Car Texas Insurance

In the vast landscape of the United States, the Lone Star State, Texas, stands as a beacon of unique cultural blend and diverse population. This diverse state, with its thriving cities and wide-open spaces, presents a distinct set of challenges and opportunities when it comes to auto insurance. Texas, with its expansive roads and vibrant communities, demands a comprehensive understanding of the local insurance landscape. This guide delves deep into the world of Car Insurance in Texas, offering an expert's perspective on navigating this essential aspect of daily life.

The Unraveling of Texas Car Insurance: An Expert’s Guide

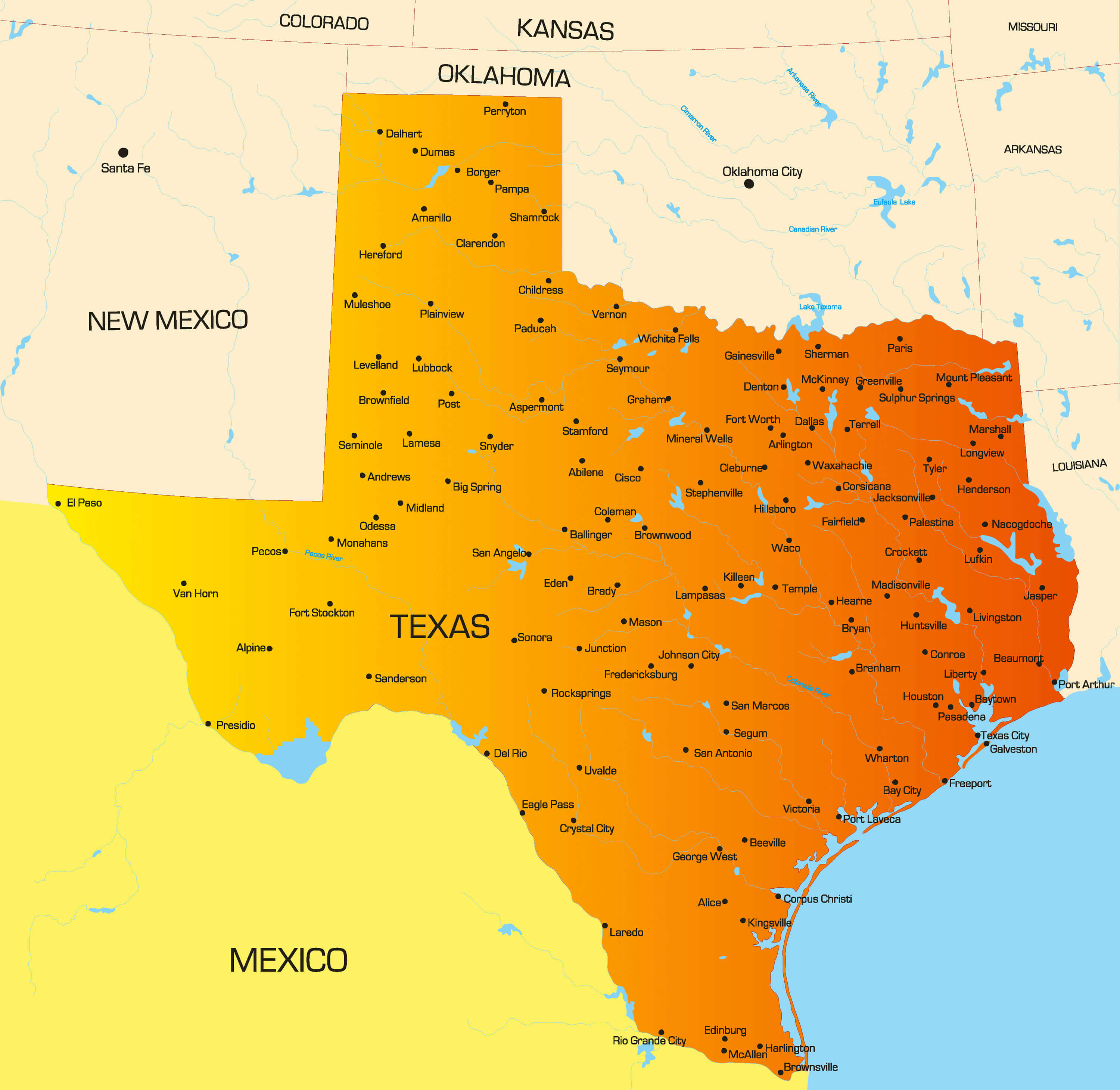

Texas, with its rich history and diverse population, presents a unique tapestry when it comes to car insurance. Understanding the intricacies of the Texas insurance landscape is pivotal for residents and visitors alike. From the bustling streets of Houston to the wide-open spaces of the Panhandle, the Lone Star State demands a tailored approach to auto insurance.

