One Day Driving Insurance

In today's fast-paced world, flexibility and convenience are key factors in many aspects of our lives, including our insurance needs. This is where One Day Driving Insurance steps in, offering a unique and tailored solution for drivers who require temporary coverage. This innovative concept has gained traction in the insurance industry, catering to a diverse range of scenarios where traditional policies might fall short. From test drives and car rentals to unexpected emergencies, this short-term insurance option provides a reliable safety net, ensuring you're covered when you need it most.

Understanding One Day Driving Insurance

One Day Driving Insurance, as the name suggests, is a type of temporary auto insurance that offers coverage for a single day or a short period of time, typically ranging from a few hours to a week. This specialized policy is designed to cater to a variety of situations where standard, long-term insurance policies might not be practical or necessary. Whether you’re borrowing a friend’s car for an errand, renting a vehicle for a short trip, or facing a sudden mechanical issue with your primary vehicle, this type of insurance provides a quick and convenient solution.

Unlike traditional auto insurance policies that are designed for long-term coverage, often lasting a year or more, One Day Driving Insurance is a flexible and adaptable option. It allows drivers to obtain coverage on-demand, providing peace of mind without the commitment of a long-term contract. This makes it particularly appealing for those who only require insurance for a specific, short-term purpose.

The Benefits and Applications

One of the key advantages of this insurance is its versatility. It can be used in a multitude of scenarios, making it an invaluable tool for drivers. For instance, if you’re planning a road trip and need to rent a car, having a One Day Driving Insurance policy can ensure you’re covered for the duration of your trip. This is especially beneficial for those who don’t own a vehicle or don’t have a personal insurance policy that covers rental cars.

Furthermore, this type of insurance is ideal for those who are borrowing a vehicle. Whether it's a friend's car for a quick errand or a family member's vehicle for a longer trip, having a One Day Driving Insurance policy can provide the necessary coverage, ensuring both parties are protected in case of an accident or other incidents.

| Key Benefits | Real-World Applications |

|---|---|

| Flexibility: Policies can be tailored to cover a few hours to several days. | Covering a test drive for a potential car purchase. |

| Convenience: Obtain coverage quickly, often with minimal paperwork. | Providing coverage for a rental car during a last-minute business trip. |

| Cost-Effectiveness: Ideal for infrequent drivers or short-term needs. | Insuring a borrowed car for a one-time family event. |

Additionally, this insurance option can be a lifesaver in emergency situations. Imagine your primary vehicle breaks down and you need to borrow a car while yours is being repaired. A One Day Driving Insurance policy can ensure you're covered during this temporary period, providing the necessary peace of mind while you navigate unexpected circumstances.

How Does One Day Driving Insurance Work?

The process of acquiring One Day Driving Insurance is designed to be straightforward and efficient. Typically, you can obtain a quote and purchase a policy online or through a mobile app, with some providers even offering instant coverage. The necessary information includes details about the driver, the vehicle, and the period for which coverage is required.

Once the policy is in place, the coverage starts immediately, ensuring you're protected as soon as you hit the road. The policy details will outline the exact scope of coverage, including any limitations or exclusions. It's important to carefully review these terms to ensure you understand what is and isn't covered.

When the insured period is over, the coverage automatically terminates. There's no need for cancellation or additional paperwork, making the entire process hassle-free. This makes One Day Driving Insurance an ideal solution for those who value simplicity and efficiency in their insurance options.

Coverage and Costs

The coverage provided by One Day Driving Insurance policies can vary depending on the provider and the specific needs of the driver. Typically, these policies include liability coverage, which protects the insured driver in case they are at fault in an accident, covering the costs of damages and injuries to the other party involved. Some policies may also include collision coverage, which can help pay for repairs or replacement of the insured vehicle if it’s damaged in an accident.

| Coverage Type | Description |

|---|---|

| Liability Coverage | Protects you if you're at fault in an accident, covering damages and injuries to others. |

| Collision Coverage | Covers repairs or replacement of your vehicle if it's damaged in an accident. |

| Comprehensive Coverage | Provides protection for non-collision incidents like theft, vandalism, or natural disasters. |

| Personal Injury Protection (PIP) | Covers medical expenses and lost wages for the insured driver and passengers. |

In addition to these standard coverages, some One Day Driving Insurance policies may also offer comprehensive coverage, which protects against non-collision incidents such as theft, vandalism, or damage caused by natural disasters. For drivers who want even more protection, Personal Injury Protection (PIP) can be included, which covers medical expenses and lost wages for the insured driver and passengers in the event of an accident.

