Fdic Insured Savings Account

In today's world of fluctuating financial markets, safeguarding your hard-earned money is a top priority for many individuals and families. One of the most secure ways to store your savings is through an FDIC-insured savings account. The Federal Deposit Insurance Corporation (FDIC) is a U.S. government agency that insures deposits in banks and savings associations, providing a safety net for your funds. Let's delve into the world of FDIC-insured savings accounts, exploring their benefits, features, and how they can help secure your financial future.

Understanding FDIC Insurance: A Secure Foundation

FDIC insurance is a vital safeguard for your savings. The FDIC was established in 1933 during the Great Depression to restore trust in the banking system and protect depositors from losses if their bank failed. Since then, it has become an indispensable tool for maintaining confidence in the financial system.

FDIC insurance covers a wide range of deposit products, including checking accounts, savings accounts, money market deposit accounts, and certificates of deposit (CDs). The standard insurance amount is $250,000 per depositor, per insured bank, for each account ownership category. This means that even if your bank fails, your deposits are guaranteed up to this amount, ensuring that you won't lose your hard-earned money.

The Benefits of an FDIC-Insured Savings Account

Opening an FDIC-insured savings account offers a myriad of advantages, providing a secure and convenient way to grow your savings. Here are some key benefits:

Safety and Security

The primary advantage of an FDIC-insured savings account is the peace of mind that comes with knowing your deposits are protected. Unlike some investment products, which carry a degree of risk, FDIC insurance eliminates the worry of losing your savings due to bank failure. Your funds are secure, allowing you to focus on building your financial future without unnecessary anxiety.

Convenience and Accessibility

FDIC-insured savings accounts are widely available at banks and financial institutions across the country. This accessibility means you can easily find an account that suits your needs, whether you prefer a traditional brick-and-mortar bank or an online banking experience. Additionally, many FDIC-insured savings accounts offer convenient features like mobile banking, online bill payment, and direct deposit, making it simple to manage your finances on the go.

Competitive Interest Rates

While the primary purpose of an FDIC-insured savings account is safety, you can still earn interest on your deposits. Interest rates may vary depending on market conditions and the financial institution, but these accounts generally offer a competitive return compared to other low-risk savings options. Some banks even provide promotional rates to attract new customers, allowing you to maximize your earnings.

Flexibility and Customization

FDIC-insured savings accounts come in various forms, catering to different savings goals and preferences. You can choose from basic savings accounts, which often have low minimum balance requirements, to more specialized accounts like money market accounts or CDs, which may offer higher interest rates but require higher minimum deposits or longer-term commitments.

Easy Access to Funds

Despite their safety, FDIC-insured savings accounts still provide convenient access to your funds. You can typically make withdrawals or transfers online, through mobile banking, or at an ATM. However, it’s important to note that some accounts may have limitations on the number of transactions you can make per month, so be sure to review the account’s terms and conditions before opening one.

Choosing the Right FDIC-Insured Savings Account

With numerous options available, selecting the right FDIC-insured savings account can be a daunting task. Here are some factors to consider when making your choice:

Interest Rates and Fees

Compare interest rates and fees between different financial institutions. Look for accounts that offer competitive rates and low or no monthly fees. Keep in mind that some accounts may require a minimum balance to earn interest or avoid fees, so choose one that aligns with your savings goals and budget.

Account Features and Accessibility

Evaluate the account’s features to ensure it meets your needs. Consider factors like mobile banking capabilities, overdraft protection, and the ability to link the account to other financial products, such as a checking account or investment portfolio. Additionally, assess the bank’s ATM network to ensure convenient access to your funds.

