Temp Insurance

Temporary insurance, also known as temp cover or short-term insurance, is a unique financial product designed to provide individuals and businesses with flexible and temporary protection. This type of insurance has gained popularity due to its ability to offer coverage for specific periods, making it an ideal solution for various scenarios where long-term commitments are not necessary or practical. In this comprehensive guide, we will delve into the world of temporary insurance, exploring its applications, benefits, and considerations.

Understanding Temporary Insurance

Temporary insurance policies are tailored to offer protection for a predetermined period, typically ranging from a few days to several months. Unlike traditional insurance policies that are designed for long-term coverage, temp insurance is a flexible alternative that allows individuals and businesses to secure insurance when and where they need it most. These policies are particularly useful in situations where the need for insurance arises unexpectedly or for a limited duration.

Applications of Temporary Insurance

The versatility of temporary insurance makes it applicable to a wide range of scenarios. Here are some common situations where temp insurance can be beneficial:

- Travel and Vacation: When planning a trip, especially to unfamiliar destinations, temporary travel insurance can provide peace of mind. It covers medical emergencies, trip cancellations, lost luggage, and other unforeseen events, ensuring a stress-free journey.

- Event Hosting: Whether organizing a wedding, a concert, or a conference, temporary event insurance can protect against liabilities and unexpected occurrences. It covers everything from property damage to personal injuries, ensuring the event proceeds smoothly.

- Business Ventures: Startups and small businesses often opt for temporary insurance to manage risks during initial operations. This can include product liability, professional indemnity, or property insurance, providing coverage until a more permanent solution is established.

- Vehicle Rental: Renting a car or other vehicles often requires insurance coverage. Temporary auto insurance can be purchased for the duration of the rental, ensuring compliance with legal requirements and providing protection against accidents and damages.

- Home Renovations: During home improvement projects, especially those involving contractors, temporary builder’s risk insurance can protect against property damage, theft, or accidents on the job site.

Benefits and Considerations

Temporary insurance offers several advantages, making it an appealing choice for many individuals and businesses. Here are some key benefits to consider:

- Flexibility: The ability to customize coverage periods allows for tailored protection, ensuring you only pay for the insurance you need, when you need it.

- Cost-Effectiveness: Temporary insurance is often more affordable than long-term policies, especially for short-term needs. It eliminates the need for excessive coverage and reduces overall insurance costs.

- Quick Turnaround: Unlike traditional insurance, temp insurance policies can be obtained rapidly, often within a matter of hours or days. This swift process ensures protection is in place when time is of the essence.

- No Long-Term Commitments: With temporary insurance, there is no obligation to renew or continue coverage beyond the agreed-upon term. This is particularly advantageous for businesses undergoing transitional phases.

However, it is essential to approach temporary insurance with a few considerations in mind. These policies may have limitations on coverage amounts, pre-existing conditions, or exclusions. It is crucial to carefully review the terms and conditions to ensure the policy meets your specific needs. Additionally, some temp insurance policies may require renewals, so understanding the renewal process and potential changes in coverage is vital.

Types of Temporary Insurance

Temporary insurance encompasses a wide range of coverage options, each designed to address specific needs. Here are some common types of temp insurance and their applications:

Temporary Life Insurance

Temporary life insurance, also known as term life insurance, provides coverage for a set period, typically ranging from 10 to 30 years. It offers financial protection to beneficiaries in the event of the policyholder’s death during the term. This type of insurance is ideal for individuals seeking coverage for a specific period, such as until their children become financially independent or during a high-risk phase of their career.

Short-Term Health Insurance

Short-term health insurance plans offer temporary medical coverage for individuals and families. These policies are designed to bridge gaps in coverage, often between jobs or during periods of transition. While they provide essential healthcare benefits, short-term health insurance plans may have limitations on pre-existing conditions and typically do not cover preventive care or prescription medications.

Temporary Auto Insurance

Temporary auto insurance, or short-term car insurance, is perfect for situations where a vehicle is only needed for a limited time. This could include renting a car for a vacation, borrowing a friend’s vehicle, or even using a temporary replacement vehicle while your primary car is being repaired. Temporary auto insurance provides liability coverage and can be customized to include additional protection, such as collision and comprehensive coverage.

Temporary Home Insurance

Temporary home insurance, or short-term homeowner’s insurance, offers protection for homeowners or renters during specific periods. This could be useful for individuals moving into a new home, undergoing renovations, or renting out their property temporarily. Temporary home insurance policies cover losses due to fire, theft, and other perils, providing peace of mind during transitional phases.

| Type of Temporary Insurance | Coverage Period | Key Benefits |

|---|---|---|

| Temporary Life Insurance | 10-30 years | Financial protection for beneficiaries during a specific term |

| Short-Term Health Insurance | Typically 3-12 months | Bridging coverage gaps, affordable healthcare options |

| Temporary Auto Insurance | Flexible, ranging from a few days to several months | Liability coverage for temporary vehicle use, customizable options |

| Temporary Home Insurance | Customizable, often for periods of 3-12 months | Protection during home transitions, renovations, or rentals |

Obtaining Temporary Insurance

The process of obtaining temporary insurance is relatively straightforward and can be done through various channels. Here are some steps to consider when acquiring temp insurance:

Assess Your Needs

Before purchasing temporary insurance, take the time to evaluate your specific requirements. Consider the duration of coverage needed, the level of protection desired, and any unique circumstances that may influence your decision. Understanding your needs will help you choose the right type of temp insurance and tailor the policy to your situation.

