Average Life Insurance Costs

Life insurance is an essential financial tool that provides security and peace of mind to individuals and their loved ones. It serves as a safety net, ensuring that beneficiaries receive a predetermined sum upon the policyholder's death. The cost of life insurance is a critical factor that influences an individual's decision to purchase coverage. This comprehensive guide delves into the average life insurance costs, exploring various factors that impact premiums and offering valuable insights to help individuals make informed choices.

Understanding Life Insurance Costs

Life insurance costs, often referred to as premiums, are the regular payments made by policyholders to maintain their coverage. These premiums are influenced by a multitude of factors, including age, health status, lifestyle choices, and the type and amount of coverage selected. Understanding these variables is crucial for anyone seeking to secure life insurance coverage that aligns with their needs and budget.

Factors Affecting Life Insurance Premiums

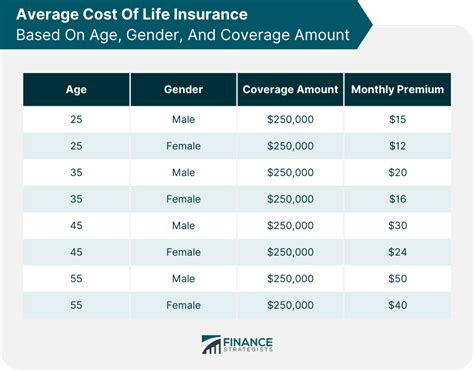

The cost of life insurance is highly personalized, taking into account an individual’s unique circumstances and risk profile. Here are some key factors that influence life insurance premiums:

- Age: Age is a significant determinant of life insurance premiums. Generally, younger individuals enjoy lower rates as they are statistically less likely to require a payout. As one ages, the risk of health issues and mortality increases, leading to higher premiums.

- Health Status: The state of an individual’s health plays a pivotal role in determining life insurance costs. Insurers assess an applicant’s medical history, current health conditions, and lifestyle habits to assess their risk level. Those with pre-existing conditions or unhealthy lifestyles may face higher premiums or even policy exclusions.

- Lifestyle Choices: Engaging in risky behaviors such as smoking, extreme sports, or hazardous occupations can lead to increased life insurance premiums. Insurers consider these factors as they directly impact an individual’s longevity and potential for accidents or health issues.

- Coverage Type and Amount: The type of life insurance policy selected, whether term or permanent, and the coverage amount chosen significantly impact premiums. Term life insurance, which provides coverage for a specific period, typically offers lower premiums compared to permanent policies like whole or universal life insurance.

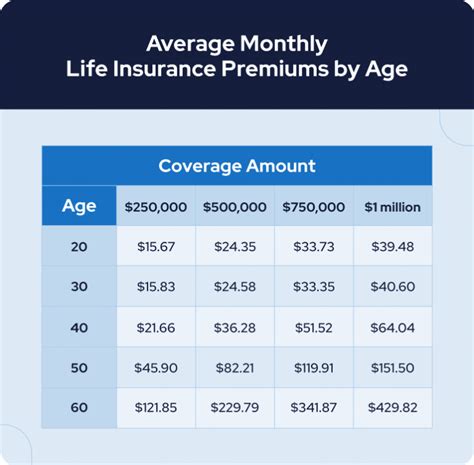

Average Life Insurance Costs by Age

Age is a fundamental factor in determining life insurance premiums. Here’s an overview of average life insurance costs across different age groups:

| Age Group | Average Monthly Premium for 250,000 Term Life Insurance</th> </tr> <tr> <td>20-24</td> <td>10 - 15</td> </tr> <tr> <td>25-29</td> <td>15 - 20</td> </tr> <tr> <td>30-34</td> <td>20 - 25</td> </tr> <tr> <td>35-39</td> <td>25 - 30</td> </tr> <tr> <td>40-44</td> <td>30 - 35</td> </tr> <tr> <td>45-49</td> <td>35 - 40</td> </tr> <tr> <td>50-54</td> <td>40 - 50</td> </tr> <tr> <td>55-59</td> <td>50 - 60</td> </tr> <tr> <td>60-64</td> <td>60 - $70 |

|---|

Premium Comparison: Term vs. Permanent Life Insurance

The choice between term and permanent life insurance significantly impacts premium costs. Term life insurance, offering coverage for a specified period, typically provides more affordable premiums compared to permanent policies. Here’s a comparison of average premiums for a 250,000 policy:</p> <table> <tr> <th>Policy Type</th> <th>Average Monthly Premium</th> </tr> <tr> <td>Term Life Insurance (20-year term)</td> <td>20 - 30</td> </tr> <tr> <td>Whole Life Insurance</td> <td>100 - 200</td> </tr> <tr> <td>Universal Life Insurance</td> <td>80 - $150

Maximizing Cost-Effectiveness

While life insurance costs are influenced by various factors, there are strategies to optimize cost-effectiveness. Here are some tips to consider:

- Compare Quotes: Obtain multiple quotes from different insurers to compare premiums and coverage options. This ensures you secure the best value for your needs.