The Legal Landscape: Understanding Texas Insurance Laws

Texas operates under a tort system for auto insurance, which means that drivers are legally responsible for the damages they cause in an accident. This system differs from a no-fault system, where drivers typically seek compensation from their own insurance provider, regardless of who caused the accident. In Texas, understanding the tort system is crucial for drivers to ensure they are adequately protected.

The minimum liability coverage required by Texas law is $30,000 for bodily injury per person, $60,000 for bodily injury per accident, and $25,000 for property damage. However, many experts recommend purchasing additional coverage to ensure adequate protection in the event of an accident. The state also requires drivers to carry proof of insurance at all times and to provide it upon request to law enforcement.

The Cost of Car Insurance in Texas

Texas is known for having some of the highest car insurance rates in the nation, with an average annual premium of $1,576. This high cost can be attributed to various factors, including the state’s large population, high number of drivers, and the frequency of accidents and claims.

The cost of car insurance in Texas can vary significantly based on several factors, including the driver's age, gender, driving record, credit score, and the type of vehicle insured. For instance, younger drivers, especially males, often face higher premiums due to their perceived higher risk profile. Similarly, drivers with a history of accidents or traffic violations may also see increased rates.

The type of vehicle insured also plays a significant role in determining the cost of insurance. Luxury vehicles, sports cars, and SUVs often carry higher premiums due to their higher repair and replacement costs. On the other hand, sedans and compact cars tend to be more affordable to insure.

Furthermore, the location within Texas can also impact insurance rates. Urban areas like Houston and Dallas often have higher rates due to increased traffic and accident risks, whereas more rural areas may offer slightly lower premiums.

Navigating Coverage Options: A Comprehensive Guide

When it comes to car insurance in Texas, drivers have a plethora of coverage options to choose from. Understanding these options is crucial to ensuring adequate protection and managing costs effectively.

In addition to the mandatory liability coverage, drivers in Texas may opt for various other types of coverage to enhance their protection. These include:

- Collision Coverage: This covers the cost of repairing or replacing your vehicle after an accident, regardless of who is at fault.

- Comprehensive Coverage: Provides protection against damage to your vehicle caused by factors other than collisions, such as theft, vandalism, weather-related incidents, and animal collisions.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you're involved in an accident with a driver who either doesn't have insurance or doesn't have enough insurance to cover the damages.

- Medical Payments Coverage: Covers the medical expenses for you and your passengers, regardless of who is at fault in the accident.

- Personal Injury Protection (PIP): Similar to Medical Payments Coverage, PIP covers medical expenses and also includes lost wages and funeral expenses.

Each of these coverage types offers distinct benefits, and the right combination depends on individual needs and circumstances. It's essential to carefully evaluate each option and understand the potential benefits and costs associated with them.

Choosing the Right Insurance Provider: A Critical Decision

With numerous insurance providers operating in Texas, choosing the right one can be a daunting task. However, making an informed decision is crucial to ensure you receive the best coverage at the most competitive rates.

When selecting an insurance provider, it's essential to consider factors such as the company's financial stability, its reputation for customer service, and its track record for claim handling. A financially stable company is more likely to be able to pay out claims, while a company with a strong reputation for customer service and claim handling is more likely to provide a positive experience if you need to make a claim.

Additionally, it's important to compare coverage options and premium costs across different providers. While some providers may offer lower premiums, they may not provide the same level of coverage or service as others. It's crucial to strike a balance between cost and coverage to ensure you're getting the best value for your money.

Furthermore, consider the availability of discounts offered by the insurance provider. Many companies offer discounts for various factors, such as safe driving records, multiple policies, and loyalty. Taking advantage of these discounts can significantly reduce your insurance premiums.

Filing a Claim: A Step-by-Step Guide

In the unfortunate event of an accident, understanding the process of filing a claim is crucial to ensure a smooth and efficient resolution. Here’s a step-by-step guide to help you navigate this process.

- Report the Accident: Immediately after an accident, it's crucial to report it to your insurance provider. Most providers have a dedicated claims hotline that is available 24/7.

