Healthcare Insurance In Ny

Healthcare insurance is a vital aspect of our lives, providing us with peace of mind and access to essential medical services. In the bustling state of New York, understanding the healthcare insurance landscape is crucial for individuals and families seeking comprehensive coverage. This comprehensive guide aims to delve into the intricacies of healthcare insurance in New York, offering valuable insights and expert advice to navigate the complex world of healthcare benefits.

The Importance of Healthcare Insurance in New York

New York, with its diverse population and thriving metropolitan areas, presents unique challenges when it comes to healthcare access. Healthcare insurance acts as a safeguard, ensuring that residents have the financial protection they need to seek medical care without incurring overwhelming costs. It plays a pivotal role in promoting overall well-being and ensuring that medical emergencies or chronic conditions are managed effectively.

The state of New York has a robust healthcare system, with a wide range of healthcare providers and facilities. However, without adequate insurance coverage, accessing these services can be a daunting task. Healthcare insurance plans in New York offer a safety net, allowing individuals to choose from a variety of providers and facilities that best suit their needs. It empowers individuals to make informed decisions about their healthcare and ensures they receive the care they deserve.

Understanding the Healthcare Insurance Market in New York

The healthcare insurance market in New York is diverse and dynamic, offering a range of options to cater to the diverse needs of its residents. Understanding the different types of plans available is essential for making informed choices.

Individual and Family Plans

Individual and family plans are designed to provide coverage for single individuals or entire households. These plans offer flexibility in terms of coverage limits, deductibles, and co-pays, allowing individuals to tailor their insurance to their specific needs and budget. Whether it’s a young professional starting out or a growing family, individual and family plans provide essential healthcare protection.

Employer-Sponsored Plans

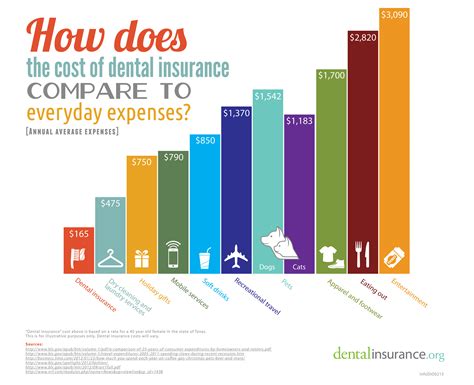

Many New Yorkers gain access to healthcare insurance through their employers. Employer-sponsored plans are often comprehensive and may include additional benefits such as dental, vision, and prescription drug coverage. These plans can be a cost-effective option, as employers often contribute to the premium costs. Understanding the specifics of employer-sponsored plans is crucial when evaluating healthcare insurance options.

Government-Sponsored Programs

New York state and the federal government offer various healthcare insurance programs to support those who may not have access to employer-sponsored plans or cannot afford individual coverage. Programs like Medicaid, Child Health Plus, and the Affordable Care Act’s Marketplace provide essential healthcare coverage to eligible individuals and families. Understanding the eligibility criteria and benefits of these programs is vital for those seeking affordable healthcare options.

Choosing the Right Healthcare Insurance Plan

Selecting the right healthcare insurance plan in New York involves careful consideration of various factors. It’s essential to assess your specific needs, budget, and preferences to make an informed decision.

Assessing Your Healthcare Needs

Before choosing a plan, evaluate your current and potential future healthcare needs. Consider factors such as chronic conditions, prescription medication requirements, and the frequency of medical appointments. Understanding your healthcare needs will help you select a plan with adequate coverage and benefits.

Evaluating Plan Options

Research and compare different healthcare insurance plans available in New York. Consider the network of healthcare providers and facilities covered by each plan. Assess the plan’s coverage for essential services, such as primary care, specialist visits, hospital stays, and emergency care. Evaluate the out-of-pocket costs, including deductibles, co-pays, and co-insurance, to determine the plan’s overall affordability.

Understanding Coverage Limitations and Exclusions

It’s crucial to carefully read the fine print of any healthcare insurance plan to understand its coverage limitations and exclusions. Some plans may have specific restrictions on certain procedures, treatments, or pre-existing conditions. Being aware of these limitations will help you make informed decisions and avoid unexpected out-of-pocket expenses.

Maximizing Your Healthcare Insurance Benefits

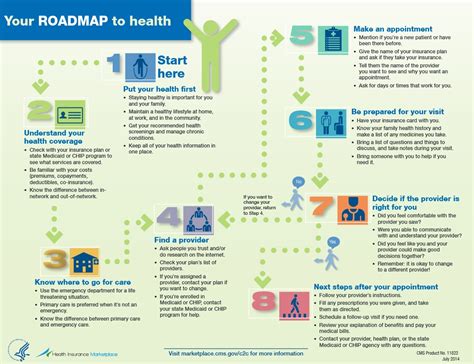

Once you’ve selected a healthcare insurance plan, it’s important to understand how to make the most of your benefits.

Choosing an In-Network Provider

Healthcare insurance plans typically offer discounted rates when you choose in-network healthcare providers. Selecting an in-network provider ensures that you receive the full benefits of your insurance plan, including reduced costs and simplified billing processes. Research and create a list of in-network providers that align with your healthcare needs to make informed choices.

Understanding Your Plan’s Coverage

Familiarize yourself with your healthcare insurance plan’s coverage details. This includes understanding the specific services covered, any pre-authorization requirements, and any steps you need to take to access certain benefits. Being knowledgeable about your plan’s coverage will help you navigate the healthcare system effectively and avoid any potential surprises.

