or providing financial assistance during temporary displacement, renter’s insurance offers a safety net that promotes financial stability and security.