Self Pay Insurance

In today's complex healthcare landscape, understanding the various insurance options is crucial. Self-pay insurance, often overlooked, offers an alternative path to healthcare coverage, providing individuals with unique benefits and considerations. This comprehensive guide aims to demystify self-pay insurance, offering a deep dive into its intricacies and exploring its potential advantages for specific demographics.

Understanding Self-Pay Insurance

Self-pay insurance, also known as direct pay or cash-pay insurance, is a healthcare coverage option where individuals pay for medical services directly, either through a one-time payment or through a pre-negotiated arrangement with healthcare providers. This model differs significantly from traditional insurance plans, which often involve premiums, deductibles, and copays. Self-pay insurance is particularly attractive to those seeking simplified, flexible healthcare coverage without the complexities of standard insurance plans.

How Self-Pay Insurance Works

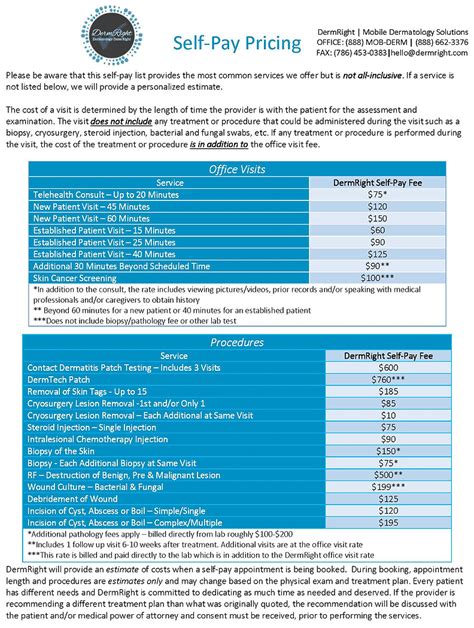

Self-pay insurance operates on a straightforward principle: individuals pay for healthcare services directly, either upfront or through a mutually agreed-upon payment plan. This model eliminates the middleman, streamlining the healthcare payment process. Healthcare providers who offer self-pay options typically have a transparent pricing structure, making it easier for patients to understand and budget for their healthcare expenses.

Benefits of Self-Pay Insurance

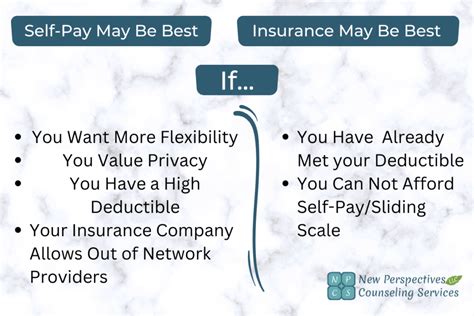

Self-pay insurance offers several advantages. Firstly, it provides individuals with greater control over their healthcare choices. By paying directly, patients can choose their healthcare providers without being restricted by a network, as is often the case with traditional insurance plans. This flexibility is particularly beneficial for those seeking specialized care or treatment from specific providers.

Secondly, self-pay insurance can be more cost-effective for certain individuals. While traditional insurance plans often come with hidden costs and complex fee structures, self-pay insurance provides a clear, upfront understanding of healthcare expenses. For those who require limited medical care or who are healthy and have the financial means to pay out-of-pocket, self-pay insurance can be a more affordable option.

Considerations for Choosing Self-Pay Insurance

While self-pay insurance offers flexibility and potential cost savings, it also comes with several considerations. Firstly, self-pay insurance may not provide the same level of financial protection as traditional insurance plans. In the event of a major health issue or accident, individuals may face significant out-of-pocket expenses. Therefore, it’s crucial to carefully assess one’s healthcare needs and financial situation before opting for self-pay insurance.

Secondly, self-pay insurance may limit access to certain healthcare services. Some providers may not offer self-pay options for all services, and certain specialized treatments may be unavailable without traditional insurance coverage. This can be a significant drawback for individuals with specific healthcare needs.

Who Benefits from Self-Pay Insurance

Self-pay insurance can be particularly beneficial for specific demographics. For instance, young, healthy individuals who require minimal medical care may find self-pay insurance more cost-effective than traditional plans. Similarly, those who frequently travel or live abroad may prefer the flexibility of self-pay insurance, as it offers more freedom in choosing healthcare providers.

Self-Pay Insurance for the Self-Employed

The self-employed often face unique challenges when it comes to healthcare coverage. Traditional insurance plans can be costly, and the self-employed may not qualify for certain subsidies or employer-based plans. In such cases, self-pay insurance can provide a flexible, affordable alternative. By negotiating directly with healthcare providers, the self-employed can often secure favorable rates and customized payment plans.

Self-Pay Insurance for Short-Term Needs

Self-pay insurance can also be a viable option for individuals with short-term healthcare needs. For instance, those who are between jobs or transitioning to a new insurance plan may benefit from self-pay insurance to cover temporary gaps in coverage. Similarly, international students or visitors may opt for self-pay insurance during their stay, as it offers more flexibility than traditional insurance plans.

Performance Analysis and Comparison

When comparing self-pay insurance to traditional plans, several factors come into play. Cost is often a primary consideration, and self-pay insurance can be more affordable for those with limited healthcare needs. However, traditional insurance plans typically offer more comprehensive coverage, including protection against catastrophic events. The choice between self-pay and traditional insurance ultimately depends on an individual’s specific healthcare needs and financial situation.

Case Study: Self-Pay Insurance for a Healthy Family

Consider the example of the Johnson family, a healthy family of four with minimal healthcare needs. The Johnsons opted for self-pay insurance, paying a fixed amount annually to their chosen healthcare providers. This arrangement provided them with flexibility, allowing them to choose their preferred providers without the restrictions of a traditional insurance network. Additionally, the Johnsons saved on insurance premiums, as self-pay insurance eliminated the middleman.

Comparative Analysis of Self-Pay vs. Traditional Insurance

| Category | Self-Pay Insurance | Traditional Insurance |

|---|---|---|

| Flexibility | High | Low |

| Cost for Minimal Healthcare Needs | Often Lower | Can be Higher |

| Financial Protection | Limited | Comprehensive |

| Provider Choice | Unrestricted | Network-Restricted |

Future Implications and Expert Insights

The rise of self-pay insurance reflects a broader shift towards consumer-driven healthcare. As individuals increasingly seek control over their healthcare choices, self-pay insurance offers a flexible, personalized approach. However, the success of self-pay insurance depends on several factors, including the willingness of healthcare providers to offer such plans and the ability of individuals to manage their healthcare expenses effectively.

Frequently Asked Questions

Can I use self-pay insurance for emergency medical situations?

+While self-pay insurance can be used for emergency situations, it’s important to note that it may not provide the same level of financial protection as traditional insurance plans. In an emergency, you may incur significant out-of-pocket expenses, so it’s crucial to assess your financial preparedness before opting for self-pay insurance.

Are there any discounts or incentives for choosing self-pay insurance?

+Some healthcare providers offer discounts or negotiated rates for self-pay patients. It’s worth discussing these options with your preferred providers to understand any potential savings or incentives.

How do I find healthcare providers that offer self-pay options?

+You can start by researching local healthcare providers and contacting them directly to inquire about self-pay options. Many providers list their self-pay rates or policies on their websites, making it easier to identify those who offer this flexible payment model.

Can I combine self-pay insurance with other insurance plans?

+Yes, you can potentially combine self-pay insurance with other insurance plans. For instance, you might use self-pay insurance for routine healthcare needs and maintain a traditional insurance plan for more comprehensive coverage. However, it’s essential to review the terms of both plans to ensure they work together effectively.