Cheapest Car Home Insurance

When it comes to finding the cheapest car and home insurance, it's essential to understand the factors that influence rates and the steps you can take to secure the most affordable coverage. In this comprehensive guide, we'll delve into the world of insurance, exploring the key considerations, strategies, and options available to help you find the best deals for your car and home insurance needs.

Understanding the Factors That Impact Insurance Rates

Insurance rates for cars and homes are influenced by a multitude of factors, each playing a role in determining the overall cost of coverage. By understanding these factors, you can make informed decisions and potentially reduce your insurance expenses.

Location and Risk Factors

One of the primary determinants of insurance rates is the location of your car or home. Insurance companies assess the level of risk associated with different areas, considering factors such as crime rates, weather conditions, and the prevalence of natural disasters. For instance, areas prone to hurricanes or earthquakes may have higher insurance premiums due to the increased likelihood of claims.

Additionally, the specific neighborhood or address can impact rates. Insurance providers analyze historical data and claims records to assess the risk level associated with each location. Areas with higher crime rates or a history of frequent accidents may result in higher insurance costs.

Vehicle and Property Characteristics

The type of car or home you own also plays a significant role in determining insurance rates. For cars, factors such as make, model, year, and safety features can influence the cost of coverage. Sports cars or luxury vehicles, for example, may attract higher premiums due to their higher replacement costs and increased risk of theft.

Similarly, for home insurance, the size, age, and construction materials of your property can impact rates. Older homes may require more extensive repairs or have outdated electrical or plumbing systems, leading to higher insurance costs. Additionally, homes with advanced security systems or fire prevention measures may qualify for discounts.

Driving and Property History

Your driving or property ownership history is a crucial factor in insurance pricing. Insurance companies analyze your claims history, traffic violations, and accident records to assess your risk level. A clean driving record with no recent accidents or violations can result in lower insurance premiums, as it indicates a lower likelihood of future claims.

For property insurance, the claims history of the specific address is considered. If the property has a history of frequent claims or major damage, insurance companies may charge higher premiums to account for the increased risk.

Coverage Options and Deductibles

The level of coverage you choose and the deductibles you select can significantly impact your insurance rates. Opting for higher coverage limits or adding optional coverage endorsements may increase your premiums. On the other hand, choosing higher deductibles can reduce your monthly payments but require you to pay more out of pocket in the event of a claim.

It’s important to strike a balance between the coverage you need and the premiums you can afford. Understanding your risk tolerance and financial situation is key to making informed decisions about your insurance coverage.

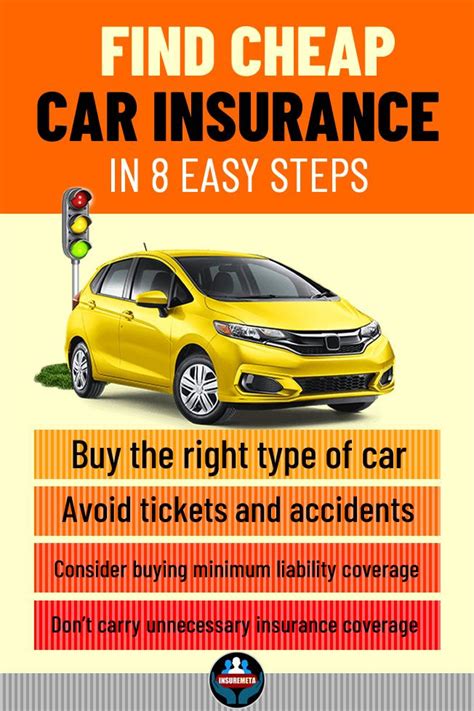

Strategies to Find the Cheapest Car and Home Insurance

Now that we’ve explored the factors that influence insurance rates, let’s dive into the strategies you can employ to find the cheapest car and home insurance options tailored to your specific needs.

Compare Multiple Insurance Providers

One of the most effective ways to secure affordable insurance is by comparing quotes from multiple providers. Insurance companies use different methodologies and risk assessment models, so rates can vary significantly between them. By obtaining quotes from at least three to five reputable insurers, you can identify the most competitive offers and choose the one that best fits your budget.

Online insurance marketplaces and comparison websites can be valuable tools for this process. These platforms allow you to enter your details once and receive multiple quotes from different insurers, making it easier to compare rates and coverage options side by side.