Compare Providers

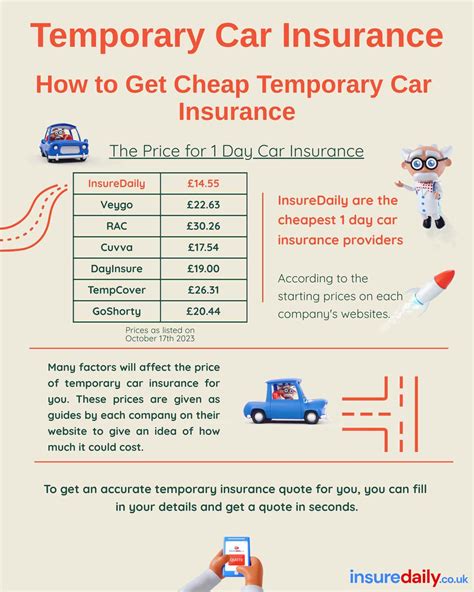

Temporary insurance is offered by a variety of providers, including insurance companies, brokers, and online platforms. Research and compare different options to find the best fit for your needs. Consider factors such as coverage options, premiums, reputation, and customer reviews. Online comparison tools and reviews can be valuable resources in this process.

Obtain Quotes

Request quotes from multiple providers to get an accurate understanding of the cost and coverage offered. Quotes should outline the specific terms and conditions of the policy, including coverage limits, deductibles, and any exclusions. Compare these quotes to ensure you are getting the most comprehensive coverage at a competitive price.

Review the Policy

Once you have selected a provider and obtained a quote, carefully review the policy document. Pay close attention to the coverage details, including what is covered, any limitations or exclusions, and the process for making claims. Ensure that the policy aligns with your needs and expectations. If you have any questions or concerns, don’t hesitate to reach out to the provider for clarification.

Purchase and Manage Your Policy

Once you are satisfied with the policy, you can proceed with the purchase. Many providers offer online or over-the-phone purchase options, making the process convenient and efficient. After purchasing the policy, it is essential to keep track of important details, such as policy numbers, contact information, and renewal dates. Regularly review your policy to ensure it continues to meet your changing needs.

Future Implications and Trends

The temporary insurance market is evolving, driven by changing consumer needs and technological advancements. Here are some future implications and trends to consider:

Digital Transformation

The insurance industry is experiencing a digital revolution, with an increasing number of providers offering online platforms and mobile apps for policy management. This trend is likely to continue, making it more convenient for individuals to access and manage their temporary insurance policies. Digital platforms also enable real-time updates, instant quotes, and streamlined claims processes, enhancing the overall customer experience.

Personalized Coverage

As data analytics and artificial intelligence continue to advance, insurance providers are better equipped to offer personalized coverage options. Temporary insurance policies may become more tailored to individual needs, taking into account factors such as lifestyle, occupation, and risk preferences. This level of customization ensures that policyholders receive the most suitable coverage for their specific circumstances.

Focus on Customer Experience

Insurance providers are increasingly recognizing the importance of customer satisfaction and experience. This shift is likely to result in more user-friendly interfaces, streamlined processes, and enhanced customer support. Temporary insurance providers may invest in innovative technologies and strategies to provide efficient and convenient services, ensuring a positive customer journey.

Collaborative Partnerships

Collaboration between insurance providers and other industries is becoming more common. For example, travel agencies and event organizers may partner with insurance companies to offer seamless travel or event insurance packages. Similarly, automotive manufacturers or rental companies may integrate temporary auto insurance options into their services. These partnerships aim to provide customers with convenient and comprehensive coverage solutions.

Can temporary insurance be renewed?

+Yes, many temporary insurance policies offer the option to renew. However, it is important to note that renewal terms and conditions may vary. Some policies may require a new application and assessment, while others may allow for seamless renewals. It is advisable to review the policy details and consult with the insurance provider to understand the renewal process.

Are there any limitations on coverage amounts for temporary insurance policies?

+Yes, temporary insurance policies often have coverage limits. These limits can vary depending on the type of insurance and the provider. It is crucial to carefully review the policy documents to understand the maximum coverage amounts and any potential restrictions. If you require higher coverage limits, you may need to consider alternative insurance options.

How does temporary insurance differ from traditional insurance policies?

+Temporary insurance differs from traditional insurance policies primarily in terms of coverage duration. Temporary insurance policies are designed for short-term coverage, typically ranging from a few days to several months or years. In contrast, traditional insurance policies are intended for long-term protection, often spanning multiple years or even a lifetime. Additionally, temporary insurance policies may have more flexible terms and conditions, allowing for customization based on specific needs.

Temporary insurance is a valuable tool for individuals and businesses seeking flexible and tailored protection. By understanding the various types of temp insurance, their applications, and the process of obtaining coverage, you can make informed decisions to safeguard your interests during specific periods. As the insurance industry continues to evolve, temporary insurance is likely to play an even more significant role in providing convenient and cost-effective solutions for a wide range of needs.