Average Cost Of Long Term Care Insurance

Long-term care insurance is an essential financial tool that provides individuals and families with peace of mind, ensuring they are prepared for the potential costs associated with extended care needs later in life. As life expectancy continues to rise, the likelihood of requiring long-term care services also increases. Understanding the average cost of long-term care insurance is crucial for making informed decisions about financial planning and securing adequate coverage.

Understanding Long-Term Care Insurance

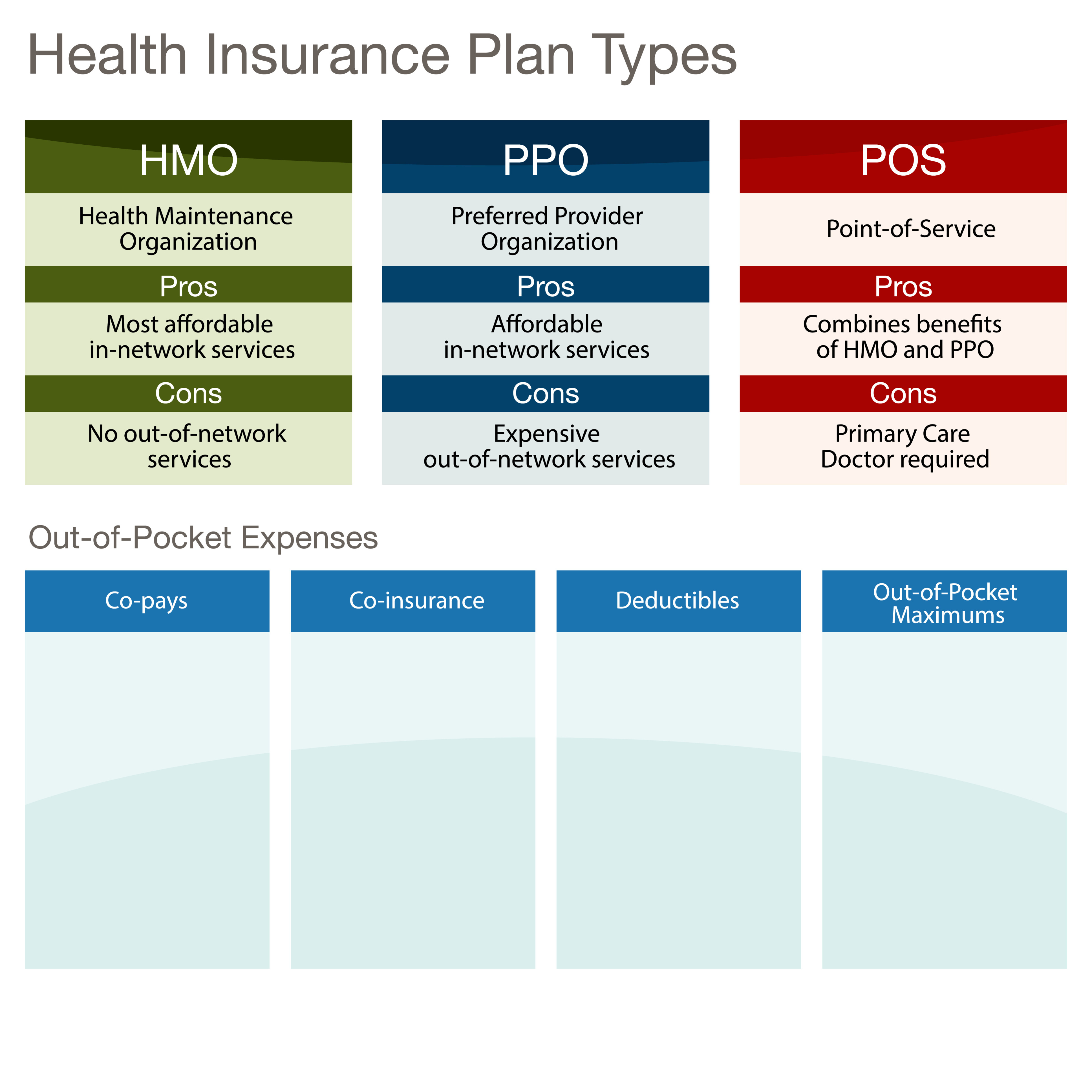

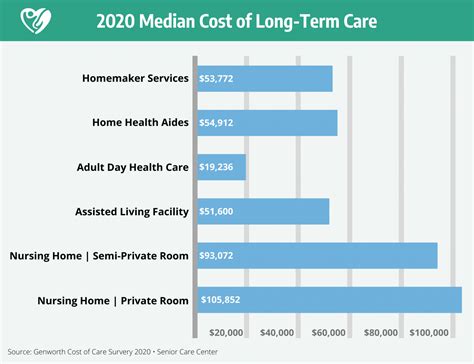

Long-term care insurance, often referred to as LTC insurance, is a specialized type of coverage designed to protect individuals from the substantial financial burden of extended care services. These services may be required due to age-related ailments, chronic illnesses, or accidents that result in the loss of functional independence. LTC insurance offers a safety net, covering a range of care options, including home healthcare, assisted living facilities, and nursing homes.

The primary goal of this insurance is to provide individuals with the financial means to access the care they need without depleting their savings or relying solely on government assistance programs. By purchasing LTC insurance, policyholders can ensure they have access to high-quality care while maintaining their preferred lifestyle and financial security.

Factors Influencing the Cost of Long-Term Care Insurance

The average cost of long-term care insurance can vary significantly based on several key factors. Understanding these variables is essential for consumers to tailor their coverage and make cost-effective choices.

Age at Purchase

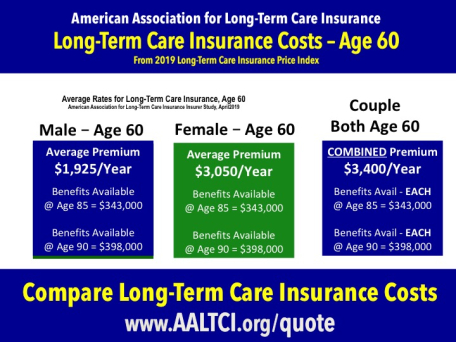

