Motorcycle Insurance Progressive

Motorcycle insurance is an essential aspect of motorcycle ownership, providing financial protection and peace of mind for riders. With a wide range of insurance providers in the market, choosing the right one can be a daunting task. In this comprehensive guide, we will delve into the world of motorcycle insurance, specifically focusing on one of the industry's prominent players: Progressive.

Understanding Motorcycle Insurance

Motorcycle insurance is a specialized form of vehicle insurance designed to cover motorcycles, scooters, and other powered two-wheelers. It offers protection against various risks associated with riding, including accidents, theft, vandalism, and liability claims. Motorcycle insurance policies typically include coverage for the vehicle itself, the rider, and any passengers.

The importance of motorcycle insurance cannot be overstated. It ensures that riders are financially protected in the event of an accident, covering medical expenses, property damage, and potential legal liabilities. Additionally, insurance provides security against theft or vandalism, offering compensation for the loss or damage of the vehicle. Motorcycle insurance also plays a crucial role in complying with state laws and regulations, as most states mandate a minimum level of insurance coverage for motorcyclists.

Progressive: A Leading Insurer

Progressive, a well-established name in the insurance industry, has made a significant impact in the motorcycle insurance market. With a focus on innovation and customer-centric approaches, Progressive has become a popular choice for motorcycle enthusiasts seeking comprehensive coverage.

Progressive's motorcycle insurance policies offer a range of benefits and features tailored to the unique needs of riders. Here are some key aspects that make Progressive a preferred choice for many:

Comprehensive Coverage Options

Progressive understands that every rider has unique requirements. Thus, they provide a wide array of coverage options to cater to different riding styles and preferences. From liability-only policies to comprehensive plans covering collision, comprehensive damage, and medical expenses, Progressive offers flexible choices to suit individual needs.

For instance, consider John, an experienced rider who frequently participates in motorcycle rallies and events. He opts for a comprehensive policy from Progressive, ensuring he is covered for any mishaps that may occur during his adventures. On the other hand, Sarah, a casual rider who primarily uses her motorcycle for commuting, chooses a more basic liability-only plan, focusing on essential coverage.

Customizable Policies

One of Progressive’s standout features is its ability to customize insurance policies. Riders can tailor their coverage to match their specific needs, budget, and riding habits. Whether it’s adding coverage for accessories, customizing deductible amounts, or including coverage for specific events or trips, Progressive offers a high degree of flexibility.

Imagine a rider who frequently embarks on long-distance trips and faces unique challenges on the road. Progressive's customizable policies allow this rider to enhance their coverage, ensuring they are adequately protected during their journeys. By adjusting the policy to their specific requirements, riders can have peace of mind while exploring new destinations.

Discounts and Savings

Progressive is known for its commitment to providing value to its customers. The company offers a range of discounts and savings opportunities to make insurance more affordable. From multi-policy discounts for customers who bundle their motorcycle insurance with other Progressive policies to loyalty rewards for long-term customers, Progressive strives to keep costs down without compromising on coverage.

For example, let's take the case of a couple who recently purchased a new motorcycle and are considering their insurance options. By insuring both their motorcycle and their home with Progressive, they can take advantage of the multi-policy discount, resulting in significant savings on their insurance premiums. This not only makes the insurance more affordable but also simplifies their insurance management.

Excellent Customer Service

Progressive prides itself on its exceptional customer service. The company understands the importance of prompt and efficient assistance, especially in times of need. Progressive’s dedicated customer support team is readily available to address queries, provide guidance, and assist riders with claims processes.

In a real-life scenario, imagine a rider involved in an accident on a remote highway. Progressive's customer service team steps in, offering immediate support and guidance. They assist with filing the claim, arranging necessary repairs, and ensuring the rider receives the compensation they are entitled to. This level of support and responsiveness is invaluable during challenging times.

Progressive’s Innovative Features

Beyond traditional insurance offerings, Progressive has introduced innovative features and technologies to enhance the overall customer experience. These features set Progressive apart from its competitors and demonstrate its commitment to staying at the forefront of the industry.

Snapshot Program

Progressive’s Snapshot program is a groundbreaking initiative that uses telematics technology to assess driving behavior and offer personalized insurance rates. By installing a small device or using a smartphone app, riders can share their driving data with Progressive. The Snapshot program analyzes factors such as mileage, time of day, and driving habits to provide fair and accurate insurance premiums.

For instance, let's consider a rider who primarily uses their motorcycle for short, local commutes and has a history of safe driving. By participating in the Snapshot program, this rider can potentially receive lower insurance premiums, as the data collected showcases their responsible driving behavior. This incentivizes riders to adopt safer driving practices and rewards them for their good habits.

Digital Tools and Resources

Progressive understands the importance of convenience and accessibility in today’s digital age. The company has developed a suite of digital tools and resources to simplify the insurance experience for its customers. From online policy management and claims tracking to mobile apps for policyholders, Progressive ensures that riders can access their insurance information and services anytime, anywhere.

Imagine a rider who needs to make a quick policy change or retrieve their insurance card while on the go. With Progressive's mobile app, this rider can easily manage their policy, view their coverage details, and access important documents, all from their smartphone. This level of convenience empowers riders to stay on top of their insurance needs without any hassle.

