Car Insurance Progressive Quote

Car insurance is a crucial aspect of vehicle ownership, providing financial protection and peace of mind for drivers across the globe. In the United States, Progressive Insurance is a prominent player in the auto insurance market, offering a range of policies and coverage options to suit various needs. Obtaining a Progressive car insurance quote is an essential step for many individuals seeking affordable and comprehensive coverage. This article will delve into the world of Progressive car insurance, exploring the factors that influence quotes, the benefits of choosing Progressive, and the steps involved in securing a quote tailored to your specific requirements.

Understanding Progressive Car Insurance Quotes

Progressive Insurance, a trusted name in the industry, is renowned for its innovative approach to car insurance. The company’s commitment to providing transparent and competitive quotes has made it a preferred choice for millions of drivers. Progressive’s quote process is designed to be straightforward and customized, taking into account various factors that impact the cost of car insurance.

Factors Affecting Progressive Quotes

Several elements come into play when Progressive calculates car insurance quotes. These factors are crucial in determining the level of risk associated with insuring a particular vehicle and driver. Here’s a closer look at some of the key considerations:

- Vehicle Type and Usage: The make, model, and year of your car significantly influence your insurance quote. Additionally, the purpose for which you use your vehicle, whether for daily commuting, business, or pleasure, can impact your rates.

- Driver Profile: Your driving history, including any previous accidents or violations, plays a pivotal role in quote calculations. Progressive takes into account your age, gender, and driving experience to assess your risk profile.

- Coverage Preferences: The level of coverage you opt for directly affects your quote. Progressive offers a range of coverage options, from liability-only policies to comprehensive plans with added benefits. Choosing the right coverage is essential to ensure you’re adequately protected.

- Location and Mileage: Where you live and the number of miles you drive annually can impact your insurance rates. Progressive considers regional factors, such as traffic density and crime rates, when determining quotes.

- Discount Opportunities: Progressive provides various discounts to make car insurance more affordable. These discounts may be based on factors like safe driving habits, vehicle safety features, multiple-policy holdings, or even your profession.

By understanding these factors, you can better prepare for the quote process and potentially identify areas where you can save on your car insurance costs.

Benefits of Choosing Progressive Car Insurance

Progressive Insurance offers a multitude of advantages that make it an attractive choice for car insurance coverage:

- Customized Coverage: Progressive allows you to tailor your insurance policy to your specific needs. Whether you require basic liability coverage or comprehensive protection, Progressive provides flexible options to meet your requirements.

- Discounts and Savings: The company is well-known for its commitment to offering discounts. From multi-policy discounts to safe driver rewards, Progressive helps customers save on their insurance premiums.

- 24⁄7 Customer Support: Progressive understands the importance of prompt assistance. Their dedicated customer support team is available around the clock to address any queries or concerns you may have.

- Innovative Features: Progressive stays ahead of the curve with innovative features like Snapshot®, which uses telematics to monitor your driving behavior and potentially lower your rates based on safe driving habits.

- Claims Handling: Progressive’s claims process is designed for efficiency and customer satisfaction. They offer multiple channels for filing claims, including online, over the phone, or through their mobile app, ensuring a smooth and stress-free experience.

Obtaining a Progressive Car Insurance Quote

Securing a Progressive car insurance quote is a straightforward process, and it can be completed in a few simple steps:

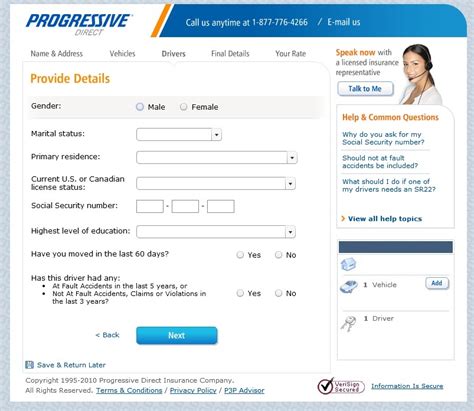

- Gather Information: Before you begin, ensure you have all the necessary details handy. This includes your vehicle’s make, model, and year, as well as your personal information, such as your driving history and any existing insurance details.