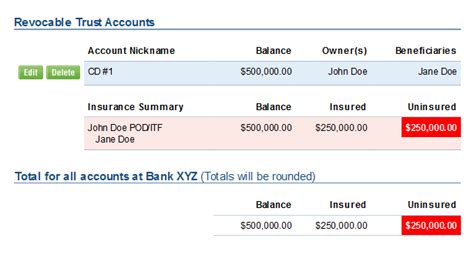

Insurance Coverage

While all FDIC-insured accounts provide a basic level of protection, it’s essential to understand the specifics of the insurance coverage. Review the FDIC’s deposit insurance coverage chart to understand how your deposits are insured. This will help you ensure that your savings are adequately protected, especially if you have substantial funds.

Customer Service and Reputation

Research the financial institution’s reputation and customer service record. Read reviews and seek recommendations from friends or family to gauge the bank’s reliability and responsiveness. A positive customer service experience can make a significant difference in your overall banking satisfaction.

Maximizing Your Savings: Strategies and Tips

Once you’ve chosen the right FDIC-insured savings account, there are several strategies you can employ to maximize your savings and achieve your financial goals:

Set Clear Savings Goals

Define your short-term and long-term savings goals. Whether you’re saving for an emergency fund, a down payment on a house, or a dream vacation, having clear objectives will help you stay motivated and focused. Break down your goals into smaller, achievable milestones to track your progress and celebrate your successes along the way.

Automate Your Savings

Take advantage of the convenience of automated savings. Set up regular transfers from your checking account to your savings account. Many banks offer this feature, allowing you to save effortlessly without having to remember to transfer funds manually. Consider starting with a small amount and gradually increasing your contributions over time.

Explore High-Yield Accounts

If you’re seeking higher interest rates, consider opening a high-yield savings account. These accounts often offer more competitive rates than traditional savings accounts, allowing your money to grow faster. Keep in mind that high-yield accounts may have higher minimum balance requirements or other conditions, so be sure to review the terms carefully.

Take Advantage of Compound Interest

Compound interest is a powerful tool for growing your savings. It’s the interest earned not only on your initial deposit but also on the interest that accumulates over time. The longer you leave your money in the account, the more your savings can grow. Start early and let time work its magic on your savings.

Monitor and Review Your Progress

Regularly review your savings account balance and progress toward your goals. This will help you stay on track and make any necessary adjustments. Consider setting up account alerts or notifications to keep yourself informed about your savings growth and any important account changes.

The Future of FDIC-Insured Savings Accounts

As the financial landscape continues to evolve, FDIC-insured savings accounts remain a staple for secure and convenient savings. With ongoing advancements in technology, we can expect to see further enhancements in the digital banking experience, making it even easier to manage and grow your savings.

Additionally, the FDIC itself is dedicated to ensuring the stability and accessibility of the banking system. They continuously review and update their policies to adapt to changing economic conditions and technological advancements. This commitment to protecting depositors and promoting financial stability ensures that FDIC-insured savings accounts will remain a trusted and reliable option for generations to come.

Conclusion

In a world filled with financial uncertainty, an FDIC-insured savings account offers a secure foundation for your savings. With its peace of mind, convenience, and competitive interest rates, it’s an essential tool for anyone looking to build and protect their financial future. By choosing the right account and employing effective savings strategies, you can achieve your financial goals and rest easy knowing your money is safe and sound.

What happens if my bank fails while I have an FDIC-insured savings account?

+If your bank fails, the FDIC steps in to ensure your deposits are protected. They will either arrange for another bank to assume your bank’s deposits or pay you directly for the insured amount. Rest assured, your deposits are secure up to the insurance limit.

Are there any limitations to FDIC insurance coverage?

+FDIC insurance has a standard coverage limit of $250,000 per depositor, per insured bank, for each account ownership category. This means that if you have multiple accounts at the same bank, the insurance coverage may be limited to this amount. To maximize coverage, consider spreading your deposits across different banks or account types.

Can I have more than one FDIC-insured savings account?

+Absolutely! You can have multiple FDIC-insured savings accounts at different banks or even at the same bank, as long as they are held in different account ownership categories. This allows you to maximize your insurance coverage and meet various savings goals.