Insurance Commissioner Complaint

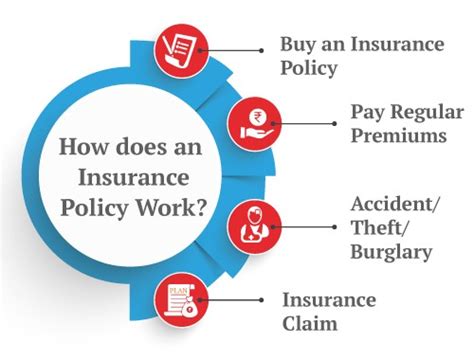

In the complex world of insurance, disputes and disagreements are bound to arise. Whether it's a claim denial, unfair practices, or a simple misunderstanding, having a mechanism to address these issues is crucial. That's where the role of an Insurance Commissioner and the process of filing a complaint come into play. In this comprehensive guide, we will delve into the world of Insurance Commissioner Complaints, exploring the steps, strategies, and potential outcomes.

Understanding the Role of an Insurance Commissioner

The Insurance Commissioner, an appointed or elected official, acts as a regulator and watchdog for the insurance industry within a specific jurisdiction. Their primary responsibility is to ensure that insurance companies operate fairly, honestly, and in the best interests of policyholders. They enforce laws and regulations, investigate consumer complaints, and take necessary actions to protect the public.

Insurance Commissioners have the power to investigate and address a wide range of insurance-related matters, including:

- Claim disputes and denials.

- Unfair business practices.

- Misrepresentation or fraud by insurance companies.

- Rate increases and policy changes.

- Licensing and compliance issues.

The Process of Filing an Insurance Commissioner Complaint

When faced with an insurance-related issue, filing a complaint with the Insurance Commissioner can be a crucial step towards resolution. Here's a detailed breakdown of the process:

Gathering Information

Before filing a complaint, it’s essential to have all the necessary information and documentation related to your insurance issue. This may include:

- Policy documents and correspondence.

- Claim forms and supporting evidence.

- Communications with the insurance company.

- Any relevant laws or regulations.

Organize your information in a clear and concise manner, as this will aid in a more efficient complaint process.

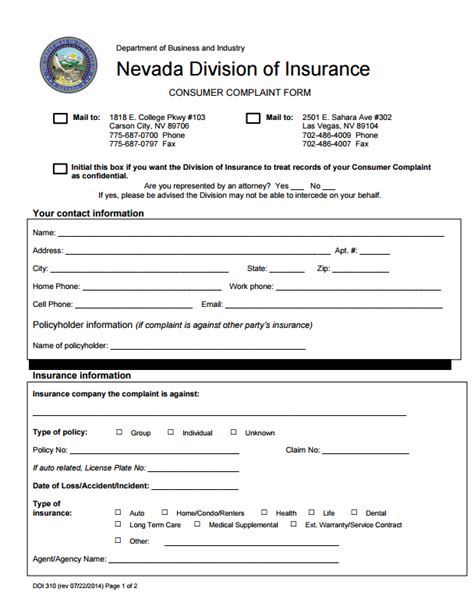

Identifying the Jurisdiction

Insurance regulation is typically handled at the state level. Therefore, it’s crucial to identify the correct jurisdiction for your complaint. Consider the following:

- State of Residence: If the issue pertains to your personal insurance policy, the state where you reside will likely be the relevant jurisdiction.

- Insurance Company’s Location: In some cases, the state where the insurance company is headquartered or licensed may be the appropriate jurisdiction.

- Policy Coverage: For business or commercial policies, the state where the policy is primarily issued may be the relevant authority.

Contacting the Insurance Commissioner’s Office

Once you’ve identified the correct jurisdiction, reach out to the Insurance Commissioner’s office. You can usually find contact information on their official website. Here’s what you can expect:

- You may be able to file a complaint online through a dedicated portal.

- Alternatively, you can call or email the office to discuss your issue and initiate the complaint process.

- Be prepared to provide a detailed account of the problem, including dates, events, and any supporting evidence.

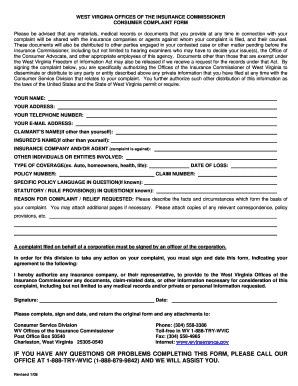

Submitting the Complaint

After contacting the Insurance Commissioner’s office, you will likely be provided with a complaint form or a specific format to follow. Here are some key points to consider:

- Accuracy and Detail: Provide as much detail as possible about the issue, including dates, events, and any relevant documentation.

- Supporting Evidence: Attach any relevant documents, such as correspondence, policy documents, or photographs.

- Clarity: Ensure your complaint is clear and concise, focusing on the specific issue at hand.

- Personal Information: Include your contact details and any relevant policy information.

Investigation and Resolution

Once your complaint is submitted, the Insurance Commissioner’s office will begin the investigation process. Here’s what typically happens:

- Review and Assessment: The complaint will be reviewed by the office to determine its validity and scope.

- Communication with Parties: The Insurance Commissioner’s office may reach out to both parties (you and the insurance company) to gather additional information and clarify the issue.

