Does Home Insurance Cover Water Damage

Water damage is a common concern for homeowners, and it's essential to understand what is and isn't covered by your home insurance policy. While water damage can stem from various sources, from natural disasters like floods to everyday accidents like pipe bursts, the coverage can vary significantly. This article aims to provide a comprehensive overview of water damage coverage in home insurance policies, shedding light on the factors that influence coverage and offering practical advice to homeowners.

Understanding Water Damage Coverage in Home Insurance

Home insurance policies are designed to protect homeowners against a range of risks, including water damage. However, it’s crucial to recognize that not all water damage is created equal, and the specific circumstances of the damage play a pivotal role in determining coverage.

Generally, home insurance policies can be categorized into two types: open perils and named perils policies. Open perils policies, often referred to as all-risk policies, provide coverage for all types of damage except those specifically excluded. On the other hand, named perils policies cover only the specific risks outlined in the policy, leaving other potential damages uninsured.

Common Sources of Water Damage

Water damage can arise from various sources, and understanding these sources is key to grasping the complexities of home insurance coverage.

- Floods and Natural Disasters: Floods, often caused by heavy rainfall, overflowing rivers, or coastal storms, can result in significant water damage to homes. While flood damage is typically excluded from standard home insurance policies, it can be covered by separate flood insurance policies.

- Pipe Bursts and Plumbing Issues: Unexpected pipe bursts or leaks from plumbing systems can lead to water damage inside the home. These incidents are often covered by home insurance policies, provided they are sudden and accidental, and the policyholder takes reasonable steps to mitigate the damage.

- Roof Leaks: Leaks from the roof, whether due to weather damage, aging, or installation issues, can cause water damage to the interior of the home. Roof leaks are typically covered by home insurance policies, as they are considered an unexpected event.

- Appliance Failures: Malfunctions or breakdowns of household appliances, such as washing machines or dishwashers, can lead to water damage. The coverage for such incidents depends on the specific policy and the circumstances of the failure.

- Sewer Backup: Blockages or failures in the sewer system can cause water to back up into the home, leading to extensive damage. Sewer backup coverage is often an optional add-on to home insurance policies and is not automatically included.

Factors Influencing Water Damage Coverage

The coverage for water damage in home insurance policies can be influenced by several factors, including the type of policy, the cause of the damage, and the location of the property.

- Policy Type: As mentioned earlier, the distinction between open perils and named perils policies is crucial. Open perils policies provide broader coverage, while named perils policies may exclude certain types of water damage.

- Cause of Damage: Home insurance policies often differentiate between sudden and accidental damage and gradual or chronic issues. Sudden and accidental water damage, such as a pipe burst, is typically covered, while gradual damage, like a slow leak over an extended period, may be excluded.

- Location and Risk Factors: The location of the property can impact water damage coverage. For instance, homes in high-risk flood zones may face challenges in obtaining flood insurance coverage or may be subject to higher premiums. Similarly, homes in areas prone to severe weather events may face stricter coverage limits or exclusions.

What is Typically Covered by Home Insurance for Water Damage

While the specifics can vary based on the policy and the circumstances, home insurance policies generally cover the following types of water damage:

- Sudden and Accidental Water Damage: This includes damage caused by unexpected events like pipe bursts, appliance failures, or roof leaks. Home insurance policies typically cover the cost of repairs and the replacement of damaged property.

- Water Damage from Storms and Wind: Damage resulting from storms, including heavy rainfall, high winds, or hurricanes, is often covered by home insurance policies. This can include damage to the exterior of the home, such as roof damage, as well as interior damage caused by water intrusion.

- Damage from Frozen Pipes: If water pipes freeze and burst due to extremely cold temperatures, the resulting damage is usually covered by home insurance. However, it's important to note that neglect or inadequate maintenance may void this coverage.

- Damage from Firefighting Efforts: Water damage caused by firefighting efforts to extinguish a fire on the insured property is typically covered by home insurance. This includes damage to both the structure and personal belongings.

What is Typically Not Covered by Home Insurance for Water Damage

While home insurance provides valuable protection against water damage, there are certain types of water-related incidents that are typically excluded from coverage. Understanding these exclusions is crucial to managing expectations and ensuring adequate coverage.

- Flood Damage: Flood damage, as defined by the National Flood Insurance Program (NFIP), is often excluded from standard home insurance policies. Floods are considered a high-risk event, and separate flood insurance policies are required to obtain coverage for this type of damage.

- Sewer Backup and Drainage Issues: Damage caused by sewer backups or drainage problems is typically not covered by standard home insurance policies. However, homeowners can often purchase optional sewer backup coverage as an add-on to their policy.

- Gradual Water Damage: Damage resulting from gradual leaks or seepage over an extended period is often excluded from home insurance coverage. This can include issues like slow roof leaks, foundation cracks allowing water intrusion, or plumbing issues that develop over time.

- Neglect and Maintenance Issues: Home insurance policies may exclude coverage for water damage if it is determined that the policyholder failed to maintain the property adequately. For example, if a pipe bursts due to frozen water because the homeowner neglected to properly winterize the home, coverage may be denied.