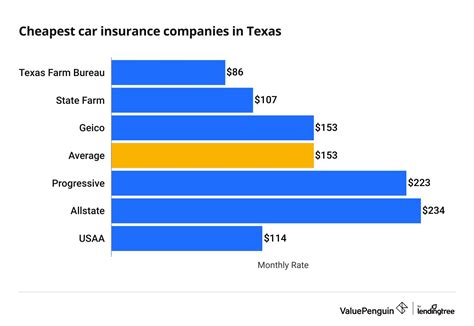

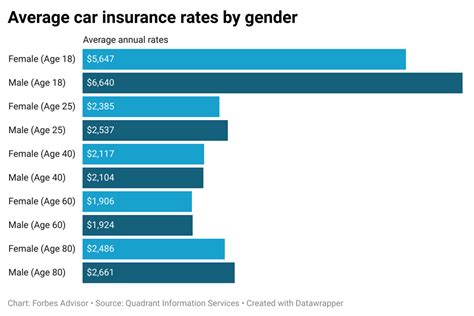

The cost of One Day Driving Insurance can vary significantly depending on a range of factors, including the driver's age, driving record, the type of vehicle being insured, and the duration of coverage. Generally, shorter periods of coverage tend to be more cost-effective, making this type of insurance an attractive option for those who only need temporary coverage.

The Future of On-Demand Insurance

The concept of One Day Driving Insurance is a testament to the evolving nature of the insurance industry. As our lives become increasingly fast-paced and unpredictable, the demand for flexible, on-demand insurance solutions is rising. This trend is not limited to auto insurance; we’re seeing similar innovations in home, travel, and even health insurance, with providers offering more tailored and customizable coverage options.

The success and popularity of One Day Driving Insurance have paved the way for further innovations in the insurance sector. Insurers are now exploring ways to make insurance even more accessible and tailored to individual needs. This includes the development of digital platforms that allow for real-time quotes and policy purchases, as well as the integration of advanced technologies like AI and machine learning to enhance risk assessment and claim processing.

Potential Impact on the Industry

The rise of One Day Driving Insurance and similar on-demand insurance models could have a significant impact on the traditional insurance landscape. For one, it encourages a shift towards more flexible and consumer-centric insurance products. This could lead to increased competition among insurers, driving innovation and potentially lowering prices for consumers.

Moreover, the success of on-demand insurance models could encourage insurers to reevaluate their existing business models. This could result in a broader range of insurance options, catering to a diverse set of consumer needs and preferences. It may also lead to the development of more specialized insurance products, designed to address specific, niche market demands.

| Potential Industry Impact | Description |

|---|---|

| Increased Competition | On-demand insurance encourages more insurers to offer flexible, tailored policies, leading to competitive pricing and innovative products. |

| Shift Towards Consumer-Centric Models | Insurers may prioritize consumer needs and preferences, offering a wider range of customizable coverage options. |

| Specialized Insurance Products | The success of on-demand insurance may inspire the development of niche insurance products catering to specific market segments. |

Additionally, the success of One Day Driving Insurance could encourage a shift towards a more digital and tech-driven insurance industry. As consumers become more comfortable with purchasing insurance online, insurers may further invest in digital technologies to enhance the customer experience and streamline operations. This could include the use of AI for risk assessment and personalized insurance recommendations, as well as the development of mobile apps for easier policy management and claim filing.

Conclusion: Embracing Flexibility in Insurance

One Day Driving Insurance represents a significant shift in the insurance industry, offering drivers a flexible and tailored solution for their temporary coverage needs. This innovative concept has not only provided a valuable service to drivers but has also paved the way for further advancements in on-demand insurance. As we move towards a more digital and fast-paced world, the demand for such flexible insurance options is likely to grow, shaping the future of the insurance industry and offering consumers greater control over their insurance choices.

How do I know if One Day Driving Insurance is suitable for my needs?

+One Day Driving Insurance is ideal for those who need temporary coverage, such as when borrowing a vehicle or renting a car. It’s a cost-effective solution for infrequent drivers or those who only require insurance for a specific, short-term purpose. If you’re unsure, it’s always best to consult with an insurance professional to determine the most suitable coverage for your needs.

Can I get One Day Driving Insurance if I have a standard auto insurance policy?

+Yes, One Day Driving Insurance can be a valuable addition to your existing auto insurance policy. It provides coverage for specific, temporary situations that your standard policy might not cover. For instance, if you’re renting a car for a vacation or borrowing a friend’s vehicle, having a One Day Driving Insurance policy ensures you’re protected during those times.

What happens if I have an accident while covered by One Day Driving Insurance?

+In the event of an accident while covered by One Day Driving Insurance, the process is similar to that of a standard auto insurance policy. You would need to contact the insurance provider and provide the necessary details, such as the date, time, and location of the accident, as well as any relevant information about the other party involved. The insurance provider will then guide you through the claims process, which may involve an investigation and an assessment of the damages.