Full Coverage Car Insurance Quotes

Welcome to our comprehensive guide on Full Coverage Car Insurance Quotes! In this article, we will delve into the world of automotive insurance, exploring the ins and outs of full coverage policies and providing you with valuable insights to help you make informed decisions. Whether you're a seasoned driver or a newcomer to the world of insurance, this guide will equip you with the knowledge needed to navigate the complex landscape of car insurance coverage.

Understanding Full Coverage Car Insurance

Full coverage car insurance is a comprehensive insurance policy designed to provide extensive protection for vehicle owners. Unlike basic liability coverage, which only covers damages caused to others, full coverage extends its reach to protect your own vehicle as well. This type of insurance policy offers a safety net against a wide range of potential risks and liabilities that drivers may encounter on the road.

Full coverage insurance typically includes:

- Collision Coverage: Pays for repairs or replacements if your vehicle is damaged in an accident, regardless of fault.

- Comprehensive Coverage: Covers non-accident-related damages, such as theft, vandalism, natural disasters, and animal collisions.

- Liability Coverage: Provides financial protection if you're found at fault for causing injuries or property damage to others.

- Medical Payments (MedPay) or Personal Injury Protection (PIP): Covers medical expenses for you and your passengers, regardless of fault.

- Uninsured/Underinsured Motorist Coverage: Protects you if an at-fault driver lacks sufficient insurance coverage.

By opting for full coverage, drivers gain peace of mind knowing that they are safeguarded against a multitude of unforeseen circumstances that could otherwise result in significant financial burdens.

Factors Influencing Full Coverage Quotes

The cost of full coverage car insurance quotes can vary significantly based on several key factors. Understanding these factors can help you estimate the potential cost of your insurance policy and make informed choices.

Vehicle Make and Model

The type of vehicle you drive plays a pivotal role in determining your insurance rates. Factors such as the vehicle’s safety ratings, repair costs, and theft frequency can impact the overall insurance premium. For instance, luxury vehicles or sports cars often command higher insurance costs due to their expensive repair and replacement parts.

Driver’s Profile and History

Insurance providers thoroughly examine a driver’s profile and history to assess their level of risk. Factors such as age, gender, driving record, and years of driving experience are considered. Young, inexperienced drivers, for example, may face higher insurance premiums due to their increased likelihood of accidents. Similarly, drivers with a history of accidents or traffic violations may also see elevated insurance costs.

Location and Usage

The area where you live and the intended usage of your vehicle can significantly influence insurance quotes. Urban areas, for instance, often have higher insurance rates due to increased traffic congestion and the higher likelihood of accidents and theft. Additionally, if you primarily use your vehicle for commuting or long-distance travel, insurance costs may be higher compared to those who primarily drive for leisure or short distances.

Coverage Options and Deductibles

The level of coverage you choose and the associated deductibles also impact insurance quotes. Higher coverage limits and lower deductibles generally result in higher insurance premiums. It’s crucial to strike a balance between the coverage you need and the cost you’re willing to bear.

| Coverage Option | Description |

|---|---|

| Liability Coverage | Protects you against claims for bodily injury or property damage caused to others. |

| Collision Coverage | Covers damage to your vehicle resulting from a collision with another vehicle or object. |

| Comprehensive Coverage | Protects against non-collision incidents like theft, vandalism, or natural disasters. |

| Uninsured/Underinsured Motorist Coverage | Provides protection if an at-fault driver lacks sufficient insurance. |

It's essential to carefully consider your coverage needs and select the options that provide adequate protection without being excessive.

Tips for Obtaining Affordable Full Coverage Quotes

While full coverage car insurance may be more expensive than basic liability coverage, there are strategies you can employ to obtain more affordable quotes. Here are some tips to consider:

Shop Around and Compare

Insurance rates can vary significantly between providers. Take the time to compare quotes from multiple insurers to find the best deal. Online quote comparison tools can be a convenient way to quickly assess a range of options.

