Auto Insurance Information

Auto insurance, or car insurance, is a vital aspect of vehicle ownership and plays a crucial role in protecting drivers and their vehicles. With a wide range of policies and coverage options available, understanding the ins and outs of auto insurance is essential for every vehicle owner. In this comprehensive guide, we will delve into the world of auto insurance, exploring its key components, the benefits it provides, and the factors that influence policy choices. By the end of this article, you'll have a deeper understanding of auto insurance and be equipped to make informed decisions when choosing the right coverage for your needs.

The Importance of Auto Insurance

Auto insurance serves as a financial safeguard, providing protection against various risks and liabilities associated with vehicle ownership and operation. It offers peace of mind by covering potential costs arising from accidents, damage, theft, and other unforeseen events. Whether you’re involved in a minor fender-bender or a more serious collision, having the right auto insurance coverage can make a significant difference in managing the financial consequences.

Protecting Your Vehicle and Assets

One of the primary purposes of auto insurance is to safeguard your vehicle and personal assets. Comprehensive and collision coverage options protect your car against damage caused by accidents, natural disasters, vandalism, or theft. By choosing the right coverage limits, you can ensure that your vehicle’s value is adequately protected, even in the event of a total loss. Additionally, liability coverage helps protect your personal assets by providing financial protection in case you’re found legally responsible for causing damage to others’ property or injuries to others in an accident.

Comprehensive Coverage Options

Auto insurance policies offer a range of coverage options to tailor protection to your specific needs. These include:

- Liability Coverage: This covers damages you cause to others’ property and medical expenses for injuries they sustain in an accident you’re responsible for. It’s typically divided into bodily injury liability and property damage liability.

- Collision Coverage: Pays for repairs or the replacement cost of your vehicle if it’s damaged in an accident, regardless of who’s at fault. It’s essential for protecting your investment and ensuring you can get back on the road quickly.

- Comprehensive Coverage: Provides protection against non-collision incidents such as theft, vandalism, natural disasters, or damage caused by animals. It’s a valuable addition to your policy, offering peace of mind in unexpected situations.

- Medical Payments or Personal Injury Protection (PIP): Covers medical expenses for you and your passengers, regardless of fault. It ensures you have the necessary financial support to address any injuries sustained in an accident.

- Uninsured/Underinsured Motorist Coverage: Protects you if you’re involved in an accident with a driver who doesn’t have adequate insurance. It covers your medical bills, property damage, and other related expenses.

Understanding Coverage Limits and Deductibles

When selecting auto insurance, it’s crucial to understand coverage limits and deductibles. Coverage limits represent the maximum amount your insurer will pay for a covered claim. It’s essential to choose limits that align with your financial needs and the value of your vehicle. Deductibles, on the other hand, are the amount you pay out of pocket before your insurance coverage kicks in. Higher deductibles can lead to lower premiums, but it’s important to strike a balance between affordability and adequate coverage.

Factors Influencing Auto Insurance Premiums

Auto insurance premiums, or the cost of your policy, are determined by a variety of factors. These factors help insurance companies assess the level of risk associated with insuring a particular driver. Understanding these factors can help you make informed decisions when choosing an auto insurance policy and potentially negotiate better rates.

Driver Profile and History

Your driving record and personal characteristics play a significant role in determining your auto insurance premiums. Insurance companies consider factors such as your age, gender, marital status, and driving history. Younger drivers, especially those under 25, are often considered higher-risk due to their lack of experience on the road. Additionally, your driving history, including any accidents, traffic violations, or claims made in the past, can impact your premiums. A clean driving record can lead to more favorable rates, while a history of accidents or violations may result in higher premiums.

Vehicle Factors

The type of vehicle you drive and its usage also influence your auto insurance premiums. Insurance companies take into account factors such as the make, model, and year of your vehicle, as well as its safety features and accident history. Vehicles with a higher risk of theft or those that are more expensive to repair may incur higher premiums. Additionally, the primary purpose of your vehicle (personal use, business use, or pleasure driving) can impact your rates. Vehicles used for business purposes or as part of a ride-sharing service may be subject to different insurance requirements and higher premiums.

Location and Usage

Your geographic location and the number of miles you drive annually are additional factors that affect your auto insurance premiums. Insurance companies analyze data on accident rates, traffic congestion, and crime statistics for different areas. Drivers living in densely populated urban areas or high-crime regions may face higher premiums due to the increased risk of accidents or vehicle theft. Furthermore, the number of miles you drive each year can impact your rates. High-mileage drivers are often considered higher-risk, leading to higher premiums.

Credit Score and Payment History

In many states, insurance companies are allowed to consider your credit score and payment history when determining your auto insurance premiums. A good credit score can lead to more favorable rates, as it indicates financial responsibility and a lower risk of filing claims. Conversely, a poor credit score may result in higher premiums. It’s important to maintain a positive credit history to ensure you’re eligible for the best insurance rates available.

