Best Dog Health Insurance

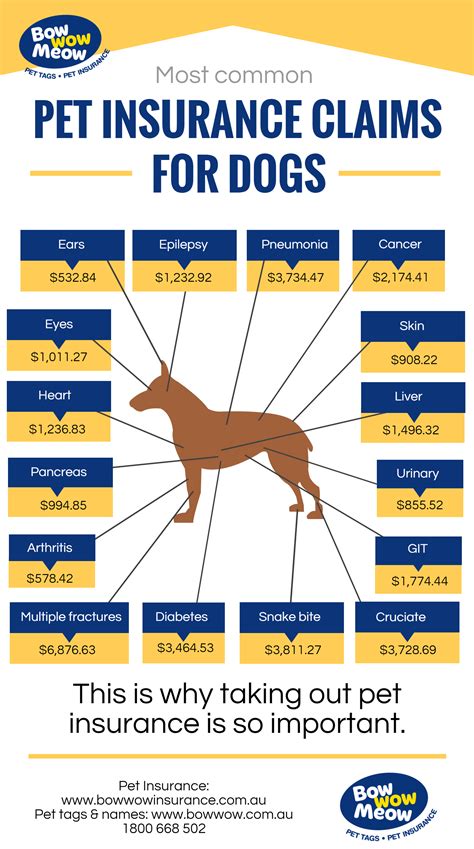

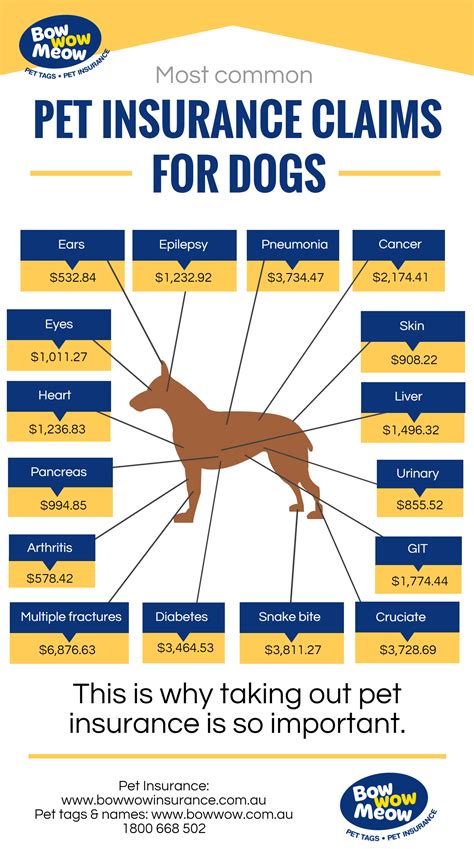

Ensuring the well-being of our furry companions is a top priority for any pet owner. In recent years, dog health insurance has emerged as a popular and practical way to provide comprehensive care for our four-legged friends. With the rising costs of veterinary services and unexpected medical emergencies, having a solid health insurance plan can offer peace of mind and financial security. In this article, we delve into the world of dog health insurance, exploring the best options available to ensure your canine companion receives the best care possible.

Understanding the Importance of Dog Health Insurance

Dog health insurance is designed to cover a wide range of veterinary expenses, from routine check-ups and vaccinations to emergency surgeries and chronic illness treatments. By investing in a suitable insurance plan, pet owners can access quality veterinary care without the burden of hefty medical bills. This financial safety net allows owners to focus on their dog’s health and well-being, rather than worrying about the financial implications.

The benefits of dog health insurance extend beyond financial protection. Many insurance providers offer additional perks such as 24/7 veterinary helplines, discounts on pet supplies, and access to a network of trusted veterinarians. These added services can greatly enhance the overall health and happiness of our canine companions.

Factors to Consider When Choosing the Best Dog Health Insurance

With numerous options available in the market, selecting the best dog health insurance plan can be a daunting task. Here are some key factors to consider when making your decision:

Coverage Options

Examine the coverage offered by different insurance providers. Look for plans that provide comprehensive coverage for both routine and unexpected medical issues. Consider the following aspects:

- Routine Care Coverage: Ensure the plan covers annual check-ups, vaccinations, and parasite prevention treatments.

- Emergency and Illness Coverage: Check for coverage limits and any exclusions for specific conditions or pre-existing illnesses.

- Prescription Medication Coverage: Some plans may include coverage for prescription drugs, which can be beneficial for dogs with ongoing medical conditions.

- Specialist Care Coverage: Inquire about coverage for specialist referrals, including advanced diagnostics and treatments.

