General Liability Insurance Definition

General liability insurance is a fundamental component of any business's risk management strategy, providing crucial financial protection against a wide range of claims and lawsuits. In today's complex and litigious business landscape, it is essential for companies to understand the scope and benefits of this insurance coverage. This article will delve into the intricacies of general liability insurance, exploring its definition, coverage, exclusions, and the key considerations for businesses seeking to safeguard their operations and assets.

Understanding General Liability Insurance

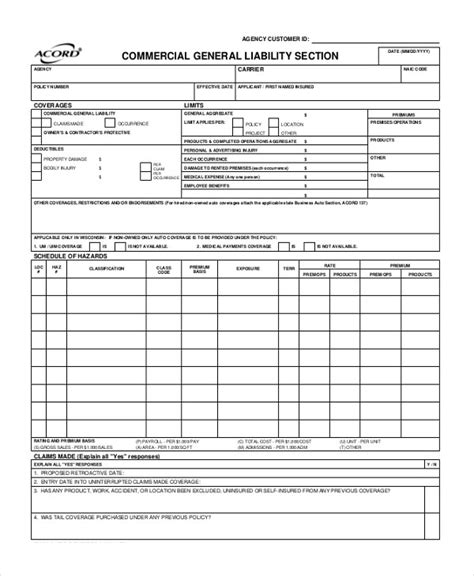

General liability insurance, often referred to as commercial general liability (CGL) insurance, is a form of liability coverage designed to protect businesses from a variety of risks. It is a cornerstone of commercial insurance, offering financial protection for claims arising from bodily injury, property damage, personal and advertising injury, and medical expenses. This type of insurance serves as a critical safety net for businesses, helping them manage the financial repercussions of unexpected events and legal actions.

Key Components of General Liability Insurance

Bodily Injury and Property Damage Coverage

One of the primary purposes of general liability insurance is to cover claims arising from bodily injury or property damage caused by a business’s operations. This includes accidents on the business premises, product defects, or even injuries caused by the business’s employees while performing their duties. For instance, if a customer slips and falls in a store, the business’s general liability insurance would typically cover the resulting medical expenses and potential legal costs.

| Coverage Type | Description |

|---|---|

| Bodily Injury | Covers medical expenses and legal fees related to injuries caused by the business. |

| Property Damage | Pays for repairs or replacements if the business's operations damage someone else's property. |

Personal and Advertising Injury Coverage

General liability insurance also extends to claims involving personal injury, such as libel, slander, false arrest, or malicious prosecution. Additionally, it covers advertising injuries, which include issues like copyright infringement, trademark violations, or even invasion of privacy through advertising materials. This aspect of coverage is particularly relevant for businesses engaged in marketing and advertising activities.

Medical Payments Coverage

A unique feature of general liability insurance is its provision for medical payments coverage. This coverage provides immediate medical expense payments for injuries sustained on the business’s premises, regardless of fault. It serves as a quick and efficient way to address medical needs without the need for a formal claim or lawsuit.

Exclusions and Limitations

While general liability insurance offers comprehensive coverage, it is not an all-encompassing solution. There are specific exclusions and limitations that businesses should be aware of. These may include intentional acts, contractual liabilities, employee injuries (which are typically covered by workers’ compensation insurance), pollution, and professional services.

Intentional Acts and Contractual Liabilities

General liability insurance does not cover intentional acts or damages arising from contracts. For instance, if a business intentionally causes harm to another party, the insurance will not provide coverage. Similarly, contractual obligations and liabilities are generally not covered, as these are considered business risks that should be managed through proper contract negotiation and risk assessment.

Employee Injuries and Pollution

General liability insurance typically excludes employee injuries, as these are addressed by workers’ compensation insurance. Additionally, pollution-related incidents are often excluded, especially if the business is involved in activities that could potentially lead to environmental damage. Separate pollution liability insurance is available for such scenarios.

Professional Services

General liability insurance is designed for bodily injury, property damage, and personal injury claims, but it does not cover professional services. Professional liability, also known as errors and omissions (E&O) insurance, is a separate type of coverage specifically tailored for businesses offering professional services. This includes industries such as law, accounting, consulting, and healthcare, where the focus is on providing expertise and advice rather than physical products or services.

Key Considerations for Businesses

Assessing Risk Profile

When evaluating the need for general liability insurance, businesses should conduct a thorough risk assessment. This involves identifying potential hazards and vulnerabilities specific to their industry and operations. For instance, a manufacturing company may face higher risks of property damage or bodily injury compared to a consulting firm. By understanding their unique risk profile, businesses can make informed decisions about the level of coverage required.

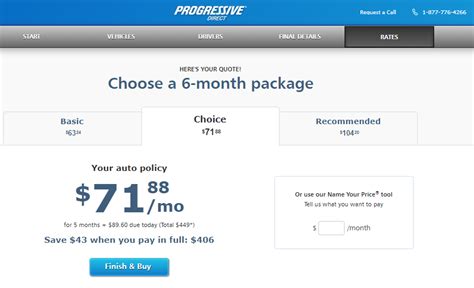

Policy Limits and Deductibles

General liability insurance policies come with various limits and deductibles. The policy limit represents the maximum amount the insurer will pay for covered claims, while the deductible is the portion of the claim that the insured business must pay out of pocket. Businesses should carefully consider these factors, ensuring that their policy limits are sufficient to cover potential claims and that the deductibles are manageable given their financial capacity.

Additional Coverage Options

General liability insurance can often be customized with additional endorsements or riders to meet specific business needs. These endorsements can provide extended coverage for unique risks or situations. For example, a business operating in a high-risk environment may choose to add an endorsement for increased limits or coverage for specific types of claims. Consulting with an insurance professional can help businesses tailor their coverage to their unique circumstances.

Claim Management and Prevention

Effective claim management is crucial for businesses with general liability insurance. This involves prompt reporting of incidents and working closely with the insurer to navigate the claims process. Additionally, businesses should focus on claim prevention by implementing safety measures, employee training, and risk mitigation strategies. By reducing the likelihood of claims, businesses can not only save on insurance premiums but also protect their reputation and operational continuity.

Regular Policy Review and Updates

As businesses grow and evolve, their risk profile may change. It is essential to periodically review and update general liability insurance policies to ensure they remain aligned with the business’s current needs and operations. This includes considering changes in the business’s size, scope, or industry regulations. Regular policy reviews help businesses maintain adequate coverage and avoid gaps that could leave them vulnerable to unforeseen risks.

Conclusion

General liability insurance is a vital component of a comprehensive risk management strategy for businesses. By understanding the scope of coverage, exclusions, and key considerations, businesses can make informed decisions to protect their operations and assets. With the right coverage in place, businesses can navigate the complexities of the modern business landscape with greater confidence and peace of mind.

What is the difference between general liability insurance and professional liability insurance?

+

General liability insurance covers bodily injury, property damage, and personal injury claims, while professional liability insurance, also known as errors and omissions (E&O) insurance, is specifically designed for businesses offering professional services. Professional liability insurance provides coverage for mistakes or negligence in the delivery of professional services, which general liability insurance typically does not cover.

How does general liability insurance help with medical expenses?

+

General liability insurance includes medical payments coverage, which provides immediate medical expense payments for injuries sustained on the business’s premises, regardless of fault. This coverage helps businesses address medical needs promptly without the need for a formal claim or lawsuit.

What are some common exclusions in general liability insurance policies?

+

Common exclusions in general liability insurance policies include intentional acts, contractual liabilities, employee injuries (covered by workers’ compensation), pollution, and professional services. These exclusions are designed to manage specific risks that are not typically covered by general liability insurance.