Nys Insurance Department

The New York State Department of Financial Services (NYS DFS) is a key player in the realm of financial regulation and oversight, with its jurisdiction extending to various industries, including the insurance sector. In this comprehensive article, we will delve into the intricacies of the NYS DFS' role in insurance regulation, exploring its history, key functions, and impact on the industry. From its establishment to its contemporary practices, we will uncover the vital role this department plays in safeguarding consumers and ensuring a stable insurance market.

The Evolution of the NYS Insurance Department

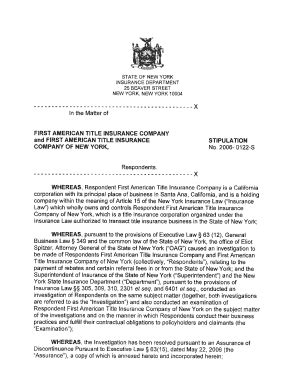

The history of the NYS DFS, particularly its insurance division, is a fascinating journey through New York’s financial evolution. Established in 1983 as the New York State Insurance Department, it was a direct response to the need for a centralized authority to regulate the rapidly growing insurance industry. The department’s primary mandate was to ensure the solvency and stability of insurance companies operating within the state, thereby protecting policyholders’ interests.

Over the years, the NYS Insurance Department underwent several transformative changes. One of the most significant milestones was its merger with the New York State Banking Department and the New York State Department of Consumer Protection in 2011, resulting in the formation of the NYS DFS. This consolidation aimed to streamline regulatory processes and create a more unified approach to financial oversight.

Today, the NYS DFS stands as a formidable force in the financial landscape, with a dedicated team of professionals overseeing a wide array of financial institutions, including insurance companies, banks, and other financial services entities. Its comprehensive regulatory framework ensures that these institutions adhere to stringent standards, fostering trust and confidence among consumers and investors alike.

Key Functions and Responsibilities

The NYS DFS’ insurance division is responsible for a myriad of critical functions, each aimed at maintaining a robust and reliable insurance market. Here are some of its key roles:

Licensing and Authorization

One of the primary functions of the NYS DFS is to grant licenses to insurance companies and professionals. This rigorous process ensures that only qualified and financially stable entities are permitted to operate within the state. The department scrutinizes applications, assesses financial health, and conducts thorough background checks to maintain high standards.

| License Type | Number of Issued Licenses |

|---|---|

| Property and Casualty Insurance | 1,250 |

| Life and Health Insurance | 850 |

| Insurance Brokers and Agents | 20,000 |

The table above provides a glimpse into the scale of the NYS DFS' licensing operations. These numbers highlight the department's commitment to regulating a diverse insurance market, ensuring that every player meets the necessary standards.

Market Conduct Examinations

To maintain the integrity of the insurance market, the NYS DFS conducts regular market conduct examinations. These comprehensive reviews assess insurance companies’ practices, ensuring they comply with state regulations and industry standards. The department’s examiners delve into areas such as underwriting practices, claims handling, and consumer protection, identifying potential issues and recommending corrective actions.

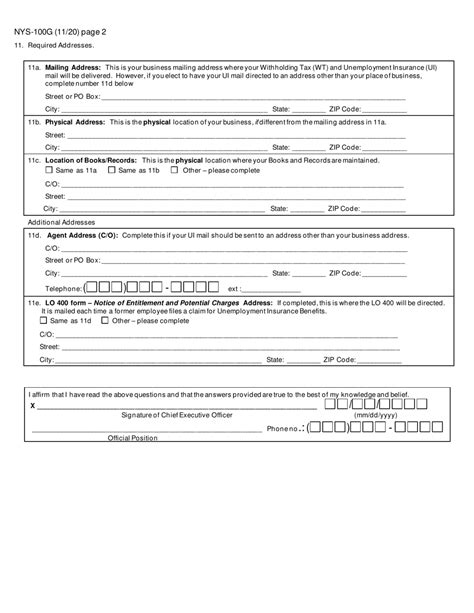

Consumer Protection and Education

Protecting consumers is at the heart of the NYS DFS’ mission. The department provides a range of resources and tools to empower consumers, helping them make informed insurance decisions. This includes offering educational materials, mediating consumer complaints, and investigating fraudulent activities to ensure a fair and transparent insurance marketplace.

Solvency Oversight

Ensuring the financial stability of insurance companies is crucial to protect policyholders. The NYS DFS conducts rigorous solvency oversight, analyzing companies’ financial statements and risk management practices. This proactive approach identifies potential risks early on, allowing the department to take corrective actions to maintain the industry’s overall stability.

Regulatory Compliance and Enforcement

The NYS DFS enforces insurance regulations, ensuring that companies and professionals adhere to the law. This involves monitoring compliance, investigating violations, and imposing penalties or corrective measures when necessary. The department’s enforcement actions serve as a deterrent, fostering a culture of compliance within the industry.