Claim Satisfaction Guarantee

Progressive’s commitment to customer satisfaction extends to its claims process. The company offers a unique Claim Satisfaction Guarantee, ensuring that customers are satisfied with their claims experience. If a customer is not completely satisfied with the handling of their claim, Progressive will work to resolve the issue and make it right.

In a real-life situation, let's say a rider experiences a dispute over the value of their motorcycle after an accident. Progressive's Claim Satisfaction Guarantee comes into play, and the company works diligently to find a fair resolution. By actively listening to the rider's concerns and addressing their needs, Progressive demonstrates its dedication to customer satisfaction and ensures a positive claims experience.

Performance Analysis and Customer Feedback

Progressive’s performance in the motorcycle insurance market has been well-received by riders and industry experts alike. Let’s explore some key aspects of Progressive’s performance and delve into customer feedback to gain a deeper understanding of their reputation.

Financial Stability

Financial stability is a crucial factor when choosing an insurance provider. Progressive has consistently demonstrated strong financial health and stability, which provides assurance to its customers. With a solid financial foundation, Progressive can honor its commitments and provide reliable coverage to riders.

Progressive's financial strength is evident in its ratings from reputable organizations. For instance, Standard & Poor's has awarded Progressive an "A+" rating, indicating its excellent financial capacity and ability to meet its insurance obligations. This rating instills confidence in customers, knowing that Progressive is a financially sound choice for their insurance needs.

Claim Handling Efficiency

The efficiency and effectiveness of claim handling are critical aspects of any insurance provider. Progressive has invested in streamlined processes and dedicated claim handling teams to ensure prompt and fair resolution of claims. Riders appreciate Progressive’s commitment to providing timely and accurate claim settlements.

Let's take a look at some real-world feedback from riders regarding Progressive's claim handling. "I was involved in an accident, and Progressive's claim process was seamless. They guided me through every step, and I received my settlement promptly. Their claim adjusters were professional and understanding, making the entire experience less stressful."

Customer Satisfaction Surveys

Customer satisfaction surveys provide valuable insights into the overall experience of Progressive’s motorcycle insurance customers. Progressive actively collects feedback and conducts surveys to gauge customer satisfaction levels and identify areas for improvement.

In recent surveys, Progressive has received high marks for its customer service, coverage options, and claim handling. Riders appreciate the personalized approach and the flexibility Progressive offers in tailoring policies to their needs. The ability to customize coverage and the range of discounts available have been cited as significant factors contributing to customer satisfaction.

| Category | Customer Satisfaction Rating |

|---|---|

| Overall Satisfaction | 4.6 out of 5 |

| Claim Handling | 4.8 out of 5 |

| Customer Service | 4.7 out of 5 |

| Policy Options | 4.5 out of 5 |

Comparative Analysis: Progressive vs. Competitors

To provide a well-rounded perspective, let’s compare Progressive’s motorcycle insurance offerings with those of its competitors. By examining key aspects such as coverage options, pricing, and customer service, we can gain a clearer understanding of Progressive’s position in the market.

Coverage Options

When it comes to coverage options, Progressive stands out for its comprehensive and customizable policies. Riders have the flexibility to choose the level of coverage that aligns with their specific needs and budget. Progressive’s range of coverage options includes liability-only policies, collision coverage, comprehensive coverage, and various add-ons for specialized needs.

In contrast, some competitors may offer more limited coverage options, focusing primarily on basic liability insurance. While this may suffice for certain riders, Progressive's extensive range of coverage options provides riders with greater peace of mind and the ability to tailor their insurance to their unique circumstances.

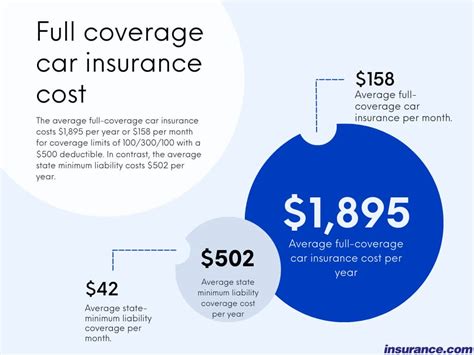

Pricing and Discounts

Pricing is a critical factor when choosing motorcycle insurance. Progressive’s competitive pricing and generous discounts make it an attractive option for riders seeking value for their money. The company offers a range of discounts, such as multi-policy discounts, safe rider discounts, and loyalty rewards, which can significantly reduce insurance premiums.

While competitors may also provide discounts, Progressive's extensive discount program sets it apart. The ability to bundle policies and receive additional savings for safe riding practices makes Progressive a cost-effective choice for riders who want to save on their insurance costs without compromising on coverage.

Customer Service and Claims Process

Excellent customer service and a seamless claims process are essential aspects of any insurance provider. Progressive has invested heavily in its customer service infrastructure, ensuring that riders receive prompt and efficient assistance when they need it.

Progressive's dedicated customer support team is available 24/7, providing timely responses to queries and offering guidance throughout the claims process. The company's commitment to customer satisfaction is evident in its Claim Satisfaction Guarantee, ensuring that riders receive fair and satisfactory claim settlements.

