E Renters Renters Insurance

Welcome to this comprehensive guide on renters insurance, a topic that often gets overlooked yet is crucial for those living in rental properties. Renters insurance is an essential aspect of financial planning and risk management, offering protection and peace of mind to individuals and families residing in rented spaces. This article aims to provide an in-depth analysis of renters insurance, covering everything from the fundamentals to advanced topics, and shedding light on why it is an indispensable tool for anyone living away from home.

Understanding Renters Insurance: A Necessary Safety Net

Renters insurance, also known as tenants insurance, is a form of property insurance designed specifically for individuals who rent their living space. Unlike homeowners insurance, which covers the structure of a home and its contents, renters insurance focuses primarily on the personal belongings and liabilities of the policyholder within their rental unit. This type of insurance acts as a financial safety net, providing coverage for losses that may occur due to unforeseen events, such as theft, fire, or water damage.

One of the primary benefits of renters insurance is its ability to protect your personal property. In the event of a covered loss, your insurance policy can reimburse you for the cost of replacing your belongings, which can be a significant financial relief. Additionally, renters insurance often includes liability coverage, which can protect you if someone is injured on your rental property and decides to sue you.

Key Components of Renters Insurance Policies

Renters insurance policies typically consist of several key components, each offering distinct coverage and benefits. These include:

- Personal Property Coverage: This is the cornerstone of renters insurance, providing financial protection for your belongings in the event of theft, fire, or other covered perils. It can help replace items like furniture, electronics, clothing, and more.

- Liability Coverage: This aspect of renters insurance protects you from legal expenses and settlements if you’re found liable for an accident or injury that occurs on your rental property. It’s an essential safeguard against potential lawsuits.

- Additional Living Expenses: In the event your rental home becomes uninhabitable due to a covered loss, this coverage can reimburse you for additional living expenses, such as hotel stays or temporary rental costs, until you can return to your home.

- Medical Payments to Others: This coverage pays for the medical expenses of others who are injured on your rental property, regardless of fault. It can help cover costs like doctor visits, hospital stays, and medications.

- Loss of Use: Similar to additional living expenses, this coverage reimburses you for the necessary increase in living expenses if you have to move out of your rental due to a covered loss.

It's important to note that renters insurance typically doesn't cover certain types of losses, such as those caused by floods, earthquakes, or poor maintenance. It's crucial to carefully review your policy and understand what is and isn't covered to ensure you have the protection you need.

Why Renters Insurance is a Smart Investment

Renters insurance is often seen as an unnecessary expense, especially for those on a tight budget. However, it’s important to consider the potential costs of not having this coverage. A single incident, such as a fire or a break-in, could result in the loss of thousands of dollars worth of personal belongings. Without insurance, you would be responsible for replacing these items out of pocket, which can be financially devastating.

Moreover, renters insurance provides crucial liability protection. If someone is injured on your rental property and decides to sue you, the financial consequences can be severe. Renters insurance can help cover the cost of legal defense and any settlements or judgments against you, up to the limits of your policy.

The Financial Benefits of Renters Insurance

From a financial perspective, renters insurance offers several advantages. Firstly, it provides peace of mind, knowing that your personal belongings and liabilities are protected. Secondly, it can help you avoid large out-of-pocket expenses in the event of a covered loss. And finally, renters insurance is often surprisingly affordable, with policies typically costing less than $20 per month.

| Average Cost of Renters Insurance | $15 - $30 per month |

|---|---|

| Coverage Limits | $10,000 - $50,000 |

| Liability Limits | $100,000 - $300,000 |

The table above provides a general idea of the cost and coverage limits of renters insurance policies. However, it's important to note that these figures can vary depending on several factors, including the location of your rental property, the value of your personal belongings, and the level of liability coverage you choose.

Choosing the Right Renters Insurance Policy

Selecting the right renters insurance policy involves careful consideration of your specific needs and circumstances. Here are some key factors to keep in mind:

- Coverage Limits: Ensure that your policy provides adequate coverage for the value of your personal belongings. You may need to conduct a home inventory to accurately assess the total value of your possessions.

- Liability Coverage: Consider your potential exposure to liability risks. If you frequently host guests or have valuable possessions that could attract thieves, you may want to opt for higher liability limits.

- Additional Coverages: Depending on your needs, you may want to add optional coverages, such as personal injury protection, identity theft coverage, or coverage for high-value items like jewelry or electronics.

- Deductibles: Choose a deductible that aligns with your financial comfort level. A higher deductible can lower your premium, but it means you’ll have to pay more out of pocket in the event of a claim.

Working with an Insurance Agent

Navigating the world of renters insurance can be complex, especially if you’re not familiar with insurance terminology and concepts. Working with an experienced insurance agent can be immensely beneficial. They can help you understand the intricacies of different policies, guide you in selecting the right coverage limits, and answer any questions you may have.

Additionally, an insurance agent can often help you bundle your renters insurance with other policies, such as auto insurance, which can lead to significant savings. They can also provide valuable advice on how to file a claim and what to expect during the claims process.