Utilizing Preventive Care Services

Many healthcare insurance plans in New York offer preventive care services at little to no cost. These services, such as annual check-ups, immunizations, and screenings, are crucial for maintaining good health and catching potential health issues early on. Take advantage of these preventive care services to stay on top of your well-being and potentially avoid more costly medical interventions down the line.

Navigating Healthcare Insurance Challenges in New York

Despite the comprehensive nature of healthcare insurance plans in New York, challenges may arise. Understanding how to navigate these challenges is essential for ensuring uninterrupted access to healthcare.

Dealing with Pre-Existing Conditions

Pre-existing conditions can sometimes pose challenges when it comes to healthcare insurance. In New York, thanks to the Affordable Care Act, insurance companies cannot deny coverage or charge higher premiums based solely on pre-existing conditions. However, it’s important to disclose all pre-existing conditions when applying for insurance to ensure accurate coverage and avoid any potential complications.

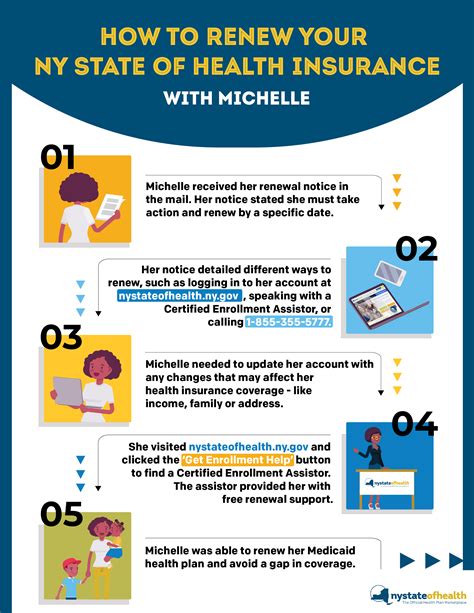

Addressing Changes in Coverage

Life circumstances can change, and these changes may impact your healthcare insurance needs. Whether it’s a job change, marriage, divorce, or the birth of a child, understanding how these changes affect your coverage is crucial. Stay informed about the open enrollment periods and special enrollment periods to make necessary adjustments to your healthcare insurance plan.

Managing Out-of-Pocket Costs

Healthcare insurance plans often come with out-of-pocket costs, such as deductibles, co-pays, and co-insurance. Managing these costs effectively is essential for maintaining financial stability. Consider setting aside funds specifically for healthcare expenses and exploring options like health savings accounts (HSAs) or flexible spending accounts (FSAs) to help cover these costs.

The Future of Healthcare Insurance in New York

The healthcare insurance landscape in New York is continuously evolving, influenced by various factors such as advancements in medical technology, changing demographics, and policy reforms. Staying informed about these developments is crucial for making future healthcare insurance decisions.

Emerging Healthcare Trends

Keep an eye on emerging healthcare trends in New York, such as telemedicine, value-based care models, and integrated healthcare systems. These trends have the potential to revolutionize healthcare delivery and insurance coverage. Understanding how these trends may impact your healthcare insurance options will help you stay ahead of the curve.

Policy and Regulatory Changes

Stay informed about any policy and regulatory changes that may affect healthcare insurance in New York. Whether it’s changes to state laws, federal regulations, or insurance company practices, being aware of these developments will ensure you make well-informed decisions about your healthcare coverage.

Exploring Innovative Insurance Models

The healthcare insurance market is constantly innovating, with new insurance models emerging to meet the changing needs of consumers. Keep an open mind and explore innovative insurance options, such as reference-based pricing or direct primary care, which may offer more affordable and personalized healthcare coverage.

Conclusion

Healthcare insurance in New York is a complex yet essential aspect of maintaining good health and financial stability. By understanding the different types of plans, assessing your needs, and maximizing your benefits, you can navigate the healthcare insurance landscape with confidence. Stay informed, stay proactive, and make informed choices to ensure you and your loved ones have the healthcare coverage you deserve.

How do I find the best healthcare insurance plan for my needs in New York?

+To find the best healthcare insurance plan for your needs in New York, consider factors such as your healthcare requirements, budget, and preferences. Assess your medical needs, including any chronic conditions or prescription medications. Evaluate different plan options, including individual, family, and employer-sponsored plans. Compare coverage, provider networks, and out-of-pocket costs. Understanding your needs and doing thorough research will help you make an informed decision.

Are there any government-sponsored healthcare programs in New York that I can qualify for?

+Yes, New York offers various government-sponsored healthcare programs. Medicaid is a state-run program that provides healthcare coverage to eligible low-income individuals and families. Child Health Plus is another program specifically for children and teens. Additionally, the Affordable Care Act’s Marketplace allows individuals and families to purchase healthcare insurance with potential subsidies based on income. Check the eligibility criteria for these programs to see if you qualify.

What should I do if I have a pre-existing condition and need healthcare insurance in New York?

+If you have a pre-existing condition, you are protected by the Affordable Care Act, which prohibits insurance companies from denying coverage or charging higher premiums based solely on pre-existing conditions. When applying for insurance, disclose your pre-existing condition to ensure accurate coverage. Many healthcare insurance plans in New York cover pre-existing conditions, so choose a plan that best meets your needs and budget.

How can I manage out-of-pocket costs associated with my healthcare insurance plan in New York?

+Managing out-of-pocket costs is essential for maintaining financial stability. Consider setting aside funds specifically for healthcare expenses. Explore options like health savings accounts (HSAs) or flexible spending accounts (FSAs) to help cover these costs. Choose a plan with a deductible and out-of-pocket maximum that aligns with your budget. Stay informed about your plan’s coverage and utilize preventive care services to potentially reduce future expenses.