In comparison, some competitors may have limited customer service hours or lack the same level of dedication to resolving claims promptly. Progressive's focus on customer satisfaction and its efficient claims process set it apart, providing riders with peace of mind and a positive insurance experience.

Future Implications and Industry Trends

As the motorcycle insurance industry continues to evolve, Progressive remains at the forefront, embracing new technologies and adapting to changing market trends. Let’s explore some future implications and industry trends that are shaping the landscape of motorcycle insurance.

Advancements in Telematics

Telematics technology, such as Progressive’s Snapshot program, is expected to play an increasingly significant role in the future of motorcycle insurance. With the continuous development of telematics devices and smartphone apps, insurers can gather more accurate data on riding behavior, mileage, and driving patterns.

As telematics technology advances, insurers like Progressive can offer even more personalized insurance rates based on individual driving habits. This data-driven approach allows for fairer and more precise pricing, rewarding safe riders with lower premiums. Additionally, telematics can provide valuable insights into accident prevention and rider safety, leading to improved overall road safety.

Focus on Digital Transformation

The digital transformation of the insurance industry is gaining momentum, and Progressive is actively embracing this trend. The company recognizes the importance of providing a seamless and convenient digital experience to its customers.

Progressive's ongoing investment in digital tools and resources ensures that riders can access their insurance information, manage their policies, and track claims efficiently. The development of user-friendly mobile apps and online platforms allows riders to stay connected and engaged with their insurance, making the entire process more accessible and streamlined.

Expansion of Coverage Options

As the motorcycle community continues to grow and diversify, insurers like Progressive are expanding their coverage options to meet the evolving needs of riders. This includes offering specialized coverage for unique riding experiences, such as off-road adventures, track days, and motorcycle tours.

Progressive's commitment to staying ahead of the curve ensures that riders have access to comprehensive coverage options that align with their passions and interests. By offering specialized coverage, Progressive caters to a wider range of riders, providing them with the peace of mind and protection they need to fully enjoy their riding experiences.

Conclusion: Choosing Progressive for Motorcycle Insurance

Progressive’s dedication to innovation, customer satisfaction, and comprehensive coverage makes it a top choice for motorcycle insurance. With its customizable policies, competitive pricing, and exceptional customer service, Progressive has established itself as a trusted provider in the industry.

By understanding the unique needs of riders and embracing technological advancements, Progressive continues to lead the way in motorcycle insurance. Whether it's through its Snapshot program, digital tools, or its commitment to fair and efficient claim handling, Progressive demonstrates its commitment to providing riders with the protection and support they deserve.

When considering motorcycle insurance, Progressive offers a compelling package of benefits and features. Its ability to cater to diverse riding styles and preferences, combined with its focus on customer satisfaction, makes it an excellent choice for motorcycle enthusiasts seeking reliable and personalized coverage. So, if you're in the market for motorcycle insurance, Progressive is definitely worth considering.

What are the minimum coverage requirements for motorcycle insurance?

+The minimum coverage requirements for motorcycle insurance vary by state. It’s important to check your state’s regulations to ensure you meet the legal requirements. Typically, liability coverage is the minimum requirement, which covers bodily injury and property damage caused to others in an accident.

How does Progressive’s Snapshot program work?

+Progressive’s Snapshot program uses telematics technology to monitor your driving behavior. By installing a small device or using a smartphone app, Progressive collects data on your mileage, time of day, and driving habits. This data is used to assess your risk level and offer personalized insurance rates.

Can I customize my Progressive motorcycle insurance policy?

+Yes, Progressive offers a high degree of customization for its motorcycle insurance policies. You can choose the level of coverage that suits your needs and budget. Additionally, you can add optional coverages such as accessory coverage, rental reimbursement, and roadside assistance to further tailor your policy.

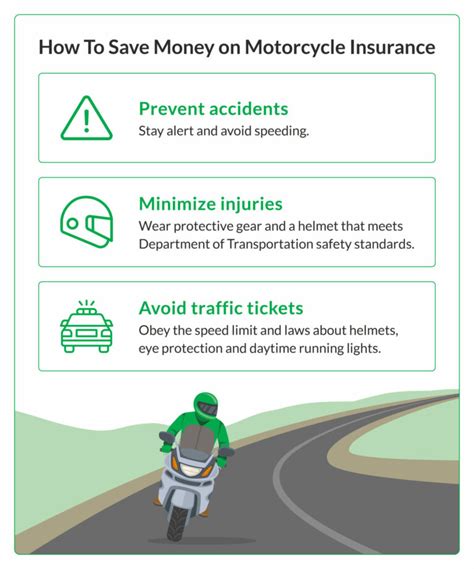

How can I save money on my Progressive motorcycle insurance premiums?

+Progressive offers various discounts to help you save on your insurance premiums. These include multi-policy discounts if you bundle your motorcycle insurance with other Progressive policies, safe rider discounts for maintaining a clean driving record, and loyalty rewards for long-term customers. Additionally, participating in the Snapshot program can potentially lower your premiums based on your driving behavior.