Bundling Car and Home Insurance

Bundling your car and home insurance policies with the same provider can often result in significant savings. Many insurance companies offer multi-policy discounts, rewarding customers who consolidate their coverage needs. By bundling your policies, you may be eligible for a discount on both your car and home insurance premiums.

Additionally, bundling can provide convenience and simplicity. Having a single provider for your insurance needs can streamline the claims process and make managing your policies more efficient.

Explore Discounts and Rewards

Insurance companies offer a variety of discounts and rewards to attract and retain customers. By understanding the types of discounts available, you can take advantage of opportunities to reduce your insurance costs.

Common discounts include safe driver discounts for maintaining a clean driving record, loyalty discounts for long-term customers, and multi-car discounts if you insure multiple vehicles with the same provider. Some insurers also offer discounts for specific occupations, good students, or members of certain professional organizations.

Additionally, many insurers provide discounts for safety features and preventive measures. Installing a home security system, smoke detectors, or fire sprinklers can qualify you for reduced premiums. Similarly, for car insurance, having advanced safety features like anti-theft devices or collision avoidance systems may result in lower rates.

Review and Optimize Your Coverage

Regularly reviewing your insurance policies and coverage limits is essential to ensure you’re not overpaying for unnecessary coverage. As your circumstances change, such as acquiring new assets or facing different risks, your insurance needs may evolve.

Assess your current coverage limits and consider whether they align with your current needs. For example, if you’ve paid off your mortgage, you may no longer require as extensive a home insurance policy. Reviewing your coverage annually and making adjustments as necessary can help you avoid paying for coverage you don’t need.

Additionally, consider raising your deductibles if you’re comfortable with a higher out-of-pocket expense in the event of a claim. While increasing deductibles may reduce your monthly premiums, it’s important to ensure you have sufficient funds set aside to cover potential deductibles.

Shop Around for Better Rates

Insurance rates can fluctuate over time, and it’s worth exploring your options periodically to see if you can find better deals. Even if you’re satisfied with your current provider, shopping around can provide valuable insights into the market and help you identify potential savings.

Consider re-evaluating your insurance needs every few years or whenever you experience significant life changes, such as purchasing a new car or moving to a different home. By staying informed and proactive, you can take advantage of new discounts or more competitive rates offered by other insurers.

Choosing the Right Insurance Provider

Selecting the right insurance provider is crucial to ensuring you receive the coverage and support you need at a fair price. When evaluating insurance companies, consider the following factors to make an informed decision.

Financial Stability and Reputation

The financial stability of an insurance company is a critical consideration. Look for providers with a strong financial rating, indicating their ability to pay claims and maintain solvency. Reputable rating agencies such as AM Best or Standard & Poor’s provide financial strength ratings that can help you assess the stability of different insurers.

Additionally, research the reputation and customer satisfaction of potential providers. Online reviews and ratings from independent sources can offer valuable insights into the customer experience and the quality of service provided by the insurance company.

Coverage Options and Customization

Assess the range of coverage options and customization available with each insurance provider. Different providers may offer unique endorsements or specialized coverage for specific needs. For example, if you own a classic car or have valuable collectibles, you may require specialized coverage that not all insurers offer.

Consider your specific requirements and choose a provider that offers comprehensive coverage options tailored to your needs. Ensure that the insurance company provides clear and concise policy language, making it easy to understand your rights and obligations under the policy.

Claims Handling and Customer Service

The claims handling process and customer service of an insurance company can significantly impact your overall experience. Research the reputation of potential providers in terms of their responsiveness, efficiency, and fairness when handling claims. Look for companies with a track record of prompt claim settlements and positive customer reviews regarding their claims process.

Additionally, evaluate the accessibility and responsiveness of the insurer’s customer service team. Consider factors such as availability through multiple channels (phone, email, online chat), response times, and the overall friendliness and helpfulness of the support staff.

Digital Tools and Resources

In today’s digital age, many insurance providers offer online and mobile tools to enhance the customer experience. Assess the digital capabilities of potential insurers, including their website functionality, mobile app availability, and online claim reporting and tracking options.

Look for providers that offer user-friendly platforms with features such as policy management, billing and payment options, and the ability to submit and track claims digitally. These tools can streamline your insurance experience and provide added convenience.