- Bundle Policies: Some insurers offer discounts when you bundle life insurance with other policies like auto or homeowners insurance.

- Consider Term Length: Evaluate the length of your term life insurance policy. Longer terms may provide better value, especially if your financial needs are stable over an extended period.

- Maintain a Healthy Lifestyle: Adopting healthy habits can lead to lower premiums. Regular exercise, a balanced diet, and avoiding risky behaviors can improve your overall health and reduce insurance costs.

Life Insurance for Different Life Stages

Life insurance needs evolve as individuals progress through different life stages. Here’s a breakdown of life insurance considerations for various life stages:

Young Adults (Ages 20-30)

Young adults often prioritize building their careers and financial stability. Term life insurance is a popular choice during this stage, providing affordable coverage for a specific period, such as during the early years of a mortgage or while starting a family.

Middle-Aged Adults (Ages 30-50)

As individuals enter their middle-aged years, their financial responsibilities often increase. This stage may involve providing for a growing family, paying off a mortgage, or saving for retirement. Term life insurance remains a viable option, offering flexibility to adjust coverage as needs change. Permanent life insurance, such as whole life, may also be considered for long-term financial planning.

Senior Adults (Ages 50+)

Senior adults may have different life insurance needs, often focused on estate planning and providing financial security for their loved ones. Permanent life insurance, with its cash value accumulation, can be a valuable tool for leaving a legacy. Additionally, some seniors opt for final expense insurance to cover funeral and burial costs.

The Future of Life Insurance

The life insurance industry is evolving, with technological advancements and changing consumer preferences shaping the future landscape. Here’s a glimpse into the potential trends and developments:

- Digitalization: The rise of digital platforms and online insurance marketplaces is transforming the way life insurance is purchased. Insurers are increasingly leveraging technology to offer more efficient and personalized services, from online quote comparisons to streamlined policy management.

- Personalized Pricing: Advances in data analytics and risk assessment are enabling insurers to offer more tailored pricing. This shift towards personalized premiums considers an individual’s unique health and lifestyle factors, potentially leading to more accurate and fair pricing.

- Enhanced Coverage Options: Life insurance providers are expanding their product offerings to meet diverse consumer needs. This includes innovative policies that address specific concerns, such as critical illness coverage or long-term care insurance, providing comprehensive protection beyond traditional life insurance.

Conclusion

Understanding the average life insurance costs and the factors influencing premiums is crucial for making informed decisions. By considering age, health status, lifestyle choices, and coverage type, individuals can secure life insurance policies that provide the necessary protection while aligning with their financial capabilities. As the life insurance industry continues to evolve, staying informed about emerging trends and seeking professional guidance ensures individuals can navigate the market effectively and secure the coverage that best suits their unique circumstances.

How does my health status impact life insurance premiums?

+

Your health status plays a significant role in determining life insurance premiums. Insurers assess your medical history, current health conditions, and lifestyle habits to assess your risk level. Those with excellent health may qualify for preferred rates, while individuals with pre-existing conditions or unhealthy lifestyles may face higher premiums or policy exclusions.

Are there any ways to reduce life insurance costs?

+

Yes, there are several strategies to optimize the cost-effectiveness of your life insurance coverage. These include comparing quotes from different insurers, bundling policies, considering the term length of your term life insurance, and maintaining a healthy lifestyle. Additionally, seeking professional guidance from a licensed insurance agent can help you identify cost-saving opportunities tailored to your specific circumstances.

What is the difference between term and permanent life insurance?

+

Term life insurance provides coverage for a specified period, typically offering lower premiums compared to permanent policies. Permanent life insurance, such as whole or universal life, offers lifelong coverage and includes a cash value component that accumulates over time. The choice between term and permanent life insurance depends on individual needs and financial goals.