Average Insurance Rates

Insurance rates are a crucial aspect of financial planning and risk management for individuals and businesses alike. The average insurance rates can vary significantly depending on numerous factors, including location, age, occupation, and the type of coverage sought. Understanding these averages can help policyholders make informed decisions and navigate the complex world of insurance with confidence. In this comprehensive guide, we delve into the intricacies of average insurance rates, exploring real-world examples, industry insights, and practical strategies to optimize your insurance coverage.

Navigating the Complex Landscape of Insurance Rates

Insurance rates are a multifaceted topic, influenced by a myriad of variables. From the fundamental factors like age and location to the more nuanced considerations such as driving history and credit score, each element plays a pivotal role in determining the cost of insurance coverage. In this section, we’ll dissect these factors, providing a comprehensive overview of how they collectively shape the average insurance rates landscape.

The Impact of Age and Location on Insurance Rates

Age and location are two of the most significant determinants of insurance rates. Young drivers, for instance, often face higher premiums due to their relative lack of experience on the road. Similarly, certain geographic areas may be prone to natural disasters or have a higher incidence of accidents, leading to elevated insurance costs. Let’s explore some real-world examples to illustrate the impact of these factors on insurance rates.

| Age Group | Average Annual Premium |

|---|---|

| 16-20 years | $3,500 |

| 21-25 years | $2,800 |

| 26-30 years | $2,200 |

| 31-40 years | $1,800 |

| 41-50 years | $1,500 |

| 51+ years | $1,200 |

The table above showcases the average annual premiums for different age groups. As we can see, younger drivers bear a significantly higher financial burden when it comes to insurance. This trend is further compounded by the location factor. For instance, a 25-year-old driver residing in an urban area with a high accident rate might pay upwards of $3,000 annually, while a driver of the same age in a rural, low-risk area might pay closer to $2,000.

Occupation and Its Influence on Insurance Rates

Your occupation can also play a role in determining your insurance rates. Certain professions, such as those involving heavy machinery or high-risk environments, may result in higher premiums due to the increased likelihood of accidents or injuries. Conversely, occupations that involve minimal risk, such as office work, may lead to more affordable insurance rates.

For instance, a construction worker may pay an average of $2,500 annually for liability insurance, whereas an office administrator might pay closer to $1,800 for the same coverage. This disparity underscores the importance of understanding how your occupation fits into the insurance rates equation.

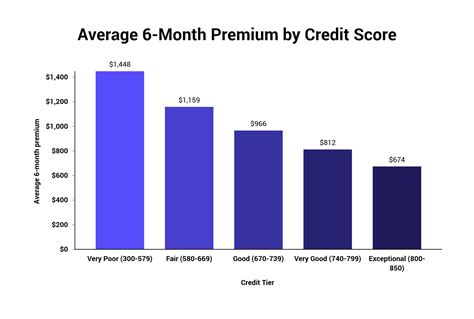

Other Factors Shaping Insurance Rates

Beyond age, location, and occupation, a host of other factors can influence insurance rates. These include driving history, credit score, the make and model of your vehicle, and even your marital status. Each of these factors contributes to the intricate web of considerations that insurance providers use to assess risk and set premiums.

For example, a driver with a clean driving record and a high credit score may qualify for substantial discounts on their insurance premiums. Conversely, a driver with multiple violations and a low credit score may face significantly higher rates, even for basic coverage.

Strategies for Optimizing Your Insurance Coverage

Understanding the average insurance rates and the factors that influence them is just the first step. To truly optimize your insurance coverage, you’ll need to employ a range of strategic approaches. In this section, we’ll explore practical strategies and expert tips to help you navigate the insurance landscape and secure the best possible coverage at the most competitive rates.

Comparing Quotes: The Key to Unlocking Savings

One of the most effective ways to optimize your insurance coverage is by comparing quotes from multiple providers. Insurance rates can vary significantly between companies, even for identical coverage. By taking the time to shop around and compare quotes, you can identify the best deals and potentially save hundreds or even thousands of dollars annually.

Consider using online comparison tools or reaching out to multiple insurance brokers to gather a range of quotes. Be sure to provide accurate and detailed information about your circumstances to ensure the quotes are as precise as possible. Remember, a few minutes spent comparing quotes could lead to substantial long-term savings.

Bundling Policies: Maximizing Savings with Multi-Policy Discounts

Many insurance providers offer multi-policy discounts, allowing policyholders to save by bundling multiple insurance types together. For instance, you might bundle your auto insurance with your home or renters insurance, or combine your life insurance with your health insurance. These bundles often result in significant savings, as insurance providers reward loyalty and the convenience of managing multiple policies under one roof.