One of the most influential factors in determining the cost of LTC insurance is the age at which the policy is purchased. In general, younger individuals can expect to pay lower premiums as they are considered less risky from an insurer's perspective. The reasoning behind this is that younger policyholders are less likely to require immediate long-term care services, thus reducing the insurer's immediate financial exposure.

For instance, a 55-year-old may pay an average premium of $2,000 annually for LTC insurance, while a 65-year-old might pay closer to $3,500. The significant difference in cost highlights the importance of purchasing LTC insurance at a younger age to secure more affordable rates.

Health and Lifestyle Factors

An individual's health status and lifestyle choices can also impact the cost of LTC insurance. Insurers carefully assess health conditions and medical histories when determining premiums. Pre-existing conditions or a history of chronic illnesses may result in higher premiums or even policy exclusions.

Additionally, lifestyle factors such as smoking or engaging in high-risk activities can lead to increased costs. For example, a smoker may pay approximately 20% more for LTC insurance compared to a non-smoker of the same age and health status.

Coverage Amount and Benefits

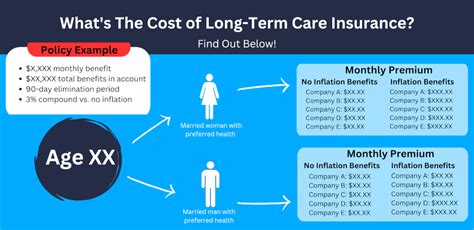

The level of coverage and the benefits included in an LTC insurance policy are major cost drivers. Policyholders can choose from a range of coverage amounts, with higher limits typically resulting in higher premiums. Similarly, policies with more comprehensive benefits, such as inflation protection or coverage for a broader range of services, will often come at a higher cost.

For instance, a basic LTC policy with a daily benefit of $150 and a 3-year benefit period may cost around $1,500 annually. In contrast, a more extensive policy with a daily benefit of $300 and a 6-year benefit period could easily exceed $3,000 per year.