Cost and Deductibles

Evaluate the monthly premiums and deductibles associated with each plan. While it’s tempting to opt for the cheapest option, consider the overall value and coverage provided. A higher premium may offer better coverage and lower deductibles, making it more cost-effective in the long run.

Additionally, some insurance providers offer customizable plans with different coverage levels and deductibles. Assess your dog's health history and future needs to determine the most suitable option for your budget.

Reputation and Customer Satisfaction

Research the reputation and customer satisfaction ratings of the insurance provider. Look for reviews and testimonials from existing policyholders to gauge their experience with the company. A reputable provider with positive feedback is more likely to offer reliable and prompt services when you need them.

Claim Process and Timelines

Understand the claim process and timelines involved. Inquire about the documentation required, reimbursement procedures, and any potential delays. A streamlined and efficient claim process can make a significant difference during times of emergency.

Additional Benefits and Perks

Explore the extra benefits and perks offered by different insurance providers. Some plans may include coverage for alternative therapies, such as acupuncture or hydrotherapy, which can enhance your dog’s overall health and recovery.

Additionally, consider additional services like behavioral training coverage, microchipping discounts, or pet travel insurance. These add-ons can provide extra value and peace of mind.

Top Dog Health Insurance Providers

Now that we’ve discussed the key factors to consider, let’s explore some of the top dog health insurance providers in the market:

PetPlan

PetPlan is a well-known and reputable insurance provider, offering comprehensive coverage for dogs. Their plans include:

- Routine Care: Coverage for annual check-ups, vaccinations, and parasite prevention.

- Illness and Injury Coverage: Up to 90% reimbursement for eligible conditions, including chronic illnesses.

- Prescription Medication: Coverage for prescription drugs, including long-term medications.

- Alternative Therapies: Reimbursement for treatments like acupuncture and physiotherapy.

PetPlan’s plans are customizable, allowing pet owners to choose their desired coverage limits and deductibles. They also offer a dedicated 24⁄7 helpline and a network of trusted veterinarians.

Healthy Paws

Healthy Paws is another highly regarded insurance provider, known for its excellent customer service and comprehensive coverage. Their plans include:

- Unlimited Annual Benefits: No annual limits on claim reimbursements, ensuring peace of mind for unexpected illnesses or injuries.

- Wellness Coverage: Optional add-on for routine care, including vaccinations and parasite prevention.

- Chronic Condition Coverage: Coverage for ongoing medical conditions, providing financial support for long-term treatments.

- Quick Claim Processing: Efficient claim processing with reimbursements typically within 10 days.

Healthy Paws also offers a mobile app for easy claim submissions and provides access to a network of licensed veterinarians.

Trupanion

Trupanion is a leading insurance provider, offering innovative and comprehensive coverage for dogs. Their plans include:

- 90% Reimbursement: Reimbursement for 90% of eligible veterinary expenses, providing significant financial support.

- No Deductibles: Unlike many other providers, Trupanion does not require deductibles, making their plans more cost-effective.

- Direct Payment Option: They offer a direct payment option, where the veterinarian is paid directly, reducing the financial burden on pet owners.

- Unlimited Lifetime Coverage: No annual or lifetime limits on claim reimbursements, ensuring long-term financial protection.

Trupanion’s plans are highly customizable, allowing pet owners to choose their desired coverage limits and add-ons. They also provide access to a 24⁄7 helpline and a network of preferred veterinarians.

Embrace

Embrace is a popular insurance provider known for its innovative approach and customer-centric plans. Their plans include:

- Routine Care Coverage: Coverage for annual check-ups, vaccinations, and spay/neuter surgeries.

- Wellness Rewards: An optional add-on that provides reimbursement for preventive care, including dental cleanings and heartworm tests.

- Chronic Condition Support: Coverage for chronic illnesses, with no limits on claim reimbursements for eligible conditions.

- Pet Parent Perks: Embrace offers additional benefits such as discounted boarding, grooming, and training services.

Embrace’s plans are designed to be flexible and customizable, allowing pet owners to choose their desired coverage and add-ons. They also provide a mobile app for easy claim submissions and access to a 24⁄7 helpline.

ASPCA Pet Health Insurance

ASPCA Pet Health Insurance is a well-established provider, offering a range of plans to suit different needs. Their plans include:

- Routine Care Coverage: Coverage for annual exams, vaccinations, and flea/tick prevention.

- Accident-Only Plans: Ideal for pet owners seeking coverage for unexpected accidents, providing reimbursement for related expenses.

- Comprehensive Plans: Comprehensive coverage for accidents, illnesses, and routine care, with various coverage levels to choose from.