- Investigation: Depending on the nature of the complaint, the office may conduct an in-depth investigation, which may involve requesting further documentation or interviewing witnesses.

- Potential Outcomes: The investigation may lead to various outcomes, including:

- A finding of no wrongdoing, and the complaint is closed.

- A recommendation for mediation or arbitration to resolve the dispute.

- Enforcement actions against the insurance company, which may include fines or corrective measures.

- A decision in your favor, with the insurance company required to take specific actions.

Real-Life Examples and Case Studies

To illustrate the impact and effectiveness of Insurance Commissioner Complaints, let’s explore some real-life scenarios:

Case Study 1: Unfair Claim Denial

Mr. Johnson, a policyholder, filed a claim for water damage to his home. The insurance company denied the claim, citing a pre-existing condition. Mr. Johnson, believing this to be an unfair denial, filed a complaint with the Insurance Commissioner. After a thorough investigation, the Commissioner’s office found that the insurance company had failed to disclose relevant policy exclusions. As a result, the company was ordered to pay the claim and was fined for its unfair practices.

Case Study 2: Misrepresentation and Fraud

A group of policyholders alleged that their insurance company had misrepresented the terms of their policies and engaged in fraudulent practices. They filed a collective complaint with the Insurance Commissioner, providing evidence of misleading marketing materials and deceptive practices. The investigation revealed widespread issues, and the Commissioner’s office took strong enforcement actions, including revoking the company’s license and imposing significant fines.

Case Study 3: Rate Increase Dispute

When faced with a sudden and significant rate increase, Ms. Smith filed a complaint with the Insurance Commissioner, arguing that the increase was excessive and unjustified. The Commissioner’s office conducted a rate review, analyzing the company’s financial data and market trends. As a result, the rate increase was found to be excessive, and the company was ordered to reduce the rates and provide refunds to affected policyholders.

Strategies for Effective Complaint Filing

To maximize the chances of a successful outcome, consider the following strategies when filing an Insurance Commissioner Complaint:

Gather Comprehensive Evidence

The more evidence and documentation you can provide, the stronger your case will be. Collect all relevant policy documents, correspondence, and any other supporting materials.

Be Clear and Concise

When describing the issue, be clear and concise. Focus on the specific problem and provide a chronological account of events. Avoid speculation or irrelevant details.

Stay Organized

Keep all your documents and communications organized. Create a file or folder dedicated to your insurance issue, making it easier to reference and provide information when needed.

Follow Up

After filing your complaint, follow up with the Insurance Commissioner’s office to ensure it has been received and is being processed. Stay engaged throughout the investigation process, providing any additional information as requested.

Seek Professional Guidance

If your insurance issue is complex or you feel overwhelmed, consider seeking guidance from a legal professional or insurance expert. They can provide valuable insights and assist you in navigating the complaint process.

The Impact and Importance of Insurance Commissioner Complaints

Insurance Commissioner Complaints play a vital role in regulating the insurance industry and protecting consumers. By filing complaints, policyholders can hold insurance companies accountable for their actions and ensure fair practices. The impact of these complaints extends beyond individual cases, as they can lead to systemic changes and improved industry standards.

Insurance Commissioner Complaints serve as a powerful tool for consumers, providing a mechanism to address disputes, seek justice, and promote transparency in the insurance market. By understanding the process and strategies outlined in this guide, individuals can navigate the complaint system with confidence and achieve favorable outcomes.

Frequently Asked Questions

How long does it typically take for an Insurance Commissioner to investigate and resolve a complaint?

+The time it takes for an Insurance Commissioner to investigate and resolve a complaint can vary depending on the complexity of the issue and the workload of the office. Generally, simple complaints may be resolved within a few weeks, while more complex cases can take several months. It’s important to stay patient and provide any additional information requested during the investigation process.

Can I file a complaint if I’m not a policyholder, but have witnessed unfair practices by an insurance company?

+Yes, you can file a complaint even if you are not directly affected by the issue. Insurance Commissioners often accept complaints from concerned citizens or industry professionals who witness unfair practices. However, it’s important to provide detailed evidence and information to support your claim.

What happens if the Insurance Commissioner finds no wrongdoing on the part of the insurance company?

+If the Insurance Commissioner’s investigation concludes that there is no wrongdoing or violation of regulations, the complaint will be closed. In such cases, the insurance company may be notified of the complaint and the findings, but no further action will be taken. However, it’s important to note that even if the complaint is closed, you may still have other legal avenues to pursue, such as seeking legal advice or mediation.

Are there any costs associated with filing an Insurance Commissioner Complaint?

+Filing an Insurance Commissioner Complaint is typically free of charge. The Insurance Commissioner’s office operates as a regulatory body to protect consumers, and they do not charge fees for complaint services. However, if your complaint leads to legal proceedings or mediation, there may be associated costs for those processes.

Can I appeal the decision made by the Insurance Commissioner if I’m not satisfied with the outcome?

+Yes, in most jurisdictions, there are appeal processes in place for individuals who are not satisfied with the Insurance Commissioner’s decision. These appeal processes may involve seeking a review by a higher authority or engaging in legal proceedings. It’s important to carefully review the options available and seek legal advice if needed.