Improve Your Driving Record

A clean driving record is a powerful tool when it comes to negotiating insurance rates. Avoid traffic violations and strive to maintain a safe driving history. Over time, this can lead to reduced insurance premiums.

Consider Higher Deductibles

Opting for a higher deductible can lower your insurance premiums. However, it’s important to choose a deductible amount that you can comfortably afford in the event of a claim. A higher deductible means you’ll pay more out of pocket when filing a claim, so be sure to select a deductible that aligns with your financial capabilities.

Bundle Your Policies

If you have multiple insurance needs, such as home and auto insurance, consider bundling your policies with the same provider. Many insurers offer discounts when you bundle multiple policies, resulting in significant savings.

Explore Discounts

Insurance providers often offer a variety of discounts to attract and retain customers. Common discounts include safe driver discounts, good student discounts, loyalty discounts, and multi-car discounts. Be sure to inquire about the discounts available and see if you qualify for any of them.

The Importance of Full Coverage Car Insurance

While full coverage car insurance may come at a higher cost compared to basic liability coverage, it offers a robust layer of protection that can prove invaluable in certain situations. Here’s why full coverage is essential:

Financial Protection in Case of Accidents

Accidents can happen to anyone, and the financial implications can be severe. Full coverage insurance provides a safety net by covering the costs of repairs or replacements for your vehicle, as well as any medical expenses for you and your passengers. This can alleviate the financial burden and provide peace of mind during challenging times.

Protection Against Uninsured/Underinsured Drivers

Unfortunately, not all drivers carry sufficient insurance coverage. In the event of an accident caused by an uninsured or underinsured driver, full coverage insurance steps in to protect you. This coverage ensures that you’re not left bearing the financial brunt of another driver’s negligence.

Comprehensive Coverage for Unexpected Events

Life is full of unexpected twists and turns, and full coverage insurance is designed to provide protection against a wide range of unforeseen circumstances. From theft and vandalism to natural disasters, comprehensive coverage ensures that your vehicle is protected even when accidents aren’t involved.

Conclusion

Full coverage car insurance quotes offer a comprehensive approach to safeguarding your vehicle and providing financial protection in various scenarios. By understanding the factors that influence insurance rates and implementing strategic approaches to obtain affordable quotes, you can ensure that you’re adequately protected without breaking the bank. Remember, when it comes to car insurance, it’s always better to be safe than sorry.

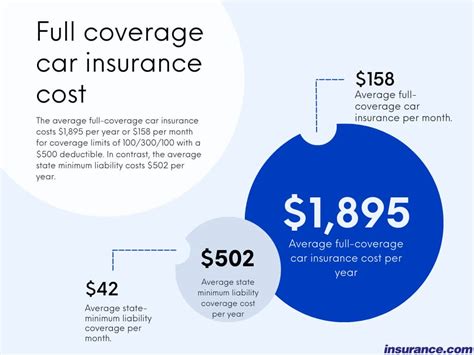

What is the average cost of full coverage car insurance in the United States?

+The average cost of full coverage car insurance in the US varies widely depending on factors such as location, driving history, and vehicle type. On average, full coverage insurance can range from 1,000 to 2,500 annually. However, it’s important to obtain personalized quotes to get an accurate estimate for your specific circumstances.

Can I get full coverage car insurance if I have a poor credit score?

+Yes, it is possible to obtain full coverage car insurance even with a poor credit score. However, insurance providers may consider credit history when determining insurance rates. Individuals with lower credit scores may face higher insurance premiums. It’s advisable to shop around and compare quotes to find the most affordable option.

Are there any disadvantages to full coverage car insurance?

+While full coverage insurance provides extensive protection, it comes at a higher cost compared to basic liability coverage. Additionally, some insurance providers may require a higher deductible for full coverage policies, which means you’ll have to pay more out of pocket when filing a claim. It’s essential to carefully consider your coverage needs and budget before opting for full coverage.