Filing a Claim with Your Renters Insurance

In the unfortunate event that you need to file a claim with your renters insurance, it’s important to understand the process and your responsibilities. Here’s a step-by-step guide:

- Contact Your Insurance Company: Reach out to your insurance provider as soon as possible after the incident. Most policies require that you report a claim within a certain timeframe, typically 24-48 hours.

- Provide Details: Be prepared to provide detailed information about the incident, including the date, time, and nature of the loss. You may also need to provide documentation, such as police reports or photos of the damage.

- Cooperate with the Claims Adjuster: Your insurance company will assign a claims adjuster to investigate your claim. Cooperate fully with the adjuster, providing any additional information or documentation they request.

- Understand Your Coverage: Review your policy to understand what is and isn’t covered. This can help you manage your expectations and ensure you receive the full benefits of your policy.

- Keep Records: Maintain records of all communications with your insurance company, including dates, times, and the names of the individuals you speak with. Also, keep records of any expenses related to the claim, such as temporary housing costs.

Tips for a Smooth Claims Process

To ensure a smooth and efficient claims process, consider the following tips:

- Take photos or videos of the damage as soon as possible after the incident.

- Keep receipts for any expenses related to the claim, such as temporary housing or repair costs.

- If your belongings are damaged, consider getting quotes for repairs or replacements to help with the claims process.

- Keep a detailed inventory of your personal belongings, including purchase receipts or appraisals, to support your claim.

Common Misconceptions about Renters Insurance

There are several common misconceptions about renters insurance that can lead to confusion and even deter people from purchasing this important coverage. Let’s debunk some of these myths:

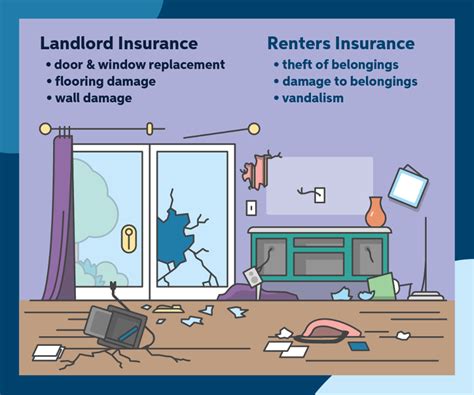

- Myth: Renters Insurance is Unnecessary: Many renters believe that their landlord’s insurance policy will cover their belongings in case of a loss. However, this is often not the case. Landlord insurance typically only covers the structure of the building and does not extend to personal belongings.

- Myth: Renters Insurance is Too Expensive: While it’s true that insurance policies can vary in cost, renters insurance is often surprisingly affordable. The average monthly premium for renters insurance is less than $20, which is a small price to pay for the financial protection it provides.

- Myth: Renters Insurance Only Covers Theft and Fire: While theft and fire are common perils covered by renters insurance, they are not the only ones. Renters insurance can also provide coverage for water damage, vandalism, and even liability if someone is injured on your rental property.

Setting the Record Straight

It’s important to separate fact from fiction when it comes to renters insurance. By understanding the true nature and benefits of this coverage, you can make an informed decision about whether it’s right for you. Remember, renters insurance is not just a financial safeguard; it’s also a way to protect your peace of mind and ensure that you’re prepared for the unexpected.

Conclusion

Renters insurance is an essential component of financial planning for anyone living in a rental property. It provides crucial protection for your personal belongings and liabilities, offering peace of mind and financial security in the event of an unexpected loss. By understanding the key components of renters insurance policies, the benefits they provide, and how to choose the right coverage, you can make an informed decision about your insurance needs.

Remember, the cost of renters insurance is often minimal compared to the potential financial losses you could face without it. So, if you're a renter, don't hesitate to explore your insurance options and ensure you have the coverage you need to protect your home and your belongings.

What does renters insurance typically cover?

+Renters insurance typically covers personal property (like furniture, electronics, and clothing) in case of theft, fire, or other covered perils. It also provides liability coverage if someone is injured on your rental property and decides to sue you. Additionally, it may cover additional living expenses if your rental home becomes uninhabitable due to a covered loss.

Is renters insurance really necessary?

+Yes, renters insurance is highly recommended for anyone living in a rental property. It provides crucial protection for your personal belongings and liabilities, which your landlord’s insurance does not cover. Without renters insurance, you would be financially responsible for replacing your belongings or covering legal expenses if someone is injured on your rental property.

How much does renters insurance cost?

+The cost of renters insurance can vary depending on several factors, including the location of your rental property, the value of your personal belongings, and the level of liability coverage you choose. However, renters insurance is often surprisingly affordable, with policies typically costing less than $20 per month.

How do I choose the right renters insurance policy?

+When selecting a renters insurance policy, consider your specific needs and circumstances. Ensure that your policy provides adequate coverage for the value of your personal belongings and choose liability limits that align with your potential exposure to risk. You may also want to consider adding optional coverages for high-value items or identity theft protection.

What should I do if I need to file a claim with my renters insurance?

+If you need to file a claim with your renters insurance, contact your insurance company as soon as possible after the incident. Provide detailed information about the loss, cooperate fully with the claims adjuster, and review your policy to understand your coverage. Keep records of all communications and expenses related to the claim.