Car And Home Insurance Bundles

In the world of insurance, one of the most popular and advantageous strategies for consumers is bundling, especially when it comes to car and home insurance. This practice offers a host of benefits, from potential cost savings to simplified policy management. But what exactly is a bundle, and how does it work? Let's delve into the details to understand the ins and outs of car and home insurance bundles.

Understanding Car and Home Insurance Bundles

A car and home insurance bundle is a single policy that combines your automobile coverage and your homeowner’s or renter’s insurance. Instead of having two separate policies and dealing with two different insurance companies, you consolidate your coverage with one provider. This strategy is often appealing to those seeking convenience and potential cost savings.

When you bundle your car and home insurance, you're essentially purchasing a multi-line policy. This means you're not just buying a single type of insurance coverage; you're acquiring multiple types of protection under one policy. The benefit of this approach is that it can offer you significant discounts and streamline your insurance management process.

For instance, let's consider a typical scenario. Imagine you're a homeowner with a car. You have a mortgage on your home and a loan on your vehicle. By bundling your car and home insurance, you can potentially reduce your overall insurance costs and simplify your financial obligations. Instead of making payments to two different insurance companies, you can consolidate your payments to one, making it more manageable and potentially reducing administrative fees.

The Benefits of Bundling

There are several advantages to bundling your car and home insurance. First and foremost is the potential for cost savings. Many insurance companies offer discounts when you purchase multiple types of insurance from them. These discounts can add up and significantly reduce your overall insurance expenses.

For example, let's say you're currently paying $1,200 annually for your car insurance and $1,500 for your home insurance. That's a total of $2,700 per year. However, by bundling these policies, you might be eligible for a discount of, say, 20%. This would reduce your total insurance cost to $2,160, saving you $540 annually.

Another benefit of bundling is the convenience it offers. With a single policy, you only have one insurance company to deal with. This means one bill to pay, one renewal date to remember, and one set of policy documents to manage. It simplifies your insurance administration, making it easier to keep track of your coverage and ensure you're always protected.

Furthermore, bundling can provide additional coverage benefits. For instance, some insurance companies offer enhanced coverage options when you bundle, such as increased liability limits or additional perks like identity theft protection or roadside assistance.

How to Bundle Your Insurance

Bundling your car and home insurance is a straightforward process, but it does require some research and planning to ensure you’re getting the best deal and the coverage you need.

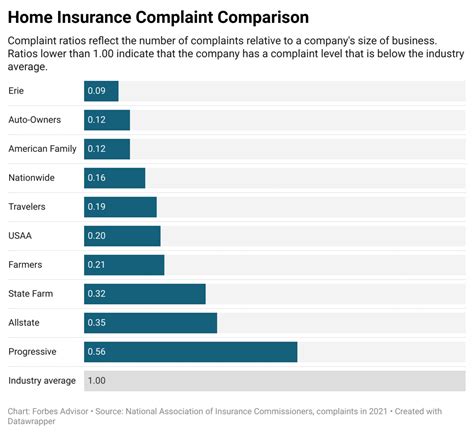

First, identify the insurance company or companies you want to work with. Consider factors such as their reputation, customer service ratings, and the range of coverage options they offer. You might also want to look at their financial stability and customer satisfaction scores to ensure they're a reliable choice.

Next, compare the prices and coverage options of different insurance providers. Get quotes for both your car and home insurance separately, and then inquire about the cost of bundling these policies. This will give you a clear idea of the potential savings you could achieve.

When you've chosen your preferred insurance company, you can request a quote for a bundled policy. Be sure to provide accurate and detailed information about your home and vehicle, including their age, value, and any additional features or upgrades. This will ensure you receive an accurate quote and the appropriate level of coverage.

Comparing Bundled Insurance Policies

When considering car and home insurance bundles, it’s important to compare policies to ensure you’re getting the best deal. Here are some key factors to consider when comparing bundled insurance options:

Coverage Options

Ensure that the bundled policy provides adequate coverage for both your car and home. This includes liability, comprehensive, and collision coverage for your vehicle, and property, liability, and additional living expenses coverage for your home. Check the policy limits and deductibles to ensure they align with your needs and risk tolerance.

| Coverage Type | Car Insurance | Home Insurance |

|---|---|---|

| Liability | Covers damage to others' property or injury to others | Protects against liability claims from visitors or third parties |

| Comprehensive | Covers non-collision incidents like theft, vandalism, or natural disasters | Covers damage to your home from perils like fire, wind, or vandalism |

| Collision | Covers damage to your vehicle in an accident | N/A |

| Additional Living Expenses | N/A | Covers temporary living expenses if your home is uninhabitable |

Discounts and Perks

Bundling often comes with discounts, but the amount and type can vary. Some insurance companies offer a flat percentage discount, while others provide a more tailored approach based on the specific policies you bundle. Additionally, look for any added perks, such as free roadside assistance, identity theft protection, or discounts on home security systems.

