Health Insurance For Cheap

Health insurance is a crucial aspect of financial planning and personal well-being, ensuring that individuals and families have access to necessary medical care without facing overwhelming costs. While the concept of affordable health insurance may seem elusive, with the right strategies and understanding of the market, it is possible to secure comprehensive coverage at a reasonable price. This article aims to provide an in-depth guide on how to navigate the health insurance landscape to find the best deals, offering a comprehensive strategy to make healthcare more accessible and affordable.

Understanding Health Insurance Options

The first step towards obtaining cheap health insurance is comprehending the various types of plans available and their unique features. Health insurance plans can be broadly categorized into four main types: Health Maintenance Organizations (HMOs), Preferred Provider Organizations (PPOs), Exclusive Provider Organizations (EPOs), and Point-of-Service (POS) plans. Each type offers distinct coverage and network options, influencing the cost and accessibility of healthcare services.

Health Maintenance Organizations (HMOs)

HMOs are known for their cost-effectiveness and comprehensive coverage. These plans typically require members to select a primary care physician (PCP) who coordinates their healthcare needs. Referrals from the PCP are often necessary to see specialists, and out-of-network care is generally not covered. While HMOs may have more restrictions, they can provide significant cost savings, making them an attractive option for those seeking affordable insurance.

| Pros | Cons |

|---|---|

| Lower premiums and deductibles | Limited choice of providers |

| Comprehensive coverage | Need for referrals to specialists |

| Preventive care often covered | No coverage for out-of-network care |

Preferred Provider Organizations (PPOs)

PPOs offer more flexibility compared to HMOs, allowing members to choose from a network of preferred providers without requiring referrals. Members have the freedom to visit any in-network provider, and out-of-network care is often covered at a higher cost. PPOs are a popular choice for those who value the ability to choose their healthcare providers and may be willing to pay slightly higher premiums for this flexibility.

| Pros | Cons |

|---|---|

| No need for referrals | Higher premiums compared to HMOs |

| Flexibility to choose providers | Out-of-network care is more expensive |

| Cover a wide range of services | May have higher deductibles |

Exclusive Provider Organizations (EPOs)

EPOs are similar to HMOs in that they require members to choose a primary care physician and referrals for specialist care. However, unlike HMOs, EPOs do not cover out-of-network care, except in emergencies. This restriction makes EPOs more affordable than PPOs but less flexible than HMOs.

| Pros | Cons |

|---|---|

| Lower premiums than PPOs | Limited provider choices |

| Comprehensive in-network coverage | No coverage for out-of-network care |

| Preventive care often included | Need for referrals to specialists |

Point-of-Service (POS) Plans

POS plans combine elements of both HMOs and PPOs. Members can choose a primary care physician and are typically required to obtain referrals for specialist care. However, like PPOs, POS plans cover out-of-network care at a higher cost. POS plans offer a balance between the flexibility of PPOs and the cost-effectiveness of HMOs, making them a popular choice for those seeking a middle ground.

| Pros | Cons |

|---|---|

| Flexibility to choose providers | May have higher premiums |

| Cover a wide range of services | Out-of-network care is more expensive |

| Preventive care often included | Need for referrals to specialists |

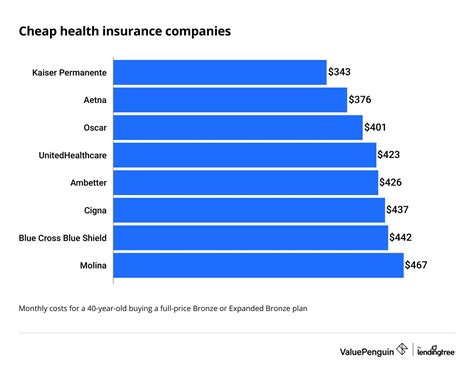

Shopping Around for the Best Deals

Once you have a grasp of the different health insurance plan types, it’s time to start comparing options and searching for the best deals. Here are some key strategies to help you find affordable health insurance:

Utilize Online Comparison Tools

Online comparison tools are a valuable resource when shopping for health insurance. These platforms allow you to input your specific needs and preferences, and they generate a list of plans that match your criteria. By using these tools, you can quickly compare premiums, deductibles, and coverage details across multiple insurers, making it easier to identify the most cost-effective options.