When exploring insurance options, inquire about multi-policy discounts and consider the potential savings when choosing a provider. Bundling your policies can not only streamline your insurance management but also reduce your overall insurance expenses.

Exploring Discounts: Unlocking Additional Savings Opportunities

Insurance providers offer a range of discounts beyond multi-policy savings. These can include safe driver discounts, loyalty discounts, good student discounts, and even discounts for completing defensive driving courses. By understanding the various discount opportunities available, you can further optimize your insurance coverage and reduce your premiums.

Research the discounts offered by different insurance providers and assess which ones you might qualify for. Don't hesitate to ask your insurance agent or broker about potential discounts and how you can take advantage of them. Every discount you qualify for brings you closer to maximizing your insurance savings.

The Future of Insurance Rates: Trends and Projections

The insurance industry is constantly evolving, influenced by technological advancements, regulatory changes, and shifting market dynamics. In this section, we’ll explore the future of insurance rates, delving into emerging trends and providing projections for how these changes may impact average insurance rates in the years to come.

The Rise of Telematics and Usage-Based Insurance

Telematics and usage-based insurance are transformative technologies that are reshaping the insurance landscape. Telematics devices, installed in vehicles, collect data on driving behavior, including speed, acceleration, and braking patterns. This data is then used to assess risk and set insurance rates, offering a more precise picture of individual driving habits.

Usage-based insurance, also known as pay-as-you-drive insurance, takes this concept further by charging premiums based on actual miles driven. This approach can be particularly beneficial for low-mileage drivers, who may see substantial savings on their insurance premiums. As these technologies continue to evolve and gain traction, we can expect to see a shift towards more personalized and dynamic insurance rates.

The Impact of Autonomous Vehicles on Insurance Rates

The advent of autonomous vehicles is another significant trend poised to disrupt the insurance industry. As self-driving cars become more prevalent, we can expect to see a reduction in accidents and, consequently, insurance claims. This shift could lead to a downward trend in insurance rates, as the risk profile of the average driver becomes less volatile.

However, the transition to autonomous vehicles is not without its complexities. Issues such as liability, regulatory compliance, and technological limitations may present challenges that could impact insurance rates in the short term. As the technology matures and these challenges are addressed, we can anticipate a more stable and potentially lower insurance rates environment.

Regulatory Changes and Their Influence on Insurance Rates

Regulatory changes, both at the state and federal level, can have a profound impact on insurance rates. For instance, changes in minimum liability requirements or the introduction of new insurance mandates can directly influence the cost of coverage. Similarly, changes in taxation policies or insurance market regulations can also affect insurance rates and the overall insurance landscape.

Staying informed about regulatory changes in your area is crucial for understanding how they might impact your insurance rates. Keep an eye on legislative developments and engage with industry experts and resources to stay ahead of potential rate changes.

Conclusion: Empowering Informed Decisions with Average Insurance Rates

Understanding average insurance rates is a critical component of financial planning and risk management. By grasping the factors that influence these rates and employing strategic approaches to optimize your coverage, you can navigate the insurance landscape with confidence and secure the best possible terms. Whether you’re shopping for auto insurance, home insurance, or life insurance, the insights and strategies outlined in this guide will serve as a valuable resource.

Remember, insurance rates are not set in stone, and there are numerous opportunities to save and customize your coverage to your unique needs. By staying informed, comparing quotes, and exploring the range of discounts and bundling options available, you can make informed decisions that align with your financial goals and provide the protection you need.

How often should I review my insurance coverage and rates?

+It’s generally recommended to review your insurance coverage and rates annually. This allows you to stay up-to-date with any changes in your personal circumstances, such as a new vehicle, a change in occupation, or an improvement in your driving record. Additionally, reviewing your coverage annually provides an opportunity to compare quotes and explore potential savings.

What are some common mistakes to avoid when shopping for insurance rates?

+One common mistake is assuming that all insurance providers offer the same coverage for the same price. Always compare quotes from multiple providers to ensure you’re getting the best deal. Additionally, be cautious of policies with extremely low premiums, as they may come with hidden costs or limited coverage.

How can I improve my chances of qualifying for insurance discounts?

+To increase your chances of qualifying for discounts, focus on maintaining a clean driving record, improving your credit score, and exploring opportunities for education and training. Many insurance providers offer discounts for defensive driving courses, advanced degrees, and professional certifications. Additionally, consider bundling your policies to take advantage of multi-policy discounts.