- Gather Information: Collect as much information as possible at the scene of the accident. This includes taking photos of the damage, exchanging contact and insurance information with the other driver(s), and gathering contact information from any witnesses.

- Notify the Police: In certain situations, such as when there are injuries or significant property damage, it's mandatory to report the accident to the police. The police report can be a valuable piece of evidence when filing a claim.

- Contact Your Insurance Provider: After gathering all the necessary information, contact your insurance provider to initiate the claims process. Provide them with all the details of the accident, including any relevant photos and the police report number (if applicable).

- Cooperate with the Claims Adjuster: The insurance provider will assign a claims adjuster to handle your case. Cooperate fully with the adjuster and provide any additional information or documentation they may request. This could include repair estimates, medical bills, and other relevant documents.

- Evaluate the Settlement Offer: Once the claims adjuster has investigated the accident and assessed the damages, they will present you with a settlement offer. Carefully evaluate this offer, considering the extent of the damages and your policy coverage. If you believe the offer is insufficient, you have the right to negotiate or seek legal advice.

Remember, the claims process can be complex and time-consuming. It's essential to remain patient and cooperative throughout the process to ensure a favorable outcome.

The Future of Car Insurance in Texas: A Glimpse into Emerging Trends

The world of car insurance is constantly evolving, and Texas is no exception. As technology advances and driving behaviors change, the insurance landscape is likely to undergo significant transformations in the coming years.

One of the most notable trends is the rise of usage-based insurance (UBI). UBI policies, also known as pay-as-you-drive or pay-how-you-drive policies, use telematics devices to monitor driving behavior and set insurance premiums accordingly. This approach rewards safe driving and could lead to significant savings for drivers with good driving records.

Additionally, the growth of electric vehicles (EVs) is expected to have a significant impact on car insurance in Texas. EVs often come with advanced safety features and are generally considered safer than traditional gas-powered vehicles. This could lead to lower insurance premiums for EV owners.

The advent of autonomous vehicles is another trend that could revolutionize car insurance. As self-driving cars become more prevalent, insurance policies may need to adapt to cover potential risks associated with this new technology. This could include liability coverage for the vehicle's manufacturer or additional coverage for passengers.

Furthermore, the integration of advanced driver-assistance systems (ADAS) in modern vehicles is expected to influence insurance rates. ADAS features such as lane departure warning, automatic emergency braking, and adaptive cruise control can significantly reduce the risk of accidents. As a result, insurance providers may offer discounts or lower premiums for vehicles equipped with these safety features.

Conclusion: Navigating the Complexities of Texas Car Insurance

Understanding the intricacies of car insurance in Texas is essential for all drivers. From navigating the legal landscape and choosing the right coverage to selecting a reliable insurance provider and effectively filing a claim, every aspect requires careful consideration and expert knowledge.

As the insurance landscape continues to evolve, staying informed and adapting to emerging trends is crucial. Whether it's embracing usage-based insurance, navigating the rise of electric vehicles, or preparing for the advent of autonomous cars, staying ahead of the curve ensures you're always protected and prepared.

In the ever-changing world of car insurance, knowledge is power. By staying informed and making informed decisions, you can ensure that you're adequately protected, your costs are managed effectively, and your driving experience in the Lone Star State is as smooth and stress-free as possible.

What is the average cost of car insurance in Texas for a 25-year-old male driver with a clean driving record?

+

The average cost of car insurance for a 25-year-old male driver with a clean record in Texas is approximately $1,350 per year. However, this can vary significantly based on factors such as the driver’s location, the type of vehicle insured, and the coverage options chosen.

Are there any discounts available for car insurance in Texas?

+

Yes, there are several discounts available for car insurance in Texas. These can include safe driver discounts, multi-policy discounts, loyalty discounts, and discounts for certain occupations or affiliations. It’s worth shopping around and comparing providers to find the best discounts available.

How does the tort system in Texas affect car insurance claims?

+

In a tort system, like Texas, drivers are responsible for the damages they cause in an accident. This means that if you’re involved in an accident, you’ll need to file a claim with your insurance provider, who will then determine fault and liability. If you’re found to be at fault, your insurance provider will cover the damages, up to your policy limits.

What are some tips for reducing car insurance costs in Texas?

+

To reduce car insurance costs in Texas, consider increasing your deductible, maintaining a clean driving record, taking advantage of available discounts, and shopping around for the best rates. Additionally, regularly reviewing your coverage options and adjusting them as needed can help ensure you’re not paying for unnecessary coverage.