New Business Insurance

The Comprehensive Guide to Navigating New Business Insurance: A Step-by-Step Roadmap

Starting a new business is an exciting venture, filled with opportunities and challenges. One crucial aspect that often gets overlooked in the early stages is insurance coverage. Protecting your business from potential risks and liabilities is essential, and understanding the world of business insurance is key to ensuring a stable and secure future for your venture. This comprehensive guide will walk you through the intricacies of new business insurance, offering expert insights and a practical roadmap to help you navigate this critical aspect of entrepreneurship.

Understanding the Fundamentals of Business Insurance

Business insurance, often referred to as commercial insurance, is a broad term encompassing various types of coverage designed to protect businesses against financial loss due to unforeseen events. These events can range from property damage to legal liabilities, and the consequences can be devastating for a new business without adequate protection.

The primary goal of business insurance is to provide financial security and risk management for your company. It ensures that in the event of a covered loss, you have the necessary resources to recover and continue operating. This is particularly crucial for startups and small businesses, where a single incident could potentially derail your operations.

Let's delve into some of the fundamental types of business insurance and their significance:

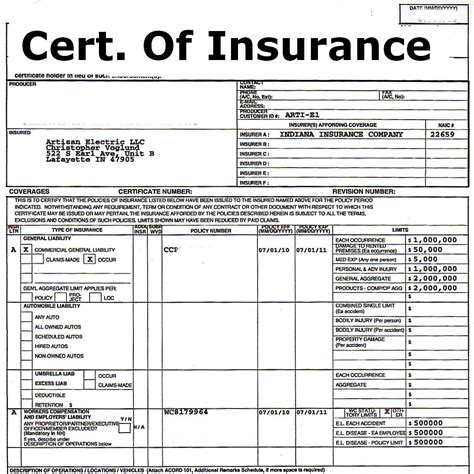

1. General Liability Insurance

General liability insurance is a cornerstone of business protection. It covers a wide range of claims, including bodily injury, property damage, and personal and advertising injury. For instance, if a customer slips and falls in your office, this policy would cover the medical costs and any legal fees if they decide to sue.

| Category | Coverage |

|---|---|

| Bodily Injury | Medical expenses, pain and suffering, lost wages |

| Property Damage | Repair or replacement costs for damaged property |

| Personal & Advertising Injury | Coverage for libel, slander, copyright infringement, and other similar offenses |

2. Property Insurance

Property insurance is vital for businesses that own or lease physical assets. It covers the loss or damage of these assets due to various perils, including fire, storms, vandalism, and theft. For example, if your office building is damaged in a fire, property insurance would cover the cost of repairs or even the rebuilding of the structure.

3. Professional Liability Insurance (Errors & Omissions)

Professional liability insurance, also known as Errors and Omissions (E&O) insurance, is designed to protect professionals against claims of negligence or inadequate work. This is particularly important for businesses in the service industry, such as consultants, accountants, and marketing agencies. If a client sues your business for a mistake made in delivering a service, this policy would cover the legal costs and any damages awarded.

4. Business Interruption Insurance

Business interruption insurance provides coverage for lost income and ongoing expenses when your business is forced to shut down due to a covered event. This could be due to a fire, a natural disaster, or even a government-mandated shutdown. It ensures that your business can continue to pay its bills and maintain some level of income until operations can resume.

5. Workers’ Compensation Insurance

Workers’ compensation insurance is a legal requirement in most states. It provides coverage for employees who are injured or become ill due to their work. This insurance covers medical expenses, a portion of lost wages, and rehabilitation costs. It also protects your business from lawsuits filed by injured employees.

Assessing Your Business’s Insurance Needs

Determining the right insurance coverage for your business involves a thorough assessment of your unique risks and liabilities. Here are some key steps to help you evaluate your needs:

1. Identify Potential Risks

Start by conducting a risk assessment. Consider the various aspects of your business, including your physical location, the nature of your work, your employees, and your customers. Identify potential hazards and the likelihood of incidents occurring. For instance, if your business involves heavy machinery, you’ll want to ensure you have adequate coverage for potential accidents.

2. Review Legal Requirements

Understand the legal requirements for insurance in your industry and location. Some industries, such as construction or healthcare, have specific insurance mandates. Additionally, certain types of insurance, like workers’ compensation, are often required by law.

3. Analyze Your Business Structure

The structure of your business can impact your insurance needs. Sole proprietorships and partnerships often have different insurance considerations compared to corporations or limited liability companies (LLCs). For example, LLCs typically offer more personal liability protection, which can impact the types of insurance you require.