- Add-on Options: ASPCA offers additional coverage for prescription medications, behavioral therapy, and alternative therapies.

ASPCA’s plans are designed to be affordable and flexible, with customizable coverage limits and deductibles. They also provide access to a 24⁄7 helpline and a network of trusted veterinarians.

Real-Life Success Stories

To further illustrate the benefits of dog health insurance, let’s explore some real-life success stories:

Bella's Story: Bella, a 7-year-old Labrador Retriever, was diagnosed with a serious heart condition. With the help of her Healthy Paws insurance plan, her owners were able to access specialized veterinary care without worrying about the financial burden. Healthy Paws' unlimited annual benefits allowed them to focus on Bella's treatment and recovery, and she is now living a happy and healthy life.

Max's Journey: Max, a 4-year-old German Shepherd, suffered a severe injury during a hiking trip. His owners, who had invested in Trupanion's insurance plan, were relieved to find that Trupanion's direct payment option covered the emergency surgery and subsequent rehabilitation. Max made a full recovery, and his owners were grateful for the financial support and efficient claim process.

Luna's Wellness Journey: Luna, a 2-year-old Poodle, had always been a healthy and active dog. Her owners opted for Embrace's Wellness Rewards add-on, which covered her annual check-ups, vaccinations, and dental cleanings. This allowed them to prioritize Luna's preventive care and ensure her long-term health and well-being.

Choosing the Right Plan for Your Dog

When selecting a dog health insurance plan, it’s essential to consider your dog’s age, breed, and health history. Younger dogs may be eligible for a wider range of coverage options, while older dogs may require plans with specific chronic illness coverage. Additionally, certain breeds are prone to specific health conditions, so choosing a plan that covers those predispositions is crucial.

It's also important to review the fine print and understand any exclusions or limitations within the plan. Some plans may have waiting periods for certain conditions or may not cover pre-existing illnesses. Ensure you thoroughly understand the terms and conditions before making your decision.

Future of Dog Health Insurance

The dog health insurance industry is constantly evolving, with providers introducing innovative features and technologies to enhance the overall experience. Here are some potential future developments to look out for:

- Telemedicine Integration: The integration of telemedicine services into dog health insurance plans can provide convenient and cost-effective options for minor health issues and routine consultations.

- Advanced Diagnostic Coverage: As veterinary medicine advances, insurance providers may expand their coverage to include more advanced diagnostic tests and treatments, ensuring pets receive the best possible care.

- Wellness Incentive Programs: Insurance providers may introduce incentive programs to encourage pet owners to prioritize preventive care, rewarding them with lower premiums or additional benefits.

- Personalized Plans: With advancements in data analysis, insurance providers may develop personalized plans based on an individual dog's health history and risk factors, offering tailored coverage and potentially lower premiums.

Conclusion

Dog health insurance is an invaluable investment for any pet owner, providing financial security and peace of mind. By understanding the key factors to consider and exploring the top insurance providers, you can make an informed decision to ensure your furry friend receives the best possible care. Remember, a healthy dog is a happy dog, and with the right insurance plan, you can focus on creating a lifetime of cherished memories together.

Can I get insurance for my senior dog?

+Yes, many insurance providers offer plans specifically tailored for senior dogs. These plans often provide coverage for age-related conditions and chronic illnesses. However, it’s important to note that some providers may have age restrictions or higher premiums for older dogs.

What is the average cost of dog health insurance?

+The cost of dog health insurance can vary widely depending on factors such as your dog’s age, breed, location, and the coverage level you choose. On average, monthly premiums range from 30 to 100, but can be higher or lower depending on your specific circumstances.

Do all insurance providers cover pre-existing conditions?

+No, not all insurance providers cover pre-existing conditions. Most plans have a waiting period or exclusion for pre-existing illnesses. It’s important to carefully review the policy details and understand the coverage limitations before purchasing a plan.

Can I switch insurance providers if I’m not satisfied with my current plan?

+Yes, you have the option to switch insurance providers if you’re not satisfied with your current plan. However, it’s important to note that pre-existing conditions may not be covered by a new provider, and there may be waiting periods or exclusions. It’s advisable to carefully research and compare plans before making a switch.

How can I save money on dog health insurance premiums?

+There are several ways to save money on dog health insurance premiums. You can consider higher deductibles or choose plans with lower coverage limits to reduce your monthly premiums. Additionally, some providers offer discounts for multiple pets, early enrollment, or annual payments. It’s worth exploring these options to find the most cost-effective plan for your needs.