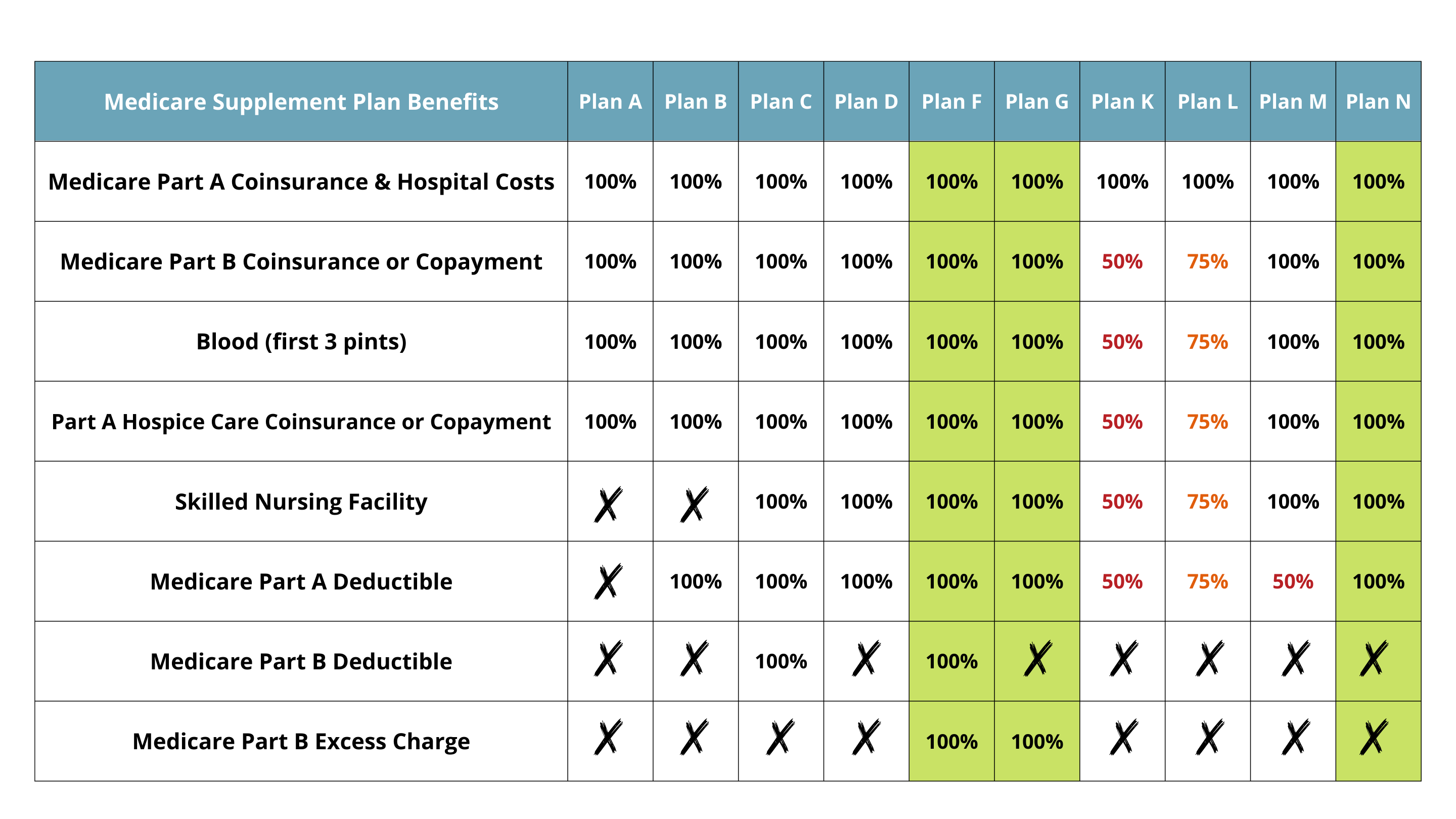

Consider Government-Sponsored Programs

If you meet certain eligibility criteria, government-sponsored health insurance programs can provide affordable coverage. For example, Medicaid offers health coverage to low-income individuals and families, while Medicare caters to individuals aged 65 and older, as well as those with specific disabilities. Exploring these options can lead to significant cost savings.

Shop During Open Enrollment Periods

Health insurance plans typically have specific enrollment periods, with the most common being the annual Open Enrollment Period (OEP). During this time, you can enroll in a new plan, switch plans, or make changes to your existing coverage. Staying informed about these periods ensures you don’t miss out on the opportunity to secure the best deals.

Explore Employer-Sponsored Plans

Many employers offer health insurance plans as part of their benefits package. These plans can provide significant cost savings, as employers often contribute a portion of the premium. Additionally, employer-sponsored plans may offer more comprehensive coverage and additional perks, such as wellness programs or discounted gym memberships.

Consider Short-Term Plans

If you’re between jobs or facing a gap in coverage, short-term health insurance plans can provide a temporary solution. These plans typically have lower premiums and offer coverage for a limited period, usually ranging from a few months to a year. While they may not provide the same level of comprehensive coverage as traditional plans, they can bridge the gap until you secure more permanent coverage.

Negotiate Your Premiums

Don’t be afraid to negotiate your premiums with insurance providers. Some insurers may be willing to offer discounts or waive certain fees, especially if you have a strong relationship with the company or have been a long-term customer. Negotiating can lead to significant savings over time.