- Earth Movement and Landslides: Water damage resulting from earth movement, such as landslides or mudslides, is typically excluded from home insurance policies. These events are considered ground-related rather than water-related and are often covered by separate earth movement policies.

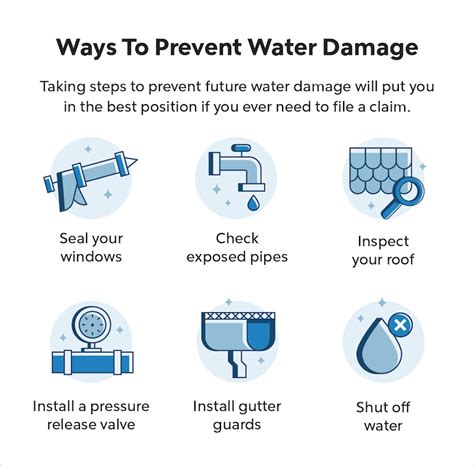

Tips for Maximizing Water Damage Coverage

To ensure that you have adequate coverage for water damage, here are some practical tips for homeowners:

- Review Your Policy: Take the time to carefully review your home insurance policy, including the exclusions and limitations. Understand what types of water damage are covered and what additional coverage options are available.

- Consider Flood Insurance: If your home is located in a high-risk flood zone, seriously consider purchasing flood insurance. Even if you're not in a high-risk area, flood insurance can provide valuable protection against unexpected flooding events.

- Evaluate Optional Coverages: Many home insurance policies offer optional coverages, such as sewer backup or water backup coverage. Evaluate your risks and consider adding these coverages to your policy if they are relevant to your situation.

- Maintain Your Property: Regular maintenance is crucial to preventing water damage. Ensure that your plumbing, roofing, and drainage systems are in good condition. Address any issues promptly to avoid potential water-related incidents.

- Document Your Belongings: Create a detailed inventory of your personal belongings, including photos and receipts. This documentation can be invaluable in the event of a water damage claim, as it provides evidence of the value of your possessions.

Filing a Water Damage Claim: A Step-by-Step Guide

In the unfortunate event of water damage to your home, knowing how to navigate the claims process can make a significant difference in the outcome. Here’s a step-by-step guide to filing a water damage claim with your home insurance provider:

- Assess the Damage: Conduct a thorough assessment of the water damage. Take photographs and videos to document the extent of the damage. Note the date and time of the incident and gather any relevant information, such as weather conditions or potential causes.

- Contact Your Insurance Provider: Reach out to your home insurance provider as soon as possible to report the claim. Provide them with the details of the incident and any supporting documentation you have gathered. Be prepared to answer questions about the damage and the circumstances leading up to it.

- Mitigate Further Damage: Take immediate steps to prevent further damage. For example, if a pipe has burst, turn off the water supply to stop the flow. If necessary, arrange for temporary repairs or services to prevent the damage from worsening.

- Prepare an Inventory: Create a detailed list of the damaged items and their estimated values. Include any receipts or appraisals you have for high-value items. This inventory will be crucial in supporting your claim and determining the compensation you receive.

- Cooperate with the Claims Adjuster: The insurance company will assign a claims adjuster to assess the damage and determine the extent of coverage. Cooperate fully with the adjuster and provide them with all the necessary information and documentation. They may schedule an inspection to evaluate the damage.

- Review the Claim Decision: Once the adjuster has completed their assessment, they will provide you with a decision on your claim. Carefully review the decision and the reasoning behind it. If you disagree with the decision or feel that your claim was undervalued, you have the right to appeal the decision or seek a second opinion.

- Seek Professional Assistance if Needed: If the water damage is extensive or if you encounter challenges with the claims process, consider seeking assistance from a public adjuster or an attorney who specializes in insurance claims. They can provide expert guidance and advocacy to ensure you receive the compensation you are entitled to.

Conclusion: Navigating the Complexities of Water Damage Coverage

Understanding the complexities of water damage coverage in home insurance policies is crucial for homeowners. By recognizing the types of water damage that are typically covered and excluded, homeowners can make informed decisions about their insurance coverage and take proactive steps to protect their properties.

While home insurance provides valuable protection against many types of water damage, it's essential to carefully review your policy and consider additional coverages where necessary. By staying informed and taking proactive measures, homeowners can effectively manage the risks associated with water damage and ensure they have the coverage they need when unexpected incidents occur.

Is flood damage ever covered by home insurance policies?

+Flood damage is typically excluded from standard home insurance policies. However, it can be covered by separate flood insurance policies, which are often available through the National Flood Insurance Program (NFIP) or private insurers. It’s important for homeowners to understand their flood risk and consider purchasing flood insurance if necessary.

Can I purchase additional coverage for sewer backup?

+Yes, many home insurance providers offer optional sewer backup coverage as an add-on to their standard policies. This coverage can provide protection against damage caused by sewer backups or drainage issues. It’s important to review the terms and conditions of the coverage and consider the potential risks in your area before purchasing this optional coverage.

What should I do if my water damage claim is denied?

+If your water damage claim is denied, it’s important to carefully review the denial letter and understand the reasons for the denial. You may have the right to appeal the decision or seek a second opinion from an independent adjuster or public adjuster. It’s also advisable to consult with an attorney who specializes in insurance claims to explore your legal options and ensure your rights are protected.