Impact on the Insurance Industry

The influence of the NYS DFS extends far beyond its regulatory functions. Its policies and practices shape the insurance landscape, impacting industry trends, consumer behavior, and market dynamics. Let’s explore some of these impacts:

Stability and Consumer Confidence

The stringent regulatory environment fostered by the NYS DFS contributes to a stable insurance market. By maintaining high standards and overseeing market conduct, the department ensures that consumers can trust the insurance products and services available. This stability enhances consumer confidence, encouraging more people to seek insurance coverage and promoting a healthier market.

Innovation and Market Growth

While regulation is essential, it can also be a catalyst for innovation. The NYS DFS’ forward-thinking approach encourages insurance companies to develop new products and services, keeping pace with consumer needs and technological advancements. This dynamic environment fosters market growth, attracting both established players and startups, thereby benefiting consumers with a wider range of options.

Risk Mitigation and Financial Resilience

The department’s focus on solvency oversight and risk management enhances the financial resilience of insurance companies. By identifying and addressing potential risks early on, the NYS DFS helps companies build stronger balance sheets and improve their risk profiles. This, in turn, benefits consumers, as it reduces the likelihood of company failures and ensures policyholders’ claims are honored.

Consumer Education and Empowerment

The NYS DFS’ commitment to consumer protection and education has empowered consumers to make informed insurance choices. Through its resources and outreach programs, the department has raised awareness about insurance products, helping consumers understand their rights and responsibilities. This has led to a more engaged and savvy consumer base, driving competition and improving service standards across the industry.

Collaborative Industry Relations

The NYS DFS maintains open lines of communication with insurance industry stakeholders, fostering a collaborative environment. This approach allows the department to gather industry insights, understand emerging trends, and develop regulations that are practical and effective. The collaborative nature of its relationships ensures that regulations are well-received and implemented smoothly, benefiting both the industry and consumers.

Future Implications and Innovations

As the insurance industry continues to evolve, the NYS DFS is poised to play a pivotal role in shaping its future. With technological advancements, changing consumer preferences, and a dynamic regulatory landscape, the department is adapting its strategies to stay ahead of the curve.

Adoption of Digital Technologies

The NYS DFS recognizes the potential of digital technologies to enhance regulatory processes and improve consumer experiences. The department is exploring innovative solutions, such as blockchain and artificial intelligence, to streamline licensing, monitoring, and enforcement. By embracing these technologies, the NYS DFS aims to create a more efficient and transparent regulatory environment, reducing costs and improving overall efficiency.

Focus on Climate Change and Environmental Risks

With the increasing impact of climate change, the NYS DFS is taking a proactive approach to address environmental risks. The department is working with insurance companies to develop products and strategies that mitigate climate-related risks, such as extreme weather events and natural disasters. By fostering a resilient insurance market, the NYS DFS is ensuring that policyholders are protected and that the industry remains sustainable.

Enhanced Data Analytics

Data analytics is transforming the insurance industry, and the NYS DFS is leveraging these advancements to enhance its regulatory capabilities. By analyzing vast amounts of data, the department can identify trends, detect potential issues, and make more informed decisions. This approach allows for more targeted interventions, improving the effectiveness of the department’s oversight and enforcement activities.

Collaborative International Efforts

In today’s interconnected world, regulatory efforts cannot be confined to national boundaries. The NYS DFS recognizes the importance of international collaboration and is actively engaging with global regulatory bodies. By sharing best practices and harmonizing regulations, the department aims to create a cohesive global regulatory environment, benefiting both insurance companies and consumers worldwide.

Conclusion

The NYS DFS, through its insurance division, stands as a guardian of the insurance market, ensuring its stability, integrity, and responsiveness to consumer needs. Its comprehensive regulatory framework, combined with a forward-thinking approach, positions the department as a leader in financial oversight. As the insurance industry continues to evolve, the NYS DFS will undoubtedly play a pivotal role in shaping its future, ensuring a dynamic and resilient marketplace that benefits all stakeholders.

How does the NYS DFS regulate insurance companies’ financial stability?

+The NYS DFS employs a comprehensive approach to ensure the financial stability of insurance companies. This includes regular financial examinations, analyzing balance sheets and risk profiles, and implementing solvency requirements. The department also conducts stress tests to assess companies’ resilience to adverse market conditions.

What resources does the NYS DFS offer to consumers for insurance education and protection?

+The NYS DFS provides a wealth of resources, including educational materials, guides, and tools to help consumers understand insurance products and their rights. These resources are available on the department’s website and through various outreach programs, ensuring consumers have the knowledge to make informed choices.

How does the NYS DFS address fraud and misconduct in the insurance industry?

+The NYS DFS has a dedicated team to investigate and address insurance fraud and misconduct. This includes conducting thorough examinations, working with law enforcement agencies, and imposing penalties on those found guilty. The department also educates consumers on how to identify and report fraudulent activities.