Cars Insurance Companies

In the realm of personal finance and asset protection, few decisions carry as much weight as choosing the right car insurance policy. With a multitude of insurance companies vying for your business, it can be an overwhelming task to navigate the complex web of coverage options, policy terms, and pricing structures. This article aims to demystify the process, providing an in-depth analysis of the key factors to consider when selecting an insurance provider for your vehicle.

Understanding the Fundamentals of Car Insurance

Car insurance is a contract between you, the policyholder, and the insurance company. In exchange for your premium payments, the insurer agrees to financially protect you against specified automobile-related losses, such as damage to your vehicle, injuries to yourself or others, or theft. The specific coverage and limits you receive depend on the type of policy you purchase and the additional endorsements or riders you choose.

The core components of a car insurance policy typically include liability coverage, which protects you if you're found at fault in an accident, and property damage coverage, which covers the cost of repairing or replacing your vehicle after an accident. Additionally, comprehensive and collision coverage can be added to provide protection against non-accident-related incidents, such as vandalism, natural disasters, or animal collisions.

Assessing Your Coverage Needs

When evaluating car insurance options, it’s crucial to first assess your specific coverage needs. Consider the following factors:

Risk Profile

Your risk profile is a significant determinant of the type and extent of coverage you require. If you have a clean driving record and reside in a low-risk area, you may be comfortable with a more basic policy. However, if you have a history of accidents or live in an area with high crime rates, you might benefit from more comprehensive coverage.

Vehicle Type and Value

The type and value of your vehicle also play a pivotal role in your insurance needs. For instance, if you own an expensive luxury car, you’ll likely want to ensure it’s covered for its full replacement value. On the other hand, if you drive an older, less valuable vehicle, you may be able to save money by opting for a policy with lower coverage limits.

Personal Financial Considerations

Your personal financial situation is another critical factor. While it may be tempting to opt for the most extensive coverage available, you must ensure that the premiums fit within your budget. Consider your disposable income and set a realistic budget for your insurance expenses.

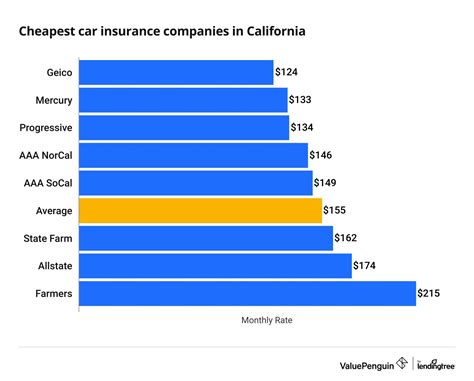

Comparing Insurance Companies: A Deep Dive

Once you’ve assessed your coverage needs, it’s time to delve into the world of insurance companies. Each provider offers unique policies, coverage options, and pricing structures. Here’s a comprehensive guide to help you navigate the market effectively.

Reputation and Financial Stability

When choosing an insurance company, it’s essential to consider its reputation and financial stability. Look for companies with a strong track record of satisfying customer claims and maintaining financial solvency. You can refer to industry ratings from reputable agencies like AM Best, Standard & Poor’s, or Moody’s to assess a company’s financial strength.

Policy Options and Customization

Insurance companies offer a range of policy options to cater to diverse customer needs. Some providers specialize in offering highly customizable policies, allowing you to tailor your coverage to your specific requirements. Others may provide more standardized policies with less flexibility. Consider your preference for customization and choose a company that aligns with your needs.

Coverage Limits and Deductibles

The coverage limits and deductibles offered by insurance companies can vary significantly. Higher coverage limits typically provide more comprehensive protection but come with higher premiums. Similarly, while lower deductibles may be more appealing, they often result in higher premiums as well. Carefully weigh your risk tolerance and financial capacity when selecting coverage limits and deductibles.

| Company | Coverage Limits | Deductibles |

|---|---|---|

| Company A | $1,000,000 | $500 |

| Company B | $500,000 | $250 |

| Company C | $2,000,000 | $1,000 |

Discounts and Rewards

Insurance companies often provide discounts and rewards to attract and retain customers. These can include multi-policy discounts (if you bundle your car insurance with other policies, such as home or life insurance), safe driver discounts, good student discounts, and loyalty rewards. Be sure to inquire about these incentives when comparing providers, as they can significantly reduce your overall premium costs.

Claims Process and Customer Service

The efficiency and effectiveness of an insurance company’s claims process can be a critical factor in your overall satisfaction. Look for companies with a proven track record of prompt and fair claim settlements. Additionally, evaluate the quality of their customer service, including the availability of support staff, the responsiveness of their representatives, and the ease of accessing policy information and making changes.

Technology and Digital Tools

In today’s digital age, many insurance companies are investing in technology to enhance the customer experience. Look for providers that offer user-friendly online portals, mobile apps, and other digital tools that allow you to manage your policy, file claims, and access important documents easily. These technological advancements can streamline the insurance process and provide added convenience.

Industry Insights and Expert Tips

To further assist you in your car insurance journey, here are some valuable insights and tips from industry experts:

The Bottom Line

Selecting the right car insurance company is a critical decision that can impact your financial security and peace of mind. By thoroughly assessing your coverage needs, comparing insurance providers, and leveraging industry insights and expert tips, you can make an informed choice that best suits your unique circumstances. Remember, the goal is to find a balance between comprehensive coverage and affordable premiums, ensuring you’re protected without straining your budget.

Frequently Asked Questions

What factors influence car insurance rates?

+Car insurance rates are influenced by various factors, including your age, gender, driving record, credit score, the type of vehicle you drive, and the area you live in. Insurance companies use these factors to assess your risk profile and determine your premium.

How can I save money on car insurance premiums?

+There are several strategies to reduce your car insurance premiums. These include shopping around for quotes, maintaining a clean driving record, increasing your deductible, bundling policies, and taking advantage of discounts offered by insurance companies, such as safe driver discounts or good student discounts.

What should I do if I’m involved in an accident?

+If you’re involved in an accident, the first step is to ensure the safety of yourself and others involved. Exchange contact and insurance information with the other driver(s) and call the police to file a report. Notify your insurance company as soon as possible, providing them with all relevant details. Take photos of the accident scene and any damages to your vehicle.