Inflation Protection

Inflation protection is an optional feature in LTC insurance policies that allows benefits to increase over time to keep pace with rising healthcare costs. While this feature provides valuable peace of mind, it also contributes to higher premiums. Policies with inflation protection may cost 10-20% more than those without this feature.

Elimination Period

The elimination period, also known as the waiting period, is the length of time an insured individual must wait before their LTC insurance benefits kick in. Shorter elimination periods, which provide quicker access to benefits, typically result in higher premiums. For example, a policy with a 90-day elimination period may cost 10-15% more than a policy with a 180-day elimination period.

Discounts and Bundling

Insurance companies often offer discounts to policyholders who take proactive steps to maintain their health or bundle their LTC insurance with other types of coverage. For instance, non-smokers, individuals who maintain a healthy BMI, or those who participate in wellness programs may qualify for premium discounts.

Additionally, bundling LTC insurance with other policies, such as life insurance or annuity products, can lead to cost savings. Insurers may offer discounted rates or waive certain fees when multiple policies are purchased together.

Average Cost of Long-Term Care Insurance by Age

The average cost of LTC insurance varies significantly based on the age at which the policy is purchased. Here's a breakdown of average annual premiums for individuals purchasing LTC insurance at different ages, based on a sample policy with a daily benefit of $150 and a 3-year benefit period:

| Age | Average Annual Premium |

|---|---|

| 40 | $1,200 |

| 45 | $1,400 |

| 50 | $1,600 |

| 55 | $1,800 |

| 60 | $2,200 |

| 65 | $2,800 |

| 70 | $3,600 |

It's important to note that these figures are averages and can vary based on the factors mentioned earlier, such as health status and the specific coverage chosen. Younger individuals may also have access to more affordable group LTC insurance plans through their employers or professional organizations.

Long-Term Care Insurance Performance Analysis

Long-term care insurance policies offer a range of benefits and protection, making them an essential component of financial planning for individuals concerned about their future care needs. The performance of these policies is influenced by several key factors, including the insurer's financial strength, the policy's design, and the insured's specific circumstances.

Insurer's Financial Strength

The financial stability of the insurance company is a critical factor in the performance of LTC insurance policies. Insurers with strong financial ratings are better equipped to manage the long-term liabilities associated with these policies. Rating agencies such as A.M. Best, Moody's, and Standard & Poor's assess insurers' financial health, providing valuable insights for consumers.

For example, an insurer with an "A+" rating from A.M. Best is considered excellent, indicating a strong ability to meet its ongoing obligations, including paying claims. This level of financial stability provides reassurance to policyholders that their benefits will be honored even in the long term.

Policy Design and Benefits

The design of the LTC insurance policy, including the coverage amount, benefit period, and additional features, significantly impacts its performance. Policies with higher daily benefit amounts and longer benefit periods provide more extensive coverage, offering greater financial protection. For instance, a policy with a daily benefit of $300 and a 5-year benefit period will provide more substantial coverage than one with a $150 daily benefit and a 3-year benefit period.

Additionally, policies with optional features such as inflation protection or restoration of benefits can enhance performance. Inflation protection ensures that benefits keep pace with rising healthcare costs, providing greater value over time. Restoration of benefits allows policyholders to reinstate their benefits after a claim, providing ongoing coverage and peace of mind.

Individual Circumstances and Health Status

An individual's health status and personal circumstances can also influence the performance of their LTC insurance policy. Policyholders who maintain good health and take proactive steps to manage their well-being may have fewer claims and, therefore, experience better policy performance. Conversely, individuals with pre-existing conditions or those who require long-term care services early in their policy term may face higher claim costs and reduced policy performance.

For example, an individual with a history of heart disease may have higher claim costs due to the increased likelihood of requiring long-term care services related to their condition. This could impact the policy's performance, potentially leading to higher premiums or even policy cancellation.

Evidence-Based Future Implications

The future of long-term care insurance is shaped by evolving healthcare needs, demographic trends, and regulatory changes. As the population ages and the demand for long-term care services increases, the industry is likely to face several challenges and opportunities.