4. Evaluate Your Financial Capacity

Consider your business’s financial capacity to handle potential risks. Determine the level of insurance coverage you can afford and the potential financial impact of various scenarios. This will help you strike a balance between comprehensive coverage and affordability.

Securing the Right Insurance Coverage

Once you’ve assessed your insurance needs, it’s time to secure the right coverage. Here’s a step-by-step guide to help you through the process:

1. Research Insurance Providers

Start by researching reputable insurance providers. Look for companies with a solid financial rating and a history of prompt claim payments. Online reviews and industry recommendations can be valuable resources in this stage.

2. Obtain Quotes

Contact several insurance providers to obtain quotes. Be prepared to provide detailed information about your business, including your industry, revenue, number of employees, and any specific risks or concerns. Compare these quotes based on coverage, exclusions, and premiums to find the best fit for your business.

3. Review Policy Details

When you’ve narrowed down your options, carefully review the policy details. Understand the coverage limits, deductibles, and any exclusions. Ensure that the policy aligns with your identified risks and provides the necessary protection. Don’t hesitate to seek clarification on any confusing terms or conditions.

4. Negotiate and Customize

Insurance policies are often customizable. Work with your insurance provider to tailor the policy to your specific needs. This might involve adjusting coverage limits, adding endorsements for specific risks, or bundling multiple policies for a discounted rate. Negotiate to ensure you’re getting the best value for your business.

5. Purchase and Maintain Coverage

Once you’ve selected a policy, purchase it and ensure that your coverage is in place before your business begins operations. Regularly review and update your insurance as your business grows and changes. This includes keeping your insurance provider informed of any significant changes to your business, such as an increase in employees or a new location.

The Importance of Regular Insurance Reviews

Business insurance is not a one-time transaction. It’s an ongoing process that requires regular reviews and adjustments. Here’s why continuous insurance evaluation is crucial:

1. Changing Business Landscape

Your business is likely to evolve over time. You might expand your operations, add new services, or enter new markets. These changes can introduce new risks and alter your insurance needs. Regular reviews ensure that your coverage remains relevant and comprehensive.

2. Market Fluctuations

The insurance market is dynamic, with premiums and coverage options changing frequently. By regularly reviewing your insurance, you can take advantage of new opportunities, such as better rates or enhanced coverage options, and ensure you’re not overpaying for outdated policies.

3. Legal and Regulatory Changes

Insurance regulations and legal requirements can change. Staying up-to-date with these changes ensures you remain compliant and have the necessary coverage to protect your business.

Conclusion: Navigating the Insurance Landscape with Confidence

Understanding and securing the right insurance coverage is a critical aspect of starting and growing a successful business. By conducting a thorough risk assessment, researching providers, and regularly reviewing your policies, you can ensure that your business is protected against a wide range of potential risks. Remember, insurance is an investment in your business’s future, providing the stability and security needed to thrive in an unpredictable business environment.

What are the most common types of business insurance, and how do they differ?

+

The most common types of business insurance include General Liability, Property, Professional Liability (E&O), Business Interruption, and Workers’ Compensation. Each type offers unique coverage: General Liability protects against bodily injury, property damage, and personal injury; Property Insurance covers physical assets; Professional Liability insures against negligent work; Business Interruption provides financial coverage during business shutdowns; and Workers’ Compensation covers employee injuries and illnesses.

How do I determine the right amount of insurance coverage for my business?

+

Determining the right coverage involves assessing your business’s risks and financial capacity. Consider the potential costs of various incidents and ensure your coverage limits are sufficient to cover these expenses. Work with an insurance professional to tailor your policy to your specific needs.

Are there any legal requirements for business insurance, and what are they?

+

Yes, there are legal requirements for business insurance. Workers’ Compensation insurance is often a legal mandate, and certain industries like construction may have specific insurance requirements. It’s crucial to understand these mandates to ensure compliance and protect your business.

How often should I review my business insurance policies?

+

Business insurance policies should be reviewed annually or whenever there are significant changes to your business, such as expansion, new locations, or increased revenue. Regular reviews ensure your coverage remains relevant and up-to-date with your evolving business needs.

What should I do if I’m unsure about my business insurance needs?

+

If you’re unsure about your business insurance needs, it’s recommended to consult with an insurance professional. They can help you conduct a risk assessment, understand your coverage options, and tailor a policy that aligns with your business’s unique risks and requirements.