Bundle Your Policies

If you have multiple insurance needs, such as health, auto, and home insurance, consider bundling your policies with the same insurer. Many insurers offer discounts when you combine multiple policies, resulting in potential savings on your health insurance premiums.

Maximizing Your Health Insurance Benefits

Once you’ve secured affordable health insurance, it’s important to understand how to make the most of your coverage. Here are some strategies to ensure you’re getting the best value from your plan:

Utilize Preventive Care Services

Most health insurance plans cover a range of preventive care services, such as annual physical exams, immunizations, and screenings, at little to no cost. Taking advantage of these services can help identify potential health issues early on, leading to better overall health and potentially reducing future healthcare costs.

Understand Your Network

Familiarize yourself with your health insurance network, including the providers and facilities that are in-network. Using in-network providers can result in lower out-of-pocket costs, as these providers have negotiated rates with your insurer. Knowing your network can help you make informed decisions about your healthcare and avoid unexpected expenses.

Review Your Explanation of Benefits (EOB)

After receiving healthcare services, you’ll typically receive an Explanation of Benefits (EOB) from your insurer. This document outlines the charges submitted by your healthcare provider, the amount covered by your insurance, and any remaining balance you’re responsible for. Reviewing your EOB can help you identify potential billing errors and ensure you’re not overpaying for services.

Utilize Telehealth Services

Telehealth services, which allow you to consult with healthcare providers remotely, can be a cost-effective way to access medical care. Many health insurance plans now cover telehealth services, providing convenient access to healthcare professionals without the need for in-person visits. This can be especially beneficial for minor illnesses or routine follow-ups.

Take Advantage of Wellness Programs

Many health insurance plans offer wellness programs or incentives to encourage healthy behaviors. These programs may include gym membership discounts, smoking cessation programs, or weight loss initiatives. Participating in these programs can not only improve your overall health but also potentially lower your insurance premiums or qualify you for additional rewards.

Future Trends and Innovations in Affordable Health Insurance

The health insurance landscape is continually evolving, with new innovations and trends shaping the industry. Staying informed about these developments can help you make more informed decisions about your coverage and potentially access even more affordable options in the future.

Telemedicine and Digital Health

The rise of telemedicine and digital health technologies is transforming the way healthcare is delivered. These innovations allow for remote consultations, virtual check-ins, and even remote monitoring of chronic conditions. As these technologies become more integrated into healthcare, they have the potential to lower costs and improve access to care, particularly for individuals in rural or underserved areas.

Value-Based Care Models

Value-based care models are gaining traction in the healthcare industry, focusing on delivering high-quality care while controlling costs. These models reward healthcare providers for achieving positive patient outcomes rather than simply providing more services. By incentivizing efficiency and quality, value-based care has the potential to reduce overall healthcare costs, benefiting both patients and insurers.

Consumer-Directed Health Plans (CDHPs)

Consumer-Directed Health Plans (CDHPs) are gaining popularity as a cost-effective alternative to traditional health insurance plans. CDHPs combine a high-deductible health plan with a tax-advantaged savings account, such as a Health Savings Account (HSA). These plans give individuals more control over their healthcare spending, encouraging them to be more conscious of costs while still providing comprehensive coverage.

Health Insurance Marketplaces

Health insurance marketplaces, such as the Health Insurance Marketplace established by the Affordable Care Act, continue to play a significant role in providing affordable coverage options. These marketplaces offer a centralized platform for individuals and small businesses to compare and purchase health insurance plans. As these marketplaces evolve, they are expected to introduce more innovative features and options, making health insurance more accessible and affordable.

FAQs

What is the difference between a HMO and a PPO plan?

+

HMOs typically have lower premiums and deductibles but require members to choose a primary care physician and obtain referrals for specialist care. PPOs offer more flexibility, allowing members to choose providers without referrals, but they often have higher premiums.

Are there any government programs that offer free or low-cost health insurance?

+

Yes, programs like Medicaid and Medicare provide health coverage to eligible individuals at little to no cost. Medicaid is for low-income individuals and families, while Medicare caters to individuals aged 65 and older, as well as those with specific disabilities.

Can I switch health insurance plans outside of the Open Enrollment Period (OEP)?

+

In certain circumstances, you may be able to switch plans outside of the OEP. These circumstances include losing your current coverage, moving to a new area, or experiencing a significant life event, such as marriage, divorce, or the birth of a child.

How can I save money on prescription medications?

+

Consider using generic medications, which are often significantly cheaper than brand-name drugs. Additionally, some insurers offer prescription savings programs or discounts through their health insurance plans. Exploring these options can help reduce your prescription costs.

What are the benefits of Consumer-Directed Health Plans (CDHPs)?

+

CDHPs give individuals more control over their healthcare spending by combining a high-deductible health plan with a tax-advantaged savings account. This encourages individuals to be more conscious of costs while still providing comprehensive coverage.