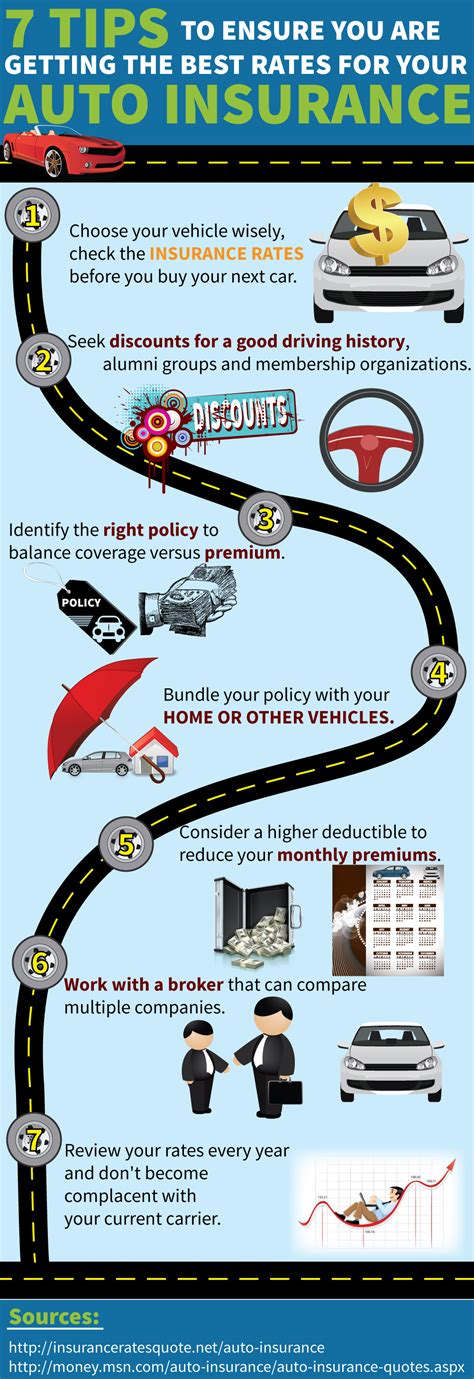

Tips for Choosing the Right Auto Insurance

Selecting the right auto insurance policy involves careful consideration of your specific needs and circumstances. Here are some tips to help you make an informed decision:

Assess Your Coverage Needs

Before choosing an auto insurance policy, evaluate your coverage needs. Consider the value of your vehicle, your financial situation, and the potential risks you may face. Determine the level of liability coverage you require, whether you need comprehensive and collision coverage, and if additional endorsements or riders are necessary to protect your specific circumstances.

Compare Multiple Quotes

Obtain quotes from multiple insurance providers to compare rates and coverage options. Shopping around can help you find the best value for your money. Online comparison tools and insurance brokerages can simplify the process of gathering quotes and assessing different policies.

Understand Policy Exclusions

Read the fine print of each policy to understand any exclusions or limitations. Exclusions are situations or circumstances that are not covered by your insurance policy. Understanding these exclusions can help you make an informed decision and ensure you’re not left unprotected in certain situations.

Consider Discounts and Bundling

Insurance companies often offer discounts for various reasons. These may include safe driving records, good student discounts, multi-policy discounts (bundling auto insurance with other policies like homeowners or renters insurance), or loyalty discounts for long-term customers. Take advantage of these discounts to reduce your premiums.

Choose a Reputable Insurer

Select an insurance company with a strong financial rating and a good reputation for customer service and claim handling. Look for reviews and ratings from independent sources to ensure you’re choosing a reliable insurer.

Understanding Auto Insurance Claims

In the unfortunate event of an accident or other covered incident, understanding the auto insurance claims process is crucial. Here’s a simplified breakdown of the steps involved:

Reporting the Incident

Immediately after an accident or incident, contact your insurance company to report the claim. Provide them with all the necessary details, including the date, time, location, and any relevant information about the other parties involved. It’s essential to report the claim promptly to avoid any potential delays in processing.

Documenting the Scene

Take photos of the accident scene, including any visible damage to your vehicle and the surrounding area. Capture any relevant details, such as license plate numbers, road conditions, and weather conditions. Documenting the scene can be valuable when filing a claim and providing evidence to support your case.

Filing the Claim

Your insurance company will guide you through the claims filing process. They may require you to complete a claim form, provide additional documentation (such as police reports or medical records), and answer any questions related to the incident. Be prepared to provide accurate and detailed information to facilitate a smooth claims process.

Claim Investigation and Settlement

Once your claim is filed, the insurance company will investigate the incident to determine liability and assess the extent of the damages. This may involve inspecting your vehicle, interviewing witnesses, and reviewing any available evidence. Based on the investigation, the insurance company will determine the value of your claim and offer a settlement. It’s important to review the settlement offer carefully and seek clarification or additional compensation if needed.

Conclusion

Auto insurance is a complex but essential aspect of vehicle ownership. By understanding the various coverage options, factors influencing premiums, and the claims process, you can make informed decisions to protect yourself and your vehicle. Remember to assess your coverage needs, compare quotes, and choose a reputable insurer to ensure you have the right protection in place. With the right auto insurance policy, you can drive with confidence, knowing you’re covered for the unexpected.

How often should I review my auto insurance policy?

+It’s a good practice to review your auto insurance policy annually or whenever your life circumstances change significantly. This ensures that your coverage remains up-to-date and aligns with your current needs. Factors such as purchasing a new vehicle, getting married, or moving to a different location may require adjustments to your policy.

Can I switch auto insurance providers mid-policy term?

+Yes, you can switch auto insurance providers at any time. However, it’s important to understand the potential consequences. Some insurers may charge a fee for canceling a policy mid-term, and you may need to pay a new deductible if you switch to a different provider. Additionally, ensure that your new policy starts on the same date as the cancellation of the old policy to avoid any gaps in coverage.

What should I do if I’m involved in an accident?

+If you’re involved in an accident, stay calm and prioritize the safety of yourself and others. Exchange information with the other parties involved, including their names, contact details, and insurance information. Take photos of the accident scene and any visible damage. Report the accident to your insurance company promptly, providing them with all the necessary details. Follow their guidance on filing a claim and submitting any required documentation.