Policy Exclusions and Limitations

Just as important as understanding what’s covered is knowing what’s not. Carefully review the policy exclusions and limitations to ensure there are no surprises. For instance, some policies may have restrictions on coverage for high-value items like jewelry or artwork, or they might limit coverage for certain types of natural disasters.

Customer Service and Claims Handling

Consider the reputation of the insurance company for customer service and claims handling. Look for reviews and ratings to gauge their responsiveness, efficiency, and overall customer satisfaction. A company with a strong track record in these areas can provide peace of mind when you need to make a claim.

Potential Drawbacks of Bundling

While bundling car and home insurance offers many benefits, it’s not without potential drawbacks. One of the main concerns is the possibility of increased costs if you’re not careful. If you don’t shop around and compare prices, you might end up paying more for your bundled policy than you would for separate policies.

Additionally, bundling may not always provide the best coverage for your specific needs. For instance, if you have a high-value home and a luxury car, you might require specialized coverage that a standard bundled policy doesn't offer. In such cases, it might be more beneficial to have separate policies tailored to your unique needs.

Furthermore, if you're considering switching insurance companies, bundling can make the process more complex. You'll need to ensure that both your car and home insurance policies are transferred to the new provider, which can involve additional paperwork and coordination.

Making the Most of Your Bundled Policy

If you decide to bundle your car and home insurance, there are several steps you can take to maximize the benefits of your policy.

Regularly Review Your Coverage

It’s important to review your insurance coverage regularly, especially when your circumstances change. This could include buying a new car, making significant home improvements, or having a life event such as marriage or the birth of a child. These changes can impact your insurance needs, so it’s essential to ensure your coverage remains adequate.

Explore Additional Coverage Options

Bundled policies often come with additional coverage options that you can add on to further protect yourself. These might include coverage for high-value items, identity theft protection, or enhanced liability coverage. Consider your specific needs and risks to determine if any of these additional coverages are worthwhile for you.

Take Advantage of Discounts

Bundling usually comes with discounts, but you can often save even more by exploring other potential discounts. For instance, many insurance companies offer discounts for safe driving records, home security systems, or loyalty rewards. Ask your insurance provider about these discounts and see if you qualify for any additional savings.

Future Implications of Bundled Insurance

The trend towards bundling insurance policies is likely to continue, as it offers significant benefits to both consumers and insurance companies. For consumers, bundling provides convenience, potential cost savings, and often enhanced coverage. For insurance companies, bundling can lead to increased customer loyalty, reduced administrative costs, and improved risk management.

As technology advances, we can expect to see even more innovative features in bundled insurance policies. This could include the integration of smart home technology, where insurance policies could dynamically adjust coverage based on real-time data from your home. For example, if your smart home system detects a potential fire hazard, your insurance coverage could automatically increase to provide additional protection.

Additionally, the rise of electric vehicles and autonomous driving technology could also impact the future of car insurance bundles. Insurance companies may offer tailored coverage options for these vehicles, taking into account their unique features and potential risks. This could include coverage for battery replacement or repairs specific to electric vehicles, or liability coverage for autonomous driving systems.

In conclusion, car and home insurance bundles offer a convenient and potentially cost-effective way to protect your assets. By combining your car and home insurance policies, you can simplify your insurance management and often benefit from significant discounts. However, it's important to carefully research and compare bundled policies to ensure you're getting the best coverage and value for your money. As the insurance industry continues to evolve, we can expect to see even more innovative features and coverage options in bundled policies, making them an even more attractive option for consumers.

What is a car and home insurance bundle, and how does it work?

+

A car and home insurance bundle is a single policy that combines your automobile coverage and your homeowner’s or renter’s insurance. By bundling, you consolidate your coverage with one provider, often leading to potential cost savings and simplified policy management.

What are the benefits of bundling car and home insurance?

+

Bundling offers potential cost savings through discounts, simplifies insurance management with one policy and one bill, and may provide additional coverage benefits like increased liability limits or added perks like roadside assistance.

How can I bundle my car and home insurance?

+

To bundle your insurance, first identify the insurance company you want to work with, considering factors like reputation and customer service. Compare prices and coverage options, and then request a quote for a bundled policy, providing accurate details about your home and vehicle.

What are some potential drawbacks of bundling car and home insurance?

+

Potential drawbacks include the possibility of increased costs if you don’t shop around, the risk of inadequate coverage for your specific needs, and the complexity of switching insurance companies if you decide to change providers in the future.