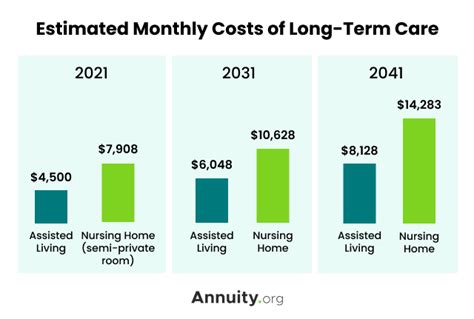

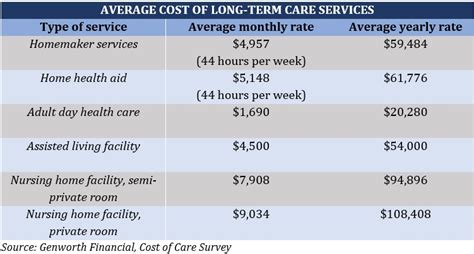

Increasing Demand for Long-Term Care Services

The aging population is a significant driver of demand for long-term care services. As life expectancy continues to rise, more individuals will require extended care support, putting pressure on both public and private healthcare systems. This increased demand is likely to result in higher costs for care services, making long-term care insurance an increasingly valuable financial tool for individuals and families.

Regulatory Changes and Market Stability

Regulatory changes in the insurance industry can impact the stability and availability of long-term care insurance products. In recent years, some insurers have exited the LTC insurance market due to concerns about the long-term profitability of these policies. This trend has led to a reduction in the number of LTC insurance providers, potentially impacting consumers' access to this type of coverage.

However, regulatory initiatives aimed at stabilizing the LTC insurance market, such as the Long-Term Care Insurance Community Living and Support Act, are being proposed to address these challenges. These initiatives focus on providing tax incentives for individuals purchasing LTC insurance, encouraging insurers to remain in the market, and improving overall market stability.

Innovations in LTC Insurance Products

The LTC insurance industry is also experiencing innovations in product design and delivery. Insurers are developing more flexible and customizable policies to meet the diverse needs of consumers. These new products may offer more affordable premiums, broader coverage options, and improved consumer protections.

For example, some insurers are introducing hybrid policies that combine long-term care coverage with life insurance benefits. These policies provide a death benefit if the insured passes away without using their LTC benefits, offering a level of flexibility and peace of mind for policyholders.

Technological Advances and Care Delivery

Advancements in technology are transforming the way long-term care services are delivered. Telehealth and remote monitoring technologies are becoming increasingly popular, offering convenient and cost-effective care options for individuals with chronic conditions or those who require ongoing support. These technological innovations may reduce the overall cost of care, benefiting both consumers and insurers.

The Role of Government Assistance

Government assistance programs, such as Medicaid, play a critical role in providing long-term care services to individuals who cannot afford private insurance. As the demand for these services increases, governments may need to reevaluate their funding strategies and eligibility criteria to ensure the sustainability of these programs. This could impact the overall landscape of long-term care insurance, potentially influencing the role and value of private LTC insurance policies.

FAQ

Can I purchase long-term care insurance after retirement?

+Yes, it is possible to purchase LTC insurance after retirement. However, premiums are typically higher for older individuals, and health conditions may impact eligibility. It's advisable to explore options early to secure more affordable coverage.

<div class="faq-item">

<div class="faq-question">

<h3>Are there tax benefits associated with long-term care insurance?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>In many countries, including the United States, there are tax advantages for LTC insurance. Premiums may be tax-deductible, and benefits received are generally tax-free. It's best to consult a tax professional for specific advice.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>What happens if I need long-term care before my policy's elimination period ends?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>If you require long-term care before your policy's elimination period ends, you will need to pay for those services out of pocket. It's important to carefully consider your financial situation and choose an elimination period that aligns with your needs and budget.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>Can I customize my long-term care insurance policy?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Yes, LTC insurance policies can be customized to meet your specific needs. You can choose the daily benefit amount, the benefit period, and add optional features like inflation protection. Working with an insurance professional can help you tailor a policy that fits your requirements.</p>

</div>

</div>