The Future of Insurance: Technology and Innovation

The insurance industry is evolving rapidly, driven by technological advancements and innovative approaches to risk assessment and coverage. Here’s a glimpse into the future of insurance and how it may impact the way we secure car and home insurance.

Telematics and Usage-Based Insurance

Telematics technology, which involves the use of devices to track driving behavior and vehicle usage, is gaining traction in the insurance industry. Usage-based insurance programs, also known as pay-as-you-drive or pay-how-you-drive, utilize telematics data to offer personalized insurance rates based on actual driving habits.

These programs can provide significant savings for safe and cautious drivers, as insurance companies can more accurately assess the risk associated with individual drivers. Additionally, telematics data can help identify potential issues, such as aggressive driving or vehicle maintenance needs, allowing insurers to offer tailored advice and discounts.

Artificial Intelligence and Data Analytics

Artificial intelligence (AI) and data analytics are transforming the way insurance companies assess risk and personalize coverage. Advanced algorithms and machine learning models enable insurers to analyze vast amounts of data, including historical claims, demographic information, and even social media activity, to make more accurate predictions about individual risk profiles.

AI-powered systems can identify patterns and correlations that traditional underwriting methods may overlook, leading to more precise pricing and coverage recommendations. This technology can also streamline the claims process, utilizing AI-powered chatbots and automated systems to expedite claim assessments and settlements.

Digital Onboarding and Instant Coverage

The digital transformation of the insurance industry is making it easier and faster for customers to obtain coverage. Digital onboarding processes, including online applications, video verification, and electronic signatures, enable insurers to provide instant quotes and bind coverage within minutes.

This convenience is particularly beneficial for individuals who require insurance quickly, such as those purchasing a new car or moving into a new home. Digital onboarding also reduces administrative burdens for insurers, allowing them to focus on providing excellent customer service and innovative coverage options.

Blockchain and Smart Contracts

Blockchain technology, known for its secure and transparent nature, is being explored in the insurance industry to enhance claim settlements and reduce fraud. Smart contracts, self-executing contracts with predefined rules, can automate certain aspects of the insurance process, such as verifying policy conditions and triggering payments upon meeting predefined criteria.

Blockchain-based insurance platforms can improve efficiency, reduce administrative costs, and provide greater transparency and trust between insurers and policyholders. Additionally, blockchain technology can facilitate peer-to-peer insurance models, allowing individuals to pool their risks and share coverage in a secure and decentralized manner.

Conclusion: Empowering Your Insurance Journey

Finding the cheapest car and home insurance is not just about securing the lowest premiums; it’s about making informed choices and understanding the factors that influence your insurance costs. By comparing quotes, bundling policies, exploring discounts, and regularly reviewing your coverage, you can take control of your insurance journey and make it work for your specific needs and budget.

As the insurance industry continues to evolve with technological advancements, staying informed and embracing innovative solutions can further enhance your insurance experience. From usage-based insurance programs to AI-powered risk assessment, the future of insurance promises greater personalization, efficiency, and transparency.

Remember, when it comes to insurance, knowledge is power. By understanding the factors that impact rates, exploring your options, and choosing the right provider, you can secure the coverage you need at a price that fits your financial goals. Empower yourself with the right tools, information, and strategies, and you’ll be well on your way to a brighter and more affordable insurance future.

How often should I review my insurance policies?

+It’s recommended to review your insurance policies annually or whenever significant life changes occur, such as buying a new car, moving to a new home, or experiencing a major life event. Regular reviews ensure your coverage remains adequate and up-to-date.

Can I negotiate insurance rates with providers?

+While insurance rates are largely determined by standardized algorithms and risk assessment models, you can still negotiate with providers to some extent. Consider highlighting your loyalty, safe driving record, or any unique circumstances that may impact your risk profile. Some insurers may offer flexible pricing or work with you to find a suitable solution.

Are there any downsides to raising deductibles to lower premiums?

+While raising deductibles can lower your monthly premiums, it’s important to consider the potential financial impact in the event of a claim. Higher deductibles mean you’ll need to pay more out of pocket before your insurance coverage kicks in. Ensure you have sufficient emergency funds or savings to cover the increased deductible amount.