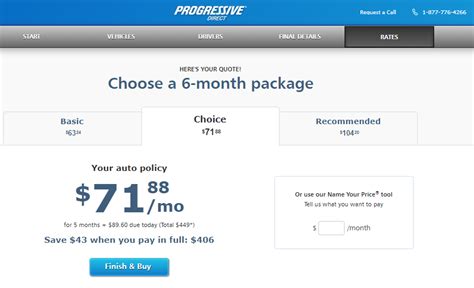

- Choose Your Coverage: Decide on the type and level of coverage you desire. Progressive offers various coverage options, so take the time to understand each and choose the one that aligns with your needs.

- Provide Vehicle and Driver Details: Share your vehicle’s specifications and your personal information accurately. This ensures that Progressive can provide an accurate quote based on your specific circumstances.

- Review and Compare Quotes: Progressive will present you with a personalized quote. Take the time to review it thoroughly and compare it with other quotes you may have obtained. Consider the coverage, premiums, and any additional benefits offered.

- Choose Your Preferred Option: Once you’ve compared quotes and found the one that best suits your needs and budget, you can proceed with purchasing your Progressive car insurance policy.

Remember, obtaining multiple quotes is essential to ensure you're getting the best deal. Progressive's quote process is designed to be transparent and efficient, making it a hassle-free experience for prospective customers.

Tips for Getting the Best Progressive Quote

To optimize your Progressive car insurance quote, consider the following tips:

- Bundle Your Policies: If you have multiple insurance needs, such as home or renters insurance, bundling them with your car insurance can lead to significant savings.

- Explore Discounts: Take advantage of Progressive’s various discount programs. From safe driver discounts to multi-policy savings, there are numerous ways to reduce your insurance costs.

- Improve Your Driving Habits: Progressive’s Snapshot® program rewards safe driving. By adopting safer driving practices, you may qualify for lower rates based on your improved driving behavior.

- Consider Higher Deductibles: Opting for a higher deductible can lower your insurance premiums. However, ensure you can afford the deductible in the event of a claim.

- Compare Quotes Regularly: Insurance rates can change over time, so it’s beneficial to compare quotes periodically. This ensures you’re always getting the best deal and aren’t missing out on potential savings.

Progressive Car Insurance: A Comprehensive Solution

Progressive Insurance has established itself as a leading provider of car insurance, offering a comprehensive range of coverage options and benefits. By understanding the factors that influence Progressive quotes and taking advantage of the company’s innovative features and discounts, you can secure a policy that provides the protection you need at a competitive price.

Remember, car insurance is an essential investment to protect your vehicle and your finances. Progressive's commitment to customer satisfaction and its flexible approach to coverage make it a top choice for drivers seeking affordable and reliable insurance solutions.

Conclusion: Progressive’s Impact on the Insurance Landscape

Progressive Insurance’s influence on the car insurance market cannot be overstated. With its customer-centric approach, innovative technologies, and commitment to providing competitive quotes, Progressive has set a new standard for the industry. By offering tailored coverage, exceptional customer support, and opportunities for savings, Progressive continues to be a preferred choice for drivers seeking comprehensive and affordable car insurance.

As you embark on your journey towards securing car insurance, consider Progressive's quote process as a reliable and efficient way to find the coverage that suits your needs. With its focus on transparency and customization, Progressive ensures that you receive a quote that reflects your unique circumstances and provides the protection you deserve.

How often should I compare car insurance quotes?

+It is recommended to compare car insurance quotes annually or whenever your circumstances change significantly, such as a move to a new location, a change in marital status, or the addition of a new vehicle to your household.

What is the Snapshot® program, and how can it benefit me?

+Snapshot® is Progressive’s telematics program that monitors your driving behavior. By enrolling in Snapshot®, you can potentially lower your insurance rates by demonstrating safe driving habits. It provides a personalized assessment of your driving risks and rewards you for safe practices.

Are there any hidden fees or charges associated with Progressive car insurance quotes?

+Progressive is transparent about its pricing and does not typically charge hidden fees. However, it’s important to review the policy details and any applicable fees or surcharges before purchasing a policy. Progressive provides clear information about potential additional charges to ensure there are no surprises.